Knowledge & Ideas

@TheBigBull_https://t.co/Iww7sbeKqM

Similar User

@STOCKMarketAn14

@gandhi_kaushal

@sanziravishal

@Vloveplanes

@miteshdd

@srinivasantati

@sachinsunda1

@STARFAN107

@shelkevishal

@RahilAnalyst

The value of 1 Crore: (assume 7% inflation) approx - 10 years from now= 50Lakhs. - 15 years from now= 36Lakhs. - 20 years from now= 25Lakhs. Don’t be happy seeing 1 cr value after 20 years on excel actual value will be 25 lakhs

🚨 Rejection Rate of EPFO is Increasing • 2018 - 16% • 2019 - 21% • 2020 - 26% • 2021 - 28% • 2022 - 28% • 2023 - 27% 1 Out of 3 Withdrawal Application was Rejected Portal is Extremely Poor, Shameful That People Have To Struggle To Get Their Own Money

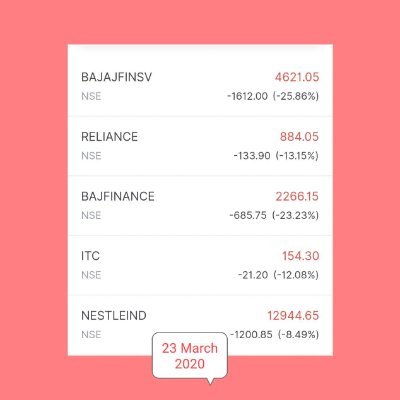

A beautiful example by @ravisaraogi on the danger of over optimistic FIRE calculations. He tested a projection against actual historical data.

🚨TRAI September 2024 Data Breakdown: Jio lost the most users but added active users, which Airtel and Vi didn't. Here's everything: Overall Wireless Subscriber Base Changes: - Jio lost 7,969,785 users - Airtel lost 1,434,612 users - Vi lost 1,553,978 users - BSNL added…

Dear yash and stocky bhai, Network 18 owns 13.54% of Viacom18. Viacom 18 owns 46.82% of Reliance - Disney Joint venture (70352 cr value ) So network18 in turn owns 13.54% of 46.82 That is 6.34% of the total Joint Venture, 4460 crore. Attaching the media release statements.

Risk of Govt Decision on stocks PSU

IGL down 18% MGL down 15% Gujarat gas down 8% Here is why ….

Electronic Manufacturing Services (EMS) - Valuations, Financial snapshots Valuations :

DIFFERENCE between research based stock Vs TIPS based stock In research based stock you never Tense about prices being ups and downs having known to valuation and fundamental reasons to invest. In tips based stock हमेशा डर बना रहता है कि कही गिर न जाए।

Companies With Highest PE सबसे महंगा वैल्यूएशन Company: PE 1) Nykaa: 1121x 2) Piramal Pharma: 570x 3) PTC Ind 400x 4) Signature Global : 330x 5) Zomato: 318x 6) E2E Network: 243x 7) Hitachi Energy: 243x 8) Inox Wind: 219x 9) Premier Energies: 212x 10) Kaynes Tech: 200x…

Valuation Comparison ~ Swiggy & Zomato with global food delivery majors EV/Sales on FY26E/CY25E ~ Zomato : 8 ~ Swiggy : 5.3 ~ DoorDash : 5.1 ~ Just Eat : 0.6 ~ Deliveroo : 0.8 ~ Delivery hero : 1.2 ~ Meituan : 2.6 ~ Grab : 3.8 Average : 3.2 Src ~ MoFSL

Nifty Next 50 - 5 Yr Dividend History Happy Dividends 💵

90% of investors on SM never share when they exited. Its pretty dangerous to blindly buy based on their purchase. My friend convinced many in a WhatsApp group about a stock, why its going to be a multi-bagger. Stock corrected 30%, he quietly exited.🤣

Paint Sector Market Share (Decorative) Asian Paints: 53% Berger Paints: 19% Kansai Nerocal: 12% Akzo Nobel: 5% IndiGo: 2% Others 9% Years Established Asian Paints: (1942) Berger Paints: (1923) Kansai Nerocal: (1920) Akzo Nobel:(1904 ) IndiGo: (2000) #AsianPaints #Berger

United States Trends

- 1. #WWERaw 31,8 B posts

- 2. Drake 283 B posts

- 3. Lamar 154 B posts

- 4. Ravens 40,1 B posts

- 5. Chargers 38,2 B posts

- 6. Canada 389 B posts

- 7. Bateman 3.815 posts

- 8. Elfrid Payton 1.772 posts

- 9. Not Like Us 72,6 B posts

- 10. #BALvsLAC 4.630 posts

- 11. Malik Harrison 1.234 posts

- 12. Jack Smith 212 B posts

- 13. Justin Herbert 4.700 posts

- 14. Greg Roman N/A

- 15. Lamelo 8.395 posts

- 16. Finn 11,8 B posts

- 17. #BoltUp 2.888 posts

- 18. Hurley 9.502 posts

- 19. Sheamus 1.953 posts

- 20. Derrick Henry 6.827 posts

Something went wrong.

Something went wrong.