GLMoney

@Greenlifemoney#contributing towards #Financial_Literacy in India. ~not Sebi registered. Education purposes. #Equity #Mutualfunds #Alternative #investments.

Similar User

@btctbtctb

@HenryJerom79282

@Marteau98597585

@RonaldArinaitwe

@satoshi132009

@xzixzexzo

Once upon a time #Chowkidars of public money. # Legends

Market Makers on ET NOW | Sunil Singhania of Abakkus Asset Manager and Prashant Jain of 3P Investment Managers express their opinions on emerging themes and the India story; WATCH @SunilBSinghania #StockMarket

In most of the cases where we screw up, it is the human factor. Yet, strangely, we underplay it almost always. Because our ego probably won’t let us admit that we can be our worst enemy. #MoneyTalkWithL

So many learning in one column...

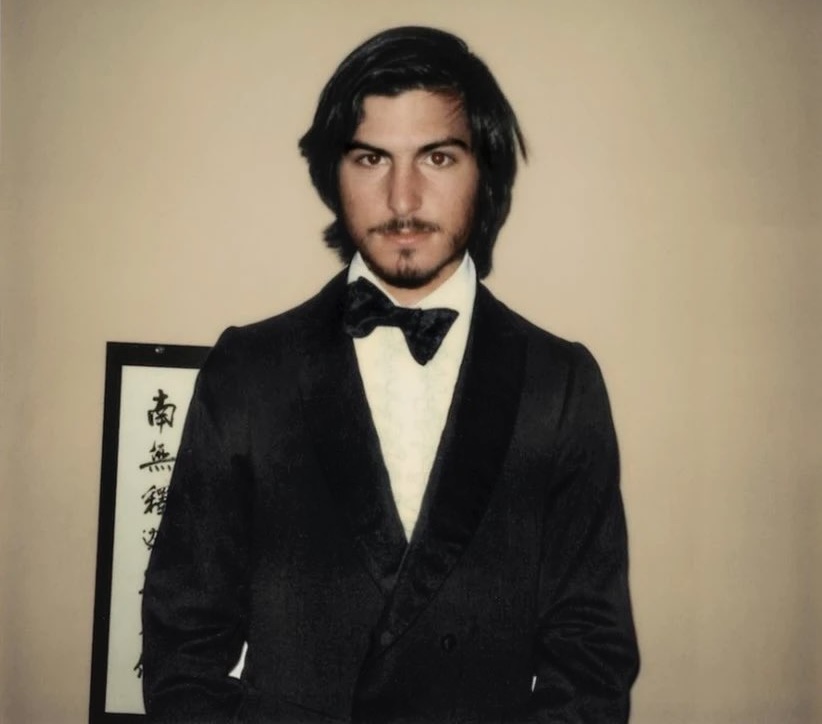

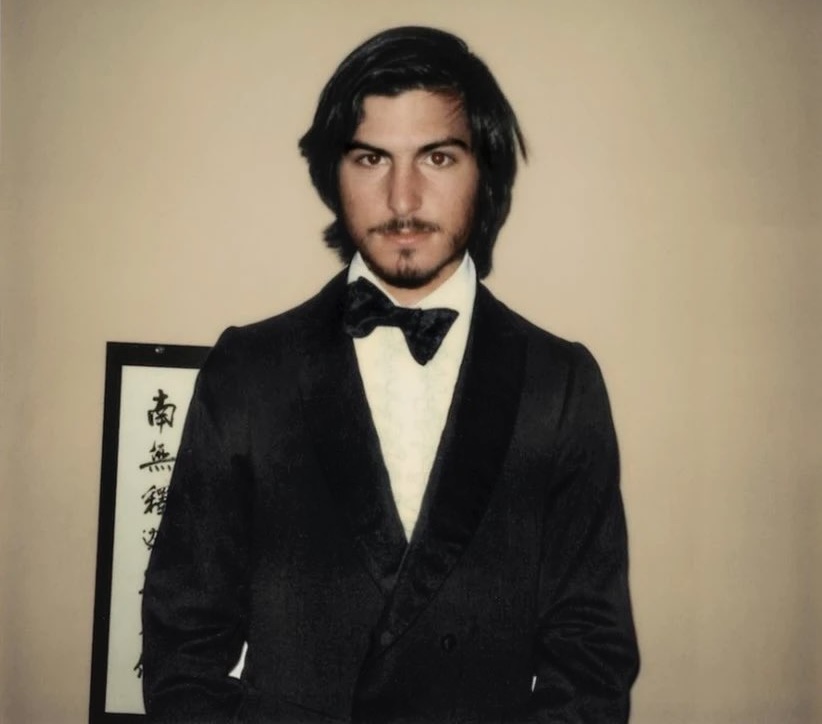

Lessons Steve Jobs wanted to pass on. Written right before he died. In his own words: 1. ON BUILDING A REAL COMPANY: I hate it when people call themselves “entrepreneurs” when what they’re really trying to do is launch a startup and then sell or go public, so they can cash…

Lessons Steve Jobs wanted to pass on. Written right before he died. In his own words: 1. ON BUILDING A REAL COMPANY: I hate it when people call themselves “entrepreneurs” when what they’re really trying to do is launch a startup and then sell or go public, so they can cash…

Subramanian is one interesting man, his interests and courage had no boundaries

AXIS BANK: BJP LEADER SUBRAMANIAN SWAMY ALLEGES RUPEES 5100CR SCAM INVOLVING BANK AND MAX LIFE INSURANCE SHARES; DELHI HC ADJOURNS CASE TO MARCH.13, 2024

I believe that there are five big, interrelated influences that are driving the changing world order and that they tend to evolve in big cycles. They are: 1. How well the debt/money/economic system works, 2. How well the internal order (system) works within countries to…

No doubt Largecaps like TCS, HDFC Bank, ITC etc won't be 100 bagger from the current prices but they also won't fall 60-70% when the market falls. Betting solely on smallcaps and microcaps in anticipation of 100 bagger returns can lead to sleepless nights during market collapse.

While #HDFCBank reported profits look better than expectations The Net Interest Income is much below expectations Profits are higher due to tax writeback of Rs 1500 Crores Otherwise results below expectations

This is why retail investors make loss in the market. Game of warewolf 👍👍

4.1% working age translates to 45.2% WPR where 48.5% LFPR close to 27 mn. Where I am missing Even IT says around 7 cr people filled Income tax and above 8LPA less than 30mn. So the number 60mn, how. @iRadhikaGupta @devinamehra @Moneylifers @NileshShah68 @ActusDei #GoldmanSachs

लोहड़ी, मकर संक्रान्ति, पोंगल, माघ बिहू और उत्तरायण के अवसर पर सभी देशवासियों को मेरी हार्दिक शुभकामनाएं। कृषि से जुड़े ये सभी पर्व प्रकृति का सम्मान करने की हमारी परम्पराओं का जीवंत रूप हैं। मेरी कामना है कि ये त्योहार देशवासियों में प्रेम और सद्भाव का संचार करते रहें। मैं…

CPI rose to a four-month high of 5.69% in Dec from 5.55% in Nov, was 5.72% in Dec22. IIP growth declined to 2.4% in November from 11.7% in Oct In Aug'23, inflation touched a high of 6.83%. IIP growth down by the manufacturing sector -> mere 1.2 % vs 10.2% in Oct. #India #Life

If investing could be learnt through "Paid Investing Seminars" Everyone would be an expert investor in 15 days Well it requires 15 years if not more to make mistakes and learn. Over time mistakes reduce but are never eliminated.

What is the income growth rate of our bottom 70%, 40%, 20% population. Any time frame. @iRadhikaGupta @connectgurmeet @firstglobalsec @LarissaFernand

So I invest 2/3rd in funds with strong valuation guard rails & 1/3rd where growth is first criteria / valuation is 2nd Is this the best way of investing - I don’t know In some decades it will look good - in some it won’t As long as it earns >index & inflation - I m fine

2024 is a year to cut risks, invest cautiously, protect downside as valuations are high Like 2023 was a year to take risks and try for higher returns as valuations were in favor

The three ministers in the Maldives posted derogatory comments against India, Indians and Modi, but Indian media outlets are only referring to their remarks against Modi, as if comparing India with cow dung or insulting Indian tourists and Indians generally is not newsworthy!

It's easy to sell a SIP in a small cap today. It will be difficult to stop the redemption of this SIP when small caps correct. For new investors start SIP in Balanced, BAF, Multi Asset and flexi cap fund. #Sales #SIP #Behaviour

1. Longevity of returns, staying in the game and survival are far more important than heroic returns achieved in any given few years.

🙏🙏 The four most dangerous words in investing are, it’s different this time. Sir John Templeton

United States Trends

- 1. DeSantis 36 B posts

- 2. Pete 312 B posts

- 3. Jokic 12,8 B posts

- 4. Kerr 7.414 posts

- 5. Mavs 12,7 B posts

- 6. Podz 3.462 posts

- 7. Clemson 25,3 B posts

- 8. Wiggins 2.820 posts

- 9. XDefiant 18,9 B posts

- 10. Nuggets 17,2 B posts

- 11. Brea 2.720 posts

- 12. Jamal Murray 1.555 posts

- 13. Kentucky 19,3 B posts

- 14. #SpotifyWrapped2024 6.931 posts

- 15. azealia 4.508 posts

- 16. Kuminga 2.384 posts

- 17. Marcus Smart 2.720 posts

- 18. NBA Cup 15,6 B posts

- 19. #MFFL 4.209 posts

- 20. SecDef 9.058 posts

Something went wrong.

Something went wrong.