Cam Marzi

@Ivested__In_YouFinancial Planner/Owner of Rogue Advisors • I help agency owners & high earners maximize their wealth and financial clarity💸 Tweets ≠ advice

Relevant financial education is nonexistent in schools. Graduates don’t know how to: - Budget - Buy a house - Start a business - Use credit wisely - Invest in the market Can you believe they prioritized calculus over basic finance?

Business owners: Don’t buy things JUST for the write off A $100 write off doesn’t save you $100 on taxes It saves you $100 * your marginal tax rate Even if you’re in the 37% tax bracket, $100 purchase saves you $37. Meaning you just spent $63!

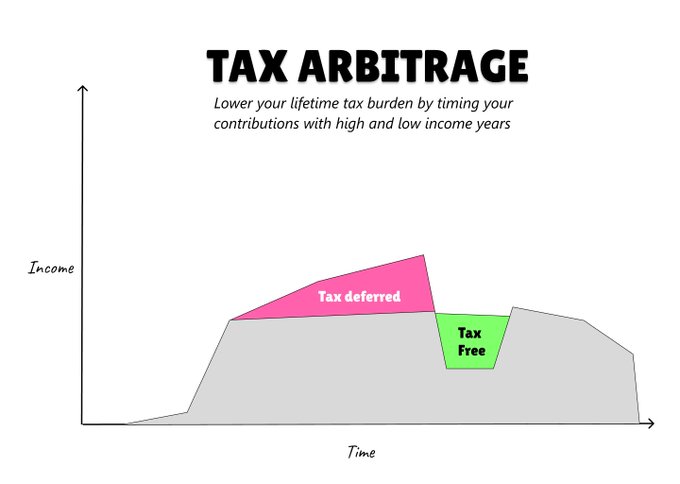

This year my client is making mid 6 figures and paying taxes at a 37% marginal tax rate. Next year he will live off of cash and pay near $0 in taxes. This is the strategy we’re using to take advantage of his change in income: 🧵Bookmark this for later to save on taxes🧵

Be careful when projecting Roth conversions over long time periods Because factors like tax rates and income can change a lot over time As always, none of this is tax or investment advice. Always consult a pro.

Thanks for reading! If you enjoyed this thread make sure to: 1. Follow me for more educational content 2. Share the first tweet with your audience or someone who needs to see it!

Shameless self congratulatory post: Last quarter’s revenue was a record for the business! After Q3 we are up $36k vs this time last year. Crazy how far things have come..

I'll never argue against the constant crowd calling for a market meltdown Doomsayers can be right I'd rather be wealthy

Account selection is just as important as the investments themselves. Here’s what I mean: 1. $100 in my 401k ≠ $100 in my Roth One gets taxed at distribution The other is tax free. When I pull $100 out of my 401k I might end up with $70 in my bank after taxes 2. Loss in my…

Everyone should have a financial partner Doesn’t have to be a paid professional It can be your spouse or a friend even But the value of someone who keeps you honest, engaged, and on track with your finances is immense

The clients I just met with are an interesting case study A couple in their 60s with a 8 figure net worth. They have 7 figures invested with us. They don’t foresee needing the money, it’s going to be left (mainly) for the kids and they gift money every year to them The…

When I time block I’m so much more productive - Make a to do list - Determine priorities - Set a timer for each task This allows me to get 8 hours of work done in 5-6 hours.

The most important day of your life: The one where you don’t need to work for money anymore. Retirement, or as I like to call it - Work optionality, is a time everyone needs to be prepared for Here’s 10 things you need to know to succeed🧵

Start by creating a detailed description of your perfect day and think of some of the things you’ve always wanted to achieve

Thanks for reading! If you enjoyed this thread make sure to: 1. Follow me for more educational content 2. Share the first tweet with someone who needs to see it!

A 80/20 allocation doesn’t mean 80% stocks and 20% bonds in all of your accounts. Tax exempt bonds = Taxable account Stocks, crypto = Roth accounts Taxable bonds, dividend stocks = Deferred accounts Optimized tax LOCATION = Optimized returns

I've come to the conclusion that I'd much rather have stress from being too busy than have stress because I have nothing to do. Nothing else makes sense to me.

Most people think budgeting = restrictive In reality, budgeting = freedom IYKYK

Wow - surprised how many people have had bad experiences with used cars I’ve had all good experiences except 1. Maybe I’ve been lucky..

Is there any situation where buying a new car off the lot makes sense? I can't think of one..

Is there any situation where buying a new car off the lot makes sense? I can't think of one..

Procrastination and finances go hand in hand. - Waiting to pay down debt - Waiting to start investing - Waiting to diversify correctly - Waiting to protect your money In personal finance, being proactive is crucial Getting started is step number one

United States Trends

- 1. Tyson 431 B posts

- 2. $MAYO 11,7 B posts

- 3. Pence 50,3 B posts

- 4. Kash 85,3 B posts

- 5. Debbie 25,9 B posts

- 6. Dora 23,5 B posts

- 7. Mike Rogers 15 B posts

- 8. Whoopi 78,7 B posts

- 9. #LetsBONK 10,4 B posts

- 10. Gabrielle Union 1.525 posts

- 11. Iron Mike 18,2 B posts

- 12. Laken Riley 52,6 B posts

- 13. The FBI 241 B posts

- 14. Ticketmaster 17,7 B posts

- 15. #FursuitFriday 16,4 B posts

- 16. National Energy Council 3.727 posts

- 17. Pirates 20,6 B posts

- 18. Fauci 178 B posts

- 19. Cenk 12,7 B posts

- 20. B-Fab N/A

Something went wrong.

Something went wrong.