Akshay Naheta

@Akshay_NahetaEntrepreneur; Investor; Personal opinions only; No investment advice

Similar User

@t_xu

@ReadwiseReader

@ApoThera

@StockMarketNerd

@DNair5

@lincolnmurphy

@airstreet

@5amVentures

@redwood_ryan_a

@avlok

@minney_cat

@makersfundvc

@backus

@psyopcapital

@CryptoCrash23

America and most of the developed world needs a disruption in politics along with an end to woke culture. I’m rooting/hoping for @VivekGRamaswamy to run for @POTUS

Hopefully, a change in American leadership can act as a catalyst to provide an off-ramp from the current wars in Europe and the Middle East. We need peace in this world and an end to the suffering of innocent people. Politicians aren’t the ones fighting on the frontlines.

Democracy, free speech and meritocracy was the winner tonight.

UAE should be off the grey list in the next couple months. That should provide another boost for the economy and the real estate markets.

Fortunate to be part of an ever-evolving UAE. @MohamedBinZayed @HHShkMohd have provided a safe, clean and efficient environment for its citizens and expats alike to flourish and prosper! #UAENationalDay 🇦🇪

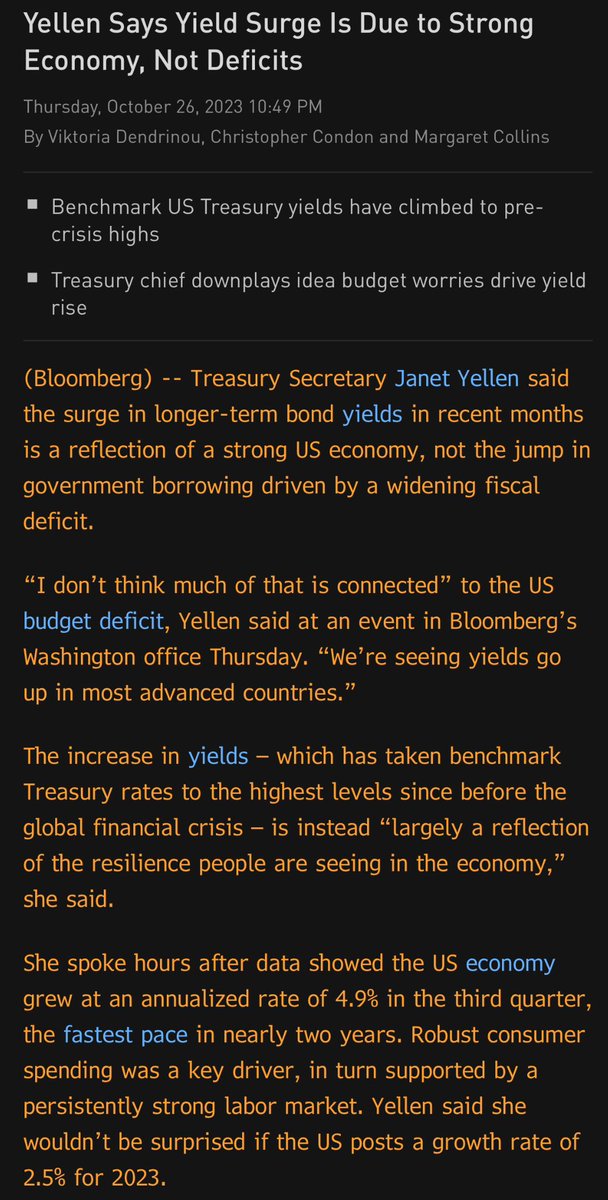

How to be consistently wrong - another nugget from @SecYellen Yields are going a lot higher in the medium-term, unless @federalreserve starts printing money again - QEᴺ

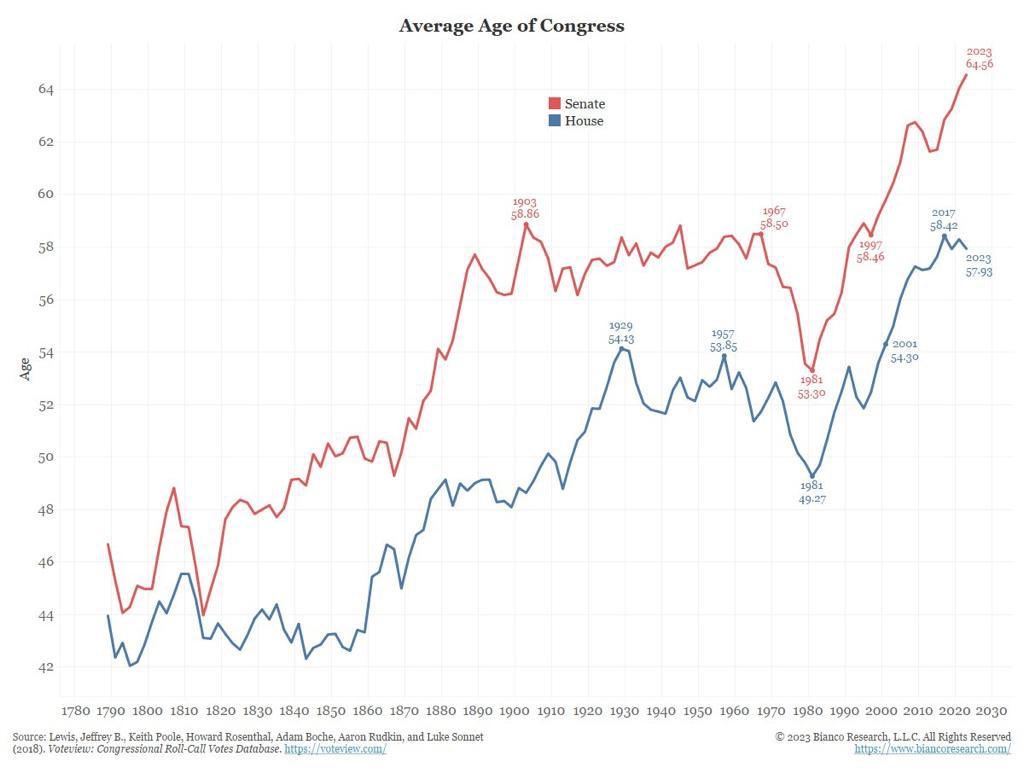

The current American administration is living in a past era. There is an urgent need for global leaders to understand the present realities. The world is fraught with immense risks and the real possibility of a major global conflict. The world is changing fast.

Over the next few years, the most important divergence that one has to lookout for in markets is that between long-term yields and the strength of the dollar (specifically yields rising and dollar weakness).

A prediction for year-end 2023: - inflation down (for the US) - commodities down - equities down - treasury yield down (rates rally) Thereafter, it’s a rocky road. Too much issuance from the US govt will make it extremely uncertain. And, @federalreserve actions will add to it.

"Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate," Treasury Secretary Mellon told President Hoover, after the Crash of 1929. "It will purge the rottenness out of the system, enterprising people will pick up the wrecks from less competent people."

It’s all about liquidity! And here we sit, nearly 500bps higher on short rates, but between the BOJ, @ecb and the SVB “bailout” a liquidity drain never happened. With the debt ceiling charade to be soon behind us, is a liquidity drain in store for markets due to t-bill issuance?

US$1.5tn in CRE loans coming due in the next 3 years. Industry now wants a govt bailout, because losses are meant to be socialised & profits are privatised in America! The US is becoming a banana republic, where capitalism is dying by a thousand cuts. @federalreserve @USTreasury

Blind leading the blind! @federalreserve

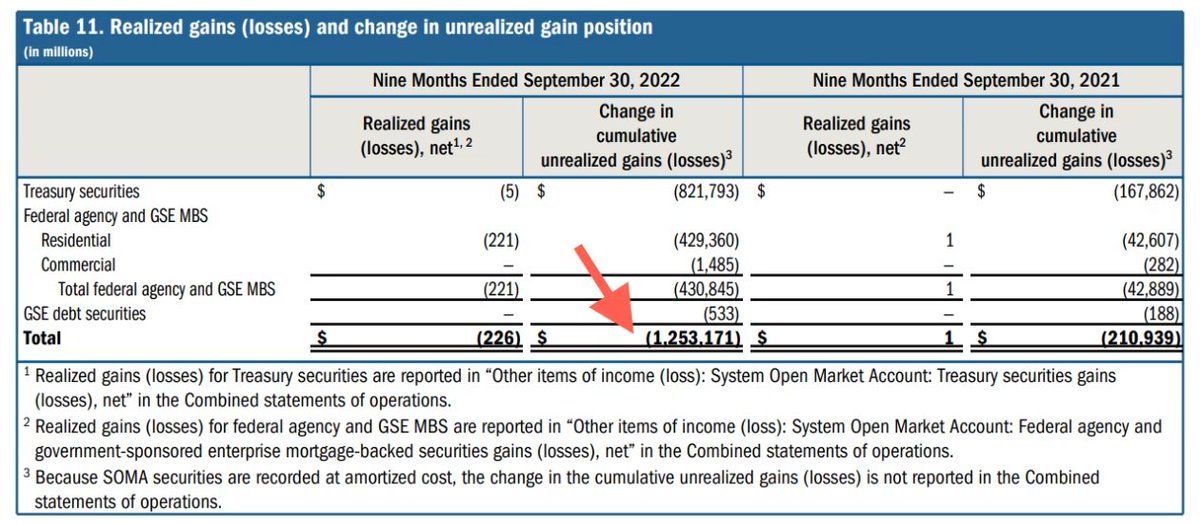

If you thought SVB was bad ... The Fed is sitting on unrealized losses of ~$1.2 trillion on their $8.3 trillion bond portfolio. And the Fed is losing money every day by paying $$$ to commercial banks via reverse repos.

America has truly become a #BailoutNation. The @federalreserve & @USTreasury are working hard to undermine the USD’s dominance as a global reserve currency - with bailouts, endless money printing with different acronyms (QE, BTFP, etc), and uncontrolled federal spending/deficits.

The equity value of PE LBO deals - deals with substantial debt/leverage - based on where their debt trades in the secondary market is basically ZERO. Most PE firms still have to recognise this in their fund NAV. Next the @federalreserve will backstop the investors in these funds?

It’s baffling to see more policy errors on the part of @federalreserve We’re in for a massive spike in inflation if they back off from rate hikes and QT. @federalreserve’s balance sheet is as screwed as that of SVIB’s. Its the blind leading the blind!

We need to restore the integrity of capitalism.

United States Trends

- 1. Auburn 34,3 B posts

- 2. Bama 35,7 B posts

- 3. Lakers 38,2 B posts

- 4. #LasVegasGP 59,3 B posts

- 5. Max Verstappen 63,9 B posts

- 6. UCLA 10,3 B posts

- 7. Lewis 82,3 B posts

- 8. Oklahoma 50,3 B posts

- 9. Nuggets 30,1 B posts

- 10. Chuck Woolery 3.831 posts

- 11. LAFC 3.307 posts

- 12. #AEWFullGear 82,4 B posts

- 13. Jokic 20,1 B posts

- 14. Milroe 16,9 B posts

- 15. Texas 148 B posts

- 16. Sainz 28 B posts

- 17. Lincoln Riley 1.092 posts

- 18. Lando 21,6 B posts

- 19. Sounders 1.389 posts

- 20. Ferrari 45,8 B posts

Who to follow

-

Tony Xu

Tony Xu

@t_xu -

Reader

Reader

@ReadwiseReader -

ApoThera - Clinical Decision Support - Mobile App

ApoThera - Clinical Decision Support - Mobile App

@ApoThera -

Brad Freeman

Brad Freeman

@StockMarketNerd -

Dinesh Nair

Dinesh Nair

@DNair5 -

Lincoln Murphy

Lincoln Murphy

@lincolnmurphy -

Air Street Capital

Air Street Capital

@airstreet -

5AM Ventures

5AM Ventures

@5amVentures -

Ryan Auger // Industrial & Storage

Ryan Auger // Industrial & Storage

@redwood_ryan_a -

avlok

avlok

@avlok -

Minn

Minn

@minney_cat -

Makers Fund

Makers Fund

@makersfundvc -

John Backus

John Backus

@backus -

Psyop Capital

Psyop Capital

@psyopcapital -

Crypto Crash

Crypto Crash

@CryptoCrash23

Something went wrong.

Something went wrong.