CharlestonRealEstate

@bheron3Real Estate Professional in Charleston SC and surrounding areas

Similar User

@big30054

@declan_deus

@LTK6260

@paua95

@Tavione11

Scott Turner, Trump's pick for HUD Secretary, is a man of incredibly infectious optimism, faith and love for people. Genuine love for helping others. AND a guy with a background in multifamily housing development! Plus champion of Opportunity Zones. Home run.

The average 30-year fixed mortgage rate today: 7.03% Spread: 262 bps

Being “Client-Oriented” isn’t lip service. Top brokers go beyond transactions, aligning with client goals. The deal isn’t the end – it’s the beginning of a relationship. Aim to be indispensable!

In 2020, 4.5% of single-family starts were BTR. In 2023, it was 9.5%. We are seeing BTR growth in AZ and TX and expect BTR to continue growing its market share over the next decade. Read more of our BTR insights in @ResidentialClub with @NewsLambert: resiclubanalytics.com/p/this-ceo-who…

OCTOBER HOUSING STARTS 80k Single-Family starts This is a recessionary trajectory

Multifamily starts for October 2024 came in lower than any October in 12 years. Year-to-date, completions are outpacing starts by 218,500 units -- a massive deficit pointing to significantly reduced apartment supply by 2026.

The average 30-year fixed mortgage rate heading into the weekend: 7.12% Spread: 269

We will never have 3% interest rates again. NEVER. The public does not understand what a historical anomaly 3% interest rates were.

BREAKING: Fed Chair Powell says the Fed does not need to be "in a hurry" to reduce interest rates. He said, "the economy is not sending any signals that we need to be in a hurry to lower rates." Why did the Fed cut by 50 basis points in September?

12) Back to operations: Renter turnover remains low, mirroring an industrywide trend. AVB attributed that, in part, to "record lows" in move-outs to purchase homes.

Multifamily cap rates and rent growth projections - by market.

Camden (apartment REIT w/ 60k units) had its earnings call last week. As usual, Camden offered lots of color -- particularly on the buy-or-build dynamics of today's market. Highlights: 1) It's tough to build b/c "construction costs have NOT come down and rents HAVE come down."

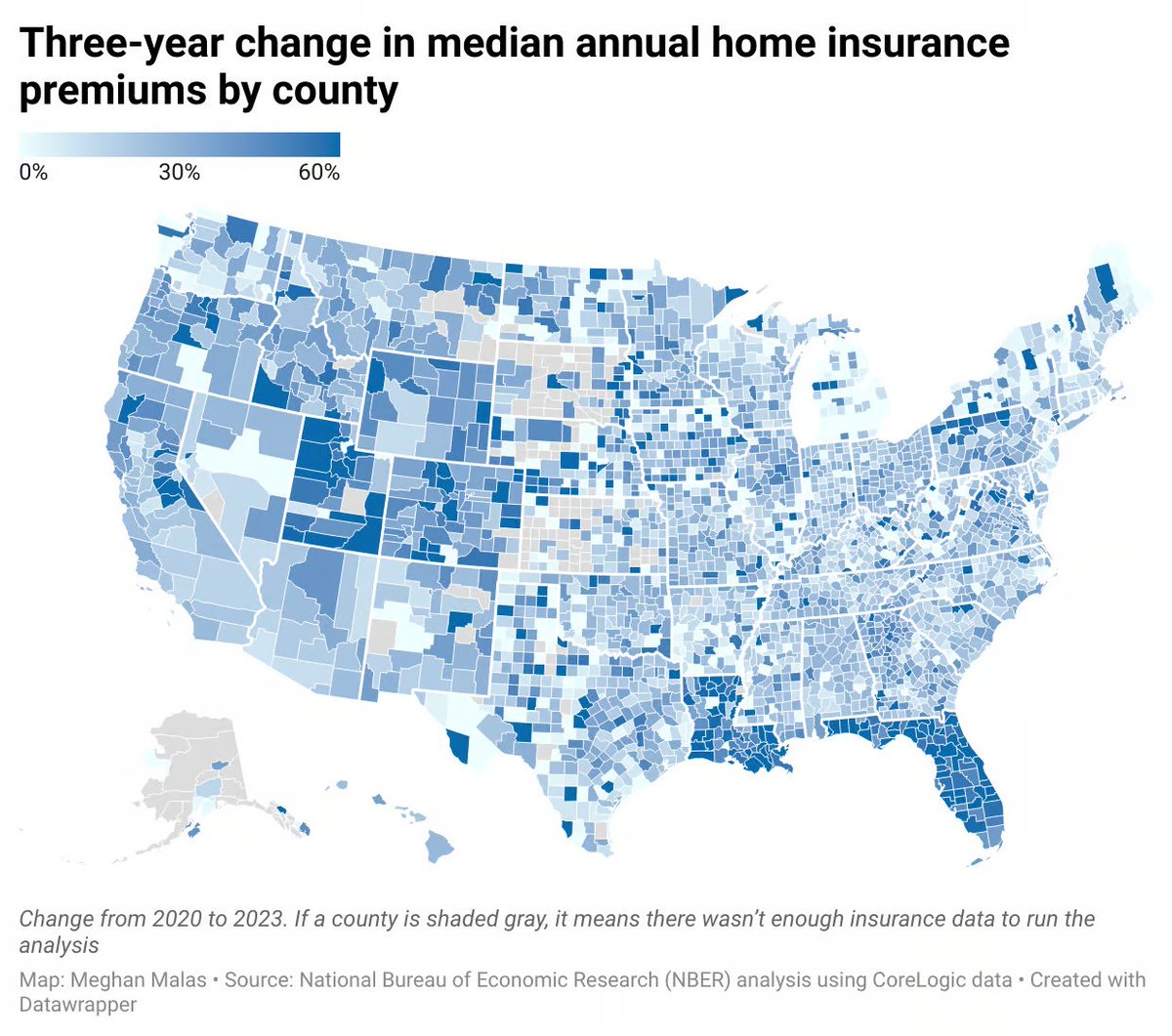

Insurance will be the biggest story in real estate over the next decade

Housing is getting hit by a home insurance shock To better understand where home insurance is headed next, I’ll be interviewing John Rogers, CoreLogic’s Chief Analytics Officer, at ResiDay on Friday (tomorrow!) in NYC Get your ResiDay ticket here: lu.ma/wy03vch0

6-handle is back The average 30-year fixed mortgage rate slips to 6.98% Spread: 263 bps

Eight potential impacts of Trump's win (and GOP taking Senate) on rental housing: 1) It's less likely we'll see legislation to push tax penalties on single-family rental investors. Also, the author of that Harris-endorsed legislation (Brown) lost re-election. 2) It's less…

D.R. Horton forecast 2025 revenue and home deliveries below estimates today. That pushed homebuilder stocks down. In terms of margins, D.R. Horton is still above pre-pandemic levels despite making adjustments in some markets to keep sales going x.com/ResidentialClu…

The gross margins of @DRHorton—America's largest homebuilder—by Q4 2017 Q4 --> 20.8% 2018 Q4 --> 21.9% 2019 Q4 --> 21.8% 2020 Q4 --> 24.3% 2021 Q4 --> 28.3% 2022 Q4 --> 28.9% 2023 Q4 --> 25.8% 2024 Q4 --> 25.5%

We recently asked homebuilders if they’d change their 2025 starts targets should mortgage rates stay 6%+ and resale inventory expand into the spring selling season. Only 17% said they’d lower their starts target, but I suspect if we had said 6.5%+ or 7% like today’s rate…

Fannie Mae and Freddie Mac have just increased their appraisal waiver programs from 80% to 90% LTV/TLTV. This means more home buyers will be able to put just 10% down and avoid the expense and waiting period of a traditional appraisal. These waivers allow lenders to underwrite…

There are fewer starter homes than ever before, per Bloomberg:

“The biggest shortage in the country is entitled land that we can build on.” - John Burns, CEO John Burns Research & Consulting @johnburnsjbrec @JBREC

The number of new homes completed and available for sale in September 2024 is 38% above pre-pandemic September 2019 levels

United States Trends

- 1. Southampton 60,2 B posts

- 2. Liverpool 142 B posts

- 3. #AskFFT N/A

- 4. Geraldo 5.788 posts

- 5. Mo Salah 14 B posts

- 6. Good Sunday 72,2 B posts

- 7. #SOULIV 26,6 B posts

- 8. #sundayvibes 9.661 posts

- 9. #AskZB N/A

- 10. #RollWithUs N/A

- 11. Chuck Woolery 15,7 B posts

- 12. Xcretion N/A

- 13. Robertson 13,6 B posts

- 14. Michael Oliver 4.639 posts

- 15. Jim Montgomery 1.919 posts

- 16. Rachel Maddow 25,9 B posts

- 17. Bannister 2.043 posts

- 18. Konate 4.210 posts

- 19. Robbo 3.380 posts

- 20. Defund NPR N/A

Something went wrong.

Something went wrong.