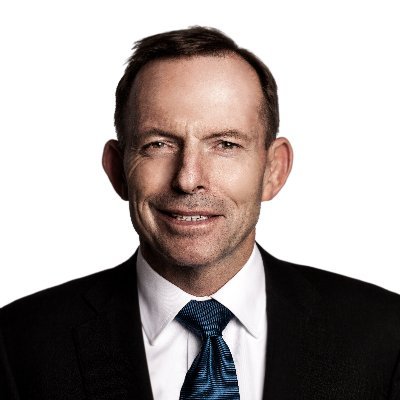

BMT Tax Depreciation

@BMT_Tax_DepBMT Tax Depreciation Quantity Surveyors provide tax depreciation schedules to maximise the cash return on residential and commercial properties Australia-wide.

Similar User

@SmartPropertyHQ

@apimagazine

@homelycomau

@eliteagentmag

@PRDAustralia

@REINSWnews

@RealtyTalkcomau

@REBAA_Aus

@larryschles

@Renoqueen

@SamanthaMcLean

@richharvey

Curious about how landscaping impacts investment property depreciation? Read our blog to learn. ow.ly/mZTY50UeBtm #Realestate #Depreciation #Landscaping

Discover how transforming commercial properties into residential spaces can create valuable opportunities for developers, investors, and tenants. Read more in our blog! ow.ly/5Gob50UcpBI #RealEstate #PropertyInvestor

Did you know you can claim tax deductions on the wear and tear of your property’s structure and permanent fixtures through #CapitalWorks #Deductions (Div 43)? Want to know more? Download the full #infographic here: ow.ly/WVzh50UaAQ3

Nearly 1 million BMT depreciation schedules completed to date! Want to know how we do it? At BMT Tax Depreciation, we make arranging your depreciation schedule easy and stress-free. Here’s how it works: ow.ly/WZWU50U8KVL #Depreciation #Schedules #Investors #Deductions

In the hospitality industry, hotels constantly grapple with property damage from wear and tear. This article explores how proactive maintenance and regular inspections are vital for minimising risks and safeguarding your investment. ow.ly/ix0u50U5ONu

Holiday rentals are appealing investments and offer significant tax depreciation benefits. In this article, we discuss important points to keep in mind. ow.ly/HWcq50U5NE9 #airbnb #tax #depreciation #deductions

Here’s a list of tax deductions every agribusiness owner should consider claiming. ow.ly/lRwS50U4446 #Farm #AgriBusiness #TaxTips

As Australia's population ages, the demand for high-quality aged care and retirement living facilities continues to rise. Check out our latest article @Recondaily for more insights! ow.ly/Bnmi50U0WEx #Investment #Retirement

Renting to friends and family can be a rewarding opportunity for both parties. Here are five tips to help you navigate this arrangement effectively: ow.ly/7UXX50U0Wwh #Rental #Tips #Investment

Discover the key growth drivers behind the life science sector and why it’s becoming an appealing investment opportunity. ow.ly/2nqY50TW1br #LifeScience #RealEstate #InvestmentInsights

Think you know all there is about tax depreciation? Put your knowledge to the test and get rewarded! surveymonkey.com/r/BMT-Quiz-Soc… #Quiz #Prize #TaxDepreciation

As a commercial property tenant, you may be eligible to claim significant depreciation deductions. These deductions lower your taxable income and enhance your cash flow. Find out more: ow.ly/R83c50TW18s #Commercial #Tenant #TaxDepreciation

Owning an investment property can offer significant tax advantages. Here are 6 essential tax benefits every investor should know! ow.ly/bky350TU7Et

Investors are eyeing @TheBlock houses ahead of the November auctions on Phillip Island, with tax deductions projected to be double. Our CEO Bradley Beer highlights that this year's deductions could be a game changer. Find out more in the link below: ow.ly/psX450TSeiS

We’re back on #TheBlock! Our CEO, Bradley Beer, inspected all five houses and calculated their depreciation schedules, providing valuable insights for potential investors. Catch the full episode in the link below! ow.ly/FjgY50TSf8U

When disputes arise over #repairs and #maintenance, who is responsible - the #landlord or the #tenant? In this guide, we break down common areas of contention to help you navigate these situations with ease. ow.ly/NiGU50TRjg5

As the October 31 tax deadline for self-lodgment approaches, ordering a depreciation schedule from BMT is easy! Our CEO, Bradley Beer outlines the process: ow.ly/Oixx50TPnAi

If you’re a first-time investor, navigating rising property prices and loan complexities, check out this article for insights on investment loans -ow.ly/wFqW50TO6MW #InvestmentProperty #Loan #Tips

Discover the hidden savings in your commercial property! A tax depreciation schedule can help both owners and tenants unlock significant deductions. Find out more here: ow.ly/P78o50TKsUv #Commercialbusiness #TaxDepreciation

Tax time alert! If you’re filing your own tax return this year, remember the deadline for self-lodgement is October 31. With just a couple of weeks left, here’s what you need to know: ow.ly/SfpY50TKrmW #TaxDepreciation #Oct31

United States Trends

- 1. $ELONIA N/A

- 2. Mack Brown 2.637 posts

- 3. $CUTO 5.477 posts

- 4. #tuesdayvibe 4.287 posts

- 5. #csm185 1.336 posts

- 6. #GivingTuesday 1.907 posts

- 7. Shaq Barrett N/A

- 8. Bill Gates 39,9 B posts

- 9. Tariffs 167 B posts

- 10. Happy Thanksgiving 22,4 B posts

- 11. Canada 443 B posts

- 12. #TTPDTheAnthology 2.711 posts

- 13. #GMMTV2025 3,43 Mn posts

- 14. Good Tuesday 37,7 B posts

- 15. SNKRS 1.320 posts

- 16. Chanyeol 107 B posts

- 17. Taco Tuesday 8.864 posts

- 18. Alec Baldwin 6.315 posts

- 19. Hangovers N/A

- 20. hobi 139 B posts

Who to follow

-

Smart Property Investment

Smart Property Investment

@SmartPropertyHQ -

API Magazine

API Magazine

@apimagazine -

Homely.com.au

Homely.com.au

@homelycomau -

Elite Agent

Elite Agent

@eliteagentmag -

PRD Real Estate

PRD Real Estate

@PRDAustralia -

REINSW

REINSW

@REINSWnews -

Kevin Turner

Kevin Turner

@RealtyTalkcomau -

Real Estate Buyers Agents Association of Australia

Real Estate Buyers Agents Association of Australia

@REBAA_Aus -

Larry Schlesinger

Larry Schlesinger

@larryschles -

Jane Slack-Smith

Jane Slack-Smith

@Renoqueen -

Samantha McLean

Samantha McLean

@SamanthaMcLean -

Rich Harvey

Rich Harvey

@richharvey

Something went wrong.

Something went wrong.