Carl Davis

@carlpdavisResearch Director @iteptweets. Tweeting tax and how it intersects w/ inequality, education, infrastructure, cannabis. Tweets are my own.

Similar User

@iteptweets

@dashching

@ScoopOnTaxes

@stevertax

@davidckamin

@ChuckCBPP

@taxjusticewonk

@amyhanauer

@jacsamoby

@bearerfriend

@Kamolika_Das

@ShannonCBPP

@gardmaf

@TaxNotes

@jtcurry005

NEW: We just published the first-ever data, by income level, looking at who's using state voucher tax credits to reroute their tax dollars away from public coffers and into private and religious schools. In case there was any doubt: it's the wealthy. 1/ itep.org/tax-avoidance-…

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Our latest edition of Who Pays? examines the tax systems in all 50 states and D.C. itep.org/whopays-7th-ed…

Really regretting switching to @ATT fiber internet. Our neighborhood has been in an outage for almost 24hrs. It's the only outage in the area. Are there zero techs on standby for dealing with this?

Hot off the press: A first-ever comprehensive look at earned income tax credits provided by local governments. We examine 3 credits that raise the incomes of 700,000 low-income working families, with new distributional analysis by income and race. itep.org/local-earned-i…

State tax levels have little effect on whether and where people move. And to go a step further: "...states can increase taxes on the wealthy without any serious risk of significantly impacting migration." New findings from @CenterOnBudget here. cbpp.org/research/state…

Illinois's school privatization tax credit, called "Invest in Kids," is atrocious policy. It reimburses rich folks for 75%+ of the "gifts" they make to fund private and religious K-12 schooling. Donors to other causes get no such reimbursement, of course. itep.org/illinois-vouch…

The largest small business tax break goes by many names: the pass-thru deduction, Section 199A deduction, QBI deduction. What it's NOT is a tax break for small business. Sure, some small businesses claim it. But over half the benefit of the 199A deduction goes to the very rich.

Utterly shameless. Are you a huge corporation hiding your profits in tax haven countries? Montana doesn't want to hear about it anymore, under legislation just signed this week. leg.mt.gov/bills/2023/bil…

Incredible news.

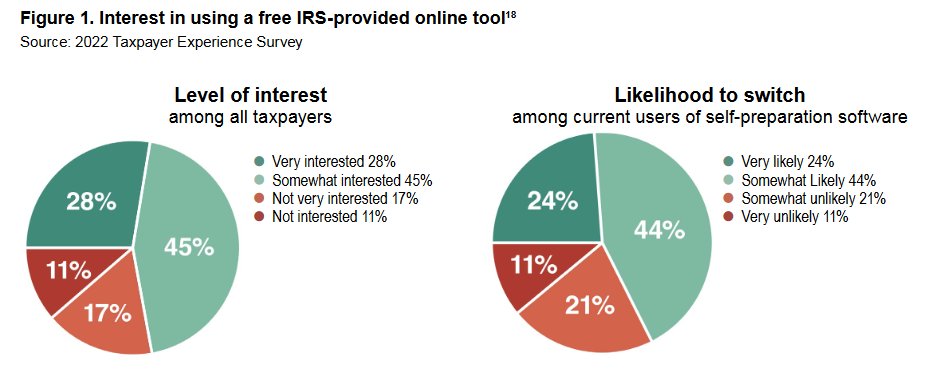

🦇🚨 TAX SCOOP: IRS has built an e-filing prototype that could compete with tax-prep software giants. Pilot program for certain filers coming January 2024. washingtonpost.com/business/2023/…

My guess is that corporate tax planners are a whole lot more worried about what's going on in Minnesota than the corporations themselves. The companies can afford to pay a fair tax bill. It's the planners who become useless if we end their games. startribune.com/dont-let-exper…

Property tax cuts have been a big topic lately, but most miss the mark. If you're worried that property tax bills have become unaffordable for some families, there's no better way to deal with that than circuit breakers. New from @BrakeyshiaSamms and me: itep.org/property-tax-a…

Why are the business and tax planning lobbies working overtime to stop this reform in Minnesota? "Because [it] would eliminate virtually all corporate state income tax avoidance... there’s no credible policy argument against this elegant solution." news.bloombergtax.com/tax-insights-a…

Wealthy seniors' political clout is on display again, this time in Missouri, with near-unanimous approval of atrocious tax carveouts. Income tax cuts exclusively for upper-income seniors + a property tax freeze that's totally divorced from ability to pay. missouriindependent.com/briefs/bill-ex…

It is my pleasure to sign a joint professors letter in support of Minnesota's proposed Worldwide Combined Reporting reforms to combat international corporate tax avoidance. Our letter is available here: tinyurl.com/5ajnn4ne

Whistleblower @GriswoldDon published the corporate tax avoidance playbook last year -- complete with names and diagrams. It's impossible to read it without coming away feeling embarrassed for outgunned state tax departments. WWCR is how we fix this. #mnleg taxnotes.com/tax-notes-stat…

Babies are more likely to survive their first year in states that raise adequate revenue from those most able to pay. Don't believe me, believe the Journal of the American Medical Association.

Tax policy is an important, modifiable social determinant of health. Increased state-level tax revenue and increased tax progressivity (ie, higher taxes for wealthier individuals) were both associated with decreased infant mortality in the US, 1996-2019. ja.ma/3LAyAyZ

A little under half the country lives in states where adults can legally buy cannabis.

It's #420day today. Cannabis is legal for general adult use in 20 states, with sales underway in 19 of those states (Maryland will begin sales this summer). What’s the law in your state? We’ve got you covered with a new data map. itep.org/cannabis-taxes…

United States Trends

- 1. ICBM 116 B posts

- 2. The ICC 28,8 B posts

- 3. Good Thursday 23,7 B posts

- 4. #KashOnly 9.123 posts

- 5. Dnipro 42,9 B posts

- 6. Bezos 24,2 B posts

- 7. #thursdayvibes 3.109 posts

- 8. #ThursdayMotivation 4.399 posts

- 9. #21Nov 2.384 posts

- 10. Happy Friday Eve N/A

- 11. #ThursdayThoughts 2.970 posts

- 12. Nikki Haley 28,5 B posts

- 13. $DUB 7.556 posts

- 14. MIRV 4.955 posts

- 15. Bitcoin 628 B posts

- 16. Adani 706 B posts

- 17. Juice WRLD 24,8 B posts

- 18. Happy Birthday Nerissa 7.573 posts

- 19. Ellen DeGeneres 70,3 B posts

- 20. Aunt Jemima N/A

Who to follow

-

ITEP

ITEP

@iteptweets -

Chye-Ching Huang

Chye-Ching Huang

@dashching -

ScoopOnTaxes

ScoopOnTaxes

@ScoopOnTaxes -

Steve Rosenthal

Steve Rosenthal

@stevertax -

David Kamin

David Kamin

@davidckamin -

Chuck Marr

Chuck Marr

@ChuckCBPP -

Richard Phillips

Richard Phillips

@taxjusticewonk -

Amy Hanauer

Amy Hanauer

@amyhanauer -

Samantha Jacoby

Samantha Jacoby

@jacsamoby -

Jeremy Bearer-Friend

Jeremy Bearer-Friend

@bearerfriend -

Kamolika Das

Kamolika Das

@Kamolika_Das -

Shannon Buckingham

Shannon Buckingham

@ShannonCBPP -

Matthew Gardner, also @mindthegaap.bsky.social

Matthew Gardner, also @mindthegaap.bsky.social

@gardmaf -

Tax Notes

Tax Notes

@TaxNotes -

Jonathan Curry

Jonathan Curry

@jtcurry005

Something went wrong.

Something went wrong.