Similar User

@TMT_Jack_

@buysidebogey

@crazyjoedavola_

@SaasquatchC

@VPCapital100

@bucketshopcap

@hedgie007

@MRatable

@lfg_cap

@SouthpawCapital

@BlackSailsRsch

@MDD_IRR

@seeking_beta24

@CrosscheckC

@leveredbetaboy2

🚨 BREAKING NEWS 🚨 IN NVIDIA’S 10-K FORM FROM FEBRUARY THEY STATED THAT THEY ARE USING FUTURE EXPECTED GAINS INTO THEIR CURRENT INCOME FORMS THIS IS EXACTLY WHAT #ENRON DID WHICH IS CALLED MARK-TO-MARKET ACCOUNTING $NVDA COULD BE NEXT TO COLLAPSE LIKE $SMCI & $CSCO DID…

I started doing this at 27 after moving to the west coast for work and wouldnt trade it for anything

At 71 years old, Druckenmiller wakes up at 4:00 AM and goes to sleep at 8:30 PM.

How are things going at $APP?: - Q2 Y-o-Y: Software Platform revenue grew 75% to $711 million. - Q3 Y-o-Y: Software Platform revenue grew 66% to $835 million - Released our eCommerce BETA, the fastest growth we've ever seen in a product. Our CEO's reaction:

When @cboe introduces a new way to short some form of convexity again

This is my quant

What a crazy pump fake it would be if software shits the bed again next week

“So you’re saying they’re capital efficient and I can have delta equivalent stock exposure but with a fraction of the downside risk and unlimited upside.”

banger of a take

now do guidance

Snowflake quarter. @RamaswmySridhar becoming CEO, Frank to chairman - $775m rev (+32% YoY) vs $757m consensus (2% beat) - $748m next Q product rev guidance vs $770m consensus (3% miss) - Guided full year to 22% growth. Consensus 29% - 131% NRR - 39 months GM adj. CAC payback -…

the juice is loose!

I was semi-bullish coming into 2024 and felt good about my portfolio but I certainly wasn’t expecting to be up +52.7% YTD on February 8th. This is why I’ll always be a stock picker and I’ll never settle for index funds. I hope there’s more upside over the next 10+ months but…

Where is gary and who hacked Franklin

Dangerous to be comparing income from selling volatility on indices to dividends. Dividend “guys” are top 3 worst guys in the free world

Yearly dividend income with $1,000,000 invested: - QQQ: $5,700 - VOO: $14,600 - SCHD: $35,300 - JEPI: $86,500 - QYLD: $117,100 - JEPQ: $103,400 If you could only buy 1 of these ETFs forever, which one are you buying?

its unamerican for the rally to end without an SPX ATH

Hahahahahahahahahahahahahahaha

Shut up about blackrock

Blackrock & Vanguard together own 10% of Coinbase. The action today against Binance was all planned. Just like the Bitcoin ETF is planned.

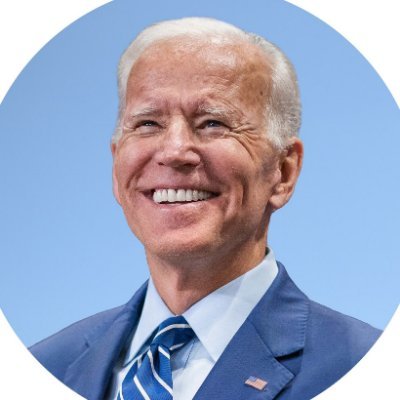

This guy can vote

#JustDarioDaily 🚨 $NVDA (PONZI) “LIES” UNDER $NVDA NOSE 🚨 I know a couple of things here and there about running a company, from work and direct experience. One thing is how easy it is to "grow" your revenues when your clients aren't going to pay for the goods you deliver.…

Nikesh condescension reaching all time highs

“Hey dude. Listen to me man, it’s fucking uranium. On a fucking blockchain dude, gonna be the next big thing. Fucking awesome, uh, yeah, fuck it. Yeah, let’s tokenize that shit.”

United States Trends

- 1. Cowboys 66,2 B posts

- 2. Texans 55,7 B posts

- 3. Cooper Rush 11,5 B posts

- 4. Jerry 42,1 B posts

- 5. Mike McCarthy 3.019 posts

- 6. Trey Lance 3.037 posts

- 7. Joe Mixon 9.879 posts

- 8. #WWERaw 60,5 B posts

- 9. Dyson Daniels 2.239 posts

- 10. Keon Ellis 1.460 posts

- 11. Norman Powell N/A

- 12. #HOUvsDAL 9.232 posts

- 13. Sixers 10,7 B posts

- 14. Pulisic 22,9 B posts

- 15. The Herta 16,9 B posts

- 16. Aubrey 15,6 B posts

- 17. Derek Barnett 1.784 posts

- 18. Zack Martin N/A

- 19. #HTownMade 3.642 posts

- 20. sabrina 101 B posts

Who to follow

-

TMT Jack

TMT Jack

@TMT_Jack_ -

Buyside Bogey

Buyside Bogey

@buysidebogey -

Art Capital

Art Capital

@crazyjoedavola_ -

SandBrook Capital

SandBrook Capital

@SaasquatchC -

VPCapital

VPCapital

@VPCapital100 -

Bucket Shop Capital

Bucket Shop Capital

@bucketshopcap -

MJH📈📉

MJH📈📉

@hedgie007 -

MrRatable

MrRatable

@MRatable -

Hemingway Capital

Hemingway Capital

@lfg_cap -

Southpaw Cap

Southpaw Cap

@SouthpawCapital -

TBall Coach Black Sails

TBall Coach Black Sails

@BlackSailsRsch -

Analysis Paralysis

Analysis Paralysis

@MDD_IRR -

Institutionalized Investor

Institutionalized Investor

@seeking_beta24 -

CrosscheckC

CrosscheckC

@CrosscheckC -

levered beta boy

levered beta boy

@leveredbetaboy2

Something went wrong.

Something went wrong.