DJY Kara📉

@DJKara7Tradevesting using sophisticated neural network systems to generate views on stocks. Views are not an investment advice.

Similar User

@Prateekbadjatya

@ThinkingCharts

@Shilpa_R0UT

@Dr_Ashutosh_MD

@wealth_verse

@akc_trading

@arabicatrader

@Rishi64776843

@rajeevmtnl1

@Gannhidden

@tradingdwave

@sainik636

@hedgefund07

@trivedisid14

@DiscretePriti

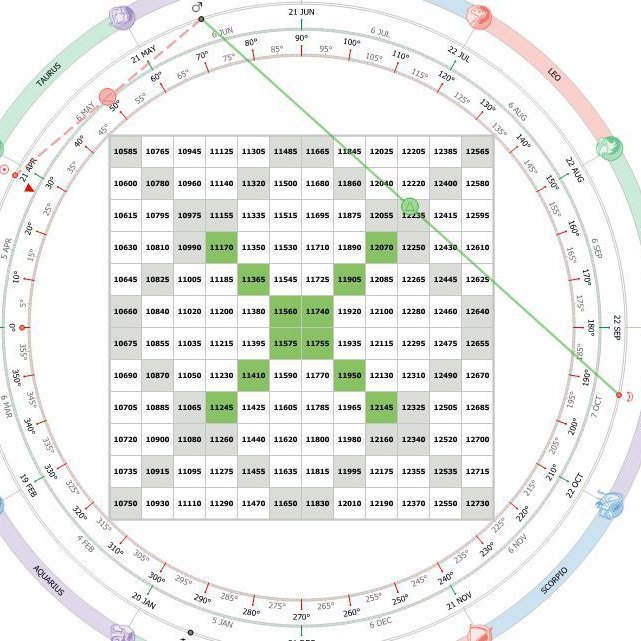

Bank nifty target for this year is Target 1 - 51, 100 Target 2 - 53, 800 one of the possible paths from here is 51,100 -> 43000/45000--> 53800.

Summary of Indian stocks markets in 2024 1st half of 2024- Buy & Hold 2nd half of 2024 - Buy & Pray !

Irony of life - 4K Ultra HD technology to watch the worst video content ever produced by mankind.

Reliance at support near 50 month moving avg. Last time it touched the 50 mma was during the COVID crash in 2920.

Nifty Gap fill done !

Midcap Index appraoching resistance ( 50 dma, upper bollinger band on daily, previous swing high, trendline from top). Dead cat bounce could terminate soon

Will a maharashtra election result gap remain unfullfilled for long ( that too when the same party came back to power and the fact was known after exit polls)

Not sure why so many market pundits are bullish on financial & banking If the economic activity is slowing down, hard to imagine that banks will continue raking profits. Their profitability has to take a hit as borrowings decrease and defaults increase.

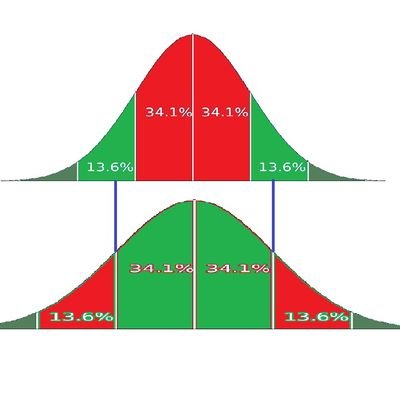

Small & Midcaps are likely to underperform the large caps & could have a major correction for the next few months as they revert to their mean / average valuations with the slow down in economic activity.

Nifty had a big rally in 2021, then in 2024. Next one will be in ? Type your answer in the comments section.

Trump is against the corrupt Pharma industry and will implement policies for better public health. Pharma stocks should course correct to accomodate this change in government policies.

India's inflation surge complicates monetary policy, overlapping with weakening corporate earnings. Easing interest rates would bolster corporate earnings & therefore the stock markets , but the RBI's primary concern – inflation containment – takes precedence. With inflation…

NSE introduces 45 new stocks in the F&O Segment. The National Stock Exchange's (NSE) introduction of new Futures and Options (F&O) products raises concerns, given SEBI's ongoing efforts to curb retail investors' participation in derivatives due to associated risks. This move…

🚨 Breaking News 🚨 NSE has introduced F&O contracts on 45 new scrips w.e.f 29th Nov 2024 Notable entrants 👇 Jio Financial Services Zomato Avenue Supermarts - Dmart Notable because they now will stand a chance to make their way into Nifty! @CNBCTV18News @CNBCTV18Live

Nifty is getting close to 200 DMA at 23550. Could see a pause to the fall around this region.

Tamo below 800 now.

Trump is pro-oil & anti-war. Green energy stocks / defence stocks one should be careful.

Update - nifty may attempt to make it to its 20 month moving avg ( center of bollinger band on monthly charts). This is just the first red month nifty has had in a while, so not expecting markets to reverse soon.

United States Trends

- 1. Hunter 1,25 Mn posts

- 2. tannie 92,6 B posts

- 3. Yeontan 305 B posts

- 4. #Brokeflyday 3.160 posts

- 5. Good Monday 29,1 B posts

- 6. #MondayMotivation 11,2 B posts

- 7. Burisma 44,7 B posts

- 8. 49ers 56,8 B posts

- 9. Josh Allen 50,5 B posts

- 10. #CyberMonday 9.255 posts

- 11. Big Guy 77,1 B posts

- 12. Niners 11,1 B posts

- 13. #BillsMafia 45,6 B posts

- 14. Dolly 15,7 B posts

- 15. #BaddiesMidwest 21,8 B posts

- 16. NO ONE IS ABOVE THE LAW 47,7 B posts

- 17. Kushner 45 B posts

- 18. Paul Manafort 10,9 B posts

- 19. Montas 3.873 posts

- 20. Roger Stone 13,4 B posts

Who to follow

-

Prateek Badjatya

Prateek Badjatya

@Prateekbadjatya -

Thinking Charts

Thinking Charts

@ThinkingCharts -

Shilpa Rout

Shilpa Rout

@Shilpa_R0UT -

Dr ASHUTOSH SAXENA

Dr ASHUTOSH SAXENA

@Dr_Ashutosh_MD -

wealthVerse

wealthVerse

@wealth_verse -

Ankit Chheda (AKC)

Ankit Chheda (AKC)

@akc_trading -

Sharad Shah

Sharad Shah

@arabicatrader -

Rishi kesh Tiwari

Rishi kesh Tiwari

@Rishi64776843 -

राजीव शर्मा (Astrologer)

राजीव शर्मा (Astrologer)

@rajeevmtnl1 -

Gann_Hidden

Gann_Hidden

@Gannhidden -

Trading D Wave

Trading D Wave

@tradingdwave -

SAINIK

SAINIK

@sainik636 -

Jayesh

Jayesh

@hedgefund07 -

S.N.H.TRIVEDI

S.N.H.TRIVEDI

@trivedisid14 -

Priti Tiwari

Priti Tiwari

@DiscretePriti

Something went wrong.

Something went wrong.