WHA

@WHA_LondonWHA are a firm of Chartered Accountants and Statutory Auditors who are the UK's leading travel regulation, licensing and bonding specialists.

Similar User

@TravlawLegal

@ittnews

@AlistairRowland

@JJ1Travels

@ABTALifeLine

@Matt_Travlaw

@TrudieClements1

@TheTravelConv

@TravelTradeC

@Debbeedale

@Shipleys_LLP

WHA Blog Entry: WHA assist Leger Shearings Group shareholders in majority shareholding process. whitehartassociates.com/blog/wha-assis…

Autumn Budget 2024 - The Tax Team at White Hart Associates cover all of key points from Rachel Reeves Autumn Budget and outline how the numerous announcements could impact you and your business. #budget24 whitehartassociates.com/wp-content/upl…

NEWS: Funding to kickstart delivery of two million extra NHS appointments. The Chancellor has confirmed new funding to help deliver an extra 40,000 elective appointments per week. Reducing waiting lists and building an NHS fit for the future.

There will be no extension of the freeze in income tax and National Insurance thresholds beyond the decisions of the previous government, Reeves says. From 2028-29, personal tax thresholds will be uprated in line with inflation, she says. #Budget24

The Chancellor announces the government will increase the stamp duty land surcharge for second-homes, by 2% to 5% from tomorrow. #Budget24

Every child should have access to a high-quality education. From 1 Jan 2025, VAT will apply to all education, training and boarding services provided by private schools. This money will help us to invest more in state education, improving standards and opportunities for all.

Travel Industry - Air passenger duty: The Government are introducing an increase of no more than £2 for an economy-class short haul flight. But on private jets there is an increase the rate of APD by a further 50% - equivalent to £450 per passenger for a private jet #Budget24

The Budget will maintain existing incentives for EVs in company car tax from 2028. It will also increase the differential between fully electric and other vehicles in the first rates of Vehicle Excise Duty beginning in April 2025, she says. #Budget24

Those that make the UK their home should pay their taxes here. That is why we are removing domicile status from the tax system from 6 April 2025 & creating a simpler residence based regime, designed to bring the best talent & investment to the UK.

We're protecting our high streets. From 2026-27 permanently lower tax rates will be introduced for retail, hospitality & leisure (RHL) properties. Plus, for 2025-26, 250,000 RHL properties will receive 40% relief on their bills, up to a cash cap of £110,000 per business.

The chancellor has lifted employers' NIC, but the drop in the threshold at which businesses start paying it is pretty startling - from £9,100 to £5,000. It will raise £25bn, she says. #Budget24

The Chancellor: "The lower rate of Capital Gains Tax will rise from from 10% to 18%, and the higher rate from 20% to 24%, she says. The CPA on residential property will remain at 18% and 24%". #Budget24

The employment allowance will increase from £5,000 to £10,500, which the chancellor says will mean 865,000 employers won’t pay any National Insurance at all next year. She adds over one million will pay the same or less as they did previously. #Budget24

The government will protect working people and those in local communities by freezing fuel duty next year. This is a tax cut worth £3bn and will save motorists almost £60 a year.

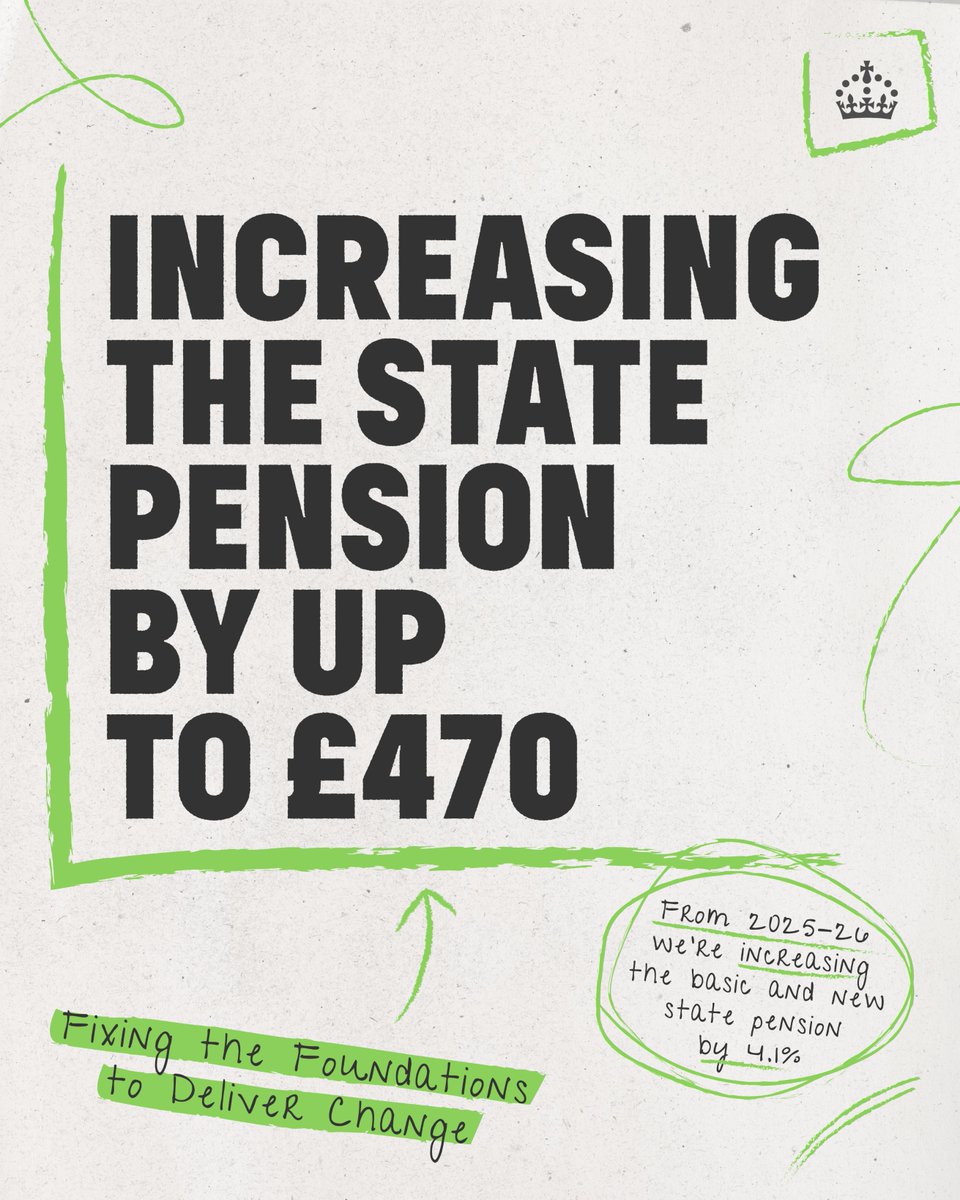

We want to give retired workers the long-term financial security they need. That’s why in 2025-26 we’re increasing the State Pension by up to £470 in line with the Triple Lock.

The Chancellor: "The National Minimum Wage will rise for people aged between 18 and 20-years old from £8.60 to £10. Apprentices will get the biggest pay bump, with hourly pay increasing from £6.40 to £7.55". #Budget24

As announced yesterday, The Chancellor confirms that the National Living Wage for people aged 21 or older will rise by 6.7% from £11.44 an hour to £12.21 from next April. #Budget24

Tax funds public services used by millions. To help close the tax gap, @HMRCgovuk will hire 5,000 extra compliance officers, update their IT systems and enhance their app, improving the user experience for millions of taxpayers.

United States Trends

- 1. $EMT 5.638 posts

- 2. #EarthMeta 1.750 posts

- 3. Hunter 2,34 Mn posts

- 4. Cyber Monday 83,9 B posts

- 5. #ChristmasCrunchSweepstakes N/A

- 6. #GivingTuesday 6.609 posts

- 7. #SarahBoone N/A

- 8. Joe Biden 1,3 Mn posts

- 9. #GalaxyFold6 N/A

- 10. Durbin 4.891 posts

- 11. SLIMETOOZ 1.138 posts

- 12. Art Cashin N/A

- 13. Take Ctrl 2.079 posts

- 14. Big E 44,2 B posts

- 15. Vin Scully N/A

- 16. PlayStation 107 B posts

- 17. Go Broncos 1.446 posts

- 18. Act 10 7.099 posts

- 19. Bloodborne 9.148 posts

- 20. RTFKT 8.576 posts

Who to follow

-

Travlaw

Travlaw

@TravlawLegal -

ITT - The Institute of Travel & Tourism

ITT - The Institute of Travel & Tourism

@ittnews -

Alistair Rowland

Alistair Rowland

@AlistairRowland -

Julie Jones

Julie Jones

@JJ1Travels -

ABTA LifeLine

ABTA LifeLine

@ABTALifeLine -

Matt Gatenby

Matt Gatenby

@Matt_Travlaw -

Trudie Clements

Trudie Clements

@TrudieClements1 -

Travel Convention

Travel Convention

@TheTravelConv -

Travel Trade Consultancy | B Corp™

Travel Trade Consultancy | B Corp™

@TravelTradeC -

Debbee Dale

Debbee Dale

@Debbeedale -

Shipleys LLP

Shipleys LLP

@Shipleys_LLP

Something went wrong.

Something went wrong.