PGMGO

@PGMGOA commodities, hard assets trader, who makes observations and provides opinions on major news events that could move markets

Similar User

@StockWarrants

@PerfectlyHedged

@miningstocks

@furg2000

@tamsir101

@YancyFX

@hft23vsh5

Every day close to $100WTI (in Canadian dollars) is a great day!!!

How about 69?

EIA: “U.S. ethane exports to China rose 35% last year.” If only there was a well-managed shipping company I could invest in, which benefits from these secular trends. <cough>

Yesterday, the Consumer Confidence Board released its consumer confidence survey. They randomly sampled 3,000 households and as questions on many topics. Since May 1987, they have asked their opinion about the stock market. In the latest reading, 51.4% said they expect it to…

1/3 The MOVE (Merrill Option Volatility Estimate) measures the implied volatility on 30-day bond options from the 2Yr note to 30Yr bond. It is the "VIX of the bond market." Today it closed at a one-year high, suggesting the bond market is pricing in upcoming volatility.

$STNG Q3 - $3.16 diluted EPS including gains - $1.75 adj diluted EPS - $675M net debt as of now - 40 cent Divi

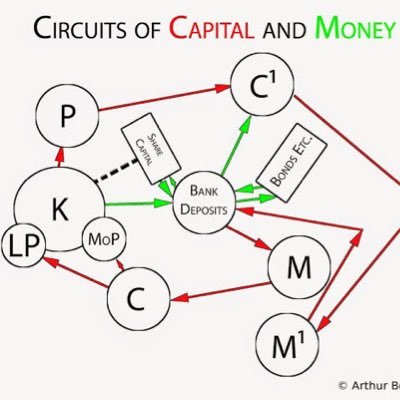

Discussion with Michael Howell, founder of the Cross Border Capital group x.com/i/broadcasts/1…

I’m not a huge fan of consumer confidence survey’s. They don’t help in forecasting. However, isn’t it interesting that after 4 years of massive deficits and money creation consumer confidence has never come back to 2019 levels. Keynesians keep telling me that government…

#DXY down? Our new venture into #forex AI-modelling using capital flow data. For info contact research@crossbordercapital.com

Our latest GLI Global Liquidity Indexes for end-July released today. A taster... World Central Banks still adding fuel

Climate alarmists tell us that heatwaves are becoming more and more common in the United States. 🇺🇸 But, that isn’t true. 🛑 ✋ A heatwave can be defined as a period of at least three consecutive days where the daily maximum temperature (Tmax) is at or above the 90th percentile…

Remember, 198 House Democrats voted against the SAVE Act which ensures that only American citizens can vote in American elections. Why? They are perfectly fine with non-citizens voting in our elections.

If Democrats Want Proof Non-Citizens Are Registering To Vote, Virginia Just Found 6,303 Examples thefederalist.com/2024/08/08/if-…

If #US economy really heading for #recession, why are #Treasury term premia breaking out higher? Surely they should be collapsing!

Should You Dare Criticize Kamala Harris... | Piers Morgan youtu.be/2-nUmJDgguY?si… via @YouTube

The last time hedge funds were this bearish commodities, prices surged. Particularly oil.

Hedge Funds Turn Bearish on Commodities - For the First Time Since 2016

United States Trends

- 1. #twug 2.588 posts

- 2. $ELONIA 1.189 posts

- 3. #RTXOn 2.528 posts

- 4. Johnie Cooks N/A

- 5. Mack Brown 4.664 posts

- 6. Happy Thanksgiving 24,8 B posts

- 7. #PumpRules 2.631 posts

- 8. #ai16z 2.389 posts

- 9. $KACY 16,9 B posts

- 10. $CUTO 7.338 posts

- 11. #GivingTuesday 2.866 posts

- 12. Billboard 568 B posts

- 13. Hezbollah 138 B posts

- 14. Lebanon 171 B posts

- 15. Tariffs 212 B posts

- 16. Dylan Sampson 1.029 posts

- 17. Avocados 8.454 posts

- 18. Jim Acosta 1.331 posts

- 19. Rivian 5.864 posts

- 20. Jim Abrahams 1.520 posts

Something went wrong.

Something went wrong.