Similar User

@Laksen6

@sanneh_si

@JT81207851

@Rafal_Kr

@FlB0NACCI

@CalvinSim9

@Vktzn

@JhetamsC

@PirateJoeMiller

@sambuga1

@Randocrypto

@chrisw3ns3

guys, ETH is massively oversold, Ethereum is over-FUD’ed, and it remains the core driver of the future of crypto that’s it, that’s the tweet

Not sure there is a full appreciation for how special EVE Frontier is You write solidity contracts on Ethereum L2 to help run your spaceship and starbases in a Triple-A PvP open world by the best space sim company in the industry. Eth L2 contracts run your space empire 🤯

Enter the Frontier: PHASE V Playtest Starts 7 November. Register for Access: community.evefrontier.com Join Discord: discord.gg/evefrontier #EVEFrontier #CCPGames

unpopular opinion: all of Ethereum's "problems" would be "solved" if the EF just hired a good marketing department and Vitalik RT'd one great project from the Ethereum ecosystem per week I have thought through it again and again, and while Solana has some cool things,…

If I was a VC funded L1, I'd be hating on Ethereum, too. That's just game theory, it's the most successful L1 in the space to date, largest developer community, highest rate of homegrown code, and unable to be replicated in its origins. If I was a competitor, I'd be foolish not…

Just recorded with Andrew Koller (Ink founder) and @hilmarxo Notes on Kraken's new L2: - 8 months from decision to launch @inkonchain - Ethereum as DA, also looked at Celestia and Eigen - L3 DA could explore more modular not just Ethereum - Could have more than one L2 in the…

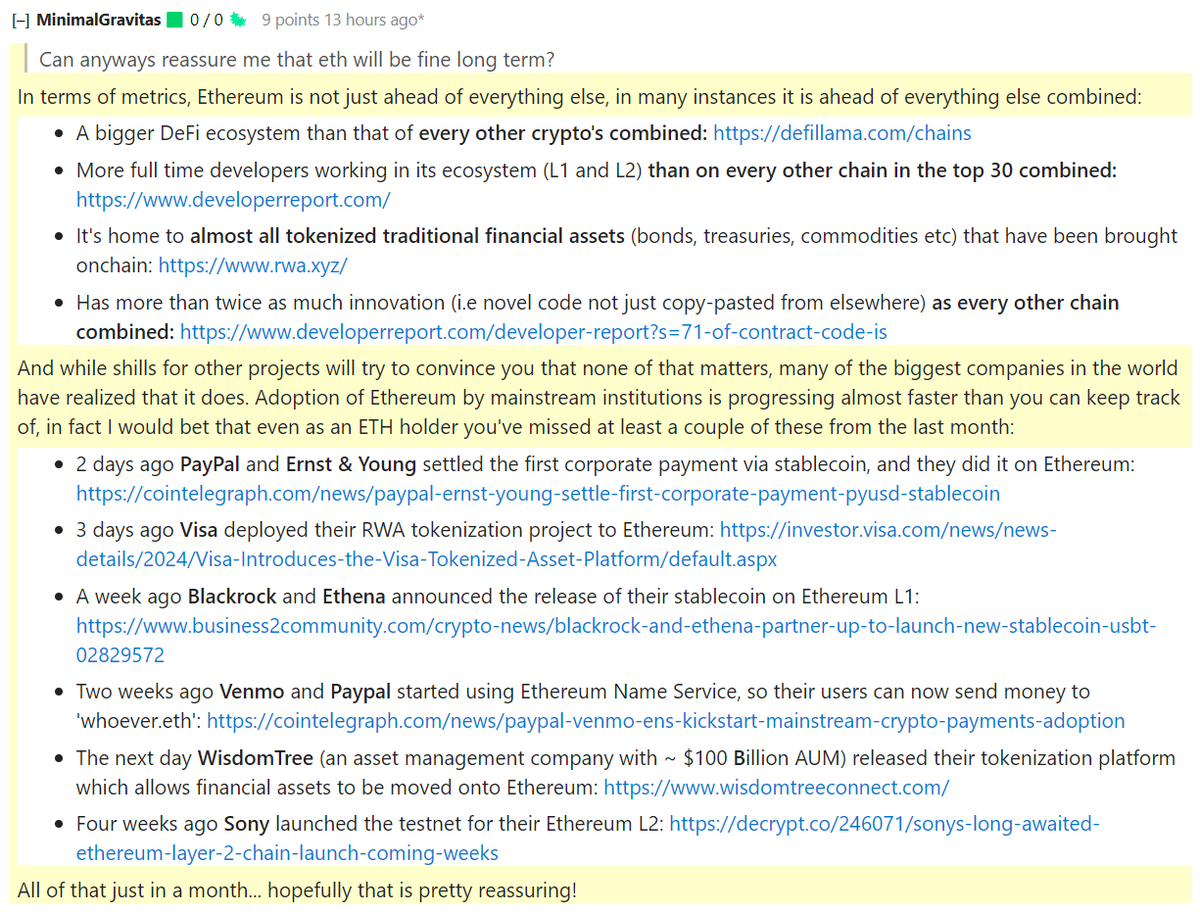

degens crying that there is nothing fun to do on Ethereum meanwhile real world adoption is taking off with both corporations and governments building on it ranging from onchain asset networks to identity solutions to stablecoin payments to decentralized finance

ETH relative price and sentiment are probably the most out of whack since Q4 2019. Meanwhile:

Ethereum’s slump has attracted some haters. What they’re missing: - More than half of all stablecoins are on Ethereum. - More than 60% of all DeFi assets are locked on Ethereum. - Polymarket settles on Ethereum. ETH looks like a potential contrarian bet through year-end 2024.

why look at ETH now? because everyone and their mother hates it and crypto is cyclical and people have short memories. halvening will possibly mark a pivot everyone acting like ETH is dead, but has 56% of TVL for the entire space- JUST at L1. and that percentage has been pretty…

.@cdixon spoke with @andrewrsorkin about future of crypto and benefits of blockchains. ‘Read Write Own - Building the Next Era of the Internet’ reveals how blockchain networks grant power/economic benefits to communities of users, not just corporations.

def possible and likely a lot of these actors play with their own L1s first to get the ropes (many already have been) but eventually they will want to plug in to something bigger which everyone can trust

I've heard some theories that BlackRock and other financial orgs will use Ethereum to act as a global ledger. I'm willing to bet they'll end up creating their own L1 chains with a controlled validator set. The Central Bank of Brazil is already doing this for their CBDC.

You should never invest as if people are rational actors They are irrational That is why massive returns exist. People invest based on emotions nothing more.

I am incredibly bullish about what @pbrody and the EY Blockchain team are doing. Paul’s words are not what you would expect from one of the big “Big Four” accounting firms. Public blockchains only ⛓️ Privacy focused 🛡️ Eth pragmatist 😎 Decentralization maxis 🎉

People really gonna fumble their bag because they think the Binance news is bearish In reality, it's some of the most bullish news we've gotten since BlackRock filed for a BTC ETF Strap in people - it's about to get wild

if you have access to ChatGPT but are not using it everyday especially with the browse web feature now enabled you are likely not being curious enough about new things in your daily life stay curious, my friends

New mortgage math is brutal. Say you buy a $1m house with $200k down at a 7% rate ($800k mortgage). Over the first three years you pay $193k ($5,322/mo.) After those $193k of payments your $800k mortgage is now at $774.5k. You paid $166k in interest, $25.5k in principle.

if you are 7+ years out of school, shift your mindset from "buy it cheap" to "buy it once, buy it right"

The ETF is going to happen. Then the ETH ETF is going to happen. Then you’re neighbor is going to knock on your door at $15,000 asking if they should buy the ETF and you’ll know you have 3 months left to sell. Then we will all cope together here again.

"Crypto UX is just too hard for mass adoption" *gets in car, drive 10 miles to bank branch open only 5 days a week, waits for a teller, asks to wire their own money, has to show 2 forms of ID, might have to talk to manager, pay a fee, wait until next day for wire to clear*

“The most powerful technologies send waves of fear through the establishment. When you see that fear in their eyes, invest in the cause of that fear.” -Fred Wilson avc.com/2023/05/the-fr…

United States Trends

- 1. $CUTO 7.020 posts

- 2. Tyson 9.557 posts

- 3. Laken Riley 19,5 B posts

- 4. Jake Paul 185 B posts

- 5. Ticketmaster 13,5 B posts

- 6. DeFi 104 B posts

- 7. Dora 20,8 B posts

- 8. #FursuitFriday 14,2 B posts

- 9. Pence 36,1 B posts

- 10. Wallo 6.412 posts

- 11. The UK 400 B posts

- 12. #FridayVibes 7.150 posts

- 13. #FridayMotivation 3.391 posts

- 14. Oscars 12,4 B posts

- 15. Iron Mike 13,9 B posts

- 16. Conan 20,7 B posts

- 17. Jen Psaki 22,4 B posts

- 18. #INDvSA 24,9 B posts

- 19. #AmericaRecyclesDay N/A

- 20. Good Friday 73,2 B posts

Something went wrong.

Something went wrong.