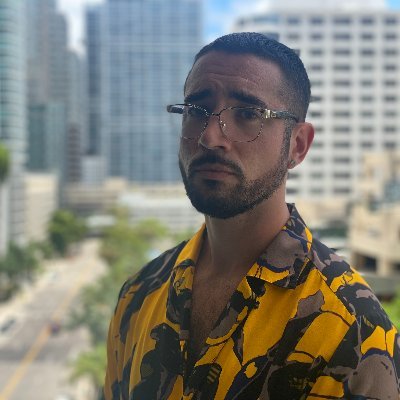

LC

@__LC__1A Trader of the #ES_F. Learn TPO at: https://t.co/mIqkC7c1Y1 Join @vwaptrader1's Coaching Class: https://t.co/mql8YhpOle Not Financial Advice

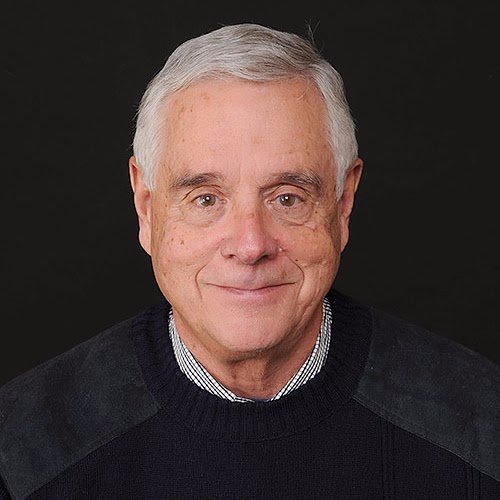

If you are interested in learning TPO charts and blue collar trading with the legendary @vwaptrader1 Checkout: bit.ly/MicroEFutures For access to a 10 week class (take it as many times as you want) and lifetime coaching with @vwaptrader1 checkout: bit.ly/JJLifeTimeWork…

After an early sell of, ES turned into a balanced day, closing just below 5900. A balanced day. There continues to be a lack of supply to break of last weeks range. Levels remain unchanged heading into tomorrow. Pivot: 5897

Friday saw a P shaped profile indicative of short covering. Heading into this week the key question is if price can accept above 5885. For tomorrow, the key level is 5897 representing Friday's value area low.

After opening on a gap higher, ES made a new all time high but was quickly sold into. This led to a `b` shaped profile with overlapping to higher value. The gap filled early in the session but ES was unable to push far into yesterday's range and value. Tomorrow's pivot 5891

After yesterday's price probe, ES failed to accept lower taking back 2 of 4 sets of single prints. With 1 set of singles to the upside today, ES attempted to take back yesterday's correction. For tomorrow, the primary level to watch is 5881.50.

Today ES rejected higher prices leading to a correction to long inventory and a trend day, with 4 sets of single prints to the downside. For tomorrow, I will closely watch price action around 5868.25 which represents the lowest set of single prints from today (K period).

ES opened on a gap higher which held throughout the day. ES also developed a P shape profile indicating short covering with value higher relative to Friday. To end the day, ES ended with a M-period price probe higher, which the base 5912.50 is marked as tomorrow's pivot.

ES continues to show a lack of supply with higher value once again on Friday. We are in unexplored areas and should expect pushes higher to be tentative as buyers are not eager to pay these prices. That said, trapped shorts continue to drive prices up. Tomorrow's pivot: 5850

After a very slow start to the week, #ES_F had supply introduced breaking free of the very tight range of the morning and taking out yesterdays low. With two sets of single prints to carry forward. Tomorrow's pivot the M period high of 5756.

After Friday opened on a gap up, #ES_F made a move lower filling the gap and testing Thursday's value area high. Lower prices were rejected and ES reversed towards the high testing 5800. The weekly pivot for this week is 5775 with tomorrow's pivot marked at 5786.

Yesterday #ES_F looked below the prior day's low but rejected lower prices and developed into a P shaped profile indicative of short covering. Value developed inside of Tues value. Levels remain unchanged: Pivot 5770

After Monday's price probe higher, #ES_F attempted to get continuation higher however was immediately met with sellers upon yesterday's open. With a strong move down, ES developed a b shaped profile indicating long liquidation with lower value. Today's pivot is prev VAH 5770.

After a very slow day, #ES_F saw a move lower shaking out weak longs before reversing course and ending the day with a price probe to the upside. Tomorrow's pivot is the base of the price probe 5798.75.

All three time frames are one time framing higher with the main focus for tomorrow on if that can continue. Pivot 5782 marking Friday's low. We are developing somewhat of a balance area as we test new highs and fail to get continuation. Keep head on a swivel as we close out Sept

#ES_F levels remain unchanged for today. Looks like we will open on a pretty decent gap up. As we explore uncharted territory, use caution and monitor for continuation. Supply may step in at any point as no longs have a cost basis up here.

For #ES_F tomorrow, 5791.25 is the pivot representing the base of the M period price probe. Upside targets 5811, 5830, 5850. Downside 5774, 5754, and 5732. We continue to lack upside follow through but with very little pullback indicating a lack of supply.

After a discussion with a few members of the @microefutures room, I am working on developing a few custom @SierraChart studies including a checklist that I personally use to assist my trading. What are some studies you wish you had?

Yesterday was quite balanced with limited upside continuation. Some #ES_F levels for today: 5678 pivot with upside targets of 5787, 5812, and 5830. Downside: 5754, 5732, and 5712

Limited analysis this week as I am traveling. But here are some levels for #ES_F tomorrow. Tomorrow's pivot 5751. Upside targets: 5768, 5787, and 5812. Downside: 5732, 5712, 5690. Main focus on where value area begins to develop relative to Friday.

After #ES_F price probed lower to end the day yesterday, supply was cut off resulting in a gap higher and new all time highs. Although the gap did not hold, value developed higher with a P shaped profile. Tomorrow's pivot 5770.

Following the Fed's announcement to cut interest rates by .50 basis points #ES_F made a strong move to the upside was made but ultimately retraced prior to a price probe to the downside. As traders digest the decision tomorrow's pivot of 5682 will provide critical insight.

United States Trends

- 1. Georgia 187 B posts

- 2. Haynes King 5.791 posts

- 3. Iowa 19,5 B posts

- 4. #SmackDown 51,6 B posts

- 5. Kirby 20,6 B posts

- 6. Nebraska 11,5 B posts

- 7. Carson Beck 2.187 posts

- 8. Chiefs 162 B posts

- 9. Ga Tech 1.929 posts

- 10. Athens 5.882 posts

- 11. Pritchard 4.029 posts

- 12. Raiders 79,7 B posts

- 13. The SEC 244 B posts

- 14. #OPLive 2.845 posts

- 15. Bobo 40,5 B posts

- 16. Dawgs 7.390 posts

- 17. Arian Smith 1.000 posts

- 18. #Huskers 1.695 posts

- 19. Dan Jackson N/A

- 20. BOB BRYAR N/A

Something went wrong.

Something went wrong.