RVP

@Renaat_VPSharing macroeconomics analysis as a stream of consciousness to form my own investment thesis.

Similar User

@DownhillSince63

@LucidMotors

@teslajapan

@VonsRaizer

@torcrobotics

@slimasim

@plugshare

@yong14719906

@0xkhan_

@ECarsReport

@kchangnyt

@KSwift111

@ray4tesla

@parrhesiaste_fr

@TheMacroMoat

Even though we are near all-time highs in #bitcoin, I personally don't "feel" like we are. Perhaps that has to do with institutions leading and the seeming lack of retail chatter (or at least yet). For example, look at Google search trends compared to last cycle:

$1.9b is unheard of for Day One. For context, $BITO did $363m and that's been around for four years. And also this is with 25,000 contract position limits. That said, $1.9b isn't quite big dog level yet tho, eg $GLD did $5b today, but give it a few more days/weeks.

UPDATE: Final tally of $IBIT's 1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts. That's a ratio of 4.4:1. These options were almost certainly part of the move to the new #Bitcoin all time highs today

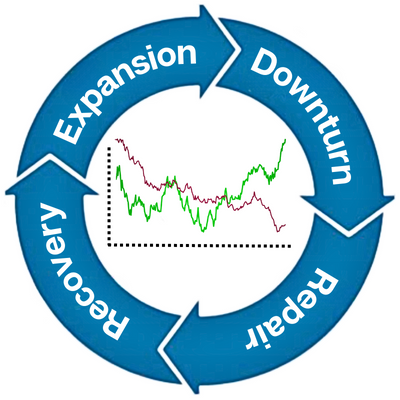

Traditionally housing activity has been an important leading indicator in cycles, in part because it was a good indication of the credit cycle. But this is an income-driven cycle with weak credit growth. Despite high rates housing has only softened modestly.

$2.5B per day in realised profit being taken, largely coming from folks who bought 6-12months ago, at prices above $56k. Reference Report newsletter.checkonchain.com/p/base-camp-1

The latest edition of #Bitcoin Cycle Top Hunting is out for @_checkonchain subscribers. This piece provides a view from both Check the Analyst, and Check the HODLer for how close the market is to reaching topping dynamics. Post is linked in tweet below.

It's another element of "over easy" dynamics in the markets today, which in the short-term is likely to keep the economy and markets going. But reliance on foreign money is building a long-term fragility that will create tough choices for policymakers during tough times ahead.

In that case, the buyers of US duration were pretty price insensitive to the yield because it was done primarily to manage currency policy of the reserve holders. Demand today happens to be strong b/c conditions are weaker elsewhere creating elevated yield diff and strong USD.

I still think we have some time But 2025 housing is going to feel very different from today. Housing usually leads everything I think economy can hold up with starts down in 2025, with a mini bubble in housing deflating in isolation, but history would argue against that idea

OCTOBER HOUSING STARTS 80k Single-Family starts This is a recessionary trajectory

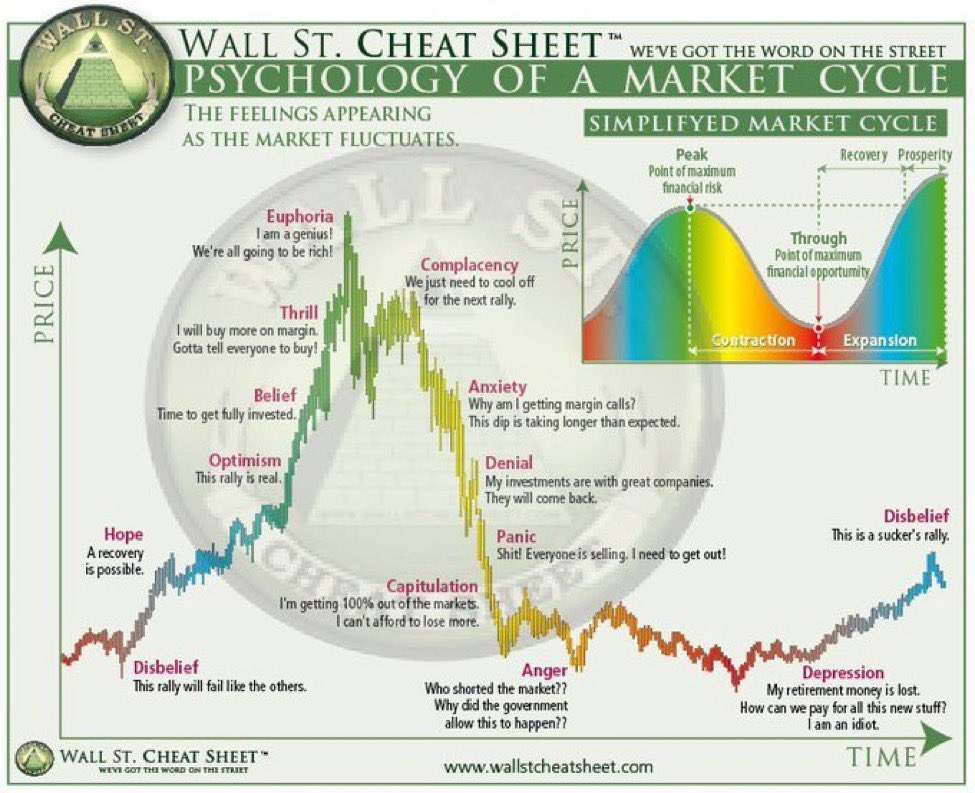

#Bitcoin euphoria is here. 99.3% of UTXOs are in profit now. Everyone's happy. This euphoric phase typically lasts 3–12 months (except Nov '21 bull trap). This started 2 weeks ago. Shorting now could be either catching the top—or shorting at the bottom of a parabolic bull run.

Retail investors are coming: #Bitcoin transaction volume under $100K hit a 3-year high.

New #Bitcoin blog is now live! What are the cycles of bitcoin's growth? Are we on track with past cycles? Full blog here: x.com/ARKInvest/stat… A thread below...

Bitcoin’s halving occurs roughly every four years, often aligning with early bull markets. The April 19 halving brought volatility, but performance aligns with past cycles, fueling our optimism for the next 6–12 months. @dpuellARK explains in a new blog. ark-invest.com/articles/analy…

We're in the bull market. #Bitcoin will go up. Apologies for my off prediction on the short-term correction. I wasn't implying a bear market, just a correction. Based on the cumulative capital flowing into the #Bitcoin market, the current upper limit appears to be $135K.

#Bitcoin could reach $112K this year driven by ETF inflows, worst-case $55K. cryptoquant.com/analytics/dash…

Leaving DC after two days of meetings with Congress and the Fed courtesy of @DigitalChamber My takeaways: - stablecoin bill is the priority, but probably won’t happen in the lame duck session - huge bipartisan desire to work on crypto. Crypto efforts in this election did not…

The #Bitcoin ETFs are by far the majority driving force of $BTC demand right now, soaking up almost all of the selling by Long-Term Holders. CME open interest is not growing meaningfully, reinforcing that this is a spot driven rally.

Belief

Today @Matt_Hougan and I gave a crypto presentation to 350+ financial advisors from Morgan Stanley to Wells Fargo. We surveyed the audience and… 77% of them do not allocate to crypto. So yeah, I’d say we’re still early.

#Bitcoin Long-Term Holders account for 78% of the supply. Don't fight this.

Spot eth ETFs now w/ net *positive* flows since launch… Have overcome $3.2bil outflows from ETHE. ETHA a top 6 ETF launch of 2024.

the regulatory environment for crypto is about to change forever. bitcoin may be exempt from capital gains. mining will be incentivized. crypto businesses will build in the us. SAB-121 will be repealed, which required crypto be marked as a liability on balance sheets.

United States Trends

- 1. #JinOnFallon 348 B posts

- 2. #RHOSLC 7.916 posts

- 3. #CMAawards 19,1 B posts

- 4. Diddy 91 B posts

- 5. Nikki 45,4 B posts

- 6. Sixers 15,3 B posts

- 7. #My82Playlist N/A

- 8. #AEWDynamite 26,5 B posts

- 9. Adani 346 B posts

- 10. Paul George 8.649 posts

- 11. Suns 11 B posts

- 12. Happy Birthday Nerissa 4.485 posts

- 13. Bitcoin 588 B posts

- 14. Coachella 559 B posts

- 15. Jalen Brunson 3.189 posts

- 16. seokjin 137 B posts

- 17. Mark Sears N/A

- 18. Dunn 4.650 posts

- 19. Grayson Allen N/A

- 20. Beal 1.497 posts

Who to follow

-

Bob Smith

Bob Smith

@DownhillSince63 -

Lucid Motors

Lucid Motors

@LucidMotors -

Tesla Japan

Tesla Japan

@teslajapan -

Augustus Fernando

Augustus Fernando

@VonsRaizer -

Torc Robotics

Torc Robotics

@torcrobotics -

Slim

Slim

@slimasim -

PlugShare

PlugShare

@plugshare -

FoxTheKnock

FoxTheKnock

@yong14719906 -

Asif Khan 💜🍏

Asif Khan 💜🍏

@0xkhan_ -

Electric Cars Report

Electric Cars Report

@ECarsReport -

Kenneth Chang

Kenneth Chang

@kchangnyt -

Kevin

Kevin

@KSwift111 -

Ray

Ray

@ray4tesla -

Le parrhésiaste

Le parrhésiaste

@parrhesiaste_fr -

The Macro Moat

The Macro Moat

@TheMacroMoat

Something went wrong.

Something went wrong.