Andrew Njiraini

@andrewnjirainiHealth and fitness enthusiast|Hiking|Farming Warren Buffet: I've been a net buyer of stocks every year since I was 11

Similar User

@Njorogehenry

@KendaPrisca

@investwithSIB

@jmwaluma1

@FundiMuigai

@ishaa_waweru

@mnandii

@AblizInvestmen1

@Callme_Otty

@financevirtuoso

@NotFaultProof

@Itsciku1

@Munuah

@CpaNzambu

@FrancisKimondo

Eburru forest was a healing, rejuvenating experience. Totally loved it. Walking in the forest in the cool of the day with birds singing in harmony. Stresses of life melted away. Thanks @outdoorerke and look forward to many more

64 hours fast done. Hopefully burnt off some of the extra fat

To be honest, Kibaki, Equity Bank and Kagame couldn't all have been wrong.

Very good news. That is how to reduce unemployment. Price falls, demand goes up. It also enhances our competitiveness. Exactly the structural change we need.

I will be eating my first meal at 11AM and my last meal at 6PM. Meanwhile my wife at 8.00 PM

The only leader in Kenya who has ever been ready to even die for doing the right thing was CJ Maraga....every other leader has been a fraud

The tariff is in place till mid-2026. From there we wait and see what EPRA will decide for the next 4 years. The whole revival was orchestrated by IMF, so we wait to see if we will go back to killing the company in 2026.

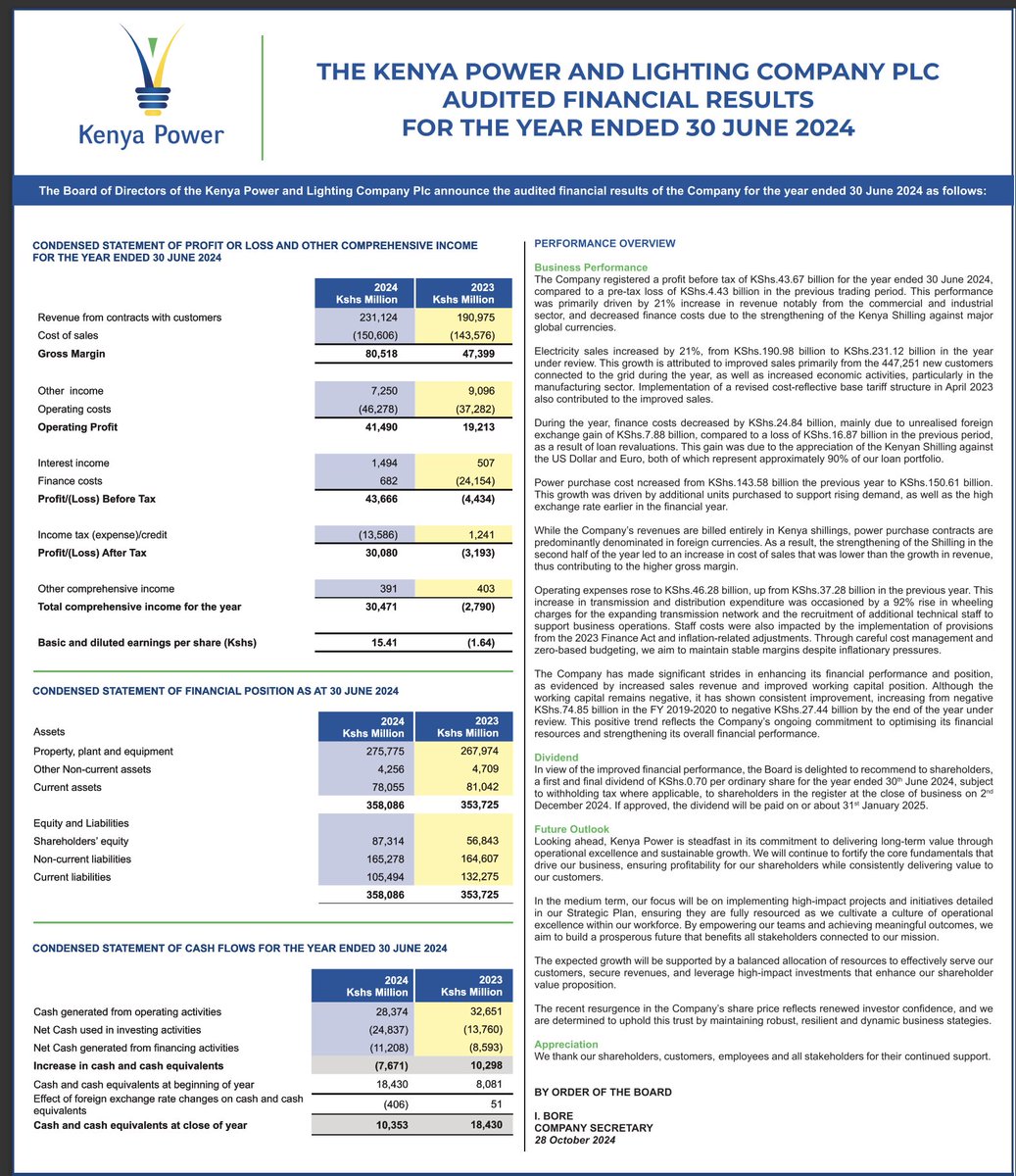

Yesterday, Kenya Power reported a staggering KSh 30 billion in net profit for the financial year ended 30th June 2024 up from a KSh 3 billion net loss last year. The main reason behind this performance was the massive increase in power tariffs implemented in April last year.…

If you have money now, lock it in below 5. Easy 14% dividend yield to start with. A valuation of 9.6bn is still undervalued. Kengen's profit are less than a quarter of KPLC yet its trading at a valuation of 25bn

Carbacid Investments Plc FY 2024 results [KES, YoY] —Turnover: +20% to 2.1B —Operating Profit: +20.5% to 1.2B —Net Profit After Tax: +3.3% to 843.3M —Assets: +22.3% to 5.6B —Earnings per Share: 3.31 [2023: 3.20] —Dividends: KES 1.70 per share

Market irrationality at best. Let us assume even KPLC was to make an after tax profit of KES 15 billion. That will be an earnings per share of sh 8.00. Compare this with current market price of sh 5 for KCB.

I’m really happy for those who have been pounding the table on $KPLC & $KENGEN. You are all probably looking at +100% gains after the dividend payouts. Congratulations & happy investing.

KenGen focuses on generating electricity, primarily through renewable sources, while KPLC is responsible for transmitting and distributing that electricity to consumers across Kenya. Both are profitable businesses listed on the Nairobi bourse....

All those people discrediting Kenya Power's reports should at least read their financial statements before commenting. The turnaround by Kenya Power was expected by investors. That's why the stock is up +146% YTD as of close of trading day, yesterday. Majorly because it was…

Kenya Power with a massive KES 30.08B in profit after tax in FY 23/24:

Kenya Power [@KenyaPower] FY 23/24 Results [KES, YoY]: —Revenue: +21% to 231.1B —Cost of Sales: +4.5% to 150.6B —Gross Profit: +70% to 80.5B —Operating Profit: +116% to 41.5B —Finance Costs: -73% to 6.2B —PAT: 30.8B [22/23: -2.8B] —EPS: 15.4 [22/23: -1.64] —Dividend: 0.70

KPLC results are out. It has made an after tax profit of sh 30.471 billion. Earnings per share of sh 15.41. Has also declared a final dividend per share of sh 0.70 per share. BOOK CLOSURE 02 December 2024. Dividend payment 31 January 2025.

Accurate BP readings are important for the diagnosis and treatment of hypertension, however, several minor errors/mistakes during BP measurement could result in overestimation of BP (erroneous high BP readings). Common situations that can result in erroneously high BP readings…

Mismeasurement of Blood Pressure in the office: Finding the common mistakes BP can erroneously increase in the following situations: 1. Talking (while BP is being measured), 2. Arm hanging freely, 3. Lack of leg or back support, 4. Sitting cross legged (while BP is measured) 5.…

Personal Statement on Political Situation Prevailing in the Country I wept for my country. It is a moment full of sorrow, pain and tears. The soul of the country is being systematically destroyed. Our Constitution and institutions are being hollowed. We are teetering to…

Our wellness group is on low carb this week. My lunch today, grass fed beef liver, Kales and banana passionfruit (not as sugary)

United States Trends

- 1. #JinOnFallon 364 B posts

- 2. #RHOSLC 8.067 posts

- 3. #CMAawards 19,2 B posts

- 4. Diddy 92,3 B posts

- 5. Nikki 46 B posts

- 6. Adani 380 B posts

- 7. #My82Playlist N/A

- 8. Sixers 15,4 B posts

- 9. #82giveaway N/A

- 10. Happy Birthday Nerissa 4.982 posts

- 11. Suns 11,1 B posts

- 12. Paul George 8.786 posts

- 13. Coachella 571 B posts

- 14. Bitcoin 602 B posts

- 15. Jalen Brunson 3.259 posts

- 16. seokjin 141 B posts

- 17. Grayson Allen N/A

- 18. Dunn 4.688 posts

- 19. Mark Sears N/A

- 20. Beal 1.512 posts

Who to follow

-

Henrich Njoroge

Henrich Njoroge

@Njorogehenry -

Prisca kenda

Prisca kenda

@KendaPrisca -

Standard Investment Bank

Standard Investment Bank

@investwithSIB -

jmwaluma HR Specialist

jmwaluma HR Specialist

@jmwaluma1 -

Bryan Muigai

Bryan Muigai

@FundiMuigai -

Waweru Ichangai

Waweru Ichangai

@ishaa_waweru -

Matthew

Matthew

@mnandii -

@Marketmark

@Marketmark

@AblizInvestmen1 -

Otty

Otty

@Callme_Otty -

Finance Virtuoso

Finance Virtuoso

@financevirtuoso -

Not Fault Proof

Not Fault Proof

@NotFaultProof -

Wanjiku

Wanjiku

@Itsciku1 -

↗️ 🇰🇪

↗️ 🇰🇪

@Munuah -

Erastus Nzambu🇰🇪

Erastus Nzambu🇰🇪

@CpaNzambu -

Naiken News

Naiken News

@FrancisKimondo

Something went wrong.

Something went wrong.