BCL is ready to fly,strategy should be buy on dip in the range of Rs 89.00 - 85.00 level for the upside target is Rs 99.00-104.00 and then 115.00-121.00 level.work with syoploss below Rs 80.00 on closing basis. #psx #PSXAnalysis #PakistanStockExchange #psx

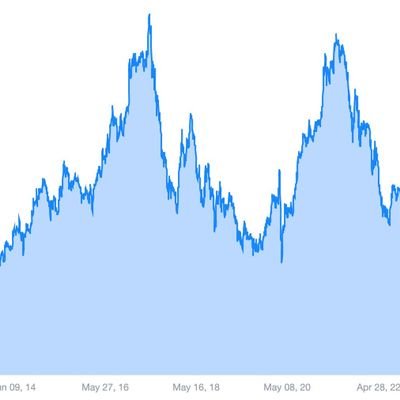

KSE 100 index is forming RISING WEDGE pattern on hourly time frame strong resistance at 95,500 and support at 94,000,if it breaks 94,000 level then selling pressure may he seen till 93,000 - 92,000 level followed by 91,400 level.Work with stoploss below 94,000 level

KSBP needs to strongly hold above Rs 155.00 level to start long Bullish momentum towards Rs180.00 - 200.00 level followed by 240.00 level.Strong support at Rs 125.00 - 115.00 level. #psxtoday #PakistanStockExchange #pakistanstockmarket #PSXAnalysis #PakistanStockExchange #Ksbp

Allahamdulillah TRG Booom 31% Gained✈ #trg #PSX #psxtoday #PakistanStockExchange #pakistanstockmarket #PSXAnalysis #PakistanStockExchange

TRG is testing multi year strong support level at Rs45.00 - 42.00 level,Strategy should be Buy on dip for the upside target is Rs90.00-135.00-180.00-300.00 and the expected channel top at Rs500.00-600.00 level.stop-loss below channel support at Rs 40.00 on Monthly basis #TRG

OCTOPUS program to war gya🤷♂️ #kse100index #psx #psxtoday #PakistanStockExchange #pakistanstockmarket #PSXAnalysis #octopus #

Sirf Rs80.00 down😜😏

ATRL hits Cup&Handle pattern upside target,now currently its testing major strong resistance at Rs 512.00-525.00 level,where aggressive profit taking plus fresh selling pressure may be seen,work with strict trailing stop-loss or manage risk according to your risk appetite. #ATRL

During the session Kse 100 index made high at 91,872 and then faced aggressive profit taking made a low at 90,003 level and closed at 90,286 down 577 points on net basis. #psxtoday #psx #pakistanstockmarket #pakistanstockexchangenews #pakistanstockexchange #PSXAnalysis

There is a high likelihood that the KSE-100 index will close in the negative zone tomorrow due to: 1. Strong trend-line resistance since December 2023. 2. Negative volume divergence. 3. No consecutive positive closings for more than 7 sessions since December 2023. #psx #kse100

BGL hits upper cap QUICE hit short-term upside target

GWLC hits mid-term upside target moved from Rs 24.00 to 42.00 level 83% Gained in 5-Months #GWLC #CEMENT #PSX #PSXTODAY #PAKISTANSTOCKEXCHANGE #PSXANALYSIS #PAKISTANSTOCKEXCHANGE #PSXTODAY #PSXANALYSIS

😍PSO hits all upside target moved from Rs 194.00 to 236.00 level Rs 42.00 profit😍 #PSO #psx #PSXAnalysis #PakistanStockExchange #pakistanstockmarket #PSX #pakistanstockexchange

ATRL hits Cup&Handle pattern upside target,now currently its testing major strong resistance at Rs 512.00-525.00 level,where aggressive profit taking plus fresh selling pressure may be seen,work with strict trailing stop-loss or manage risk according to your risk appetite. #ATRL

FFC triangle upside target is just near to complete at Rs 260.00 level and also testing monthly strong resistance line since 2005 and monthly RSI is an extremely over bought conditions stay cautious and work with strict stop-loss according to your risk appetite. #FFC #PSX

TOMCL aggressively faced rejected from channel top level at Rs 48.00 and faced selling pressure,now the short-term bearish flag pattern downside target is complete at Rs 32.80 level(where fresh buying may be seen)

TOMCL needs to break channel resistance at Rs 46.00-47.00 level to start aggressive bullish move;if it fails to break resistance then it may be move towards downside at Rs 42.00 -39.00 and 36.00 level

United States Trends

- 1. #JusticeforDogs N/A

- 2. ICBM 172 B posts

- 3. $EFR 2.118 posts

- 4. The ICC 193 B posts

- 5. $CUTO 8.774 posts

- 6. #AcousticGuitarCollection 1.958 posts

- 7. #KashOnly 33,9 B posts

- 8. Netanyahu 444 B posts

- 9. Denver 29 B posts

- 10. Katie Couric 1.709 posts

- 11. chenle 110 B posts

- 12. #ATSD 8.506 posts

- 13. #AtinySelcaDay 8.159 posts

- 14. DeFi 128 B posts

- 15. Bezos 37,1 B posts

- 16. GM Elon 1.987 posts

- 17. Unvaccinated 12,4 B posts

- 18. International Criminal Court 93,6 B posts

- 19. CPAP N/A

- 20. woozi 128 B posts

Something went wrong.

Something went wrong.