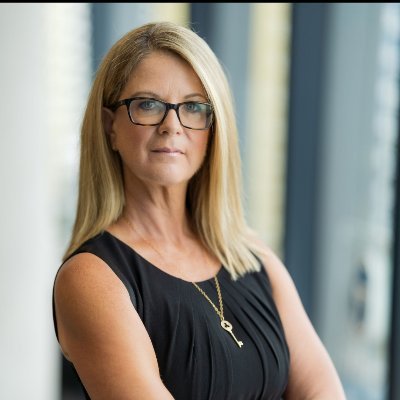

Annette Beacher

@AnnetteBeacherEconomist / working mum / political junkie

Similar User

@ANZ_Research

@ausbiztv

@_warrenhogan

@LivewireMarkets

@ShaneOliverAMP

@DaveTaylorNews

@TheKouk

@cjoye

@CallamPickering

@NadineBlayney

@SQMResearch

@TMFScottP

@Kyle_Rodda

@ricyet

@kit_lowe

Refreshing honesty from the RBA Governor. Media take note: "inflation is falling" isn't fooling anyone.

'Prices aren't coming down, they're up at a higher level now, permanently, and that is going to continue to eat into people's incomes.' RBA governor tells parliament Same in US. This is what influenced the #USElection2024 imho And will be the main game for Australia

UK’s fright night. Gilt yields surge after the budget. Containing supply to GBP299.9bn of issuance might trick the eye for a moment…

RBA and Government take note. The problem with the "cost of living" narrative is it won't come down (prices fall) without a recession/hard landing. The best the RBA can achieve is slow down price rises. That is not palatable for politicians.

One line justification for a surprise move. What do they see what consensus didn't?

Fed cuts 50bp with more to come - a clear focus on limiting any further labour market weakness.

One of the few commentators accurately summarising this CPI report. A less kind person would say these subsidies are akin to accounting fraud.

ABS Monthly Inflation (July) - Headline +3.5% YoY vs +3.4% exp - Trimmed mean +3.8% vs +4.1% prev - Ex-volatiles +3.7% vs +4.0% prev This month marks the beginning of the impact of electricity subsidies pushing down the CPI. The ABS notes that without the subsidies, electricity…

RBA Governor is adamant that either on hold for longer or a rate hike was discussed today. Those expecting a cut after the Fed have been dismissed. Inflation is too high is the message.

This has got an extraordinary response. Please retweet if you agree - the government needs to know we don't want them to take the easy, gutless, option.

Also aligns with CBA's other (generic) analysis: the older you are, the more likely you own outright, so free to spend.

Alright here it is: Who’s spending and who isn’t? Renters: spending fell 0.9% (year to June) With a mortgage: spending rose 1.5% Outright owners: spending rose 2.1% (CBA)

It feels like the ABS is producing data in silos. Strong labour market level 2, down the stairs turn right and there is flat-lining GDP growth. Please reconcile.

I recommend spending a few minutes appreciating these beauties around the world. Would make a terrific bucket list!

Thread of amazing sculptures you (probably) didn't know existed 🧵 1. Statue of King Arthur, England

RBA on hold and firmly neutral defying both cut and hike camps. Assumption that 4.35% holds until mid-25 isn't a forecast, but may well be. Not triggering unemployment is clearly a top priority for the RBA.

Start your engines!

🇦🇺 With Aussie Swaps pricing a c50% chance of a 25bp hike by September, here are a few dates for the diary that get us the hike - or conversely flips the bias back to cuts · 30 April Retail sales · 7 May RBA meeting & Statement on Monetary Policy · 2-7 May ASX200 bank earnings…

This is so misleading on so many levels I don't know where to start. Prices are still rising, and every household knows it. Facts at abs gov.au.

#BREAKING: In some good news for the hip pocket, the latest numbers show inflation has fallen by 0.5 per cent in the first three months of this year. #9News READ MORE: nine.social/Fsp

Goodness me, the quality of the presser questions for @RBAInfo is embarrassing. Do better media peeps.

Quick stats lesson on the employment report, given the breathtaking misinformation out there. Over the last 8 Dec reports, 100k jobs on ave added in original terms. This Dec was 18k, and hence this gets seasonally adjusted to a negative. So no-one was 'fired before Christmas'.

Someone needs to show them the White Island documentary. Tragic event on so many levels.

Volcano tourism in Iceland is something else

Hi there @boostmobile any tips on escaping the doom loop between text and phone calls to get my daughter's SIM replaced?

RBA lives up to its reputation as being the party pooper on Melbourne Cup Day. The lift to 4.35% was justified by a higher hurdle to get to 2-3% inflation in two years. Establishes independence from a government determined to keep writing cheques.

Despite some alarming headlines, RBA Governor Bullock made scant changes to the on-hold-at-4.1% statement. Markets are right to price in another hike while services inflation remains elevated. Missed opportunity to hint at key points in Friday's Financial Stability Review.

United States Trends

- 1. Thanksgiving 651 B posts

- 2. #AEWDynamite 6.593 posts

- 3. Custom 84,8 B posts

- 4. #BillboardIsOverParty 93,3 B posts

- 5. Zuck 5.925 posts

- 6. #CONVICT 6.766 posts

- 7. Vindman 33,8 B posts

- 8. Mbappe 432 B posts

- 9. #ConorMcGregor 6.890 posts

- 10. Madrid 537 B posts

- 11. #YIAYlist N/A

- 12. Verify 30,1 B posts

- 13. Liverpool 342 B posts

- 14. HAZBINTOOZ 9.036 posts

- 15. Brandon Crawford 3.440 posts

- 16. Kissing 47,6 B posts

- 17. Gonzaga 6.999 posts

- 18. WE HURT PEOPLE 1.010 posts

- 19. The Hurt Syndicate N/A

- 20. Juan Williams 1.793 posts

Who to follow

-

ANZ_Research

ANZ_Research

@ANZ_Research -

ausbiz

ausbiz

@ausbiztv -

Warren Hogan

Warren Hogan

@_warrenhogan -

Livewire Markets

Livewire Markets

@LivewireMarkets -

Shane Oliver

Shane Oliver

@ShaneOliverAMP -

David Taylor

David Taylor

@DaveTaylorNews -

Stephen Koukoulas

Stephen Koukoulas

@TheKouk -

christopher joye

christopher joye

@cjoye -

Callam Pickering

Callam Pickering

@CallamPickering -

Nadine Blayney

Nadine Blayney

@NadineBlayney -

SQM Research

SQM Research

@SQMResearch -

Scott Phillips

Scott Phillips

@TMFScottP -

Kyle Rodda

Kyle Rodda

@Kyle_Rodda -

Richard Yetsenga 叶森 🇦🇺 🇭🇰 🇹🇭 🇳🇱

Richard Yetsenga 叶森 🇦🇺 🇭🇰 🇹🇭 🇳🇱

@ricyet -

Kit Lowe

Kit Lowe

@kit_lowe

Something went wrong.

Something went wrong.