The Quality Small Cap Investor

@growth_iinvest1Investor mainly in small-mid cap quality growth stocks. Anything I post is personal opinion, not to be taken as investment advice.

Monthly performance update: down 0.23%, compared to ftse small cap (TR) down 0.11% Year to date I am down 7.17% compared to ftse small cap (TR) down 0.25% Star performer - Tracsis #TRCS Dog stock - Somero #SOM Quarterly report attached. Ask me anything!

This latest blog by Chris Mayer is fantastic: woodlockhousefamilycapital.com/post/drawdowns… Has massive read across for investors at moment, as we are in a huge drawdown period. “Sitting through drawdowns is a source of outperformance” That’s what I tell all my losers 😃😃

My latest blog - scrutinising the rest of my 2022 investments: …equalitysmallcapinvestor.substack.com/p/how-not-to-i…

#TAM trading update - continuing to see net inflows of £152mil per month. AUM up 19.8% for the year. Including 8AM global are at £14.78bn, way ahead of targeting £15bn by end of March 2024. IFA firms up 5.2%. I hold - very happy with these strong numbers. Not cheap though.

For anyone wanting to get into the weeds of the #BIDS CLN I’ll put this together. £2.4mil from Irdeto, split into 4 £0.6mil tranches. Interest of 10% per annum on drawn amounts. We also have a 1000-1 share consolidation. That takes the current share price to £3.35 (1/4)

If the share price is weak, and they convert at £1.37, they end up owning 70% of bids. If it’s a disaster and the share price is 1p on conversion (unlikely) then they own 99%. But basically any conversions sub £1 will wipe out existing holders. (3/4)

Now the biggest problem for me, is based on the latest set of accounts, end of June, and assuming we can’t trust the trade receivables numbers, azerion etc. then £2.4mil isn’t going to go very far. So this is a band aid for an amputation. Can’t see much positives here. (4/4)

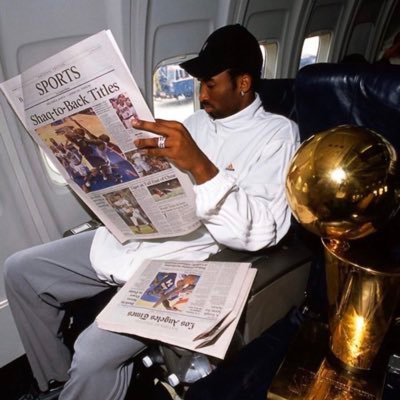

Interest factsheet and top holdings, some well known names in the private investor space

#BIDs convertible loan note which could end with irdreto owning 99% of the voting rights of bidstack. And the VST got kaiboshed, I assume by someone who saw that JD was robbing the company. Can’t make this stuff up

#LIO trading update - outflows of 5.5% for the quarter is poor. Funds themselves still struggling as investors shun sustainable growth in favour of oil! I hold - a stubborn small play on sustainability. Not my preferred AM but hold for psychological reasons

I have made a smart/stupid decision today, in 5 years time I will know which. Previously I have been told the best buys are the ones you have to hold your nose when doing so. For me that sums up #CLX. Management disgraced themselves with the mid afternoon profit warning 1/5

They have £13mil in cash and last year made profits of £6mil. That would put it on a net profit to EV of 4x. Granted, we are in a new period where Calnex will be lucky to breakeven. The cash pile will see them through and I believe that Telecoms as a whole has a big future 4/5

This is a pullback in the sector, they happen time and time again, see below my favourite chart at the moment I have no doubts that this is a high risk investment and that I could see it fall another 50% quite easily. Brave or stupid... maybe both. 5/5

#CER trading update - pbt meaningfully ahead of expectations. Revenue approx £39mil with net cash of £25mil. I hold - I was nervous coming into this with the recent telecoms slowdowns. But fantastic again with pipeline growing as well.

Today features a self deprecating blog with me. Well I’ve decided to look back through all my buys and sales in 2022 and work out if they were actually any good. Featuring #GAW #POLR #SOM #CLX #NFC #DVRG #POLX #GILD #HOTC #KWS #CHRT

#PMI aum update - aum down £0.7bn over 3 months. Still bleeding outflows with £1.1bn lost over the last 12 months. No position - not going to be much left of this firm at this rate. Down to £9.8bn aum

#GILD three fortnite players signed - but they lose two heavy hitters. No position - Unfortunately it’s sponsorship here that is required and the usual “we are in advanced talks” been heard since 2022, is no longer good enough.

#HOTC full year - revenue down 10%, profit or lack of. There is a good business here, but management overreached and the price has been paid for that. No position - I’ve been burnt on this, but at some point it’ll be worth a look.

#SPSY largest central bank consumables order - the machine keeps churning out cash… all part of the 5 year deal and with a 22% price increase (that’s inflation protection!). I hold - nothing overly surprising here, business as usual

#POLR AUM update - 6 months drop of £0.1mil. £0.6mil net outflows and positive £0.5mil in performance. I hold - tech outflows are slowing and feels like we could be in a good place soon. Tied to the market but happy with that 6 month performance

United States Trends

- 1. Mike 1,8 Mn posts

- 2. Serrano 240 B posts

- 3. Canelo 16,6 B posts

- 4. #NetflixFight 72,5 B posts

- 5. Father Time 10,8 B posts

- 6. Logan 79,3 B posts

- 7. #netflixcrash 15,9 B posts

- 8. He's 58 26,2 B posts

- 9. Rosie Perez 14,9 B posts

- 10. ROBBED 102 B posts

- 11. Boxing 301 B posts

- 12. Shaq 16,2 B posts

- 13. #buffering 10,9 B posts

- 14. My Netflix 83,3 B posts

- 15. Roy Jones 7.187 posts

- 16. Tori Kelly 5.263 posts

- 17. Ramos 70 B posts

- 18. Muhammad Ali 18,6 B posts

- 19. #netfilx 5.074 posts

- 20. #cancelnetflix 5.080 posts

Something went wrong.

Something went wrong.