Junto

@JuntolawCounsel for the next generation of leaders as they fund, scale, and sell their business.

Similar User

@CoachRipp2115

@al_flo17

@WardChanning

@sohei1L

@Patriots_Point

@MomentumBullish

@LeveesOrg

@JBanks_27

@imrankhan

@GillVerd

@LucyStats

@Shaynislegend

@iamtusharsinha

@alexjahangir

@blarson424

We've partnered with our friends at @sydecario on a three-part series exploring the legal and non-legal aspects of starting and running a VC fund, including the legal structures and players, common and important terms, and regulatory hurdles. blog.juntolaw.com/part-i-structu… #juntolaw

In 2 years, CFIUS has issued 3x more penalties than in its previous 50 years. While absolute numbers & penalties are relatively low (3 in '23, 6 in '24), Biden stiffens CFIUS penalties from $250k to $5M/violation & expands CFIUS' subpoena power over National Security concerns.

It's a common misconception that IRAs can only be used to invest in stocks and mutual funds, but that’s not the full story. With a self-directed IRA (SDIRA), you can unlock private market opportunities—including SPVs. In this month’s Sydeletter, we’re breaking down: -How SDIRAs…

How are Companies Avoiding Down Rounds? 1️⃣ Debt 2️⃣ Bridge Rounds 3️⃣ Structure (>1x liq prefs, cumulative dividends, warrant coverage participation rights) 4️⃣ Cut & Burn (preserve cash w\ layoffs, wind-downs) Avoiding this means avoiding Anti-Dilution triggers—but are they bad?

The full range of valuation at seed-stage, Series A, and Series B. First up - seed. Medians clustered around $16M-$20M. Upper end around $50M

Series A valuations for US startups this year. Low end = ~$23M or so High end = ~$120M (but can be much higher) Median right around $55M All values post-money

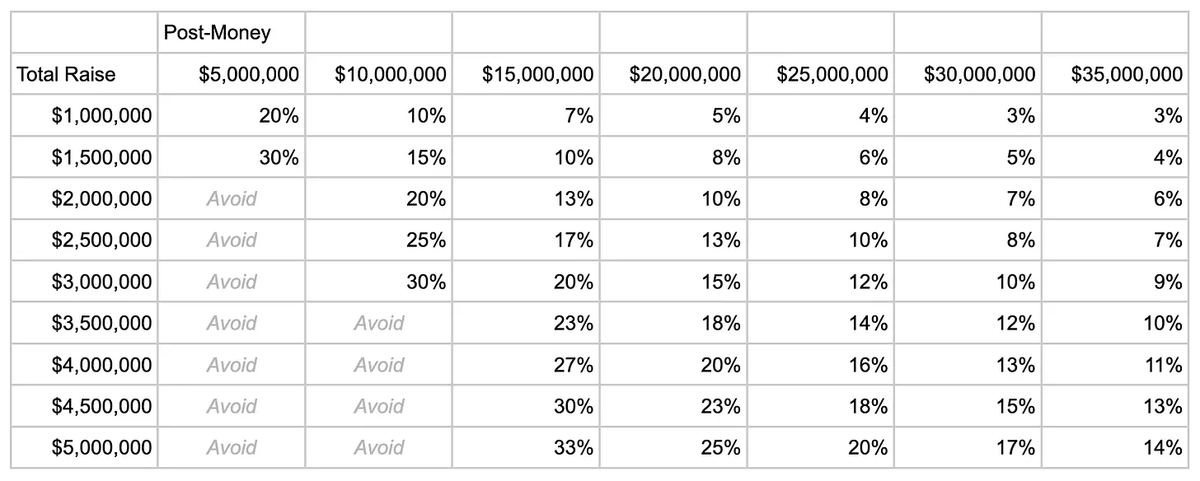

Startup fundraising benchmarks for Q3 2024. Data from US startups on Carta - post-money valuation - cash raised - dilution Split the SAFEs data into "pre-seed" of $500K-$2M and "seed on SAFE" of $2M-$5M round sizes. Others will have different opinions!

Narrative violation: ⬛ LPs are cash flow positive ($18.2B) for the first time since 2021. VC market has been down bad, but are we at an inflection point? • 𝟮𝟬𝟮𝟭: Positive cash flow📈 —Capital Contributions: ($133.2B) —Distributed: $140.6B —Net: +$𝟳.𝟰𝗕 • 𝟮𝟬𝟮𝟮:…

The dynamics of capital flow in venture are shifting—and 2024 is shaping up as a crucial year to either rebuild momentum or be constrained by the liquidity deficit left by the past two years. A recap...

The current state of granting equity to advisors at early-stage startups. Median pre-seed advisor receives 0.25% (fully diluted, full grant amount). Median seed: 0.12% Median Series A: 0.05% 1% to a startup advisor is a LOT - be careful with granting excessive equity

Raising a seed round 101 1. How much should you raise? A simple formula is to aim for a 24- to 36-month runway, building in a 25% buffer. Why 24 to 36 months? Generally, this is the right amount of time because it tends to be about how long it takes to hit product-market fit…

How far have startups incorporated in 2019 made it in the fundraising journey? Original set of 4,379: - 54% live - 42% closed - 4% acquired - 0.2% IPO (and none if you remove biotech) Most of the companies that are going concerns in the seed / Series A range

The fall fundraising season has officially kicked off. In my opinion, this is the best 10 weeks of the year for startups to raise capital. Investors are fresh from the summer and many are now behind on deployment pace. Founder friends, run at it hard and get the 💰💰💰

An interesting take on pay-to-plays in the context of the bonkers Bolt deal by @Juntolaw: Pay-to-play provisions in venture capital equity deals often require existing investors to participate in future funding rounds or risk losing their preferred stock. In Bolt's case, they…

In law school, I drove my wife crazy by applying what I was learning to our favorite shows. Did Michael commit a tort? I haven't changed much. So, I wrote about the state of the FTC's "ban on non-competes" in the context of an episode of Seinfeld. ventureawaits.substack.com/p/unenforceabl…

This. Bolt. Deal. is. Absolutely. Bonkers.⚡ 1. 💰 $450M+ Series F investment "offer" at $14B pre-money valuation • $200M+ from an unnamed Abu Dhabi-based fund • $250M from "The London Fund" in "marketing capital and dollar credits" • Valuation jumps from $11B to $14B (6…

I can't believe The Information headlined its story this morning saying “Bolt Near Deal to Raise $450 Million at $14 billion.” it's not clear that either number is real? this is the most bizarre deal i've ever seen. very hard to believe this company is being valued by anyone at…

New data for VC emerging managers. From a pool of 1,800+ funds, vintage years 2017-2022. Fresh benchmarks on IRR, TVPI, etc, alongside deployment pace, graduation rates, and much more. Link to the full report in the following post 🙏

(1/3) Qualified Small Business Stock (QSBS) is a designation under the U.S. tax code that offers significant tax advantages to investors in certain small businesses.

How SAFEs look right now in pre-seed / seed: - mostly post-money - mostly valuation cap only - lots of side letters flying around

The Q2 @cartainc report includes some interesting data on the venture landscape as we settle into Q3

Fanatics raises its offer to $225 million to acquire PointsBet's U.S. assets, outbidding DraftKings. PointsBet's board unanimously approves the proposal, and shareholders will vote on it. cnbc.com/2023/06/28/fan…

Databricks, the data storage and management startup, acquires generative AI platform MosaicML for $1.3 billion. The deal allows Databricks to expand its offerings and capitalize on the growing AI market. news.crunchbase.com/ai-robotics/ge…

United States Trends

- 1. #LasVegasGP 207 B posts

- 2. Auburn 34,7 B posts

- 3. Bama 36 B posts

- 4. Lakers 38,8 B posts

- 5. Max Verstappen 98,4 B posts

- 6. Lewis 96,9 B posts

- 7. UCLA 10,4 B posts

- 8. Sainz 34,6 B posts

- 9. Chuck Woolery 4.215 posts

- 10. Nuggets 30,3 B posts

- 11. Oklahoma 50,2 B posts

- 12. LAFC 3.452 posts

- 13. Lando 29,3 B posts

- 14. Jokic 20,3 B posts

- 15. #AEWFullGear 83,4 B posts

- 16. Milroe 17 B posts

- 17. Ferrari 52,9 B posts

- 18. Texas 148 B posts

- 19. George Russell 24,6 B posts

- 20. Sounders 1.466 posts

Who to follow

-

Chris Rippon

Chris Rippon

@CoachRipp2115 -

Alv

Alv

@al_flo17 -

Channing Ward

Channing Ward

@WardChanning -

Soheil

Soheil

@sohei1L -

Patriots Point

Patriots Point

@Patriots_Point -

𝔹𝕦𝕝𝕝𝕚𝕤𝕙𝕄𝕠𝕞𝕖𝕟𝕥𝕦𝕞.𝕊𝕦𝕚💧📈

𝔹𝕦𝕝𝕝𝕚𝕤𝕙𝕄𝕠𝕞𝕖𝕟𝕥𝕦𝕞.𝕊𝕦𝕚💧📈

@MomentumBullish -

Sandy Rosenthal

Sandy Rosenthal

@LeveesOrg -

Johnthan Banks

Johnthan Banks

@JBanks_27 -

Imran Khan

Imran Khan

@imrankhan -

Gill Verdon

Gill Verdon

@GillVerd -

Lucy D’Agostino McGowan

Lucy D’Agostino McGowan

@LucyStats -

Shayn

Shayn

@Shaynislegend -

Tushar

Tushar

@iamtusharsinha -

Alex Jahangir

Alex Jahangir

@alexjahangir -

Ben Larson, Ph.D.

Ben Larson, Ph.D.

@blarson424

Something went wrong.

Something went wrong.