{̵͉̦̜͊ ̴̖̜̯̅Δ̵̭͙͚͘̕👺 ̶̮͍̃ ̶̟̩̠̒͗}̵̡̝͋͆͝

@DeHausDemonStructured Lego Research @ LP GoblinTown // Steady Slurping low LERs in ISLLPs & CLAMMs // Primitive Design @miragegalleryai outside Yield Pimping hours

Similar User

@artikokus

@zephyr_org

@Radpiexyz_io

@0xWenMoon

@PendleIntern

@563defi

@DeFi_Made_Here

@conksresearch

@CL207

@EvgenyGaevoy

@0xngmi

@0xCrypto_doctor

@DeFiMann

@0xAtomist

@Defi_Maestro

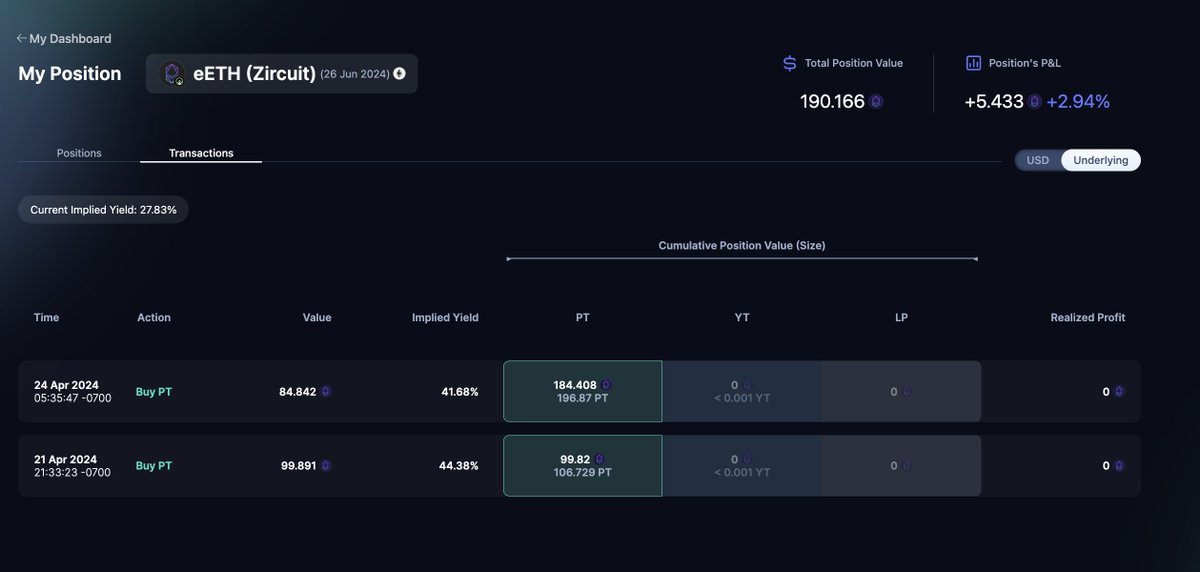

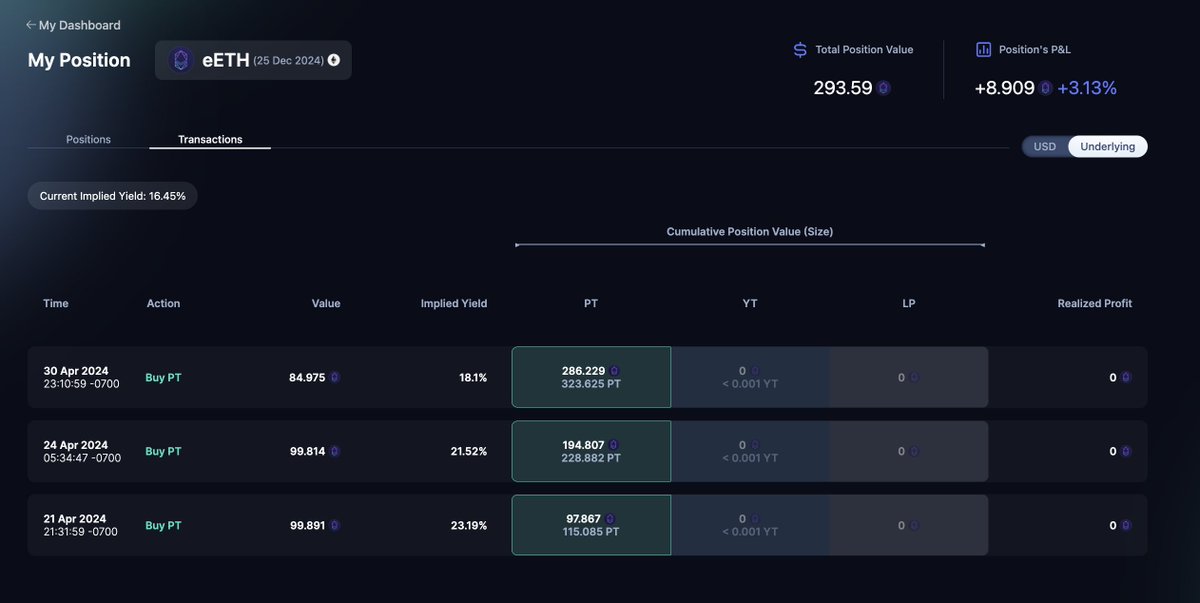

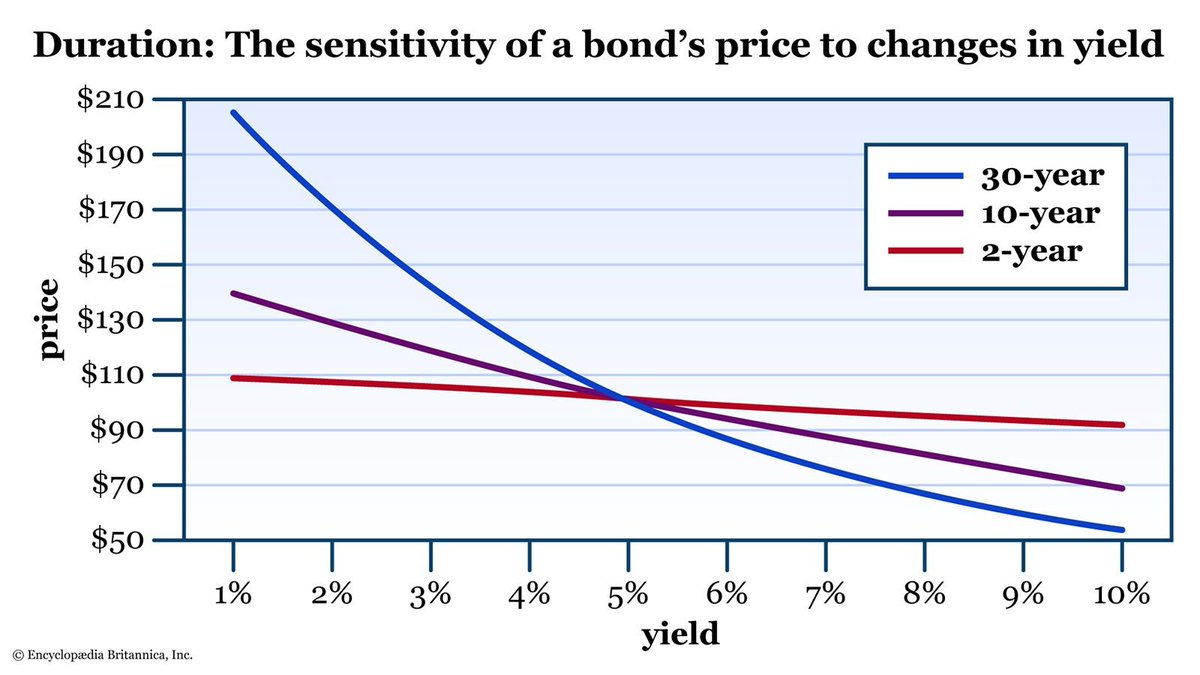

The convexity on longer-dated zero-coupon bonds is a truly beautiful thing when even the long-end of the curve matures in less than a year @pendle_fi As long as one can hold to maturity and has no liquidity requirements, the optionality on upside leverage is quite spectacular…

just came back on here to tell you guys that 20% fixed on 138 day term maturities are back in size sure there's 25% on 44 day maturities, or you could LP for 30%+ but the gamma on those longer dated ones could be beautiful depending on how long it takes the redacted masses to…

The funniest things about this whole FBI thing are that A. The way in which they did this clearly demonstrates that the agencies perspective on cryptocurrencies & tokens issued on-chain, is that there’s nothing that implicitly makes them a security, while clearly defining &…

wish I had some cool lego or arcane LP strategy to share, but the reality is that on a risk-adjusted basis the $GHO money printer can't be beat right now thank u aave daddy @lemiscate

Sorry no posts recently, been touching grass, doing real work, & letting @sommfinance @beefyfinance @pendle_fi @GMX_IO @yearnfi @HyperliquidX handle it At the end of the day, while I'm still sure I could beat my current passive yield setup (ETH & USD) by 300-800 bps using custom…

Does anyone actually take Ryan Selkis seriously?

Unlike CLOBs, attracting toxic flow can be very profitable as a market-maker in CLAMMs, as fragmented liquidity allows for strategies with non-adversarial relationships between seekers & LPs

“So what do you do for work?” “I work in Finance” “Oh cool what do you do?” “Consulting” “What kind of consulting?” “Helping those from the citadel navigate goblin town” “Uh…is that a gaming thing? I thought you worked in finance?” “Basically we provide guidance on the…

This has been a long time coming, I really wanted to give them the benefit of the doubt, but man holy shit @coinbase what the hell happened My account has now been locked for over two months, weeks gone by without a single reply from compliance after multiple emails to them,…

Gud thread, just don’t get liquidated Still convinced attempting to avoid IL is the single biggest mistake one can make as an LP Maybe will repost but did a thread awhile back about how the most profitable LPs consistently are out of range and underwater for the majority of a…

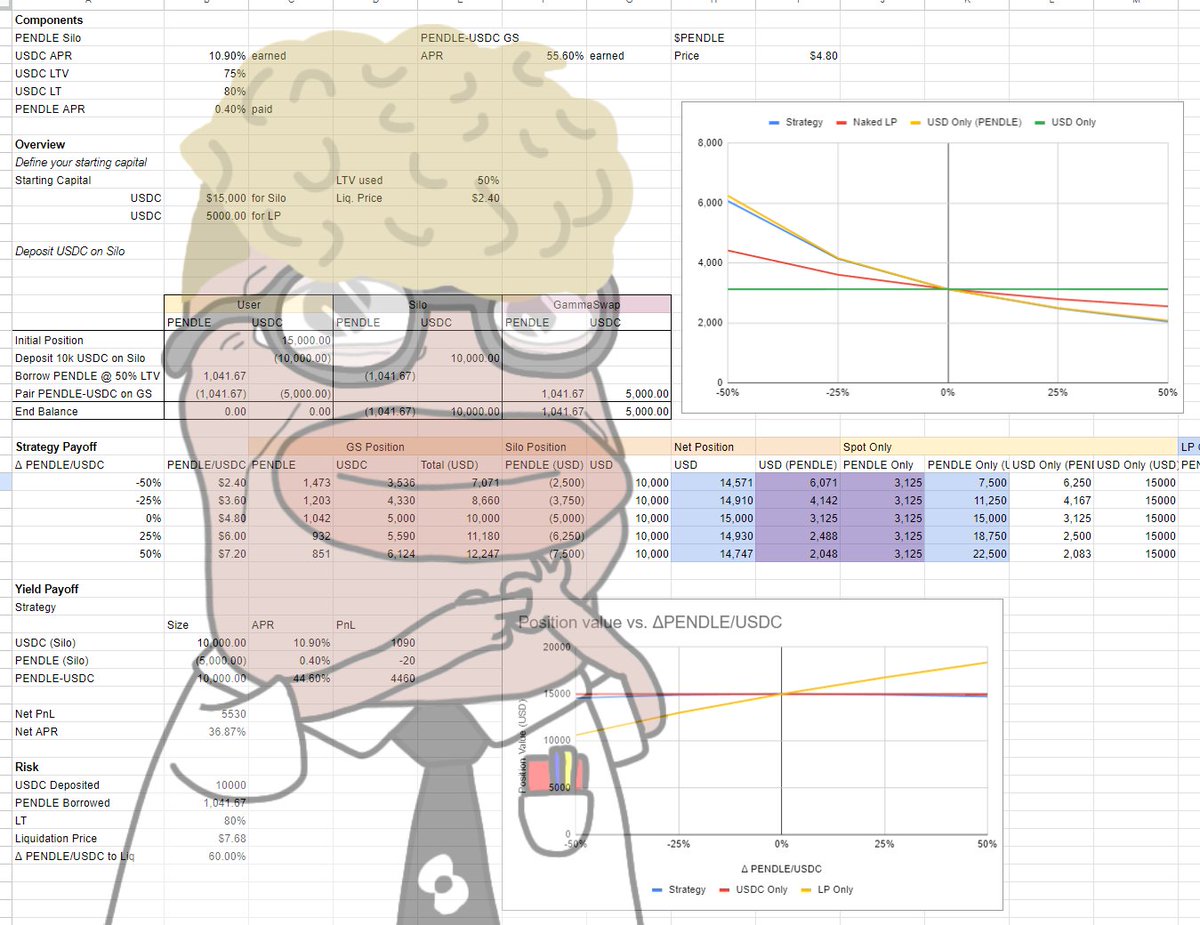

The best yields often come from paired LPs that are exposed to 𝐢𝐦𝐩𝐞𝐫𝐦𝐚𝐧𝐞𝐧𝐭 𝐥𝐨𝐬𝐬. What if intern told you to capture that yield with a 𝑛𝑒𝑎𝑟𝑙𝑦 neutral $USDC position by using Silo? Here's how to do it via GammaSwap's PENDLE-USDC pool. 👇

TLDR 200%+ APR on ETH

Here are some good graphs to give a general sense of this to the unsophisticated But it is also important to keep in mind Pendle often doesn’t follow expected bond behavior as there are lots of redacted & degenerate traders, especially when combined with points BS But a good…

lol

damn it really was the top

What part of the cycle is Goldman attributing success in crypto markets as a secular winning theme partially comprising the outperformance of their Tradfi stuff

Today is officially up there with USDC depeg & Multichain hack as one of the funnest & most profitable days to be on-chain

I love ✨Arbitrage ✨ 195% 7 day term fixed-yield on ETH has got to be a new record Wait it’s also substantially lower risk than anything on Pendle or anything fixed anywhere…. Tf is sharpe ratio

I love ✨Arbitrage ✨ 195% 7 day term fixed-yield on ETH has got to be a new record Wait it’s also substantially lower risk than anything on Pendle or anything fixed anywhere…. Tf is sharpe ratio

I miss the old DeFi, straight from the code DeFi, chop up the node DeFi, set on its amo DeFi I hate the new DeFi, the all hype DeFi, the rainbow points DeFi, retarded noise DeFi I miss the real DeFi, the natural rates DeFi, chop up the fakes DeFi…. The get fucking rekt u…

United States Trends

- 1. $MAYO 12,4 B posts

- 2. Tyson 437 B posts

- 3. Pence 51 B posts

- 4. Kash 86,7 B posts

- 5. Debbie 26,4 B posts

- 6. Dora 23,6 B posts

- 7. Mike Rogers 15,4 B posts

- 8. #wompwomp 1.536 posts

- 9. Whoopi 81,9 B posts

- 10. #LetsBONK 10,8 B posts

- 11. Gabrielle Union 1.581 posts

- 12. Iron Mike 18,4 B posts

- 13. The FBI 240 B posts

- 14. Laken Riley 53,5 B posts

- 15. #FursuitFriday 16,6 B posts

- 16. National Energy Council 4.024 posts

- 17. Pirates 20,8 B posts

- 18. Ticketmaster 17,9 B posts

- 19. Connor Williams N/A

- 20. Fauci 180 B posts

Who to follow

-

arti

arti

@artikokus -

Zephyr Protocol

Zephyr Protocol

@zephyr_org -

Radpie

Radpie

@Radpiexyz_io -

0xWenMoon 💙🧡

0xWenMoon 💙🧡

@0xWenMoon -

Pendle Intern

Pendle Intern

@PendleIntern -

563

563

@563defi -

DMH | Devcon

DMH | Devcon

@DeFi_Made_Here -

Conks

Conks

@conksresearch -

CL

CL

@CL207 -

wishful cynic

wishful cynic

@EvgenyGaevoy -

0xngmi

0xngmi

@0xngmi -

CryptoDoctor🦇🔊

CryptoDoctor🦇🔊

@0xCrypto_doctor -

DeFiMan

DeFiMan

@DeFiMann -

Atomist | rysk v2 arc

Atomist | rysk v2 arc

@0xAtomist -

Defi_Maestro ✺

Defi_Maestro ✺

@Defi_Maestro

Something went wrong.

Something went wrong.