JCIChina

@JCIChinaJCI provides market information and trade consultation to various organizations regarding China’s agricultural commodities.

Similar User

@IGCgrains

@EduardoVanin4

@StoneX_Official

@SPGCIAg

@FastmarketsAG

@AgResource

@agturbobrazil

@hedgeit

@siqueiradaniele

@GRAINSOILSEEDS

@APKInform

@tx_marcelo

@CropProphet

@sovecon

@SergeyFeofilov

China meat imports nearly 5.5 MMT in the first nine months of 2024, year-on-year decline narrowed further

China Whey Powder Weekly: Price Continues to Rise upon concerns of trade war

Non-Chinese buyers share of US soybean purchases rises, short Brazilian supply adds fuel to the fire jcichina.com/article/a93646…

Year-on-year growth in China beef imports narrows this year as the spread between imported and domestic prices contracts

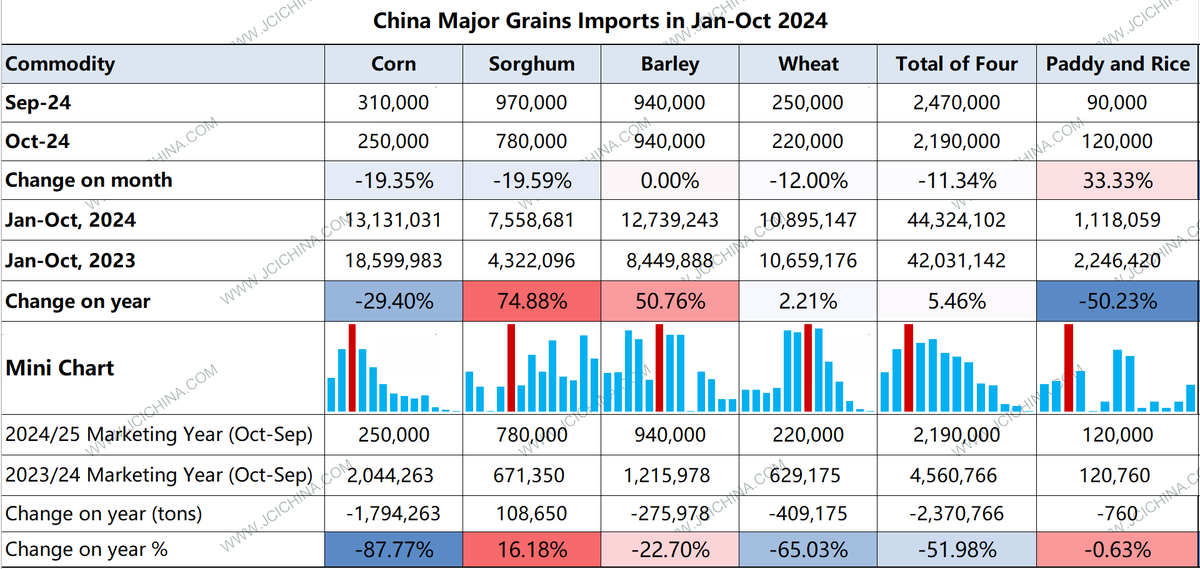

China’s imports of major grains continued to cool down in October 2024

China’s industrial feed production further decreased 2.7% on month and decreased 5.4% on year to 27.42 million MT in October 2024.

If you go with the odds, the averages, NOAA is wrong. NOAA has La Nina's strength twice as strong as most of the rest; very aggressive for how the ocean temperatures stack up. Max strength in January, then fading.

🇺🇸🇨🇳A Trump victory may stoke fears of another U.S.-China trade war involving #soybeans, but is that already happening? U.S. soy sales to #China for export in 2024/25 are at 16-year, non-trade-war lows. China accounts for just 44% of total sales, an 18-year, non-trade war low.

The hard truth is Brazil's production continues to rise while China's demand for global soy has leveled. It's quite possible by 2026 Brazil will be able to supply soybeans to China year-round.

In fact, more than 75% of all Utah cropland is growing alfalfa and hay to feed cattle. Two and a half hours of water usage in one single field of alfalfa is the same amount of water used by a family of four...for a year.

Record planting pace, some 20M acres last week. They nearly caught up to average! The 7 day keeps it dry in S Brazil where it was so wet early. The extended brings on a torrid amount of rain for nearly all crop regions in Brazil. The months forecast gets it too dry N and S.

No Bull's 5⃣ Spot on @Barchart Low water continues to plague the inland waterways system. Draft & tow restrictions tie up more barges for longer, slowing the flow of #corn & #soybeans to Gulf exporters & hurting US competitiveness in world markets barchart.com/story/news/291…

Tomorrow marks one year since the Red Sea crisis started as Iran-backed Houthis began strikes on Israel. Scores of ships in the Red Sea, Gulf of Aden, Arabian Sea, & Indian Ocean have been attacked since, rerouting hundreds of vessels around South Africa, avoiding the Suez Canal

US SAF production is taking off, literally✈️ Sep domestic renewable jet fuel RIN generation was a record 9.2Mgal, more than 2X Aug's 4Mgal record & up 353% YoY In the first 9 months of 2024, the US has cranked out more renewable jet fuel than in the 4 previous years COMBINED

La Nina growing. Then what to expect if we get "normal" this winter.

🇧🇷Mato Grosso, #Brazil's top state for #soybeans & #corn, can normally expect 1.5-2 inches of rain in Sept, but the forecast is bone dry thru mid-month, likely pushing back soybean planting. Last season (blue line) was among the state's driest ever. Soy yields fell to 8yr lows.

For #soybeans, sales over the last 8 weeks were actually a hair better than average (when considered against expectations), but overall coverage is low at just 23.5% of USDA's forecast. Aside from the trade war/ASF year (19/20), that % is an 18-year low. Could use a pickup.

🌽As of Aug. 29, new-crop U.S. #corn export sales covered 19.2% of USDA's export forecast for 2024/25. That figure can't compete with 2020/21 or 2021/22 because #China is no longer buying U.S. corn like it had been, but new-crop sales over the last 8 weeks were above average.

This is an interesting (and very direct) snippet off Purdue's agronomy page about corn in the dent (R5) stage, which lasts about a month. Yield can still be impacted in this stage and it's why I have been talking about the warm/dry finish for some of the #CropWatch24 fields.

United States Trends

- 1. Jaguar 26,7 B posts

- 2. Joe Douglas 3.301 posts

- 3. $CUTO 8.187 posts

- 4. Russia 907 B posts

- 5. Maxey 4.481 posts

- 6. Ukraine 977 B posts

- 7. #tsthecardigancollection 2.107 posts

- 8. SPLC 14,8 B posts

- 9. Aaron Rodgers 3.533 posts

- 10. Embiid 12,1 B posts

- 11. WWIII 163 B posts

- 12. Sony 67,6 B posts

- 13. #OnlyKash 3.641 posts

- 14. Nancy Mace 37,4 B posts

- 15. Woody Johnson N/A

- 16. Hacker 21,1 B posts

- 17. #InternationalMensDay 78,1 B posts

- 18. Sarah McBride 38,2 B posts

- 19. #tuesdayvibe 6.929 posts

- 20. DeFi 147 B posts

Who to follow

-

International Grains Council

International Grains Council

@IGCgrains -

Eduardo Vanin

Eduardo Vanin

@EduardoVanin4 -

StoneX Group Inc.

StoneX Group Inc.

@StoneX_Official -

Commodity Insights Agriculture

Commodity Insights Agriculture

@SPGCIAg -

Fastmarkets Agriculture

Fastmarkets Agriculture

@FastmarketsAG -

AgResource Company

AgResource Company

@AgResource -

kory melby

kory melby

@agturbobrazil -

CHS Hedging

CHS Hedging

@hedgeit -

Daniele Siqueira

Daniele Siqueira

@siqueiradaniele -

GRAINS & SOYBEANS

GRAINS & SOYBEANS

@GRAINSOILSEEDS -

APK-Inform

APK-Inform

@APKInform -

Marcelo Teixeira

Marcelo Teixeira

@tx_marcelo -

CropProphet

CropProphet

@CropProphet -

SovEcon

SovEcon

@sovecon -

Sergey Feofilov

Sergey Feofilov

@SergeyFeofilov

Something went wrong.

Something went wrong.