Mo

@PersianMacroGuyLiving the island life as a macro trader on the beaches of Puerto Rico. Past life: engineering at Google and Facebook.

Similar User

@Javad_moradiiii

@BankingIp

@Aramoon13

@imanjamshidi124

@KaikoData

@MacroRezapour

@Raaz51666797

@ideahive

@Amozaffar1

@omidahmadnejadd

@m0rganalexander

@ClarkSquareCap

@Masoud_Eu

@eshoara

@Will_XVII

I haven't posted this because I worried it would impact my decision making but today I feel proud. 63% annualized returns since 4 years ago vs S&P 15%. Very little leverage and most of the time not fully invested. This is majority of my accounts/portfolio at schwab but I do have…

$ARGT is up another 25% since this tweet even though it doesn’t have the best etf construction. A pure Argentina basket would have done even better. “If you wait for things to get better, you’ll be late to the party”

A little drawdown in Argentina but we're back. There is a 25% annualized expected return investing in Argentina. Compare to: Turkey: 17% Ukrane: 26% Egypt: 19% Iran 18% Haiti: 23% Yes. There is a lot broken with Argentina. But there is just as much discounted. If you wait for…

Took the loss here and put in $ARGT

Anger is the antithesis of being objective.

The best counterindicators are the people angry at the markets.

Shocking!!! “Powell Signals No Rush on Rate Cuts”

We might not get 2 cuts this year. Bond market will move first and then the Fed will back down

$ARGT 76/77 spreads were between 10-20 cents.

The argentina trade will probably look obvious this Friday. $ARGT And yes there are options

$ARGT up over 6% since this tweet

Sometimes it is as simple as, Buy Elon’s stock because Trump good for Elon. $TSLA Next week, Milei is coming to meet Trump and Elon. Maybe it is as simple as buy Argentina $ARGT

$2.94B. ROE is over 30% now. Stock up AH But material slowdown in cohort revenue maturation despite currency headwinds. Not something you like to see. Good conference call to listen to. $NU

$NU earnings prediction: For Q3 2024, I expect revenue to come at above $3.1 billion. The average estimate on the street is $2.85 billion. Highest estimate is $2.96 billion.

$NU earnings prediction: For Q3 2024, I expect revenue to come at above $3.1 billion. The average estimate on the street is $2.85 billion. Highest estimate is $2.96 billion.

I missed this time (along with $NU) even though the stock responded positively and sent it ATH. A few reasons for my miss: not taking into account full currency impact as well interest rate changes that affect revenue negatively but gross margins positively. Also, slower growth…

$PGY

At its core the problem with investing in a company like $PGY is that AI isn't what differentiates you but a durable source of funding. It's amazing how many times over the years the same story plays out yet these companies attract sophisticated investors. For anyone who wants…

The argentina trade will probably look obvious this Friday. $ARGT And yes there are options

Sometimes it is as simple as, Buy Elon’s stock because Trump good for Elon. $TSLA Next week, Milei is coming to meet Trump and Elon. Maybe it is as simple as buy Argentina $ARGT

It turns out shorting long-end and being long equities was indeed the answer

@FedGuy12 thinks equities will sel-off because large deficits and dovish Fed cutting cycle will weaken the dollar and cause foreign investors to get out of the US. If he thinks that, why doesn't he go short long-end and long equities? That seems more to be more representative of…

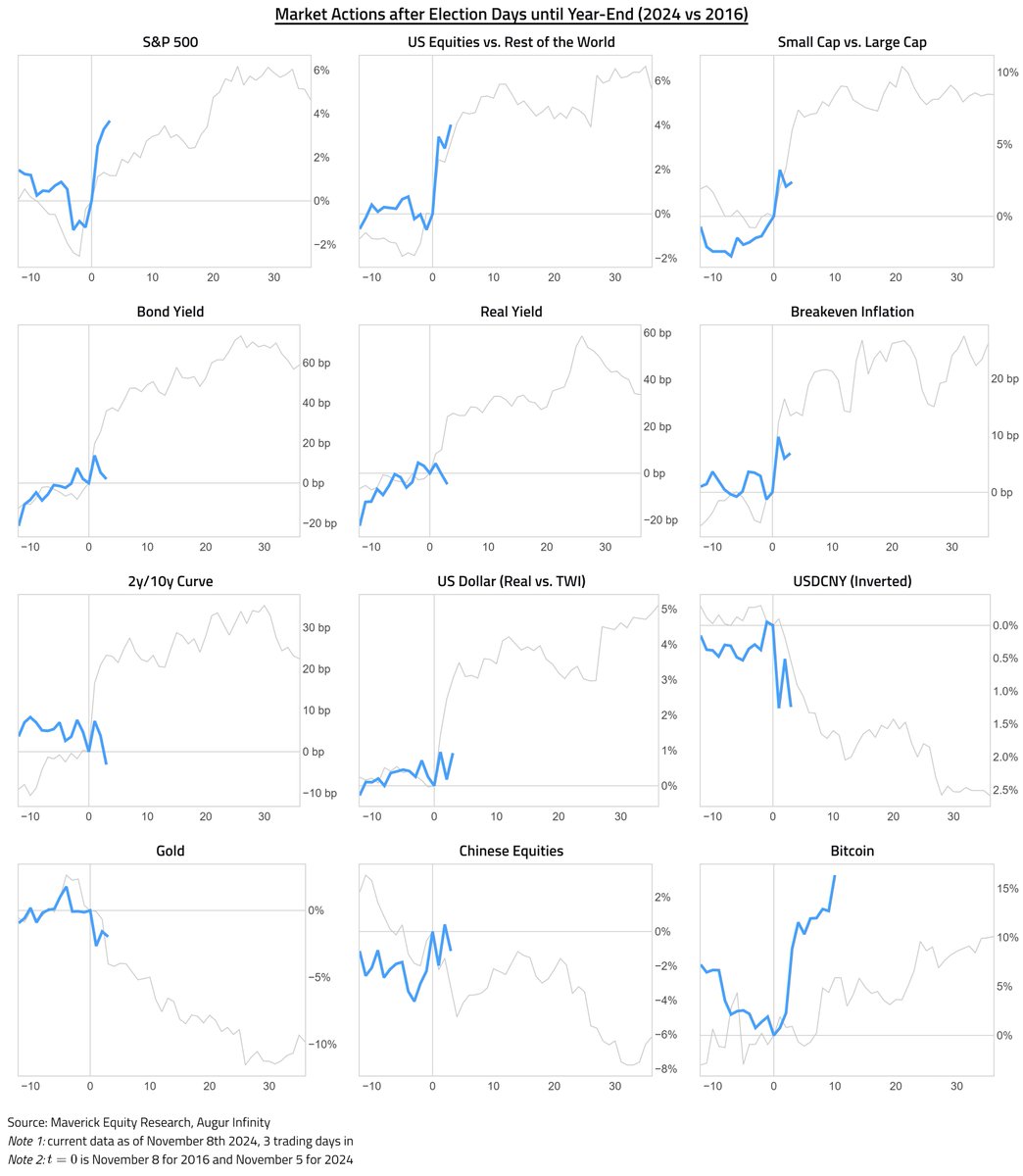

2024 vs 2016 overlay as 'The Trump Trade': 12 ideas via one Maverick visual for 10,000 words and the U.S. post elections Chart of the Year ... enjoy 👇 How similar is the 2024 markets' reaction to 2016? Visual is after 3 trading days in and until year-end: ➡️ S&P 500 = UP, way…

Sometimes it is as simple as, Buy Elon’s stock because Trump good for Elon. $TSLA Next week, Milei is coming to meet Trump and Elon. Maybe it is as simple as buy Argentina $ARGT

$TSLA has now 3 narratives going on for it. Revenue re-acceleration Trump victory Self-driving/robotaxis Won’t be surprised if this rally keeps going on for a while

$UPST will blow past expectations. Don’t know how the stock will react but probably up

“Won’t be surprised if this rally keeps going on for a while” $tsla

$TSLA has now 3 narratives going on for it. Revenue re-acceleration Trump victory Self-driving/robotaxis Won’t be surprised if this rally keeps going on for a while

But the Fed will change its stance based on what the market will do. And if the market sniffs loosening fiscal and higher growth/inflation, it’ll erase the cuts prices in

And today is a great example on why overvaluation shouldn’t mean under-owning equities

IMO, a retail investor should never be less than 70% invested in equities even if he is confident a crash is coming. Not being invested is just a recipe for being left behind or worse FOMOing at the wrong time.

🫶

If trump indeed wins, don’t you want to be in high corporate tax rate domestic companies and not big cap tech?

I don’t have a crystal ball, but …

A dovish Fed doesn't mean lower bond yeilds. A good reminder that 10 year treasury yields went up by 200 bps after the Fed started cutting cycle in 1998. The economy is arguably even stronger today than in 98.

United States Trends

- 1. Good Friday 49,6 B posts

- 2. #FridayVibes 3.868 posts

- 3. #2024MAMA 846 B posts

- 4. Browns 107 B posts

- 5. Donny Dough N/A

- 6. Pam Bondi 280 B posts

- 7. #NoMikeRogers 3.770 posts

- 8. Steelers 120 B posts

- 9. Candy Corner N/A

- 10. Lakers 56,1 B posts

- 11. yeonjun 122 B posts

- 12. yujin 36,9 B posts

- 13. #ENHYPEN 905 B posts

- 14. #FridayMotivation N/A

- 15. Mnet 334 B posts

- 16. Chris Brown 24,3 B posts

- 17. Bruno Mars 163 B posts

- 18. hanbin 38,4 B posts

- 19. CONGRATULATIONS JUNGKOOK 73,6 B posts

- 20. CONGRATULATIONS JIMIN 92,5 B posts

Who to follow

-

Javad

Javad

@Javad_moradiiii -

IP Banking Research

IP Banking Research

@BankingIp -

Aramoon

Aramoon

@Aramoon13 -

IMAN JAMSHIDI

IMAN JAMSHIDI

@imanjamshidi124 -

Kaiko

Kaiko

@KaikoData -

Ali Rezapour

Ali Rezapour

@MacroRezapour -

Raaz

Raaz

@Raaz51666797 -

Idea Hive

Idea Hive

@ideahive -

Ali

Ali

@Amozaffar1 -

omidrezaahmadnejad

omidrezaahmadnejad

@omidahmadnejadd -

M. Alexander

M. Alexander

@m0rganalexander -

Clark Square Capital

Clark Square Capital

@ClarkSquareCap -

Masoud.Eu

Masoud.Eu

@Masoud_Eu -

Erfan Shoara

Erfan Shoara

@eshoara -

Will Lau

Will Lau

@Will_XVII

Something went wrong.

Something went wrong.