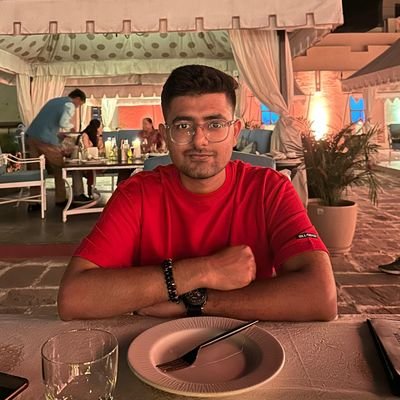

Anand

@anand1383Software engineer by day, market analyst by night. Passionate about business, investing, and growth. Observe what works and what doesn’t & why.

Similar User

@PuneetK009

@prosperotree

@prabhakarkudva

@gauravgsgs

@ashishkila

@vishalmittal22

@_kirand

@ravijain88

@ravirpurohit

@Khambatta

@moneybloke

@karansharma_09

@arpitranka

@KhivrajNaresh

@BigNitin

You really just want to be a student of life. You want to absorb a little bit of everything. Majors are a false specialization that the world wants us to have to make us productive members of society. But it doesn't make us human. - @naval killingbuddha.co/blog/2016/9/19…

Letter #239: JRD Tata (1965) aletteraday.substack.com/p/letter-239-j… An actual letter (for once!) that JRD wrote in response to a letter from a schoolteacher in Kolkata named KC Bhansali asking what were the guiding principles of his life.

Parents are more like shepherds, not like engineers - Dr. Alison Gopnik

PEARLS OF WISDOM "Valuing a business like Infy in the mid-1990s, HDFC Bank in the early 2000s, or a DMart in 2017, is a nebulous and abstract exercise." Mr. Utpal Sheth (@utpalsheth) to Prof Sanjay Bakshi (@Sanjay__Bakshi) in @CFASocietyIndia Session, 2019.

The Folly of Certainty: There simply is no place for certainty in fields that are influenced by psychological fluctuations, irrationality, and randomness. Politics and economics are two such fields, and investing is another. oaktreecapital.com/insights/memo/…

Riding multibaggers is like running a marathon. In a short 100m sprint there will be many people cheering for you from start to end. But when you are running a 42 km marathon there comes a phase in between where you are completely lonely and devoid of any cheers and whistles.…

A powerful insight from Charlie Munger on the customers you want to keep away. Source: fs.blog/knowledge-proj…

Only 2 things matter: a. Figuring out growth in earnings is 80% of the job really. b. Theme is critical for a quicker PE re-rating. kiraninvestsandlearns.wordpress.com/2021/09/26/onl…

The trend is your friend until the end when it bends. themarket.ch/english/thierr… Study of 100-baggers taught me – and this is intuitive anyway, if you think about it – is that the best performing stocks spend most of their time near 52-week highs. It makes sense. - Chris Mayer

“You should ask yourself who you’d want to spend the last day of your life with, and then figure out how to meet them, like tomorrow.” - Warren Buffett alchemy.substack.com/p/how-to-find-… Investing is a lonely path and having a friend and intellectual sparring partner is invaluable.

Most information on business channels holds as much value for investors as daily weather forecasts do for travelers who don't intend to go anywhere for a year.

Least Restrictive Means Example of Snake in the Room. First consider the least restrictive method of capturing the snake. Ex: Might start by attempting to lure the snake into a container using bait, rather than immediately resorting to more drastic measures like using firearms

Why don't you just sell all your stocks and buy ETFs, you'll probably have better performance? investmenttalk.co/p/why-dont-you…

Markets now exhibit far more casino-like behavior. The casino now resides in many homes and daily tempts the occupants. - Warren Buffett (2023 Annual Letter) H/T: @jtkoster valueinvestingworld.substack.com/p/links-022520…

Human capital is a sort of free energy for businesses. dialoguereview.com/the-human-cata… Factors, such as low levels of bureaucracy & a general feeling of being appreciated by colleagues, are better predictors of intrinsic motivation than financial rewards.

Time Arbitrage: Ideas must be given adequate time to develop & mature. Rush the process & put capital to work too quickly, & you forgo the option 2 buy later at lower prices. Other extreme is to wait for prices so low that bargains are available everywhere broyhillasset.com/broyhill-blog/…

India's entrepreneurship is mostly about subsistence, where people become entrepreneurs not to build businesses and create jobs but to merely survive. Large companies serve the top 20% market and the bottom 80% are served largely by the informal market. gulzar05.blogspot.com/2023/11/some-t…

“Man is not a rational animal; he is a rationalizing animal.” - Robert A. Heinlein “When experts are wrong, it’s often because they’re experts on an earlier version of the world.” - Paul Graham

«Good Story & Good Chart» Saves You a Lot of Trouble. themarket.ch/english/good-s… «A good business is like a strong castle with a deep moat around it. » WB Never trust the story unless confirmed by price action. «Markets are never wrong. Opinions often are.» Jesse Livermore

Winners Keep Winning - @ThierryBorgeat It is one of the great paradoxes of the stock market that what seems expensive and too high usually continues to go higher and what seems cheap and too low usually continues to go lower. themarket.ch/english/thierr…

United States Trends

- 1. Thanksgiving 2,35 Mn posts

- 2. Bears 177 B posts

- 3. Eberflus 79,3 B posts

- 4. Caleb 73,8 B posts

- 5. Giants 56,5 B posts

- 6. Giants 56,5 B posts

- 7. Drew Lock 12,4 B posts

- 8. Lainey Wilson 1.596 posts

- 9. Jelly Roll 2.059 posts

- 10. Tom Brady 5.393 posts

- 11. #NYGvsDAL 7.640 posts

- 12. Overshown 5.577 posts

- 13. Ceedee 5.577 posts

- 14. Datsun 2.047 posts

- 15. Evan Neal N/A

- 16. Turkey 403 B posts

- 17. Thankful 680 B posts

- 18. ARCANETOOZ 6.917 posts

- 19. #CHIvsDET 15,9 B posts

- 20. #Picksgiving 14 B posts

Who to follow

-

Puneet Khurana

Puneet Khurana

@PuneetK009 -

Dhruvesh Sanghvi

Dhruvesh Sanghvi

@prosperotree -

Prabhakar Kudva

Prabhakar Kudva

@prabhakarkudva -

Gaurav Sud

Gaurav Sud

@gauravgsgs -

ashish kila

ashish kila

@ashishkila -

Vishal Mittal

Vishal Mittal

@vishalmittal22 -

Kiran D

Kiran D

@_kirand -

RJ

RJ

@ravijain88 -

Ravi Purohit

Ravi Purohit

@ravirpurohit -

Low Risk Value Investor

Low Risk Value Investor

@Khambatta -

𝓢𝓾𝓷𝓲𝓵 𝓐𝓻𝓸𝓻𝓪

𝓢𝓾𝓷𝓲𝓵 𝓐𝓻𝓸𝓻𝓪

@moneybloke -

Karan Sharma

Karan Sharma

@karansharma_09 -

Arpit Ranka

Arpit Ranka

@arpitranka -

Naresh Katariya

Naresh Katariya

@KhivrajNaresh -

Nitin Siddamsetty

Nitin Siddamsetty

@BigNitin

Something went wrong.

Something went wrong.