Ray Micaletti

@RelSentTechCIO, Relative Sentiment Technologies | Examining the forces that move markets | Free weekly updates: https://t.co/9AzflLA3VQ | Not investment advice

Similar User

@practicalquant

@investingidiocy

@lopezdeprado

@paradoxinvestor

@Finominally

@macro_synergy

@TKerLLC

@choffstein

@jasoncbuck

@HanauerMatthias

@ReformedTrader

@InvestReSolve

@GestaltU

@jvogs02

@realmarkhines

For weekly updates on relative sentiment, sign up for our newsletter here: relativesentiment.com

Lots of talk about 2022 following the trajectory of 2008. Maybe so. But in fall 2008 institutions were bearish equities and bullish the dollar, whereas now they are bullish equities and bearish the dollar. Let's see what happens.

$TLT just had its highest outflow since the covid-19 crash. It was a GREAT contrarian indicator back then. And I have the same feeling this time.

$META really testing the top of the megaphone. $NVDA's results tomorrow evening might give it a push one way or the other.

Likely not auspicious if $META falls back into the long-term megaphone pattern. Not quite there yet.

The Smart Money keeps selling into the dollar's 7-week rally. So much so that dollar relative sentiment, which turned bullish in mid-July, will finally flip bearish again the last week of November. Bearish dollar relative sentiment tends to be bad for the dollar and good for…

The 10-year forward annualized expected U.S. equity return rose to the juicy level of 0.05% last week, up from the not quite as juicy -0.27% level the week before. The 10-year Treasury yield closed at 4.43%--resulting in an expected equity risk premium of -438 bps. To restore…

Composite long-duration relative sentiment is bullish and will remain that way for at least the next several weeks. The combination of bullish relative sentiment, a strong preceding selloff, and a bullish divergence between price and momentum while being in a falling wedge…

Composite equity relative sentiment (CERS) ended last week at 64%--a bullish reading. Since 1994 (2018), the market has annualized 21% (31%) with a Sharpe ratio of 1.4 (1.8) when CERS is between 60%-80%. The composite looks like it will stay between 60%-70% for at least the…

Not much movement in either gold or silver relative sentiment last week. Both are bearish. Both would likely require at least a few weeks of persistent relative buying by the Smart Money to flip them bullish. The problem is retail refuses to sell, which might mean PMs need to…

During election week, the spread between the aggregate equity positioning z-score of speculators (+3.0) and institutions (-2.8) was 5.8--pushing the highs seen at the top of the market in December 2021. Last week, that spread contracted to 3.8 (speculators, 1.95; institutions,…

This week's pullback could be because last week was too much too fast (250% annualized return) or it could be because the wrong investors are too bullish and valuations are too high.

Likely not auspicious if $META falls back into the long-term megaphone pattern. Not quite there yet.

This week's pullback could be because last week was too much too fast (250% annualized return) or it could be because the wrong investors are too bullish and valuations are too high.

Institutions sold the market aggressively (in the futures and options markets) leading into Election Day last week. Their aggregate equity positioning z-score now sits at -2.8--their most bearish stance since the top of the Everything Bubble in late-2021. In harmony,…

$IWM triggered a short-term mean-reversion signal at today's close. The last signals for $IWM, $SPY, and $QQQ, first triggered on October 31, had the following returns: $SPY: 3-day, 3.9%; 4-day, 4.7% $QQQ: 3-day, 1.7%; 4-day, 4.5% $IWM: 3-day, 3.0%; 4-day, 8.9%

$SPY triggered another signal today, which means the clock starts from 0. $QQQ and $IWM did not trigger new signals.

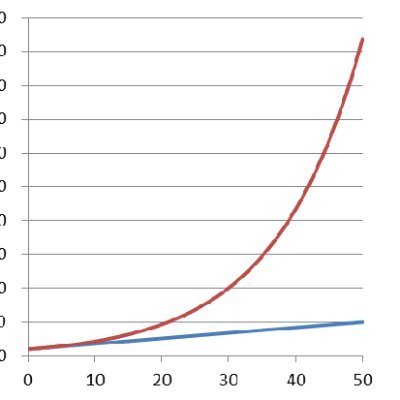

Buying back the most at the second-worst valuations of the last 75 years (2024); buying back the least at the generational low (2009).

Year-to-date US share repurchase announcements hit a record high. @soberlook dailyshotbrief.com

#Silver looking like the inverse of the dollar after its false breakdown. It's gotta feel like deja vu to silver investors--another rug-pull. But it's likely that institutions will use this drop to cover their shorts, while retail panic-sells. That would set silver up with…

Silver does indeed look to be in the midst of a false-breakout-and-plummet move. It's 200-day moving average is in the 28s. Overall, however, gold and silver relative sentiment, while bearish, is improving. Further, the Smart Money is selling the dollar. Those two factors…

Composite equity relative sentiment (CERS) dipped a little last week from 68% to 60%--a bullish reading. Since 1994 (2018), the market has annualized 21% (33%) with a Sharpe ratio of 1.4 (1.9) when CERS has been between 60%-80%. CERS looks set to range between 60%-70% for the…

The Smart Money sold the dollar last week and looks on track to flip dollar relative sentiment from bullish to bearish in early-December. Let's see if $DXY can sustain above the confluence of the two resistance trendlines.

Silver does indeed look to be in the midst of a false-breakout-and-plummet move. It's 200-day moving average is in the 28s. Overall, however, gold and silver relative sentiment, while bearish, is improving. Further, the Smart Money is selling the dollar. Those two factors…

Gold relative sentiment became marginally less bearish last week and is within striking distance of turning positive at any time if institutions continue to buy on a relative basis. Silver relative sentiment took a step back last week, becoming more bearish after surging…

At the risk of doing an Leon-Lett-like touchdown celebration with several weeks left in the month, the indicator described below looks set to pad its performance statistics this month after last week's equity market surge. Let's see if the market gods take offense.

Our Survey + Machine Learning Relative Sentiment indicator flies under the radar, as it's a monthly indicator and doesn't change all that frequently. But it was advocating a 0% equity allocation for October, as the S&P 500 was down 90 bps--the 13th time in 20 occurrences (since…

United States Trends

- 1. ICBM 112 B posts

- 2. Good Thursday 23,3 B posts

- 3. The ICC 21,9 B posts

- 4. Dnipro 40,4 B posts

- 5. #KashOnly 8.623 posts

- 6. #thursdayvibes 2.987 posts

- 7. #ThursdayMotivation 4.344 posts

- 8. Bezos 23,7 B posts

- 9. Happy Friday Eve N/A

- 10. #21Nov 2.283 posts

- 11. #ThursdayThoughts 2.928 posts

- 12. $DUB 7.440 posts

- 13. Nikki Haley 28,2 B posts

- 14. MIRV 4.710 posts

- 15. Bitcoin 644 B posts

- 16. Adani 680 B posts

- 17. Happy Birthday Nerissa N/A

- 18. Juice WRLD 24,4 B posts

- 19. Ellen DeGeneres 68,7 B posts

- 20. Aunt Jemima N/A

Who to follow

-

Jack Forehand

Jack Forehand

@practicalquant -

Rob Carver

Rob Carver

@investingidiocy -

Marcos López de Prado

Marcos López de Prado

@lopezdeprado -

Pim van Vliet

Pim van Vliet

@paradoxinvestor -

Nicolas Rabener

Nicolas Rabener

@Finominally -

Ralph Sueppel

Ralph Sueppel

@macro_synergy -

TKer

TKer

@TKerLLC -

Corey Hoffstein 🏴☠️

Corey Hoffstein 🏴☠️

@choffstein -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck -

Matthias Hanauer

Matthias Hanauer

@HanauerMatthias -

Darren 🍬 🍂 🔨

Darren 🍬 🍂 🔨

@ReformedTrader -

ReSolve Asset Mgmt

ReSolve Asset Mgmt

@InvestReSolve -

Adam Butler

Adam Butler

@GestaltU -

Jack Vogel

Jack Vogel

@jvogs02 -

Mark Hines

Mark Hines

@realmarkhines

Something went wrong.

Something went wrong.