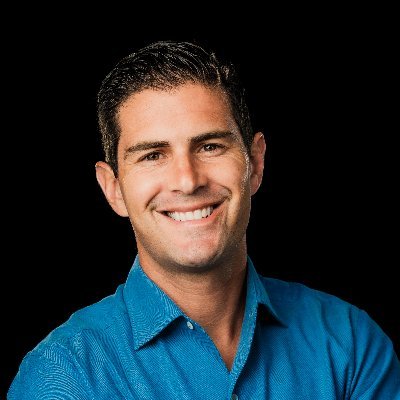

Brad Griffin

@bradgriffin_CPA | Tweeting about the intersection of startups and finance. Current COO https://t.co/NW0xt6BNVK. Former @takl_app, @deloitte

Similar User

@MrSantoshSuresh

@wolfgangsmyname

@mycarlwright

@_Selim_Uysal

@parimaldutta

@rherochoa

@sroy_tweets

@caseystamper57

@davidfblog

@GeorgeBarbov

@SOVMoneyMindset

@Zakwritez

@cagdotin

@Conflict_Coach

One of the most legendary investors of all time: Ray Dalio For the last 5 years, he has hosted an AMA on Reddit every year. I read every single answer and pulled out the best responses on economics, investing, and life (so you don't have to). Here are the top 20 nuggets:

Jeff Bezos: the most senior person at a meeting should speak last (superb leadership advice)

“For every 5 likes this gets” I’ll ask ChatGPT to make this golfer more frustrated.

“How do you know a business is operating at a high level?” These are the things I look for. My 19 traits of top 1% performing businesses:

The $15 million investment will help fuel Skin Pharm's expansion plans. trib.al/2esEBFv

The Masters is one of my favorite sporting events, and its 85+ year history brings some great traditions. So here's a running list of the most interesting facts: 1. Media tickets (badges) have RFID tags inside them so the club knows where each person is at all times.

Home Price Decline by City (% Change from High): 1. San Francisco: -17% 2. Seattle: -16% 3. San Diego: -12% 4. Phoenix: -11% 5. Las Vegas: -10% 6. Denver: -10% 7. Portland: -9% 8. Dallas: -9% 9. LA: -8% 10. Boston -6% 11. Minneapolis: -5% 12. DC: -5% 13. Chicago: -4% 14. Miami:…

The charts below show US office vacancy rates as well as office space additions and absorptions. Source: @WSJ, @shaneshifflett, @DannyDougherty

One of the most legendary investors of all time: Ray Dalio For the last 5 years, he has hosted an AMA on Reddit every year. I read every single answer and pulled out the best responses on economics, investing, and life (so you don't have to). Here are the top 20 nuggets:

Hi, I’m Lindsey. A bit about me: - Ohio mother of 4 - I employ a team of 15 as a start-up founder & CEO of Strongsuit - drive a used Honda Odessey - husband works in manufacturing - The financial future of my company, team and family are at risk w/ the collapse of SVB (1/23)

March 6, 2012, changed Michael Dubin's life forever. The night before, he posted a video on YouTube about his new start-up. When he woke up, his website was down from all the traffic. This is the story about the viral video that changed the way you sell on the internet 🧵

If you are the CEO or CFO at a business who banks with SVB; here are some things you CAN do over the weekend 1. Build a 4 week rolling daily receipts and payments style cashflow forecast. 2. Gear up finance team to actualize & reforecast every AM by 10am

The Silicon Valley Bank situation is likely not contained. They funded long-dated fixed-rate assets (that are required to be marked-to-market) with variable-rate funding (customer deposits) in a rising interest rate environment. This is toxic. There will be follow-on effects.

My god. @garrytan on CNBC just now: Over 1,000 YC companies have been impacted. This is an extinction level event for startups. These depositors will not survive without a government plan.

5. Deposits were pouring in too fast to lend responsibly. $SIVB recognized that. Rather than make dumb loans, $SIVB bought assets guaranteed by the US government - Treasuries and MBS. BUT, it bought long duration. Often 10+ year bonds. Mistake!

Silicon Valley Bank is imploding before our eyes here is how SVB threw 50 years of goodwill and $80 billion down the drain in just 30 hours

Savage

Everyone wishes they were taught personal finance in school. But none of us were. So I spent the last week on Twitter gathering all the best personal finance advice. This is Personal Finance 101 taught by the best 14 professors on Twitter:

9. Final quote is from $TSLA CEO @elonmusk on the future: ".We've got more great ideas...So the future is very exciting. As I said in the last call, there's going to be bumps along the way..But long term, I am convinced that Tesla will be the most valuable company on earth"

Tesla knows how to scale a business. In Q4: - Revenue up +37% - Operating costs drop -16% - Operating Profit surge +49% Elon is the man.

United States Trends

- 1. Feds 31,2 B posts

- 2. Brian Kelly 1.851 posts

- 3. Nuss 2.370 posts

- 4. Lagway 2.975 posts

- 5. Tyler Warren 1.714 posts

- 6. #UFC309 32,2 B posts

- 7. Travis Hunter 25,4 B posts

- 8. Clemson 10,6 B posts

- 9. Heisman 12,2 B posts

- 10. Hornets 9.591 posts

- 11. Nebraska 7.811 posts

- 12. Gators 5.964 posts

- 13. Bill Nye 5.444 posts

- 14. Chris Wright 10 B posts

- 15. #Huskers 1.049 posts

- 16. Raiola N/A

- 17. Lamelo 6.577 posts

- 18. Trey Smack N/A

- 19. Florida 65,4 B posts

- 20. #mnwildfirst N/A

Who to follow

-

Santosh

Santosh

@MrSantoshSuresh -

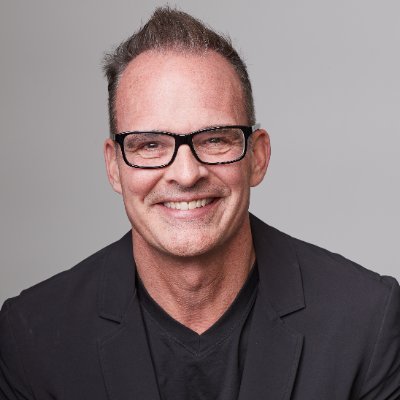

Wolfgang Gruber

Wolfgang Gruber

@wolfgangsmyname -

Carl Wright

Carl Wright

@mycarlwright -

Selim Uysal

Selim Uysal

@_Selim_Uysal -

Parimal Dutta | BetweenTheLines 🚢

Parimal Dutta | BetweenTheLines 🚢

@parimaldutta -

Raul Hernandez Ochoa

Raul Hernandez Ochoa

@rherochoa -

Su Roy

Su Roy

@sroy_tweets -

Casey Stamper

Casey Stamper

@caseystamper57 -

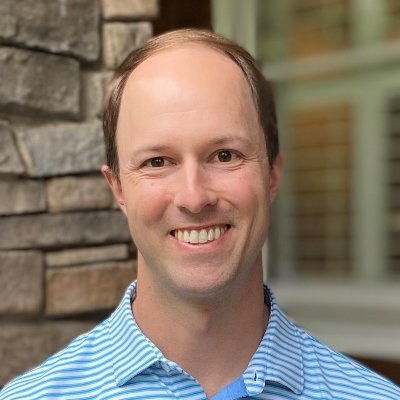

David Franzen

David Franzen

@davidfblog -

George Barbov

George Barbov

@GeorgeBarbov -

Cameron GrandPre

Cameron GrandPre

@SOVMoneyMindset -

Zak

Zak

@Zakwritez -

cag.in

cag.in

@cagdotin -

Sarah Albo | Your Conflict Coach 🚢

Sarah Albo | Your Conflict Coach 🚢

@Conflict_Coach

Something went wrong.

Something went wrong.