Similar User

@keklytic

@0xWangarian

@liquifi_finance

@StarbloomVent

@saurabhonchain

@hal2001

@patfitzgerald01

@Mikey0x_

@typebcc

@MrGem_0x

@Shittoastposter

@SoA_432

@HuttCap

@PigFahy

@wagmiAlexander

@_SmartFunds_ 's @patfitzgerald01 weighs in on our vision of what the future of funds might look like using native tooling. medium.com/smart-money-de…

Is 30,000x good?

According to Franklin Templeton, clearing tokenized assets is over 30,000x cheaper. Yes, you read that right. On stage at the RWA Summit, Head of Digital Assets Roger Bayston compared the total cost of clearing 50,000 transactions: Legacy system: ~$50,000 Blockchain: $1.52

Congrats to our friends at Bridge Protocol (@stablecoin) on their $1.1B acquisition by Stripe. SmartFunds has integrated Bridge and we're big fans of the product and team.

I just published a blog post on how Stripe's $1.1B acquisition of Bridge could reshape the fintech landscape, and why this deal reminds me of Google’s acquisition of Youtube. bit.ly/3UgQDhx

👇👀

I am increasingly convinced that the RWA trend is the early stages of getting the traditional financial system onto blockchains in a way that we have not seen yet. Some of the world's largest financial institutions are already putting tokenized funds on-chain, and I think we are…

We concur with @SergeyNazarov's comments here. Bringing legacy finance onchain is a massive unlock for everyone.

I personally believe that the RWA industry's size can eventually surpass the cryptocurrency market as a whole. If you count stablecoins, gold coins and all commodity coins as RWAs, you already see a lot of the potential for how RWAs can continue to put even more value on-chain.…

Tokenization is coming faster than you think 👀

BlackRock CIO of ETFs Samara Cohen discusses private assets and tokenization. @EricBalchunas is correct in my opinion: private assets can’t be ETF-ized but can be tokenized. Our tokenization platform will lead the global market. More to come soon. 👀

This is exactly why alternative forms of liquidity are so important. Literally a game changer.

Talked to two angel investors today who shared that their best returning investments were $250M and $500M exits respectively. Were able to see massive multiples because the companies had only raised one round of funding before selling.

prediction: Larry Fink will go all-in on tokenization on top of Ethereum as his legacy to the financial world tokenization won't be the only use case of Ethereum, but once many of the assets are all tokenized there, it will unlock a plethora of other use cases at scale lfg 🚀

The infrastructure for tokenization continues to make progress watcher.guru/news/chainlink…

Blackrock is now tokenizing funds, soon everyone else will be too! ft.com/content/3b8071…

Welcome, @BlackRock to the world of tokenized funds!

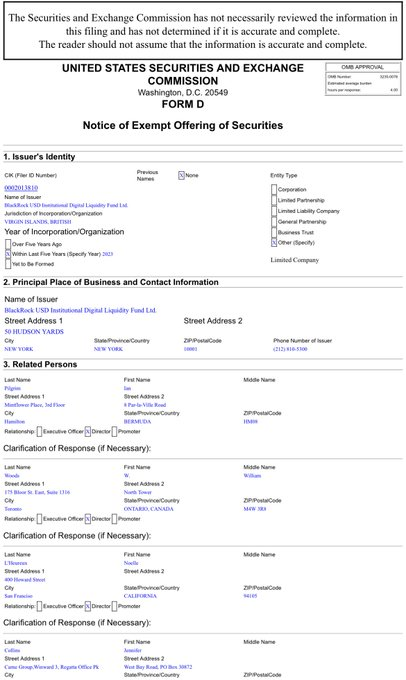

Breaking: @BlackRock has tokenized their BlackRock USD Institutional Digital Liquidity Fund into 100 shares on an @ethereum erc20 contract 👀 Fund: blackrock.com/cash/en-za/pro… SEC filing: sec.gov/Archives/edgar… Ethereum contract: etherscan.io/token/0x84e371…

We concur 🤝

A Bitcoin ETF is nice but I’m more excited about bringing traditional assets onchain than crypto assets off chain. What the $AVAX ecosystem is doing to bring traditional markets onchain is truly unmatched. Soon enough all markets will be onchain trading 24/7

Everyone will be tokenizing funds sooner than later.

Citi Bank used layer 1 Avalanche’s Spruce Subnet to explore the tokenization of private equity funds to re-architect capital markets. trib.al/khVTs7R

We couldn't agree more, which is why we built #SmartFunds to enable use cases like this. Tokenization made simple.

As are we.

Bullish on chain private credit markets

United States Trends

- 1. Gaetz 845 B posts

- 2. Ken Paxton 16,4 B posts

- 3. DeSantis 29,9 B posts

- 4. Volvo 22,2 B posts

- 5. Attorney General 214 B posts

- 6. Mark Levin 2.337 posts

- 7. 119th Congress 9.693 posts

- 8. John Curtis 28,9 B posts

- 9. Murkowski 51,2 B posts

- 10. Murkowski 51,2 B posts

- 11. Mike Davis 3.518 posts

- 12. Trey Gowdy 5.432 posts

- 13. Andrew Bailey 3.866 posts

- 14. Gary Gensler 35,8 B posts

- 15. Rubio's Senate 12,5 B posts

- 16. Netanyahu 861 B posts

- 17. Dragon Believer 2.787 posts

- 18. Dashie 3.769 posts

- 19. Katie 41,8 B posts

- 20. Pray for President Trump 2.031 posts

Who to follow

-

cats as our master

cats as our master

@keklytic -

Wangarian

Wangarian

@0xWangarian -

Liquifi | Token Management Platform

Liquifi | Token Management Platform

@liquifi_finance -

Starbloom Ventures

Starbloom Ventures

@StarbloomVent -

Saurabh Sharma | Buildoor Labs 💜

Saurabh Sharma | Buildoor Labs 💜

@saurabhonchain -

Hart @ Devcon (⛺️,⛺️)

Hart @ Devcon (⛺️,⛺️)

@hal2001 -

Patrick Fitzgerald

Patrick Fitzgerald

@patfitzgerald01 -

mikey

mikey

@Mikey0x_ -

beca's | ROSIE 💌

beca's | ROSIE 💌

@typebcc -

Mr. GEM 💎

Mr. GEM 💎

@MrGem_0x -

Toaster

Toaster

@Shittoastposter -

Yevhen Haievyi 🇺🇦

Yevhen Haievyi 🇺🇦

@SoA_432 -

Hutt Capital

Hutt Capital

@HuttCap -

BFa.SOL.BTC.BDC

BFa.SOL.BTC.BDC

@PigFahy -

alexander

alexander

@wagmiAlexander

Something went wrong.

Something went wrong.