Similar User

@ForexSA1

@r_tot4

@Aa_a208

@shamri_azoz

@candleroyy

@SalehMarwan5

Não foi a primeira vez, nem a segunda e nem a terceira. O racismo é o normal na La Liga. A competição acha normal, a Federação também e os adversários incentivam. Lamento muito. O campeonato que já foi de Ronaldinho, Ronaldo, Cristiano e Messi hoje é dos racistas. Uma nação…

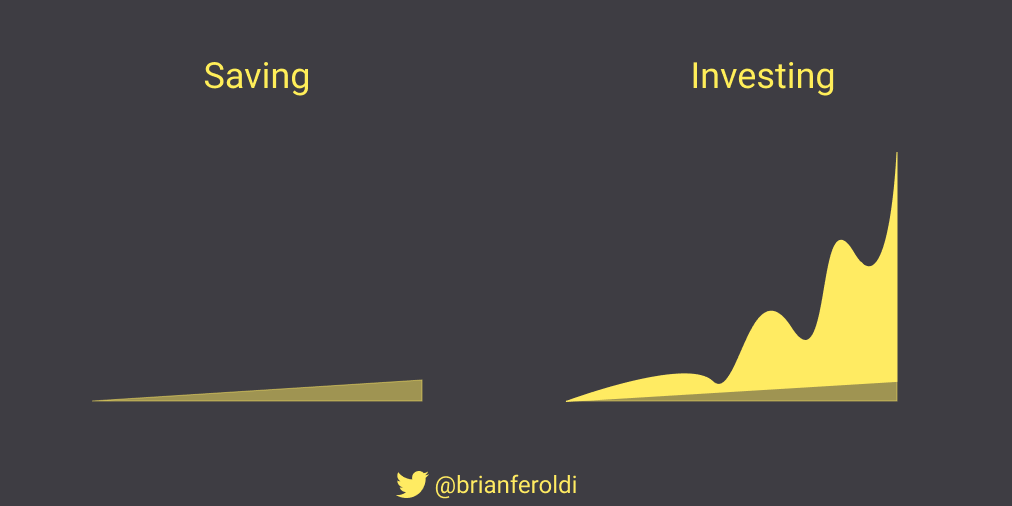

15 timeless investing principles, visualized: 1: If you want to build wealth, you have to invest

BREAKING: The Federal Reserve is very likely to hike interest rates by 75 basis points this week, @CNBC's @SteveLiesman reports.

#WeareallIdrissa Freedom of speech means he can choose to support or not support anything he want Stop acting civilized while all of u are the exact opposite @IGanaGueye

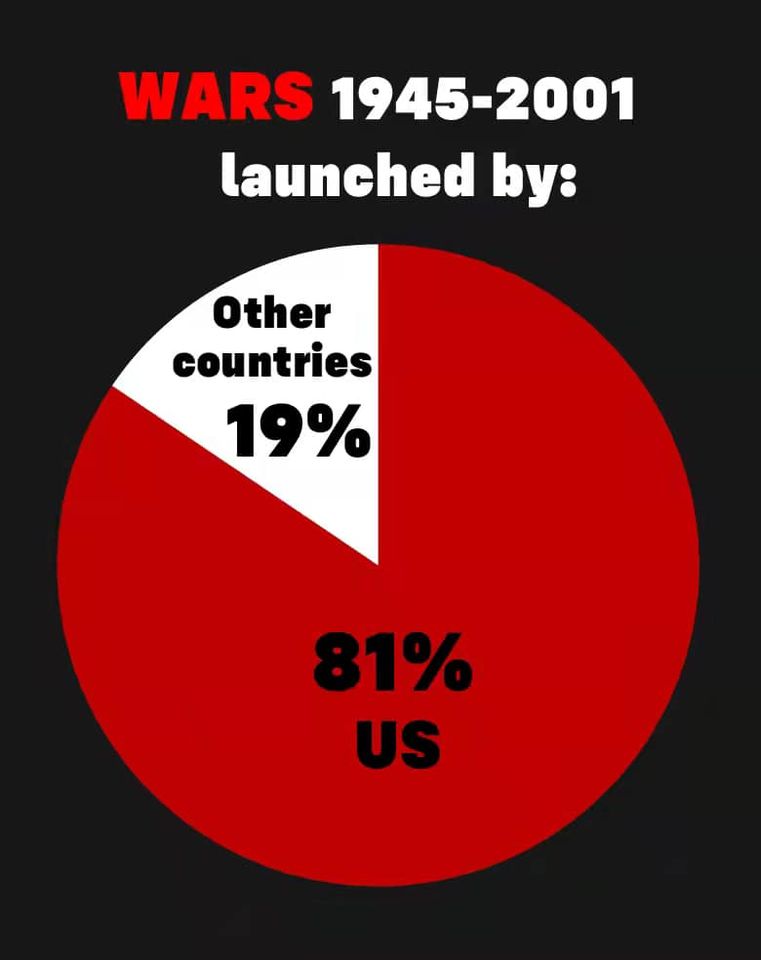

Among the 248 armed conflicts that occurred in 153 regions across the world from 1945 to 2001, 201 were initiated by the #US, accounting for 81% of the total number.

When I was a kid, the worst thing anyone could ever say was “I’m telling your mom.” I feared her more than any cop, teacher, or other authority figure. Society, in general, would be better off if we could return to that kind of parenting.

Don't just buy and hold. Buy and continually verify. Here are 9 red flags that indicate that your thesis might be busted:

Great lessons and advice for every investor in the stock market

Billionaire investor Seth Klarman once explained the key insights he learned from Warren Buffett. “As Warren Buffett was a student of Benjamin Graham, today we are all students of Buffett” Here are Klarman’s top 12 lessons:

sharing economy

Uber has no cars Airbnb has no real estate Inflation is transitory This is the new economy

A knowledge and economic treasure

In the last 2.5 years, my whole portfolio multiplied 450% But it wasn't always like that. I used to only buy cheap stocks. Things changed after I learnt how to find and hold Multi-baggers. Here's my top 9 tweets on finding 10-100 baggers, and holding them. Enjoy!

Boring disclaimer : None of this is investment advice. Do what suits your strengths & goals and don't take random online advice. /END 🙏

Yes, all of this is easier to say during a Bull Market, but if you're investing for the long-term in individual stocks, given that you buy into quality companies and keep improving your process, Volatility is the price you have to pay for higher returns beating the indexes.

✔️This eventually helped me to just hold on to some 10+ bagger positions like $MELI $SHOP $ISRG $V $LULU $W despite their constant volatility, as long as the core thesis is in tact.

✔️Selling $NVDA in 2014, $NFLX $MSFT in 2017 (for a quick gain, despite buying them all for a LT holding), forced me to do a deeper analysis & improve the process, so that I can hold onto to the best & winning Companies & not focus so much on short term valuations & Mkt levels).

✔️Buying $AAPL ensured that I keep a close eye on Mobility trends and buy into other consumer facing Co's leveraging Tech trends $SQ $PTON $MTCH $FVRR $RDFN $ABNB

✔️Buying $FB $GOOG helped me to see how Advertising is shifting to Digital -> Programmatic ->CTV and get into Co's like $PINS $ROKU $TTD

✔️Buying $AMZN ensured that I didn't ignore the huge Cloud/SaaS trends (due to Valuations) and buy into the Tech stack at PaaS and SaaS levels $CRM $NOW TWLO $VEEV $DOCU $CRWD $NET $ZS $OKTA $DDOG $SNOW $ZM and few more

United States Trends

- 1. Mika 63 B posts

- 2. $CUTO 10,5 B posts

- 3. #IDontWantToOverreactBUT 1.382 posts

- 4. DeVito 15,9 B posts

- 5. Drew Lock 2.489 posts

- 6. DeFi 125 B posts

- 7. #MondayMotivation 19,1 B posts

- 8. #TSTTPDHolidayEssentials 1.479 posts

- 9. Mar-a-Lago 60,1 B posts

- 10. Daikin Park 1.525 posts

- 11. Tommy Cutlets N/A

- 12. Minute Maid Park N/A

- 13. Spirit Airlines 6.918 posts

- 14. Victory Monday 3.968 posts

- 15. #MondayVibes 3.527 posts

- 16. Ratings 28,8 B posts

- 17. Standout 6.807 posts

- 18. Ice Box N/A

- 19. Enron Field N/A

- 20. Good Monday 57,5 B posts

Something went wrong.

Something went wrong.