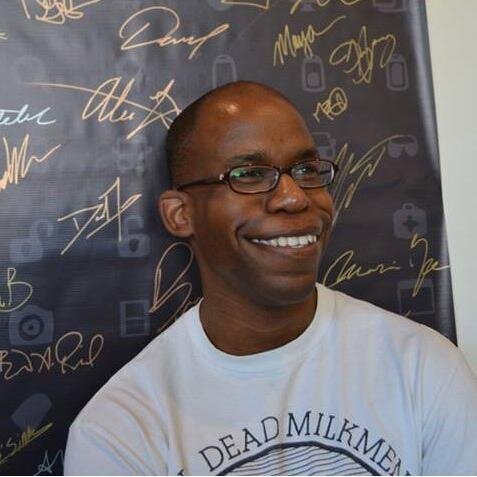

James Akers

@RealJamesAkersPrincipal at Fruitful Advisors Over 99,000 Instagram Followers Over 1.8 million YouTube Views

Similar User

@HFJ_36

@TheMoondalorian

@VivianWeyll

@sb3q8y

@anthromemology

@001Nea

If you've changed jobs and had a retirement plan at your former employer, don't leave it, take it with you! I recommend not rolling it into your new employer's plan, but moving it into a qualified IRA so you still have control over it. Have questions? We can help you be FRUITFUL!

I have great CD options for those worried about the market... Currently 5.35% on the 12 month, 5.283% on the 9 month, 5.216% on the 6 month, and 5.145% on the 3 month. If you want longer terms, 5.25% on the 2 year, 5.1% on the 3 year, and 4.8% on the 5 year.

Stay on top of the latest retirement news by contacting us to receive our weekly updates.

Compare what you’re spending to what you’re saving. Trim the fat where you can and cut back on any unnecessary expenditures so that you can allocate more to your retirement savings column. (Source: Yahoo! Finance)

We would like to keep you up to date on the latest retirement news, let’s talk today!

Wealth Wednesday Tip #740: Do you get financial envy? Don't be fooled by social media's money mirage: It's easy to get caught up in what others post on Facebook and Instagram, but don't let that affect the way you view and manage your money. (Source: Morning Star)

I reached a point in my life a few years ago that I started to succeed in everything I did. Not because I was the smartest, luckiest, or most talented, because I'm not. But because I refused to give up on my dreams and I worked until I found success in everything I attempted.

With inflation rising and account balances falling, financial advisors say having a plan is more important than ever — and can help “stress test” your investment strategy. (Source: CNBC)

What happens if your retirement falls short? We can help!

Many people are not saving enough money to have a secure retirement. You'll need a nest egg that provides a good amount of income to supplement Social Security, and the sooner you begin investing, the easier it will be to amass the necessary funds. (Source: WFMZ)

United States Trends

- 1. Chandler 60,8 B posts

- 2. #UFC309 173 B posts

- 3. Bo Nickal 7.876 posts

- 4. #MissUniverse 406 B posts

- 5. Do Bronx 6.901 posts

- 6. Tatum 25,9 B posts

- 7. Tennessee 53,3 B posts

- 8. Beck 21,1 B posts

- 9. Oregon 33,4 B posts

- 10. Paul Craig N/A

- 11. #GoDawgs 11 B posts

- 12. Georgia 96,7 B posts

- 13. Keith Peterson N/A

- 14. Nigeria 273 B posts

- 15. Locke 5.847 posts

- 16. Dinamarca 35 B posts

- 17. #discorddown 2.017 posts

- 18. Wisconsin 46,9 B posts

- 19. Mike Johnson 44,3 B posts

- 20. Dan Lanning 1.327 posts

Something went wrong.

Something went wrong.