CGST Raigad

@cgstraigadOfficial Twitter handle of CGST and Central Excise, Raigad Commissionerate| Mumbai Zone | Ministry of Finance| Govt of India

Similar User

@CgstGurugram

@GSTnavimumbai

@CGST_ThaneRural

@GstSalem

@cgstraigadaudit

@Dgtpsmumbaicbic

@CGSTBhiwandi

@CGST_ALWAR

@cgstmumbaizone

@CgstKutch

@cgstranchizone

@CgstDimapur

@cgstbelapur

@AhmedabadDgts

@CgstJaipur

@cgstraigad busts a fake ITC racket of Rs. 19 Cr & arrested Director of M/s Passion Play India & the mastermind on 14.03.2023. The firm was engaged in availing & passing fraudulent ITC on bogus invoices of Rs. 90 Cr. Both accused remanded to jud. custody for 14 days.@cbic_india

As part of Vigilance Awareness week 2024, Essay competition on the topic “Culture of Integrity for Nation's Prosperity” was conducted in Raigad CGST&CX .

Shri Vishal Sanap, Commissioner@cgstraigad, administered the integrity pledge to the officers of CGST & CEX Raigad as a part of Vigilance Awareness week 2024.@cbic_india @CVCIndia#integritypledge#vigilanceawarenessweek2024.

As part of SHS Campaign 2024, CGST & C.Ex. Raigad carried out cleanliness drive in the office premises to keep the surroundings clean..

As part of SHS 2024 campaign Officers of CGST Raigad Commissionerate carried out cleanliness drive at Shree Dnyaneshwar Mauli Education Institution Panvel and also conducted a session to ignite a sense of awareness about cleanliness among them. @cbic_india @cgstmumbaizone

Thank you to all GST Taxpayers for contributing towards Nation Building

Raigad GST Commissionerate conducted In-House Trainers of Officers by Master-Trainers iro BO transition

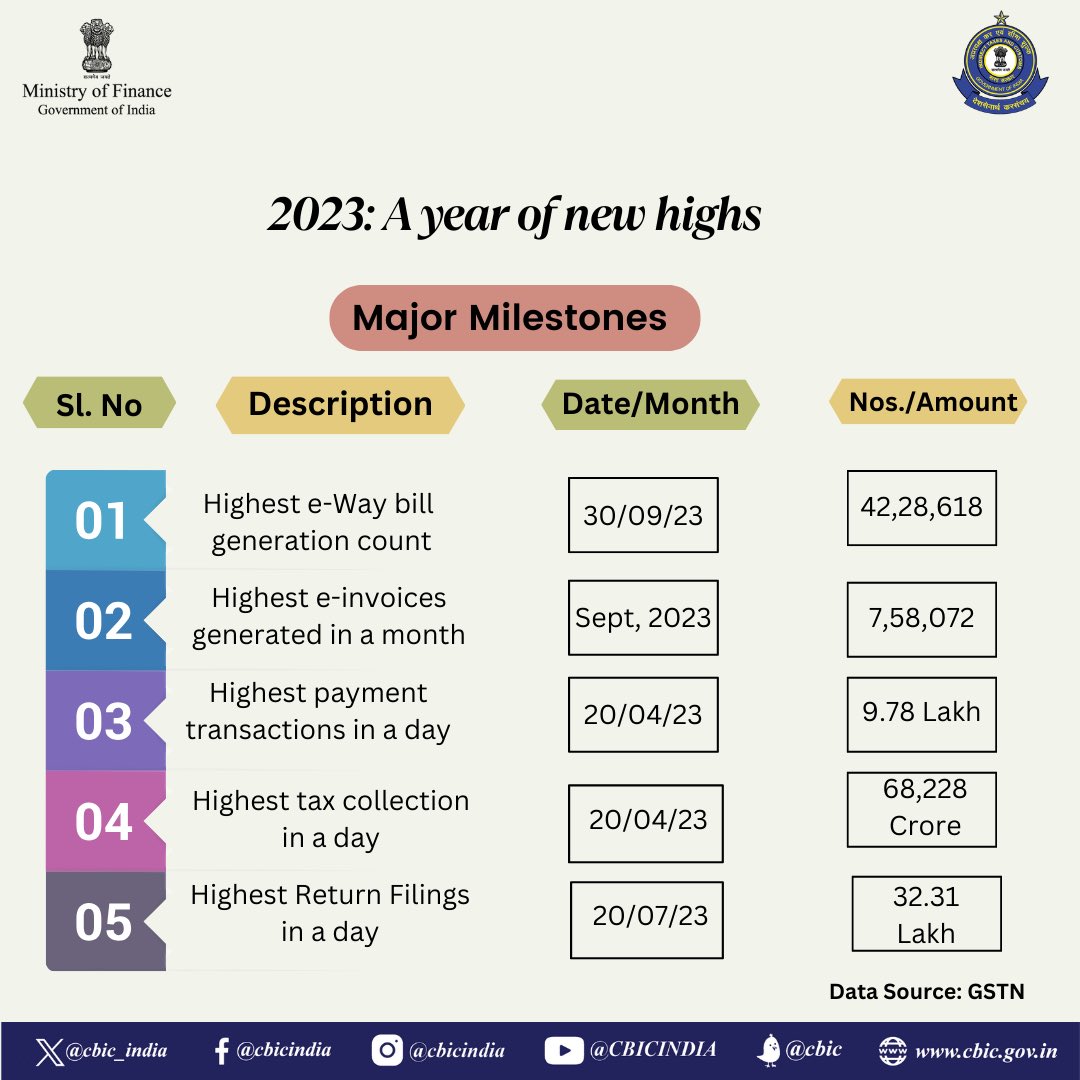

Year 2023 has been a year of new highs in a single day, in terms of highest e-way bill generation, highest payment transactions, Highest Tax collection and Highest Return filing. #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023

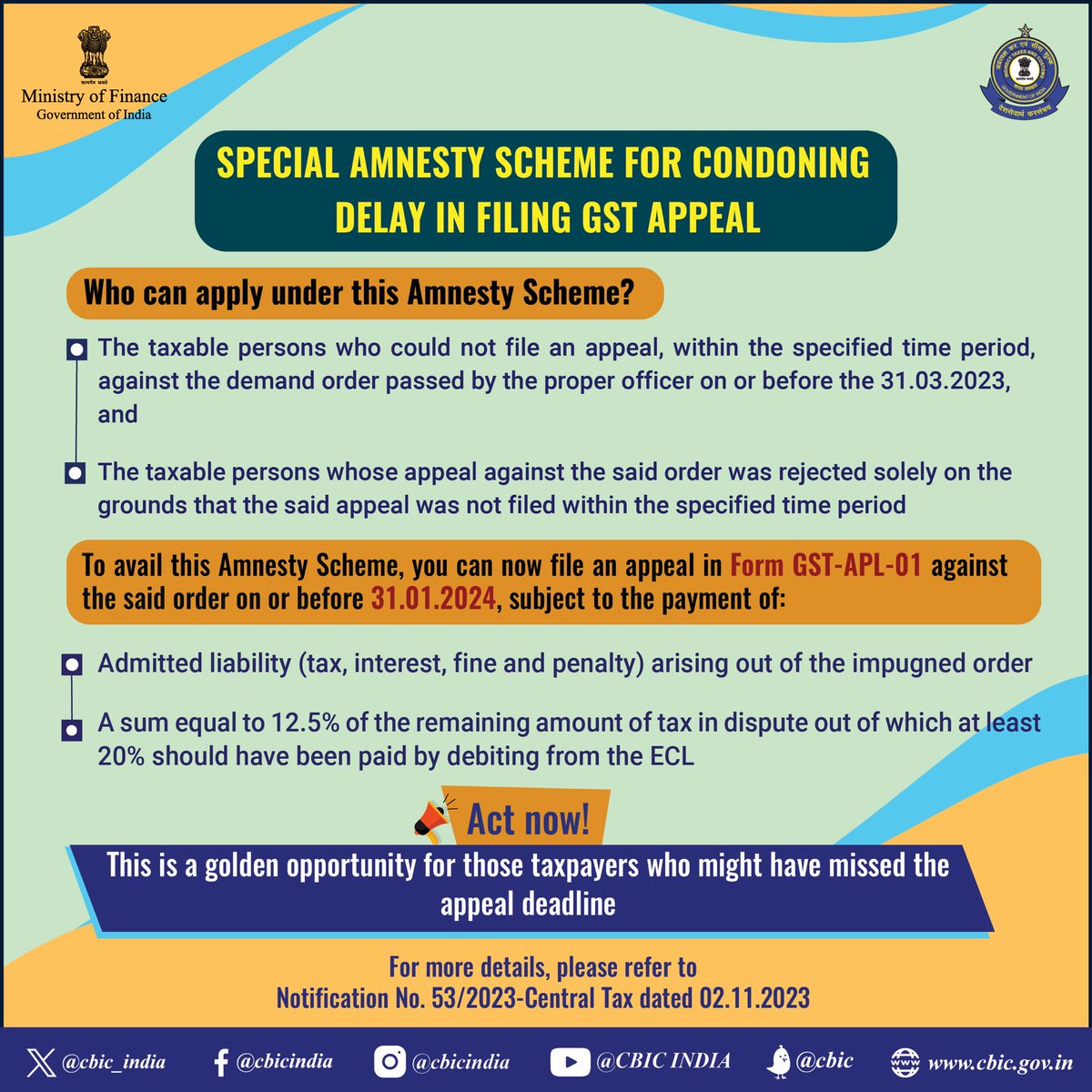

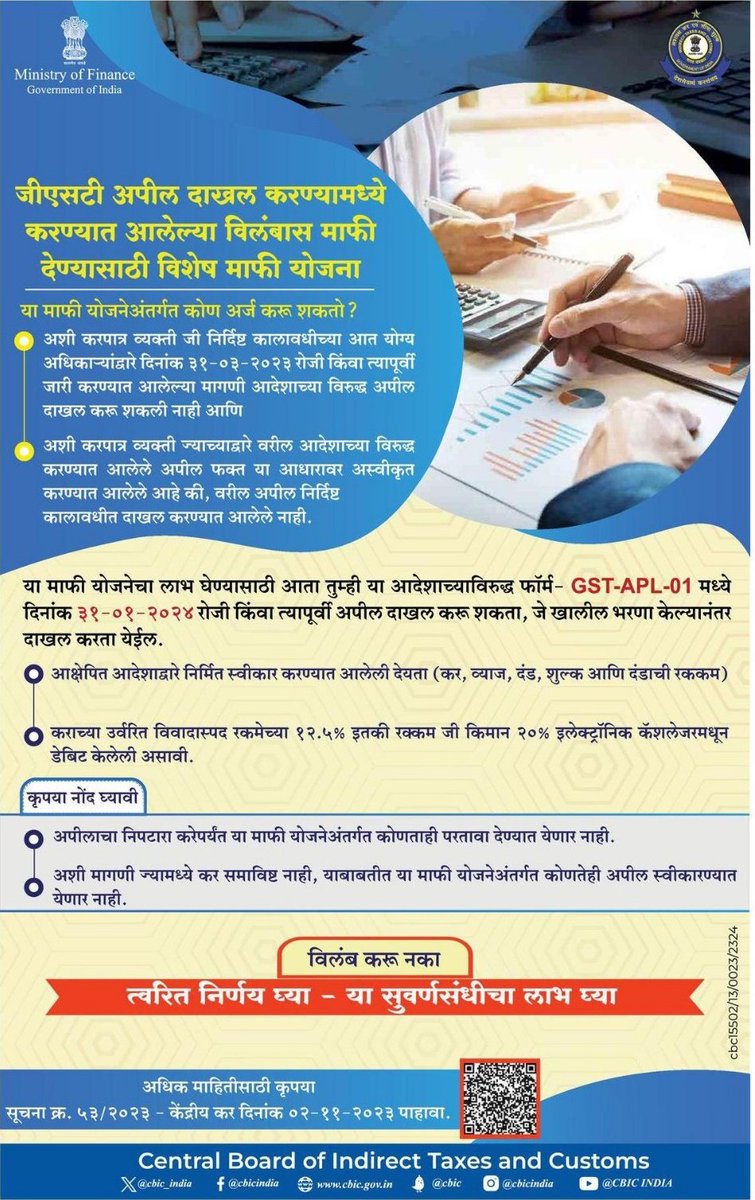

Special Amnesty Scheme announced for condoning delay in filing GST Appeal. The amnesty scheme is available till 31st January 2024. This is a golden opportunity for those taxpayers who might have missed the appeal deadline. #GSTforGrowth #EaseofDoingBusiness #ViksitBharat…

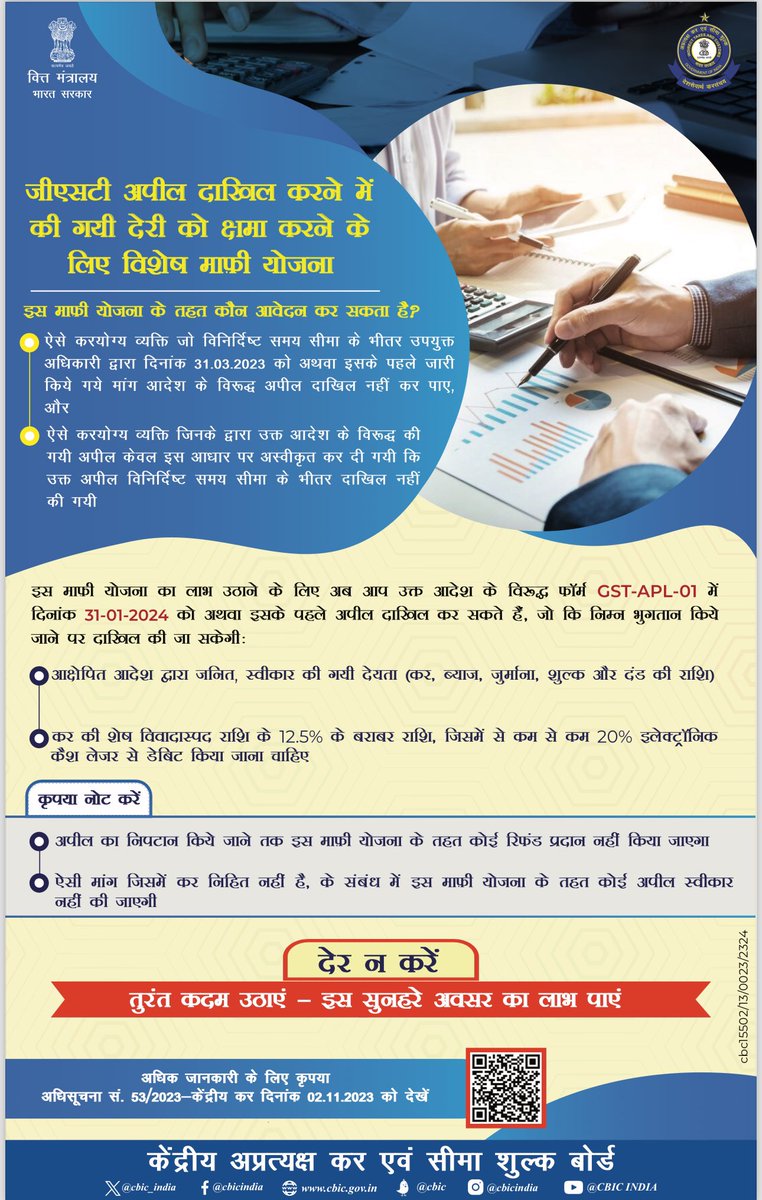

जीएसटी अपील दाखिल करने में देरी के लिए माफ़ी हेतु विशेष माफ़ी योजना।

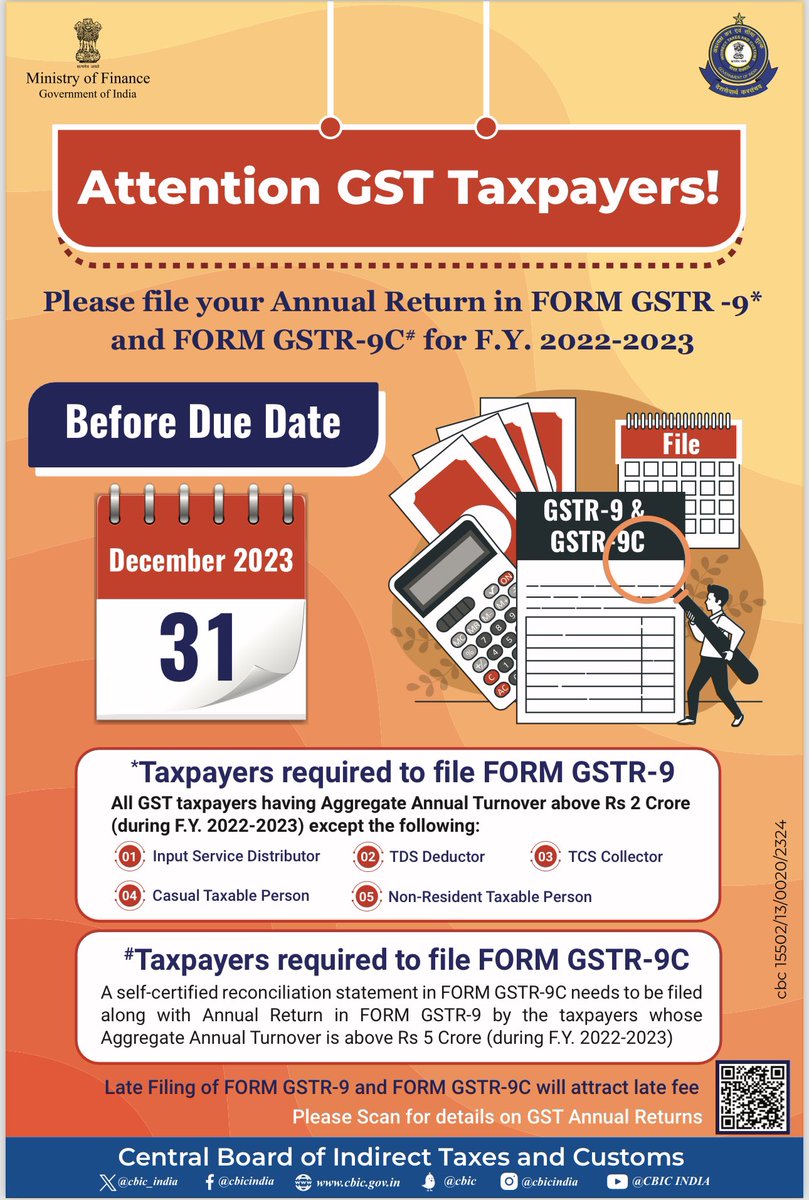

File your Annual Return in Form GSTR-9 and Form GSTR-9C before the due date.

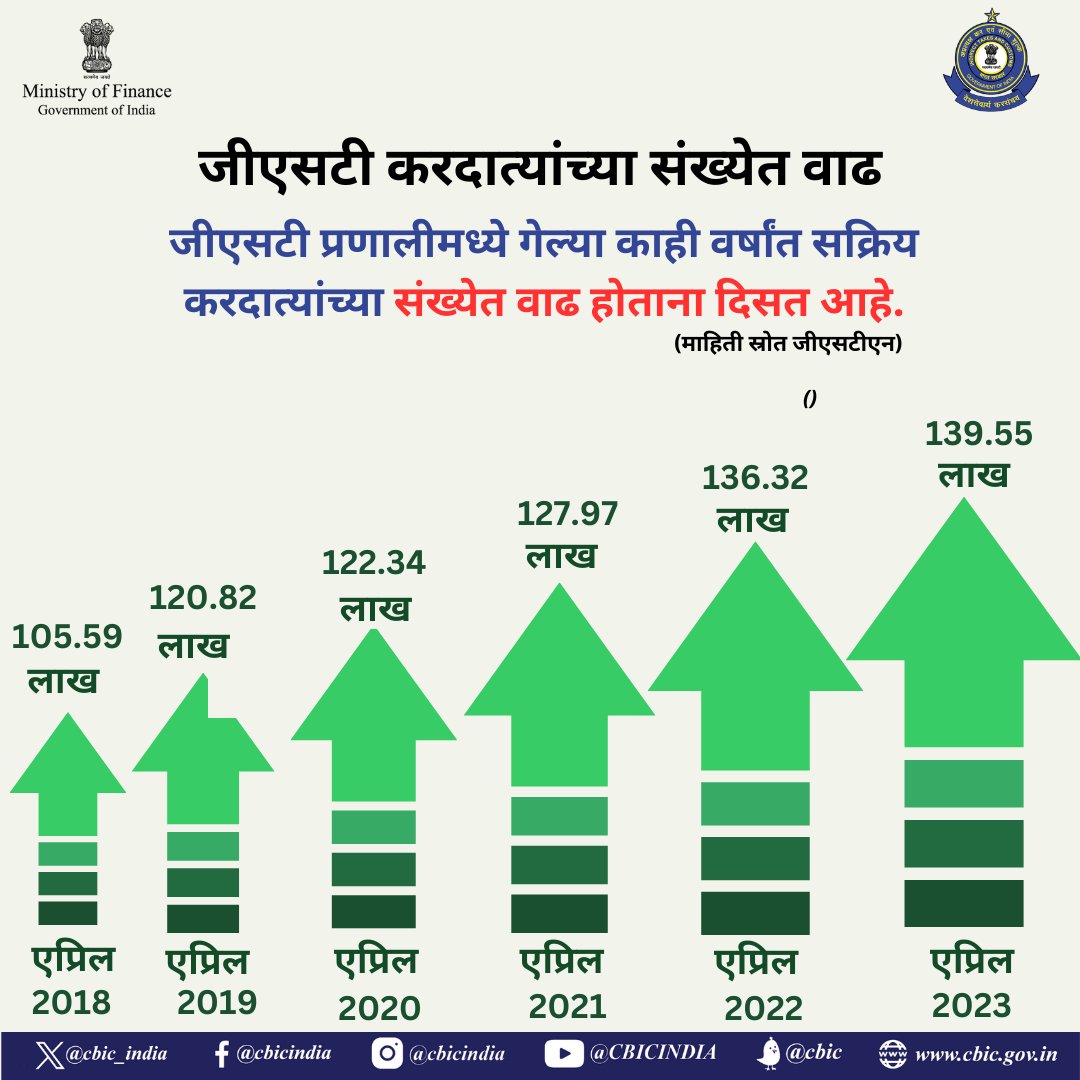

जीएसटी प्रणालीमध्ये गेल्या काही वर्षांमध्ये सक्रिय करदात्यांच्या संख्येचा वाढता कल दिसत आहे. #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023 @nsitharamanoffc @cbic_india @FinMinIndia @DrBhagwatKarad @mppchaudhary @PIB_India @DDNewslive @airnewsalerts

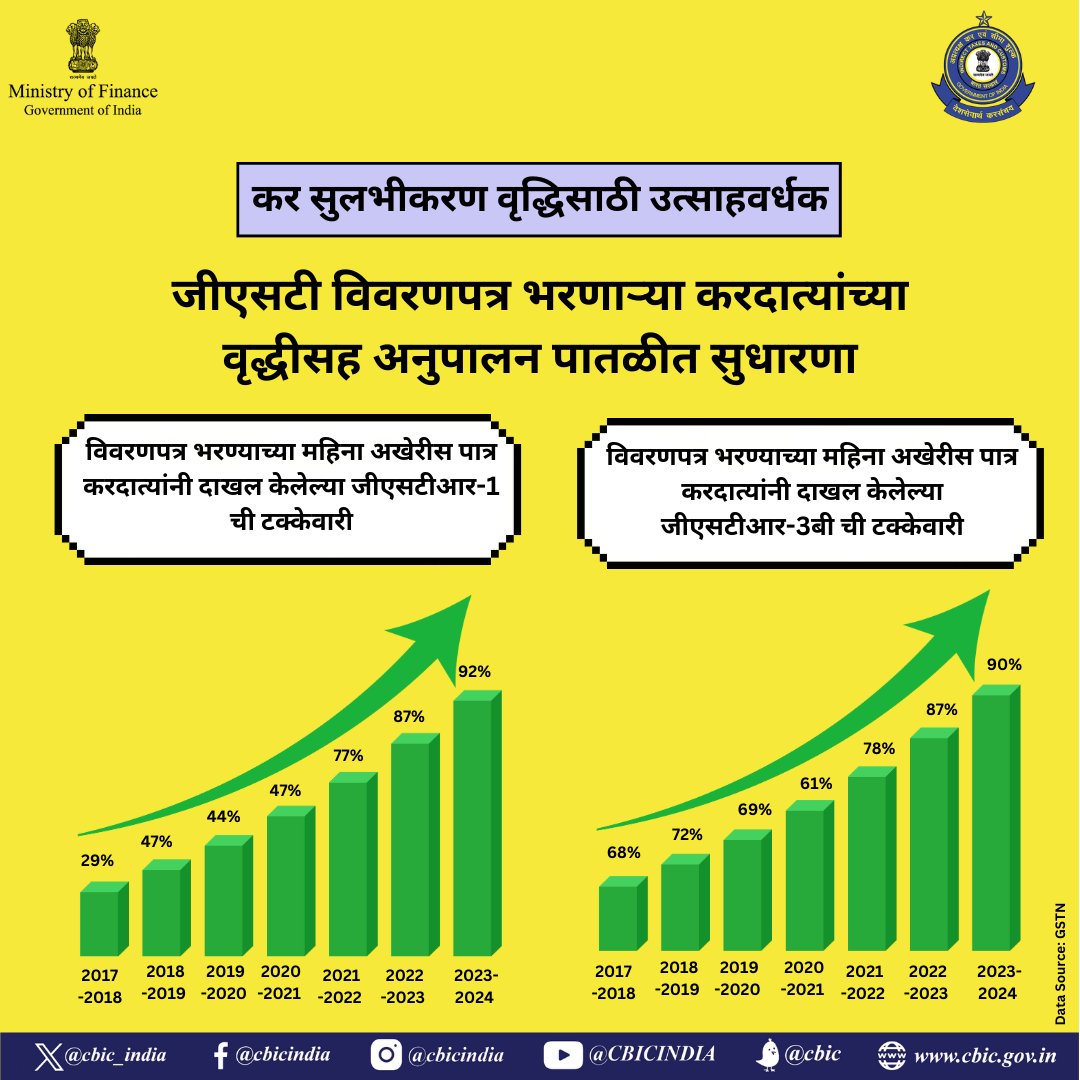

जीएसटीमधील प्रभावी धोरण आणि व्यवस्थात्मक बदलांमुळे जीएसटी विवरणपत्र दाखल करण्यामधील अनुपालन स्तरामध्ये गेल्या काही वर्षांत सुधारणा झाली आहे #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023 @nsitharamanoffc @cbic_india @FinMinIndia @DrBhagwatKarad @mppchaudhary

जीएसटीमधील नियम आणि प्रक्रिया सुलभीकरणामुळे पात्र करदात्यांच्या विवरणपत्र दाखल करण्याच्या टक्केवारीत वाढ #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023 @nsitharamanoffc @cbic_india @FinMinIndia @DrBhagwatKarad @mppchaudhary @PIB_India @DDNewslive

जीएसटी अपील दाखल करण्यामध्ये करण्यात आलेल्या विलंबास माफी देण्यासाठी विशेष माफी योजना

2 कोटी रुपयांपर्यंतची उलाढाल असलेल्या छोट्या करदात्यांना जीएसटीआर-9 अर्जामध्ये वार्षिक विवरणपत्र भरण्याची आवश्यकता नाही. #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023 @nsitharamanoffc @cbic_india @FinMinIndia @DrBhagwatKarad @mppchaudhary @PIB_India

समान पॅन असलेल्या नोंदणीकृत व्यक्तींमध्ये इलेक्ट्रॉनिक कॅश लेजरमध्ये (ईसीएल) शिल्लक हस्तांतरण करण्याची नवीन सुविधा. #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023 @nsitharamanoffc @cbic_india @FinMinIndia @DrBhagwatKarad @mppchaudhary @PIB_India @DDNewslive

जीएसटीआर-3बी अर्जातील सुधारणा, इलेक्ट्रॉनिक क्रेडिट आणि रि-क्लेम विवरण यांच्यामुळे जीएसटीआर-3बी विवरणपत्र भरणे सोपे झाले आहे. #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023 @nsitharamanoffc @cbic_india @FinMinIndia @DrBhagwatKarad @mppchaudhary @PIB_India

करविषयक दायित्वातील भिन्नता आणि इनपुट टॅक्स क्रेडिट #ITC (आदान कर क्रेडीट) मधील फरक स्पष्ट करण्यासाठी करदात्यांकरिता नवीन ऑनलाईन सुविधा पुरवण्यात आली आहे. #GSTforGrowth #EaseofDoingBusiness #ViksitBharat #FinMinReview2023 @nsitharamanoffc @cbic_india @FinMinIndia

United States Trends

- 1. Chiefs 126 B posts

- 2. Josh Allen 6.236 posts

- 3. 49ers 2.136 posts

- 4. Niners 7.709 posts

- 5. Mahomes 35 B posts

- 6. Geno 33,2 B posts

- 7. Super Bowl 17,9 B posts

- 8. Bo Nix 15,7 B posts

- 9. #KCvsBUF 20,5 B posts

- 10. WWIII 97,9 B posts

- 11. Falcons 20,1 B posts

- 12. Seahawks 27,2 B posts

- 13. Broncos 33,7 B posts

- 14. Kyle 46,1 B posts

- 15. Chargers 17,5 B posts

- 16. Steelers 128 B posts

- 17. Paige 19,2 B posts

- 18. 72 Dolphins 1.183 posts

- 19. Ravens 87,5 B posts

- 20. Bears 118 B posts

Who to follow

-

CGST Gurugram Commissionerate

CGST Gurugram Commissionerate

@CgstGurugram -

CGST Navi Mumbai (Mumbai Zone)

CGST Navi Mumbai (Mumbai Zone)

@GSTnavimumbai -

CGST Mumbai Zone-Thane Rural Commissionerate

CGST Mumbai Zone-Thane Rural Commissionerate

@CGST_ThaneRural -

Salem GST Commissionerate

Salem GST Commissionerate

@GstSalem -

CGST Raigad Audit

CGST Raigad Audit

@cgstraigadaudit -

DGTPS MUMBAI CBIC

DGTPS MUMBAI CBIC

@Dgtpsmumbaicbic -

CGST Bhiwandi Commissionerate

CGST Bhiwandi Commissionerate

@CGSTBhiwandi -

CGST & Central Excise Alwar

CGST & Central Excise Alwar

@CGST_ALWAR -

CGST Mumbai Zone

CGST Mumbai Zone

@cgstmumbaizone -

CGST Kutch Commissionerate

CGST Kutch Commissionerate

@CgstKutch -

CGST Ranchi Zone

CGST Ranchi Zone

@cgstranchizone -

Dimapur CGST Commissionerate

Dimapur CGST Commissionerate

@CgstDimapur -

CGST BELAPUR

CGST BELAPUR

@cgstbelapur -

DGTS AHMEDABAD CBIC

DGTS AHMEDABAD CBIC

@AhmedabadDgts -

CGST Jaipur

CGST Jaipur

@CgstJaipur

Something went wrong.

Something went wrong.