Carlos Mata

@MataPetrolPetroleum Engineer and Systematic Futures Trader

Similar User

@WeAreSoEarly

@YvesTan1011

@live_clean_

@Co_Located

@BillJams

@talesofagypsy0

New Blog Post on the power of diversification! Check it out! Setting up a Portfolio of Futures Trading Strategies open.substack.com/pub/tradingstr…

New Article! Trading Commodity Futures Calendar Spreads open.substack.com/pub/tradingstr…

La principal razón por la que no invierto en Dubai es la volatilidad de los precios La segunda, por la misma cantidad de € puedo tener muchos más m2 en una capital europea

These are the kinds of market days where you learn whether you're prepared or not. - Are you comfortable with the risk you're taking? - If you have a system, do you have the urge to change some things? - Are you looking to other investing approaches to switch over to? - Did you…

I've done trading for 7 years now, and this is my core strategy. Demystifying Trend Following Trading. * Can retail traders afford it? * Different ways to structure strategies * Data considerations * Execution considerations open.substack.com/pub/tradingstr…

Hunting for profitable trading ideas? Me too!. Just got this great commodity trading idea from @pyquantnews in the @bettersystrader podcast, and decided to test it. Check out my new blog post where I take a stab at a "Crack Spread" concept. Looks good! open.substack.com/pub/tradingstr…

I started a blog! To keep a journal of trading strategy research, implementation and performance. Let's see where this goes!. Welcome to Trading Strategies open.substack.com/pub/tradingstr…

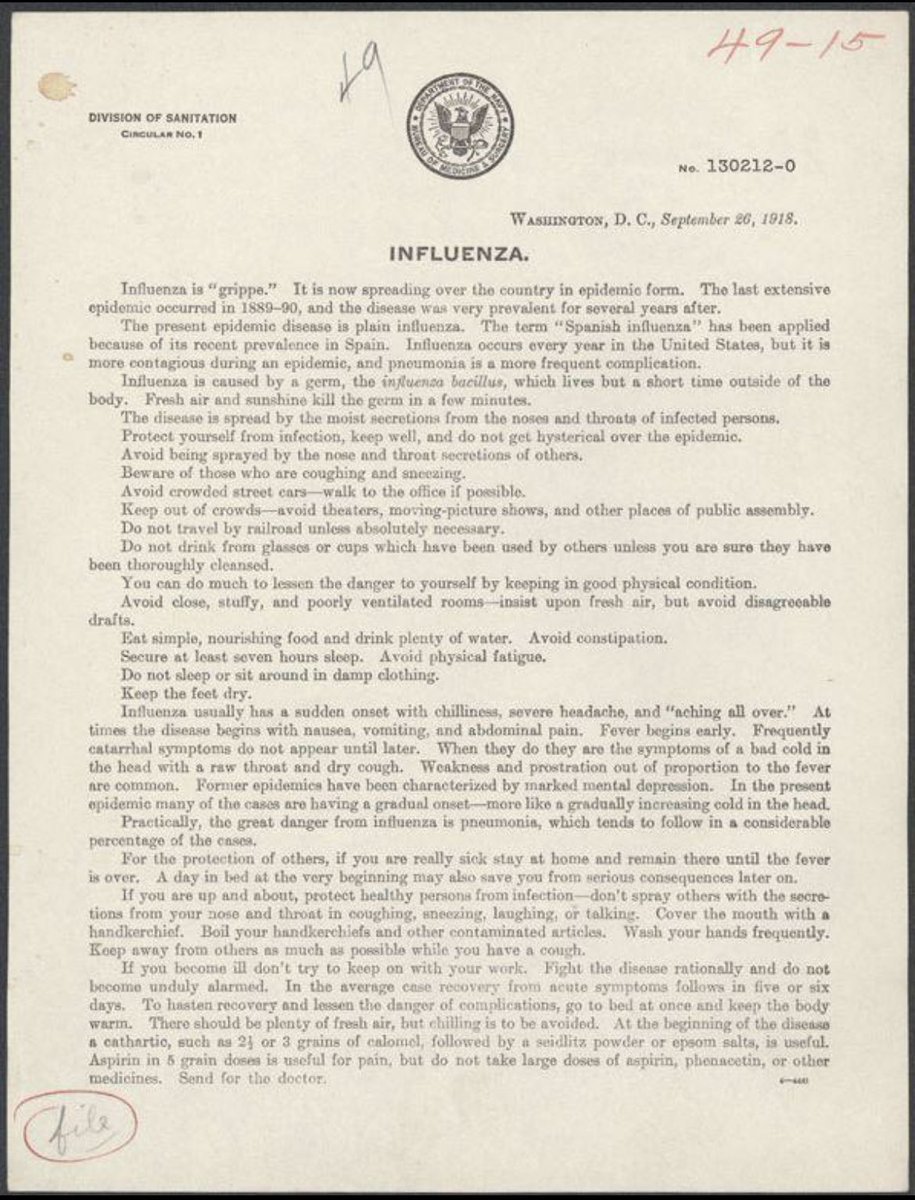

This one page document from the US government in 1918 on 'Spanish Flu' is more measured, more scientific, and more holistic than everything we have been fed for the past 2 years... Incredible.

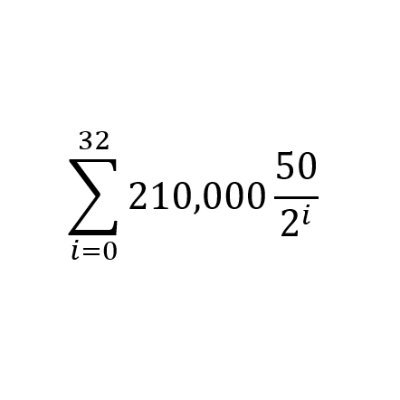

Broadly, there are 3 types of systematic trading strategy that can "work". In order of increasing turnover: 1. Risk premia harvesting 2. Economically-sensible, statistically-quantifiable slow-converging inefficiencies 3. Trading fast-converging supply/demand imbalances 👇👇👇

Traders often implicitly assume recent conditions will persist - without checking whether that's likely to be true. You need to understand the assumptions you are making, and whether they are reasonable. Here are some examples and a simple analytical approach 👇👇👇 1/n

United States Trends

- 1. #PaulTyson 30,1 B posts

- 2. Ramos 58,4 B posts

- 3. #NetflixFight 6.298 posts

- 4. #SmackDown 58,1 B posts

- 5. Jerry Jones 4.140 posts

- 6. Rosie Perez 4.782 posts

- 7. My Netflix 17,9 B posts

- 8. Cedric 9.827 posts

- 9. Goyat 21 B posts

- 10. #buffering N/A

- 11. #netfix 1.781 posts

- 12. Nunes 30,2 B posts

- 13. Holyfield 7.018 posts

- 14. Michael Irvin N/A

- 15. Naomi 24,2 B posts

- 16. Bronson 7.107 posts

- 17. Grok 49,5 B posts

- 18. Shinsuke 3.469 posts

- 19. Serrano 21,9 B posts

- 20. Seth 22,8 B posts

Something went wrong.

Something went wrong.