StockPHD

@StockPHDBalancing capital growth with advanced derivate plays. Let's build an investment profile together, as always my DMs are open. We'll focus on what works.

Similar User

@reevbreskin

@Wen9199

@2016Lide

@POYA_Univ_Grad

@Oniongoggleslol

@ossalamanca

@Lee19225

@HenrydozieO

@Growyourpips

@monkreet

@sandeepmoras

Our DMs are always open for questions or breakdowns. Even if you just wanna brag a little.

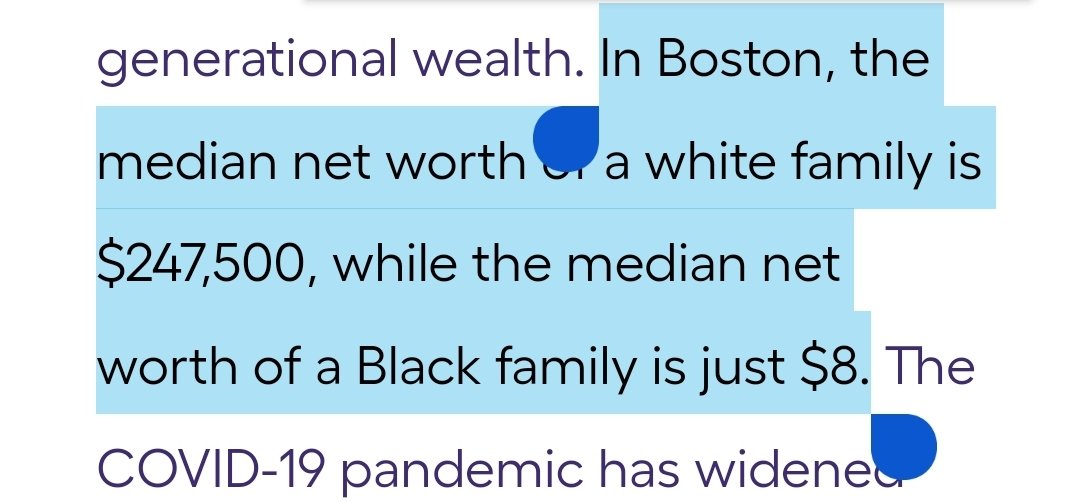

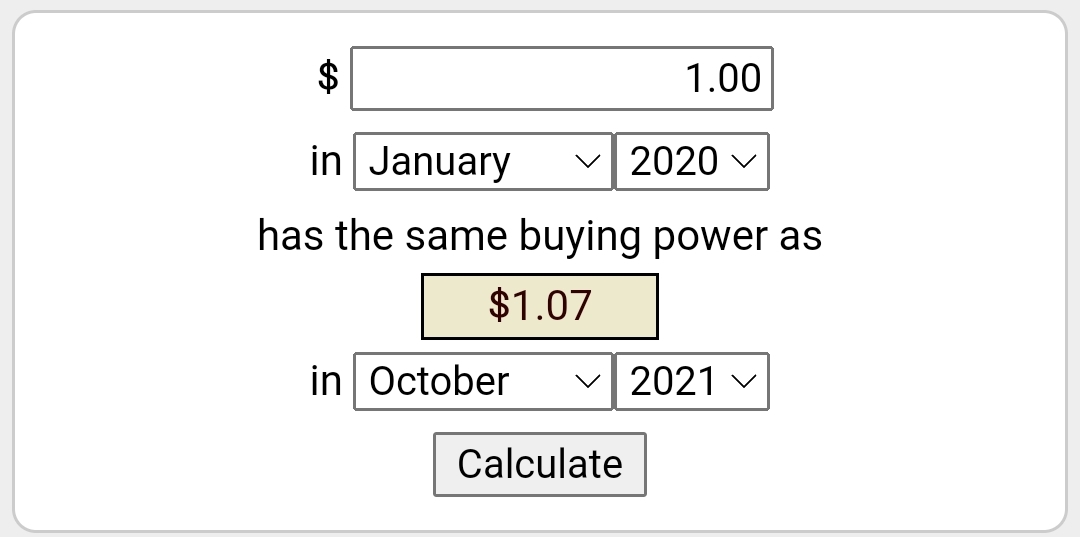

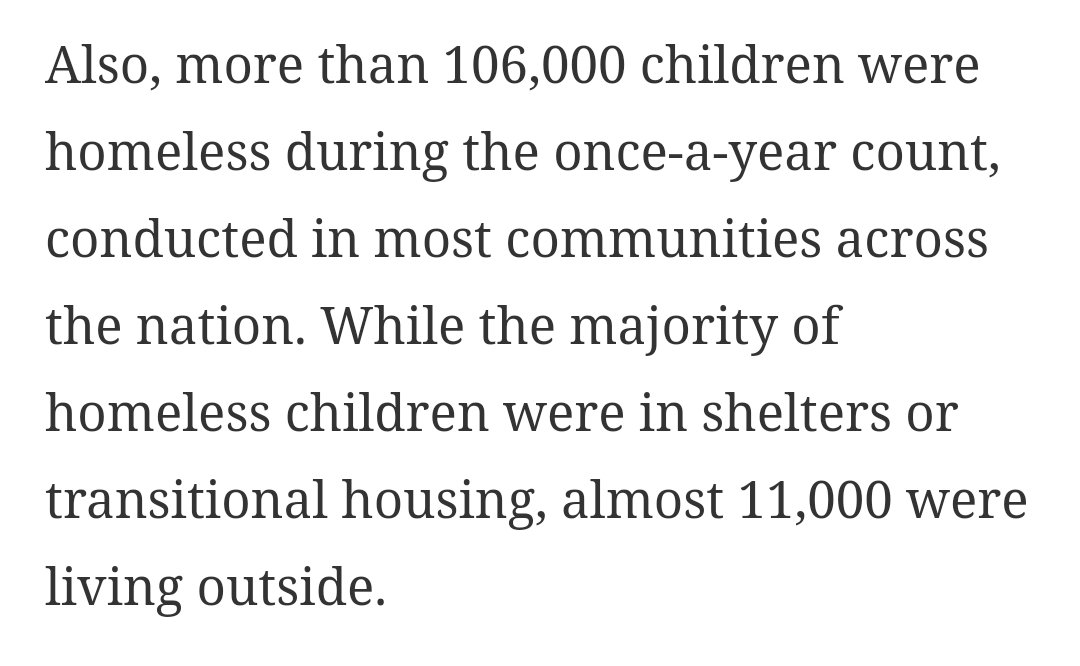

Inflation slamming the nation at about 7% is going to exacerbate an untold number of hardships if we dont get government intervention.

If you're into dividends you're going to love selling options it's got me by the ear.

Reminder if your timeline/tolerance is 20, 30, 40 years just ride it.

Finance twitter is 99% motivational quotes when really you just need some discipline. It is crazy cool the moment you see yourself actually act on something you've been telling yourself you need to do.

Merck severely undervalued, wall street forgetting that healthcare companies are not covid companies and maintain a number of active products, their unexpected earnings beat is evidence of this. I'd put them at 97-105 in fair market value?

Gamestop market cap now in the 13.5 billion range or 5% of Bank of America's. Definitely maintaining don't buy in unless you value Gamestop at 13.6Billion or more. Otherwise it's dangerous speculation

I’m casually watching some of the Sunday morning shows and it’s stunning how much the finserv advertisements focus on “trading.” It makes me want to scream. For the vast majority of people, investing successfully has nothing to do with trading acumen.

This feels like the first time the market wants something and the government isn't giving it to them. If wall street and the people both want a stimulus who's being appeased by blocking it?

To Jamie's point (Someone I consider a premier and must be respected voice in finance/retirement planning) It seems the stock market, economists, and government all want to see a worthwhile stimulus revitalize the economy and put food on the table so why so much pushback?

The stock market and the new york post have way too much in common.

No a million dollars is not a lot of money if you are 65 and just have SSI. But it's certainly livable if you're cautious.

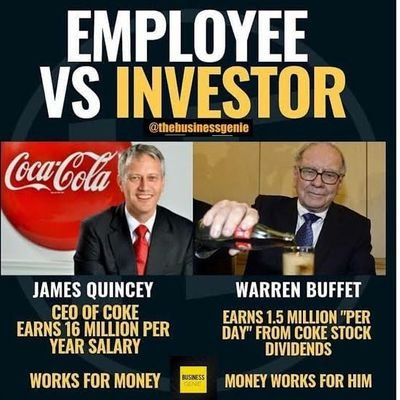

Normalize that losses are okay. You should see where Warren Buffett was in 08 and where he would've been without a bailout. If after normalizing them they still aren't okay, reduce your exposure to individual stocks. You're guessing. Buy ETFs.

When you buy an overbought company you are guessing that the company does even BETTER than what the market prices in. This can dragdown and cause a lot of stagnation in your portfolios. Don't go for the home run everytime.

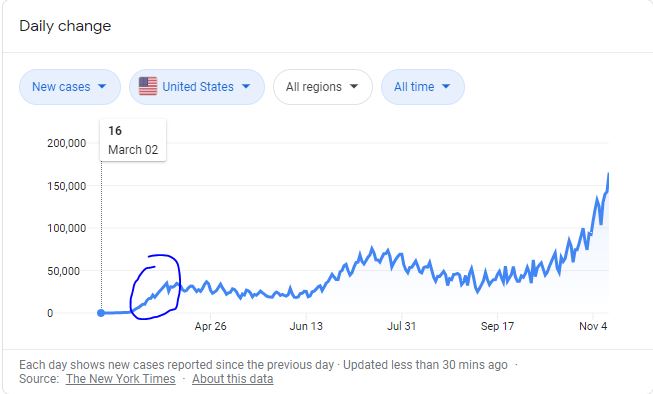

Do you think we need another shutdown? US Stocks can take it in my opinion, reminder that we shutdown here.

China national debt crossed 303% of GDP. I hear way too many on fintwitter talk about how doomed the US is but this is a global issue. US isn't at risk of defaulting and we've held a higher debt to gdp ratio than this.

Huge boon to stocks like $CCL that won't deserve its new valuation for years. Takes one infected passenger to skip testing to blow the entire industry up again.

CDC Cruise guidelines include social distancing while on board lol, ok

Did you know for every $1 spent on seeds you can grow an average of $25 dollars worth of produce with only a few minutes of effort per day?

I'm sorry but there's no way that Snap is worth 50billion unless I completely underestimate how much a 16 year olds data is worth.

I'm all in on $vz there is next to no pricing in the uncompetitive markets they'll tap into when their ultrawideband 5g is available as in home internet. Lab results of 7.5gbps with upload speeds that are much faster than broadband.

United States Trends

- 1. Thanksgiving 502 B posts

- 2. #Overwatch2Sweepstakes 1.750 posts

- 3. #iubb 2.132 posts

- 4. $CUTO 7.641 posts

- 5. Woodson 1.824 posts

- 6. Custom 73,3 B posts

- 7. Louisville 5.472 posts

- 8. Vindman 5.270 posts

- 9. UNTITLED UNMASTERED 1.472 posts

- 10. Deleted 55,6 B posts

- 11. Chucky Hepburn N/A

- 12. Darnold 4.692 posts

- 13. The IRS 41,4 B posts

- 14. Drew Lock 1.380 posts

- 15. Standard Time 8.923 posts

- 16. Dodgers 70 B posts

- 17. CFPB 4.346 posts

- 18. Section 80 2.868 posts

- 19. Nissan 9.956 posts

- 20. Happy Birthday Steve 1.548 posts

Something went wrong.

Something went wrong.