ASX Bull

@asxbulllNew ASX investor / trader ... nothing makes you learn faster than losing money!

Similar User

@heffandstonks

@J_MFTC

@asxHunter6

@Where_is_Wayne

@Tommy__Trades

@RealYowie

@Trader_9797

@FillipPrestipi1

@Burntasxchef

@KrillinTrades

@Elliot_r_l

@Anthony03698594

@hingdog

@kevin_ervine

@caps_biggie

Pinning this here to remind me!

The most underrated trading skill is not trading when there is no signal.

JUST IN 🚨: Warren Buffett Indicator hits an all-time high of 202%, surpassing the Dot Com Bubble, the Global Financial Crisis, and the 2022 Bear Market 🐻

It's been real, big-cap tech $XLK Price action is telling us to run for the hills, while the narrative is these stocks are the only game in town The summer selloff looks like initiation of a new downtrend And it's happening where the ratio peaked during the dot-com bubble

BREAKING 🚨: Super Micro Computer $SMCI is down more than 80% since joining the S&P 500 on March 18. Has there ever been a worse debut in the $SPX?

The S&P 500 just closed above its upper daily Bollinger Band for the THIRD STRAIGHT session. This hasn't happened since January. The momentum in this rally is off the charts. 💪 $SPY

$QQQ The glass ceiling has been shattered. 💥

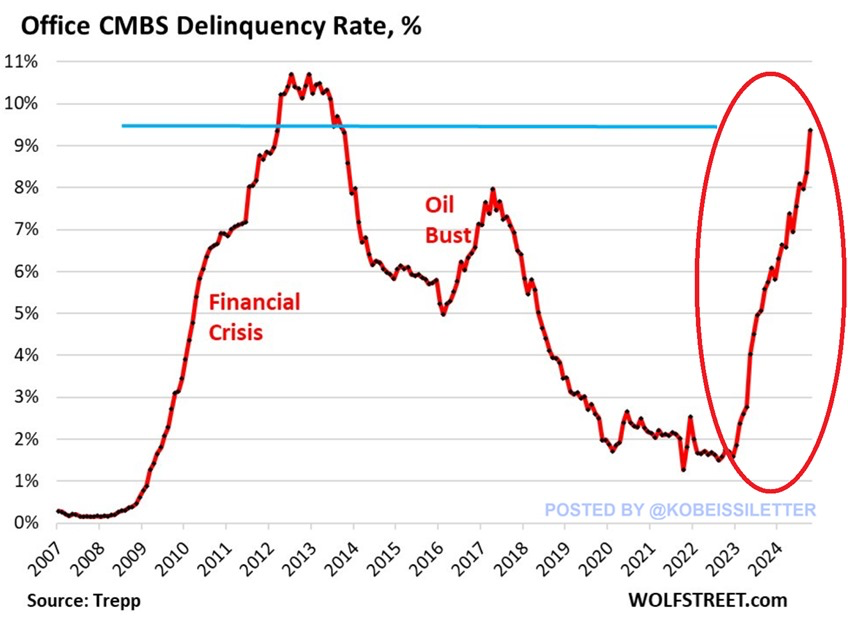

BREAKING: The delinquency rate on commercial mortgage-backed securities (CMBS) for offices spiked to 9.4% in October, the highest in 11 years. The delinquency rate of office CMBS loans has now risen by 5 TIMES over the last 2 years. Delinquencies are officially rising at a pace…

All tricks, no treat 🎃 $SPY $QQQ

A gentle reminder that the stock market doesn't care about your politics.

Yet another $NVDA thread. There are 4 illegitimate ways a company can grow revenue and maintain margins the way Nvidia has.

Gold has outperformed the S&P 500 and the Russell 2000 over the past TWENTY YEARS. Probably nothing.

Soft landing expectations are through the roof This happened right before: - 2001 Dot Com recession - 2008 Financial Crisis recession Buckle up

Since 1957, the S&P 500 has experienced 12 bull markets lasting at least 2 years, with an average return of 60.1% and a median return of 57.7% over that period. Tomorrow marks the 2-year anniversary of the current bull market, which has returned 62.6% – right in line with…

💯

Current market mentality: 1. Jobs report above expectations: Buy stocks, we avoided a recession. 2. Jobs report below expectations: Buy stocks, the Fed is going to cut rates. 3. Jobs report in-line with expectations: Buy stocks, the Fed is on track for a "soft landing." How…

WTF is going on in Canada and Australia? Real estate debt bubble in the US in 2007 looks almost cute in this chart.

Things are ripe to burst this week. Everyone is literally all-in. When everyone is on the one side of the boat, It usually sinks fast.

Insider selling has hit levels unseen since the 2021 top And retail sentiment is now hitting new all-time highs This is a MAJOR warning signal A thread 🧵

After 50bps cuts that kicked off Fed cutting cycles in 2001 and 2007, job openings and unemployment rates deteriorated rather quickly … worth keeping an eye on converging trends since former is already below pre-pandemic high and latter has been drifting higher

United States Trends

- 1. Celtics 25,7 B posts

- 2. Cavs 24,4 B posts

- 3. Joey Galloway N/A

- 4. $MADGUY N/A

- 5. #OnlyKash 75,7 B posts

- 6. Mobley 2.517 posts

- 7. #MCADE N/A

- 8. Nancy Mace 98,6 B posts

- 9. Pat Murphy 2.643 posts

- 10. #RHOBH 1.815 posts

- 11. Queta N/A

- 12. Linda McMahon 8.190 posts

- 13. Jaguar 71,3 B posts

- 14. Cenk 19,4 B posts

- 15. Lichtman 4.187 posts

- 16. Medicare and Medicaid 32,4 B posts

- 17. Mendoza 9.723 posts

- 18. Córdoba 45,1 B posts

- 19. Starship 221 B posts

- 20. Niang 1.434 posts

Who to follow

-

heffandstonks

heffandstonks

@heffandstonks -

Jarred

Jarred

@J_MFTC -

Justin

Justin

@asxHunter6 -

WaYnE

WaYnE

@Where_is_Wayne -

Tommy T

Tommy T

@Tommy__Trades -

Yowie

Yowie

@RealYowie -

Trader_97

Trader_97

@Trader_9797 -

Fillip

Fillip

@FillipPrestipi1 -

Maxwell

Maxwell

@Burntasxchef -

Brandon

Brandon

@KrillinTrades -

Elliot

Elliot

@Elliot_r_l -

Ant

Ant

@Anthony03698594 -

hdog

hdog

@hingdog -

Trader

Trader

@kevin_ervine -

BSCAPS

BSCAPS

@caps_biggie

Something went wrong.

Something went wrong.