Ryan Sweet

@RealTime_EconHusband, father of 3, Chief US Economist @OxfordEconomics. Views are my own. Former: @economics_ma and @WCUofPA. Grad of @washcoll, @UDelaware and @JHUCarey.

Similar User

@Markzandi

@AnnaEconomist

@IanShepherdson

@jasonfurman

@economics_ma

@mioana

@TimDuy

@fcastofthemonth

@jc_econ

@conorsen

@jeskeets

@EconBerger

@TheLynetteZang

@SaxoAustralia

@ModeledBehavior

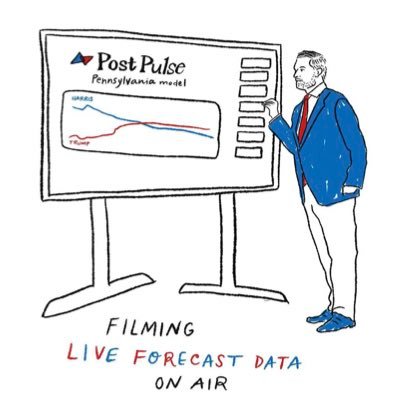

Inflation is the foremost issue voters are concerned about, and how it is perceived will determine the election. Our modeling suggests Pennsylvania will be the state that pushes the eventual presidential winner over the finish line. okt.to/Axk9E2

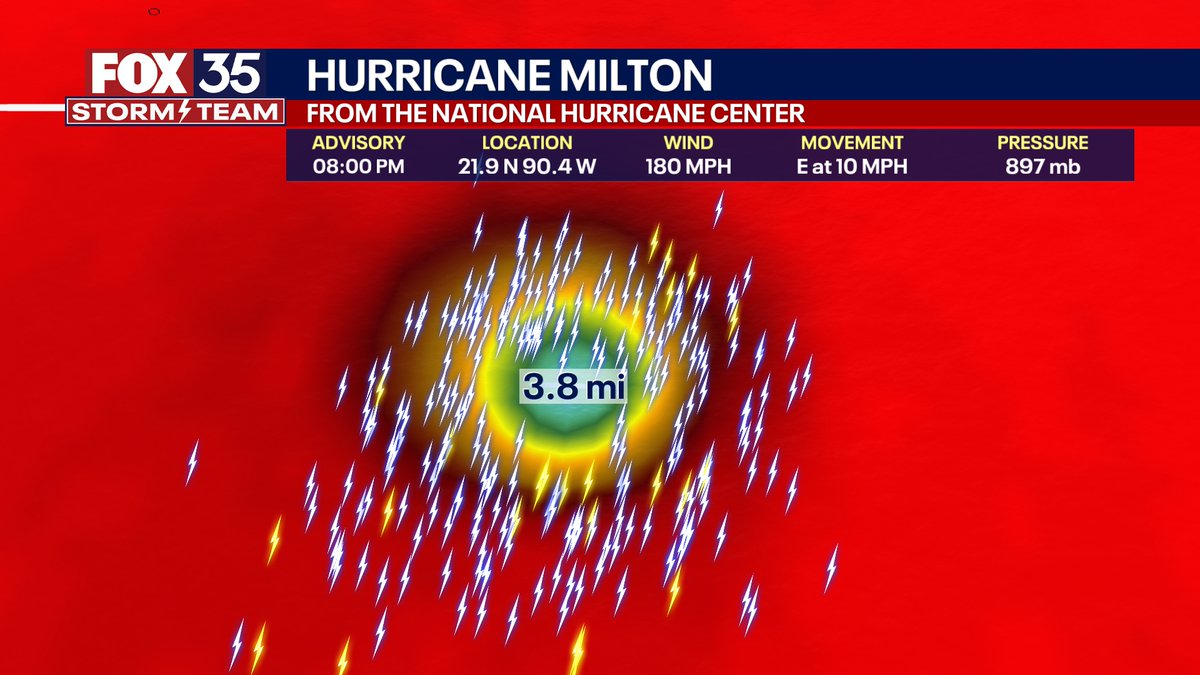

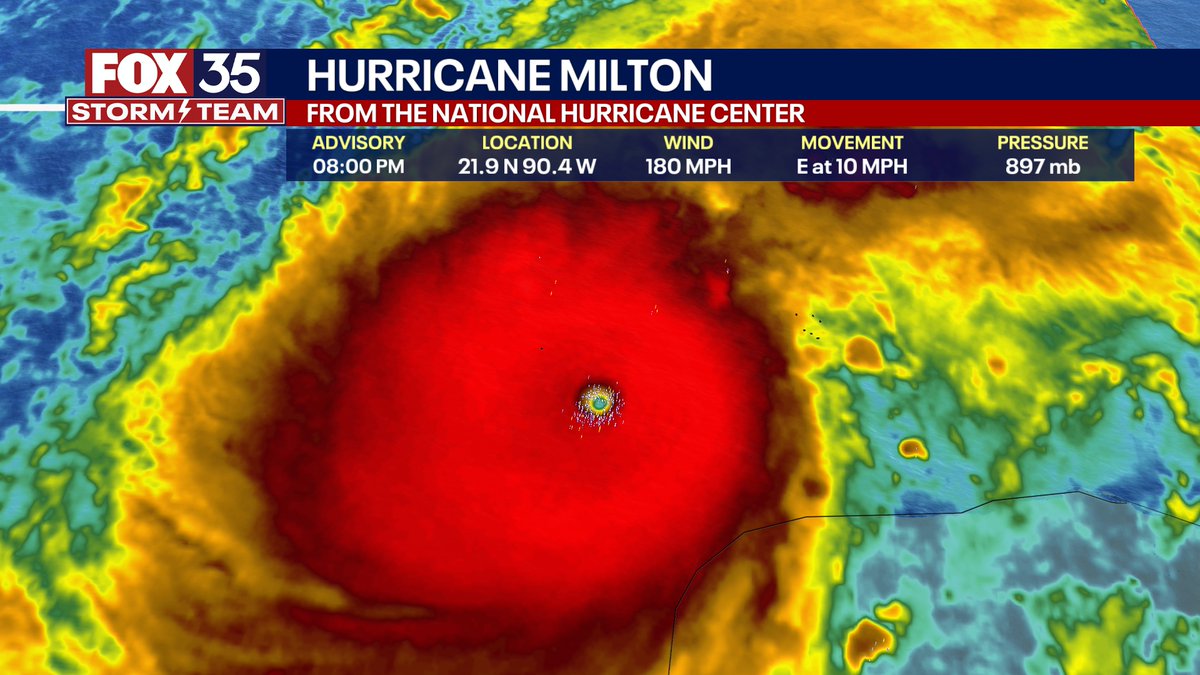

One of the most ominous tweets I’ve ever read: “ This hurricane is nearing the mathematical limit of what Earth's atmosphere over this ocean water can produce.”

8PM EDT: This is nothing short of astronomical. I am at a loss for words to meteorologically describe you the storms small eye and intensity. 897mb pressure with 180 MPH max sustained winds and gusts 200+ MPH. This is now the 4th strongest hurricane ever recorded by pressure on…

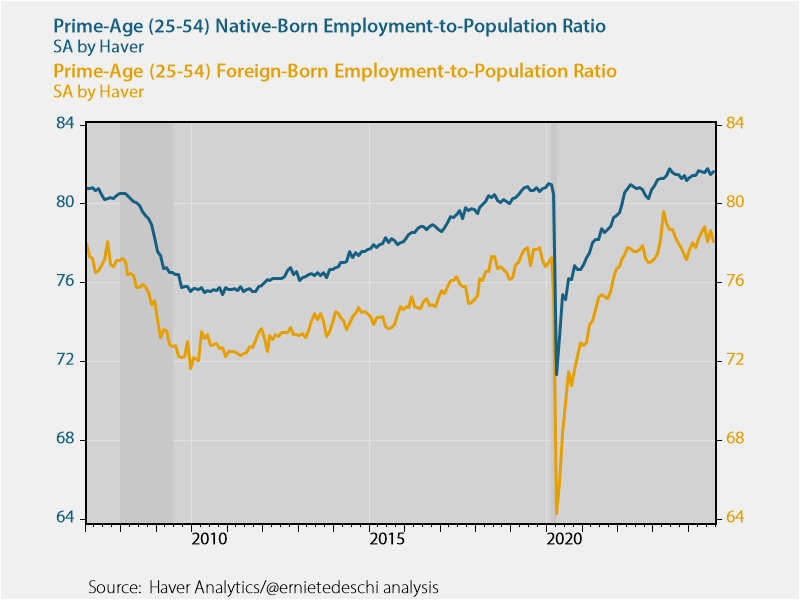

The prime-age (25-54) native-born employment rate remains both higher than the foreign-born employment rate and higher than at any point pre-pandemic since BLS began publishing the series in 2007, including higher than any point in the Trump Administration.

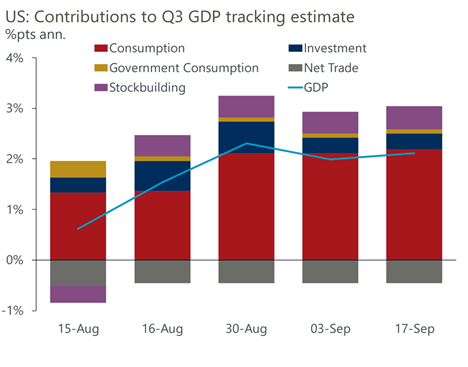

Accounting for our estimate that the PCE deflator rose by 0.11% last month, we estimate real consumption growth was up 0.1% in August. That would put real consumption on track to rise 3.2% annualized in Q3, better than Q2's gain of 2.9%. Consumer is hanging in there.

The Fed faces a finely balanced set of considerations over whether to cut by 25 or 50 basis points at its meeting that begins today. The case for 50 comes down to what Fed officials call risk management but what might be thought of as regret minimization. Per former Dallas Fed…

Relive the ’04 run like never before. The Comeback: 2004 Red Sox, only on Netflix Oct 23

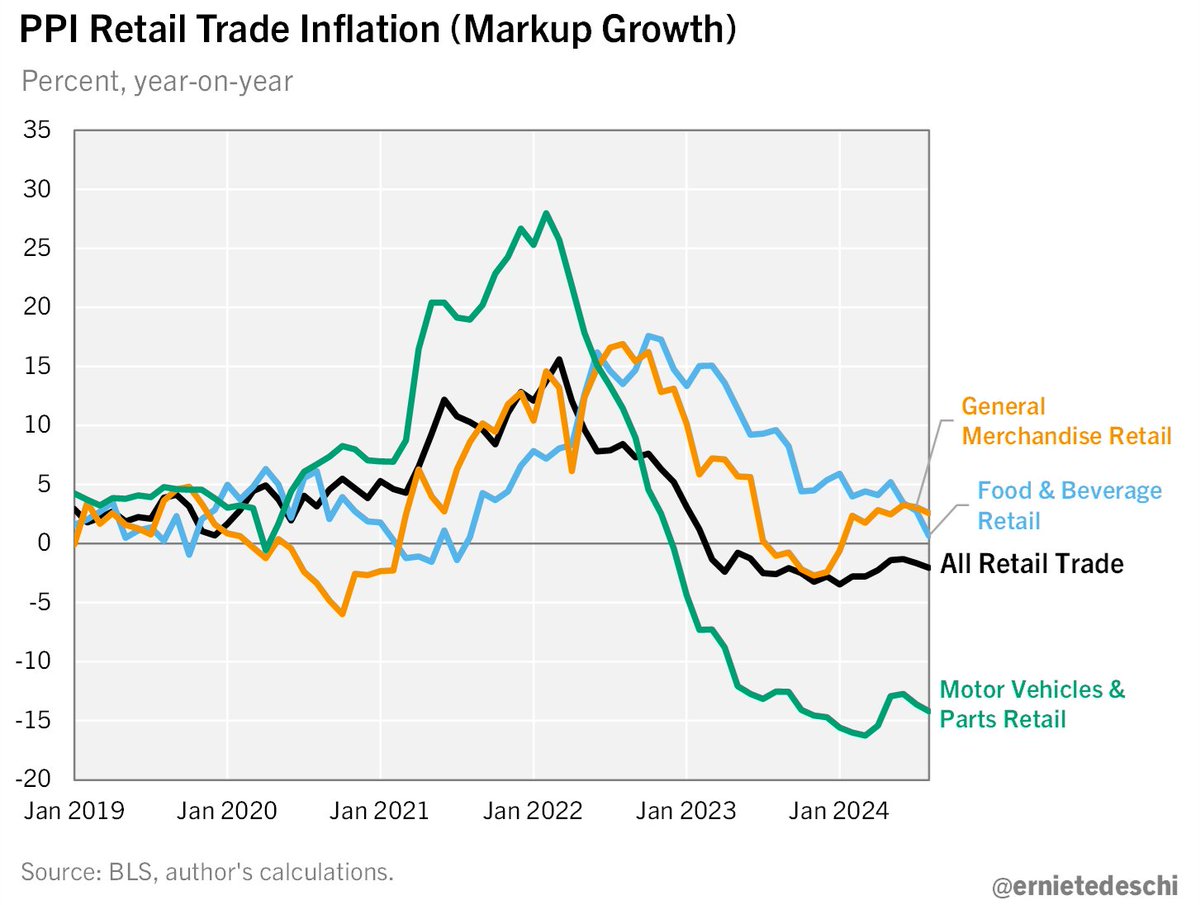

One of the most interesting things the PPI tracks that the CPI doesn't is retail markups. Retail markup growth has slowed considerably & this has been a contributor to disinflation. In August in particular, growth in grocery markups fell to 0.7% YY, the slowest in 3 years.

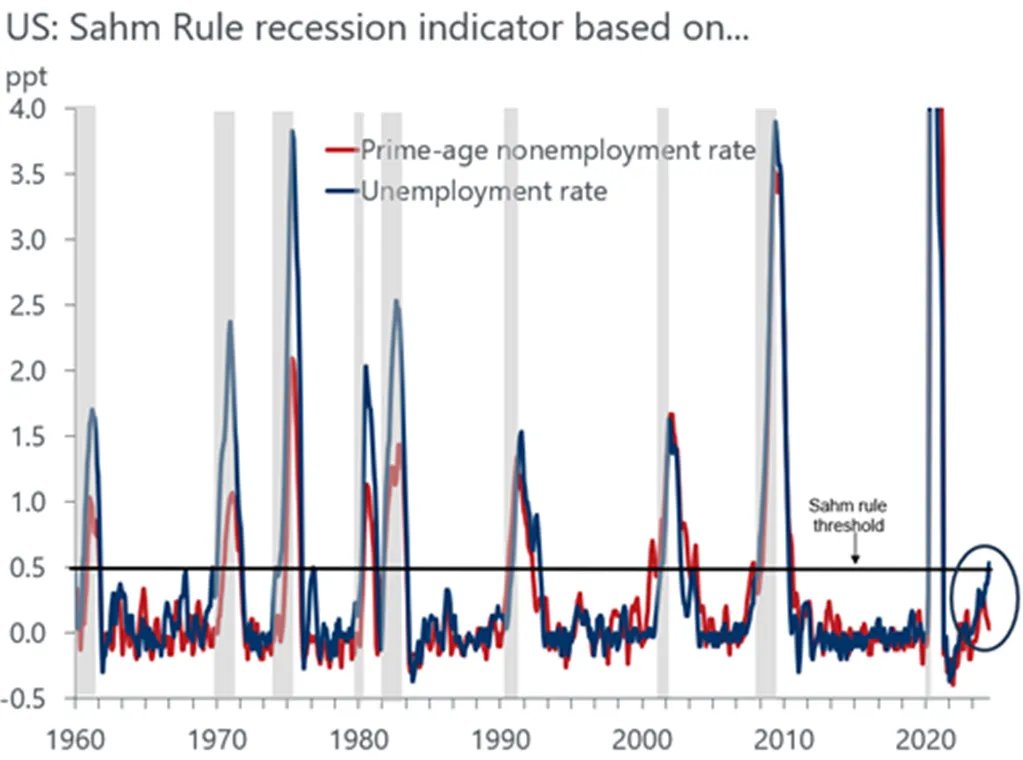

🇺🇸 Ryan Sweet of Oxford Economics tried a different version of the Sahm Rule focusing on the 25-54 age group; it has recently diverged sharply from the overall unemployment rate version and suggests little risk of recession - Bloomberg bloomberg.com/opinion/articl…

Weekly jobless claims come in at 230,000. “I think this is a good sign for the Fed that even though the labor market has risen, it’s not because of a lot of layoffs,” Oxford Economics chief economist @RealTime_Econ says.

Jobs data is now in the front seat, says. Oxford Economics chief US economist @RealTime_Econ: "The Fed is arguably, maybe, a little behind the curve. And to get caught up, if we do, in fact, have a weak August employment number, they may opt to go with 50 BPS."

Like most, I'm still waiting for the US preliminary benchmark revisions. While waiting, the state data is out. As a share of total employment, Colorado is the big loser.

@RealTime_Econ Inflation heading toward 2% - and unemployment jump not showing labor market in distress sets Fed up for two 25bps cuts this year.

A quick mapping of the CPI and PPI components that are source data for the PCE deflator suggest that the headline and core deflators were up 0.17% and 0.18% m/m in July, respectively. Fed can, and should, cut but I wouldn't hold your breath for a supersized one.

United States Trends

- 1. #UFC309 316 B posts

- 2. Jon Jones 195 B posts

- 3. Jon Jones 195 B posts

- 4. Jon Jones 195 B posts

- 5. Chandler 89,9 B posts

- 6. Oliveira 74,3 B posts

- 7. Kansas 23,7 B posts

- 8. #discorddown 7.040 posts

- 9. Bo Nickal 9.268 posts

- 10. ARod 2.221 posts

- 11. Pereira 11,9 B posts

- 12. Do Bronx 11,5 B posts

- 13. Dana 267 B posts

- 14. #BYUFootball 1.428 posts

- 15. Mike Johnson 47,2 B posts

- 16. Rock Chalk 1.455 posts

- 17. Alec Baldwin 8.871 posts

- 18. #MissUniverse 453 B posts

- 19. #kufball 1.165 posts

- 20. Big 12 16,9 B posts

Who to follow

-

Mark Zandi

Mark Zandi

@Markzandi -

Anna Wong

Anna Wong

@AnnaEconomist -

Ian Shepherdson

Ian Shepherdson

@IanShepherdson -

Jason Furman

Jason Furman

@jasonfurman -

MoodysAnalytics ECON

MoodysAnalytics ECON

@economics_ma -

Ioana Marinescu

Ioana Marinescu

@mioana -

Tim Duy

Tim Duy

@TimDuy -

Omair Sharif

Omair Sharif

@fcastofthemonth -

Julia Coronado

Julia Coronado

@jc_econ -

Conor Sen

Conor Sen

@conorsen -

J.E. Skeets

J.E. Skeets

@jeskeets -

Guy Berger

Guy Berger

@EconBerger -

Lynette Zang

Lynette Zang

@TheLynetteZang -

Saxo Australia

Saxo Australia

@SaxoAustralia -

Adam Ozimek

Adam Ozimek

@ModeledBehavior

Something went wrong.

Something went wrong.