Similar User

@yanaioron

@AshkenaziRenana

@Slovoman

@omrig9

@eidomink

@meluban

@MatanBros

🚀 Thrilled to release the 2024 @Accel Euroscape: AI Eating Software and unveil the Top 💯 AI & Cloud companies from 🇪🇺& 🇮🇱 linkedin.com/pulse/2024-acc… @LucyWimmer @RafaelFQL @TDRawlinson #accelfamily

How many times did we get an offer to split the land with the Jews? 1. Peel Commission (1937): This was the first major proposal for partition by the British, recommending a division of Palestine into separate Jewish and Arab states. The plan proposed a small Jewish state in>

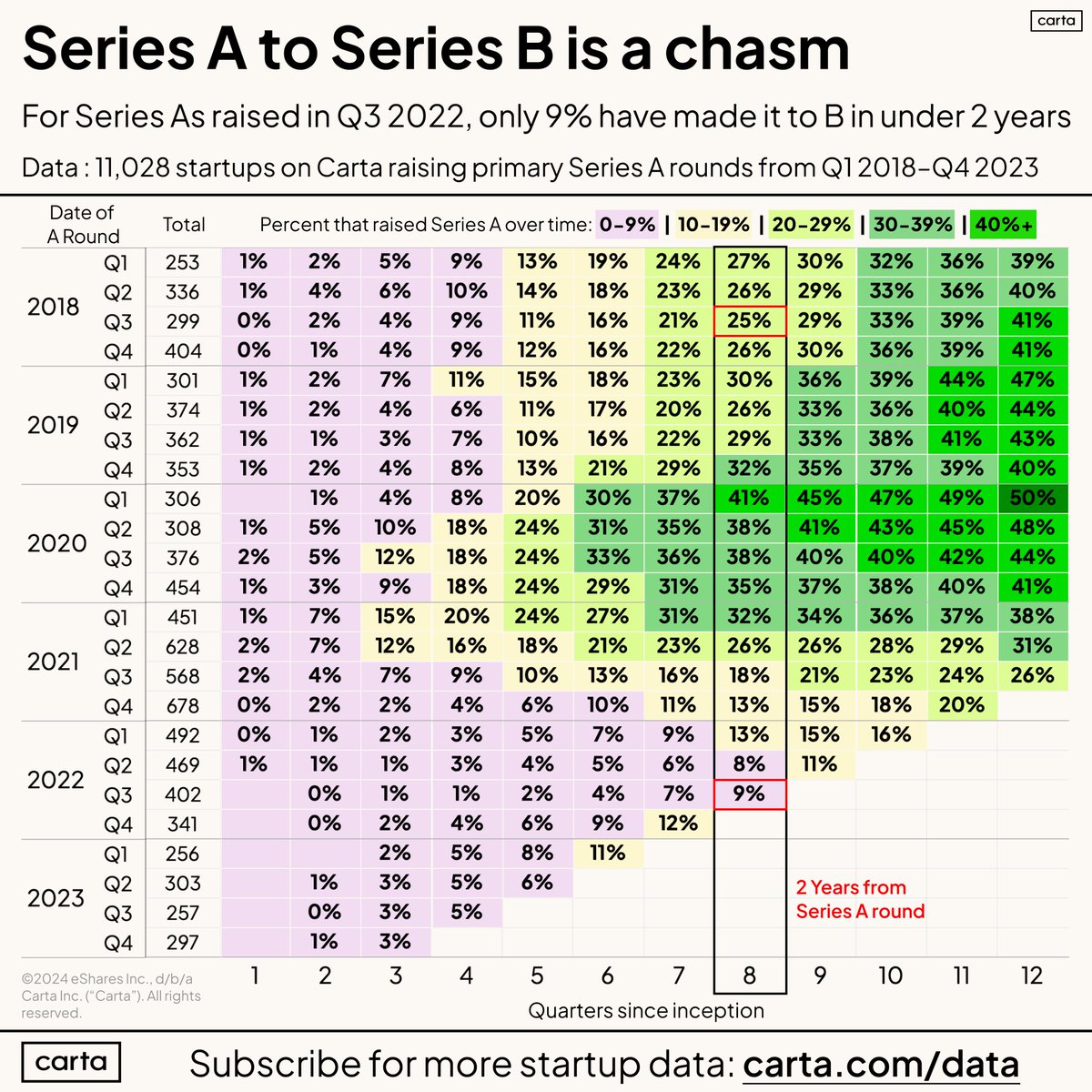

Getting from Series A to B is actually harder (in percentage terms) than from Seed to A. Used to be about 25% did so in under 2 years, latest cohort with data is at 9%.

Budget cuts followed interest rate hikes in 2022. By late 2023, more than a year of financial scrutiny had challenged many publicly traded software companies. However, 2024 has been a tough year again. Net dollar retention for publicly traded software companies fell from 113%…

Family Office Asset Allocation • Public equities increased from 22% to 28% in 2024.- Fixed income rose from 16% to 18% • The rise in public equities was due to cash deployment and continued market recovery from 2022 lows • Private equity decreased from 22% to 17%, likely due…

1. Has DPI Died in 2024 Our fund III (2018 vintage) still has no DPI. Even our smaller hits in Fund I and II have given DPI. It was a perfect storm of ZIRP & day trading during COVID. Love to hear your thoughts on this @jasonlk @beezer232 @semil

Heard from VC LPs this week: For our AGM, we asked @StepStoneVC (best VC data) to analyze return distribution in VC. @fredwilson @pmarca have discussed; this is 25+ yrs of data. TLDR: Even Top 5% underperform underwriting on ~3/4 of deals. Great = $$ in big winners #powerlaw

כשסיימתי תואר ראשון בביולוגיה חישובית לפני המון שנים הרבה אנשים כיוונו אותי לתחום הגנומיקה החישובית, חקר חישובי של חומצות גרעין (דנ"א, רנ"א), שהיה בשיאו עם מהפיכת ריצוף הדנ"א. התחום של חקר חלבונים באופן חישובי (פרוטאומיקה) היה תקוע שנים די רבות. לא היו אלגוריתמים מספיק טובים,

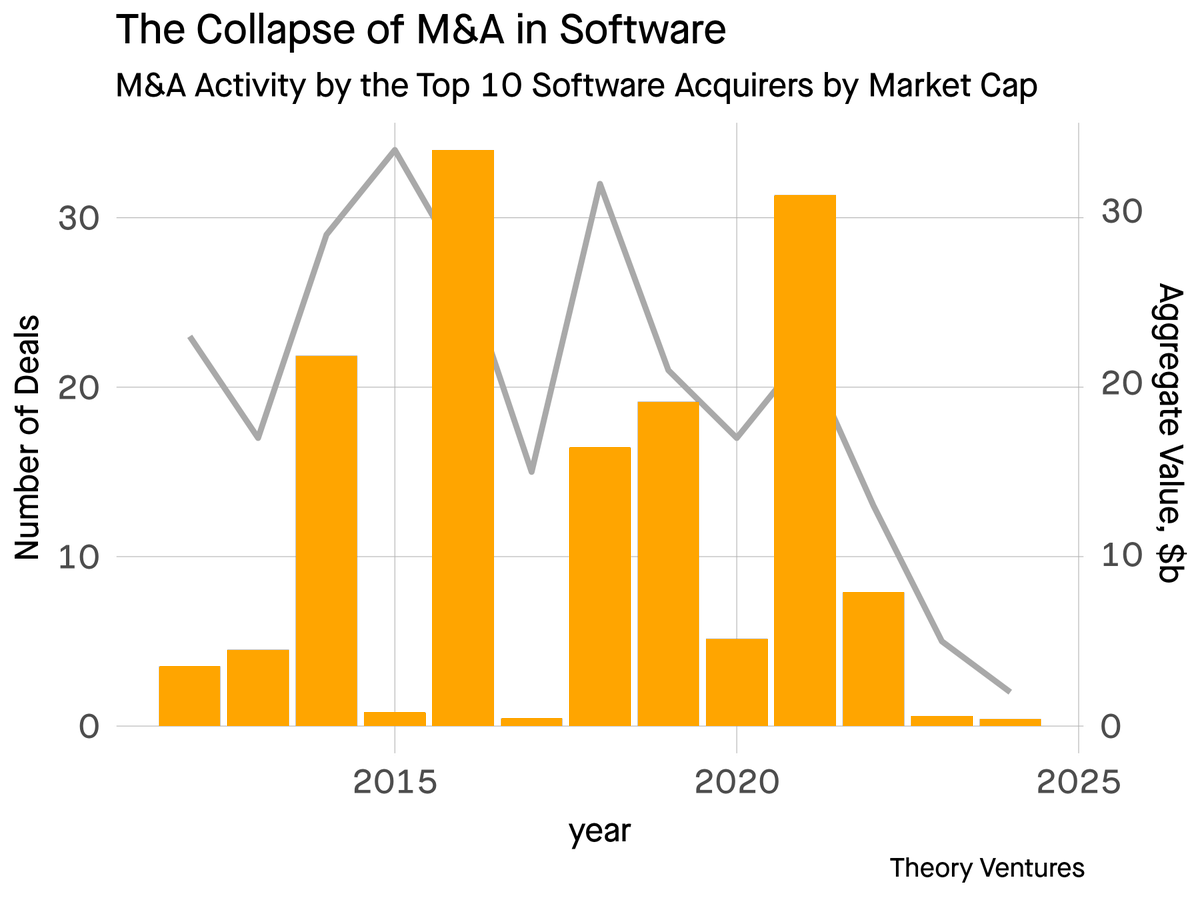

Recently, Thomas Laffont of Coatue highlighted a non-obvious impact of the M&A slowdown after this preamble : “Ironically and I think somewhat perversely one of the byproducts of constraining big companies from buying small companies is it hurts small companies. This point is…

With shifting market dynamics, many LPs are in a bind, waiting for capital returns that may never materialize. Great insights from my colleague @natewcl in @secondariespei on the value of secondaries and how they unlock critical flexibility for startups, GPs, and LPs—plus…

🧵The secondary market saw $112B in deal volume in 2023. With liquidity hard to come by, secondaries are a vital tool, providing cash flow without signaling distress. @SapphirePrtnrs’ @natewcl shares 4 key questions to consider before diving into the market in a recent…

המלצת צפייה לשבת, רגע לפני שמכונת הרעל תחזור בכל הכח בניסיון להשכיח את האחריות של הקואליציה למצב - סדרת הרשת "סיכון מחושב", על התהליכים שהובילו אותנו לאן שהגענו. הנה קישור לפלייליסט של כל הפרקים ביחד ותזכורת על מה שהיה רגע לפני שהליכוד הפך לסניף של הימין הקיצוני.…

When I was growing up in the 1960’s and 70’s a statement like this was inconceivable, and a vast majority of Israelis would have celebrated it. And now, here it is (and has been for years). Are there risks? Of course. But that’s what leaders are for.

7 Things LPs Should Know Before Investing in VC Funds: - The definition of venture capital (VC) has evolved from being artisanal, early-stage financing to a broad spectrum ranging from inception to pre-IPO. Essentially, VC now represents minority investing in private technology…

KKR just published a 64 page Alternative Investments report a few days ago Some of the most interesting charts 🧵 1/ High Net Worth Individual allocation to alternatives investments (private equity, private credit, infrastructure, real estate)

The ongoing debate on small vs large funds is totally missing the point. LPs need to optimise on the best managers, not focus on fund size. Some data on why this is the case. /1

Hey all EMs! new program @Yale is committing $50m to 5 emerging managers alongside an 8 week intensive program. Apps due by Oct 14 investments.yale.edu/prospect/ #openlp

3/ @Yale has now announced their Prospect Fellowship -- an eight-week intensive program that seeks to partner with five forward thinking investment management entrepreneurs. Want to learn from the best? Apply below. Want a minimum LP commitment of $25 million at…

🧵1/ We've seen a ton of spirited discussion around @cartainc's recent VC fund performance report. We compared @SapphirePrtnrs early DPI analysis against Carta's corresponding cohorts & wanted to share lessons learned. TLDR: As LPs - we don’t think cause for any 🚨s. Here's…

“There are almost no IPOs. There were more IPO’s during the depths of the financial crises and the aftermath of the Internet bubble than there were over the last few years.” Thomas Laffont, Coatue

TRUE !! Especially in the past 9 years - VCs started to “buy logos” (invest at $5bn valuation and then add to one’s resume. Invest via SPV but no board access) - VCs got fake markups in 2021/22 when 1,200 new “unicorns” created (1k won’t exit > $1bn) so TVPI won’t become DPI -…

This is so true! It takes a much longer time in VC to return capital and many VCs never even achieve a 1x on their own portfolios. So reputations in VC aren’t always correlated with actual job performance until you look over 10-15 years

yes yes yes...so well said as as always @fintechjunkie "For Emerging Managers,...LPs are not looking for generalists with decent short-term markups and interesting logos. They're seeking specialized expertise, unique angles, and differentiated strategies that can generate alpha…

The Evolving Landscape of Venture Capital: Are Emerging Managers DOA? There’s been a lot of debate lately around whether the VC ecosystem is being negatively impacted by the largest firms hoovering up LP money at the expense of Emerging Managers. The observation is real and it’s…

United States Trends

- 1. #PaulTyson 126 B posts

- 2. #SmackDown 37 B posts

- 3. Goyat 17,1 B posts

- 4. Rosie Perez 2.562 posts

- 5. Barrios 23 B posts

- 6. Evander Holyfield 2.353 posts

- 7. #NetflixBoxing N/A

- 8. #netfilx 1.189 posts

- 9. Shinsuke 2.996 posts

- 10. #NetflixFight 1.013 posts

- 11. Bronson Reed 2.767 posts

- 12. Cedric 6.332 posts

- 13. Purdue 6.370 posts

- 14. Lennox Lewis 1.166 posts

- 15. Ramos 43,3 B posts

- 16. Bayley 5.438 posts

- 17. Cam Thomas 2.616 posts

- 18. My Netflix 9.868 posts

- 19. LA Knight 4.601 posts

- 20. Grok 48,1 B posts

Something went wrong.

Something went wrong.