Similar User

@mgrahamwood

@PhilJW123

@CalderCapital_

@investorman_9

@WrightmanAIM

@Oilplayer2009

@john78846295

@SLowie100

@ThomasTitmouse

@jlawsonbaker

@parisvi

@Licensed2trade

@SteveStubbsy1

@investor_prime

@JohnM_AIM

Angola is cementing its leadership in offshore oil & gas with multi-year licensing rounds, highlighting vast exploration opportunities. Afentra is well-positioned to unlock value in Angola’s upstream market. #AET #OffshoreAngola #Energy Read more: reuters.com/business/energ…

Ian Cloke, COO of @AfentraPLC, spoke at #AfricaEnergyWeek2024 on the Company's strategic acquisitions in Angola and its commitment to sustainable, responsible asset management in Africa's energy transition. #AET #AEW24 Watch the interview here: afentraplc.com/#news-and-media

🤝 #AET is committed to establishing and maintaining strong partnerships that deliver mutually beneficial outcomes for stakeholders. As a non-operating partner, it provides technical support to the Operator and wider partnership in order to maximise asset value. More detail ⤵️

Great to see Shore Capital initiate independent coverage stating: “we believe our 103p/share Tangible NAV estimate provides a good indication of fair value…implying the shares have potential to double"

Cavendish has issued a research note that states: ‘with a portfolio of both near-term, low-cost, short-cycle growth opportunities and significant longer-term opportunities, Afentra is well placed to materially increase both production and cash flow’ ⤵️ research-tree.com/companies/uk/o…

First Cannacord, now Shore Capital and Cavendish. *AFENTRA PLC RATED NEW BUY AT SHORE CAPITAL; PT 103 PENCE *AFENTRA PLC RATED BUY AT CAVENDISH; PT 83.1 PENCE #AET

#AET Plan to grow significantly in Angola. More growth over the next 3 years than the last 3 years.

🗣️ Our CEO, Paul McDade, sat down with @PeelHunt to discuss #AET's asset portfolio, its role in the energy transition and reducing carbon emissions, M&A priorities and strategy for onshore and offshore business growth, and outlook for 2025. Listen here ⤵️ peelhuntoilandgas.gallery.video/240927

Earlier this year, our COO, Ian Cloke, spoke at @EnergyCapPower's Invest in African Energy Forum in Paris. He shared insights on #AET’s strategy to collaborate on mid-life assets in West Africa, focusing on extending their lifespan while reducing emissions. Watch the interview ⤵️

At the Invest in African Energy (IAE) forum, Ian Cloke, Chief Operating Officer at @AfentraPLC discussed the company's key asset in Angola, Block 3/05, in partnership with @sonangoloficial Afentra is focused on working with mid-life assets in West Africa, leveraging its…

📈 Great to see Canaccord Genuity (@CG_Driven) initiate independent coverage on Afentra PLC, with a target price indicating 70% upside from current share price. #AET $AET

#AET be interesting to see what the next acquisition is 🤔

📈 Since its formation, Afentra has completed 3 highly accretive deals, leading to substantial gains in production, cash flow, and reserves. The company is well-positioned to build on these successes. Watch this video for #AET's growth outlook, both near and long-term. $AET ⤵️

📈 Since its formation, Afentra has completed 3 highly accretive deals, leading to substantial gains in production, cash flow, and reserves. The company is well-positioned to build on these successes. Watch this video for #AET's growth outlook, both near and long-term. $AET ⤵️

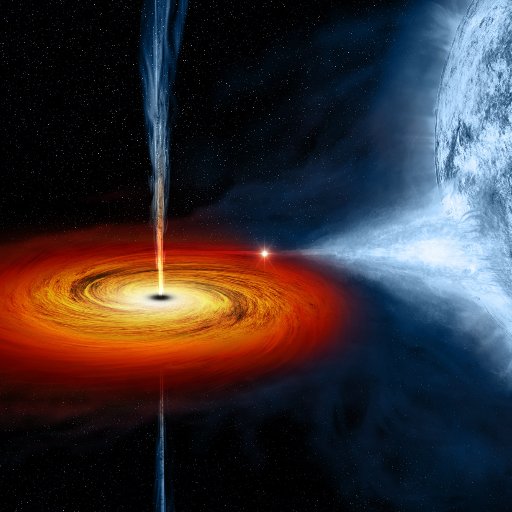

Oil production naturally declines at a rate of about 15% per year. That’s nearly double the IEA’s prior estimates of about 8%. --ExxonMobil #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket

Exxon and OPEC are warning of a looming oil crisis. As global investments in new oil projects decline, the risk of severe supply shortages and skyrocketing prices becomes more real. Exxon predicts that without fresh investments, the world could face a 70 million barrel/day…

Our CEO, Paul McDade, will be speaking at the West African Energy Summit in Accra, #Ghana. He’ll be part of a key debate on 4th September at 9:45 AM, discussing how to strengthen policy and regulation in the West African O&G sector. @SummitWaes

🇬🇧 Keir Starmer “we’ll freeze those energy bills going forward” “Under a Labour Government we would allow prices to go up Ella” When the man is on record so many times stating what he is going to do, then within weeks does the opposite - the trust is gone. How can anyone ever…

(1/2) In 2023, two successful light well intervention (LWI) campaigns resulted in 30 well interventions, boosting production. Gross average combined production for the period to the end of June 2024 for both Block 3/05 and 3/05A was 22,686 bopd

(1/3) Block 3/05, located offshore Angola in the Lower Congo Basin, is a significant shallow-water production asset with substantial upside potential. With more than 3 billion barrels of light oil in place, it benefits from established infrastructure across its 8 fields

Why have you closed comments on this?

United States Trends

- 1. #twitchrecap 15,8 B posts

- 2. $VSG 3.184 posts

- 3. #VECTOR N/A

- 4. taemin 18,8 B posts

- 5. Heinz 6.764 posts

- 6. Walz 12,5 B posts

- 7. Strahan 1.068 posts

- 8. Microsoft 50,4 B posts

- 9. Jimmy Butler 7.277 posts

- 10. Favre 2.148 posts

- 11. Gastineau 1.361 posts

- 12. #GalaxyZFlip6 N/A

- 13. John Kerry 15,6 B posts

- 14. Among Us 19,1 B posts

- 15. Jamie Foxx 7.076 posts

- 16. #HumanRightsDay 101 B posts

- 17. Bill Belichick 10,3 B posts

- 18. Nunez 21 B posts

- 19. Caitlin Clark 21,1 B posts

- 20. Seiya 5.184 posts

Who to follow

-

Malcolm Graham-Wood

Malcolm Graham-Wood

@mgrahamwood -

Phil

Phil

@PhilJW123 -

Calder Capital

Calder Capital

@CalderCapital_ -

The Investor Man

The Investor Man

@investorman_9 -

Sasha_Sethi

Sasha_Sethi

@WrightmanAIM -

Oilplayer2009

Oilplayer2009

@Oilplayer2009 -

john

john

@john78846295 -

Lowie

Lowie

@SLowie100 -

Thomas Titmouse

Thomas Titmouse

@ThomasTitmouse -

𝐉𝐀𝐌𝐄𝐒

𝐉𝐀𝐌𝐄𝐒

@jlawsonbaker -

paris

paris

@parisvi -

Bondy

Bondy

@Licensed2trade -

Steve Wayne

Steve Wayne

@SteveStubbsy1 -

Investor Prime

Investor Prime

@investor_prime -

JohnM

JohnM

@JohnM_AIM

Something went wrong.

Something went wrong.