ΑΛΞΧ

@alexfalivmarket microstructure / market structure / stat arb

Similar User

@StanDolgopolov

@chucktowntrader

@eeeeehq

@CHIEFSOSA55

When I was on the floor you might see a smart mm doing a trade others weren't. Then 10 min later you'd know why. When trading was good the instructions to novice traders was stand in the pit, raise your hand and say "me too" whenever the smart mms were on a ticket.

This is obviously a joke, but only kind of. I really believe one of the most important skills you can cultivate is understanding who to trust and tail. You can’t know everything about every potential investment. You can’t even know a small fraction of it, really.

1/x In my1st year in the pits of Chicago, I quickly learned a favorite pastime of idle traders on a Friday w/nothing trading was to create a humorously absurd challenge for someone on the floor to undertake & then coax the entire trading apparatus into action betting on outcomes.

People love positioning/flow arbs on this site (dealer option hedging, target vol and risk parity flows, convexity hedging etc etc, all the same shit with different names) so let me tell you about the **greatest flow arb that ever existed**

In the late 80s, the Chicago trading community was rocked by news of a widespread FBI sting operation in the pits of the CME and CBOT. This is the story of Operation Sourmash and Operation Hedgeclipper:

A (long) Friday financial history thread for fintwit. It's one of my favorite historical examples of how the material infrastructures of finance matter: a pre-history of HFT if you will. And I just had to cut it from my dissertation, so wanted to share.

As your resident vol explainer guy, here's a long-form version of how one can be down 200% a la Malachite. They were doing capped vs. uncapped variance swaps, 'picking up $100 bills in front of a Soviet locomotive'

I’ve avoided fighting with this insane person for a while, as while sometimes brilliant, he’s often very wrong and clearly both nuts and a world class terrible person. Didn’t need that in my life. But sometimes the insane people eventually get around to you.

1/n AQR issued 2 flawed reports saying tail risk hedging doesn't work (in theory), options are "expensive" Yet they did not reveal that 1) Their OWN risk premia strategies lost money. 2) Their other public crap underperforms the MKT. Insult to clients & the REAL WORLD.

Bored so thought I’d tell a small story from my time in banking. One day my director S gets a call from a client asking for $150M. They are looking to purchase a pool of assets and want an asset-backed warehouse to finance this purchase. 1/n

one year later... same storage, +50% ram / identical increase in cores... how come the storage has not changed? 🤔

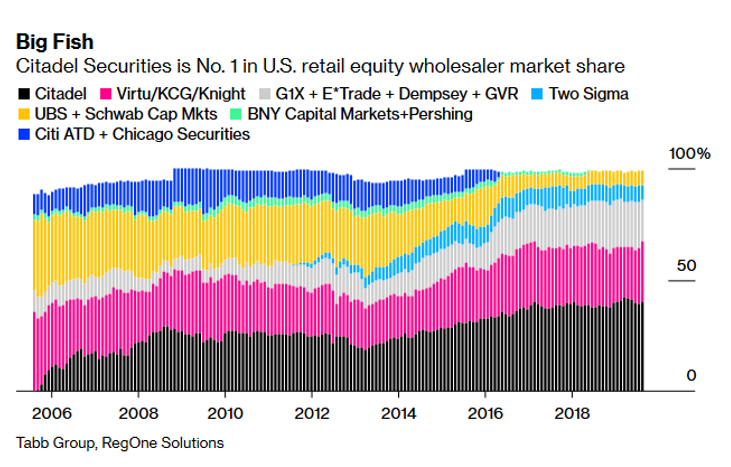

"E-Trade also discloses that Citadel Securities, Virtu and others paid less than 0.0017 of a cent per share for the orders" chicagobusiness.com/finance-bankin…

More exchanges decelerate drive for speed, experiment with miniscule delays johnlothiannews.com/more-exchanges…

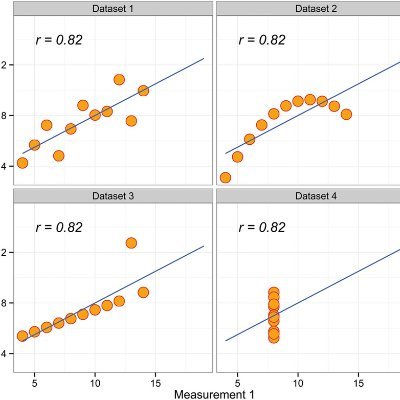

they examined 152 papers: - 38 use data from questionable sources - 38 incorrectly employ non-traded prices - 36 use non-synchronous data having said this: - 25 papers do use proper traded prices - 5 papers do use concurrent data tandfonline.com/doi/abs/10.108…

A British hedge fund’s attempt to hire a senior trader from Citadel Securities has landed it in a London lawsuit filled with allegations that it obtained a secret trading strategy while using texts and Whatsapp messages to hide all traces of the plan trib.al/MnMrznI

Bank Of England Admits High Frequency Traders Hacked Its Press Briefings zerohedge.com/markets/bank-e…

“Getting faster is expensive, but it’s actually kind of easy,” Tabb said. “It’s much more difficult to become smart." bloomberg.com/news/articles/…

Delighted to announce the launch of Platometrics today, in collaboration with @PlatoMarkets! Platometrics provides market participants with European market quality metrics free of charge bmlltech.com/bmll-technolog…

Notable in this paper, other than how badly most traders do trying to daytrade, is how only 11 HFTS accounted for >40% of the volume. 11. poseidon01.ssrn.com/delivery.php?I…

United States Trends

- 1. Mike Rogers 137 B posts

- 2. #FridayVibes 6.908 posts

- 3. Good Friday 64,4 B posts

- 4. $mad 5.480 posts

- 5. Happy Friyay 2.721 posts

- 6. CONGRATULATIONS JIMIN 311 B posts

- 7. Jason Kelce 1.730 posts

- 8. Pam Bondi 321 B posts

- 9. #FridayMotivation 11,4 B posts

- 10. #FridayFeeling 3.528 posts

- 11. #KashOnly 70,5 B posts

- 12. McCabe 25,3 B posts

- 13. #FursuitFriday 12 B posts

- 14. Chris Brown 30,9 B posts

- 15. Randle 7.503 posts

- 16. President John F. Kennedy 7.663 posts

- 17. Finally Friday 3.307 posts

- 18. Kang 35,5 B posts

- 19. Jameis 71,7 B posts

- 20. St. Cecilia 1.531 posts

Something went wrong.

Something went wrong.