Real #americansabroad

@AbroadSaveGive us real RBT Repeal FATCA Saving Americans Abroad

Similar User

@USAccidental

@SEATNow_org

@ExpatriationLaw

@AccidentallyUSC

@JCDoubleTaxed

@TAPInternation

@AbroadRebecca

@ZachExpat

@CrossBriton

@MikeBre14267200

@Amy_From_Sydney

@ACAVoice

@AmerIronCurtain

@slpng_giants_fr

@Keith__REDMOND

NEW VIDEO! What it's like as an American abroad with TAXES. I explain how the US doubly taxes all expats and even penalises you for marrying non-Americans. It's WILD. youtu.be/4l2RDCx2YnA

Simplifying the tax code will free Americans overseas from life and financial planning harms of U.S. over-regulation and double taxation, via simultaneously and wrongly claiming tax residents of other countries also tax residents of the U.S. @elonmusk x.com/elonmusk/statu…

So @SpeakerJohnson & @GroverNorquist are OK in continuing to screw and ruin Americans overseas with small to medium sized businesses with the retroactive back 1986 Transition Tax + GILTI? How goes this jive with ending double taxation of Americans overseas? 🤔 #FATCA #RBT

.@SpeakerJohnson made it clear that Republicans in Congress stand with President Trump in making permanent the 2017 Republican tax cuts that delivered economic growth, boosted workers’ wages, incentivized manufacturing and increased jobs.“--@GroverNorquist atr.org/atrs-norquist-…

Please note that this does not only affect Accidental Americans but all tax residents of other countries deemed ‘US citizens’ and ‘US persons’. #FATCA #RBT

Meanwhile, USA Government applies tax laws to USA citizens abroad on non-USA income! How much money under the table is that???

.@SEATNow_org's submission to Treasury abt #PFIC, #Form8621 and #Ameriansabroad. Includes 4 regulatory solutions to the hell, compliance, expense and opportunity cost imposed on @USCitizenAbroad Retirement planning should create security and NOT anxiety! seatnow.org/2024/11/21/sea…

On the 1000th day of Russia’s atrocious war, Europe stands by Ukraine. For every single day of the war. And every day thereafter.

Crazy idea: let’s simplify the tax code 🤷♂️

Americans spend $546 billion trying to figure out their taxes. Because the tax code is 10 million words of incomprehensible legalese. 21 times longer than the Lord of the Rings trilogy. And if you disobey one word they'll put you in a cage.

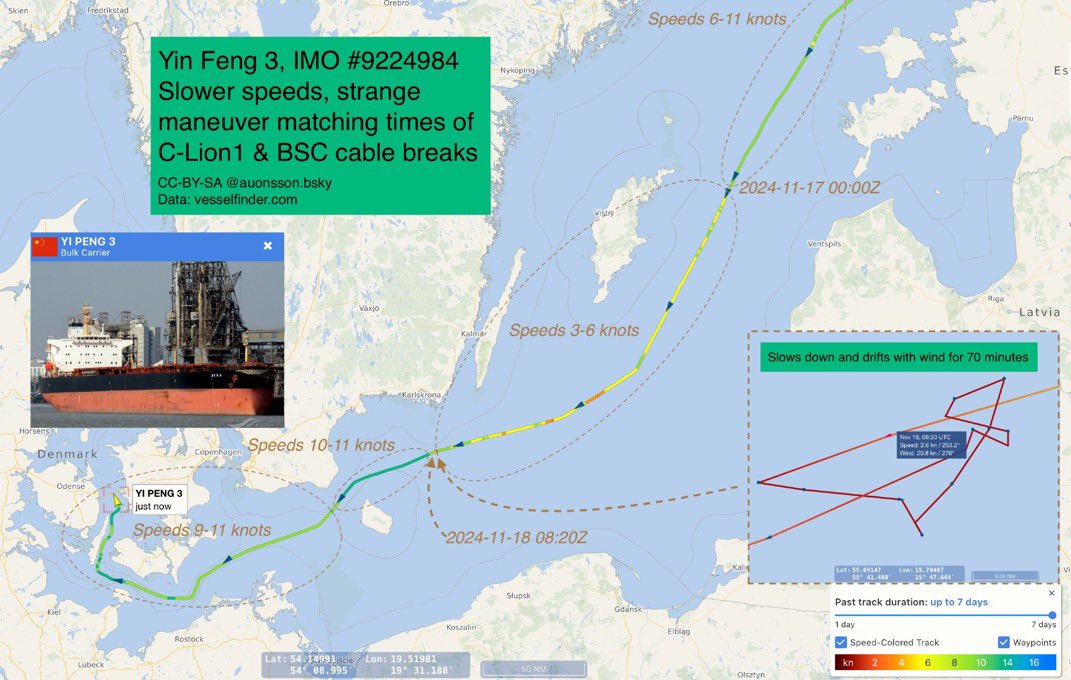

BREAKING: Strong evidence indicating that the Chinese bulk carrier Yi Peng destroyed 2 undersea telecom cables connecting Finland-Germany & Sweden-Lithuania A Danish Navy vessel is shadowing Yi Peng right now. She’s trying to leave the Baltic Sea. Board the ship! Via @auonsson

NEW: Ending Double Taxation on Americans Abroad is Long Overdue by @michaeljhout libertyaffair.com/2024/11/19/end…

Today, France's leading business daily, Les Echos, reported on the campaign by Americans abroad to change U.S. tax laws that discriminate against them. #taxfairnessnow #fatca #fbar #doubletaxation lesechos.fr/patrimoine/imp…

Grover Norquist talks about #enddoubletaxation of #Americansabroad starting at about the 1:50 mark. foxbusiness.com/video/63647793…

But they would still be required to report US residents, the outrageous penalty is still over their heads if they get the residency wrong, right? Or no FATCA at all? Perhaps mutual CRS type reporting and #FATCA in the rubbish bin of history where it belongs?

Hi friends! I wanted to give a quick update on The Onion’s purchase of InfoWars, which we can’t wait to relaunch as the dumbest site on the internet. Long and short of it: We won the bid and — you're not going to believe it — the previous InfoWars folks aren't taking it well.

Does this include ending FATCA from your perspective. Would we be allowed to buy ETFs in Europe again? it’s more than just “taxes.”

I’m sorry - but people need to be able to invest and save in the country that they were born and live in. If born outside the US, but have 1 US parent, US laws prohibit you from doing that in your country of birth. Rejected from having accounts and investments. It’s absurd.

But Mr. Yue, the banks have no interest in how US taxation works. They are only interested in #FATCA and if you want them to start deciding who is and is not genuinely resident you only complicate things for them and make US citizens even more toxic. Am I missing something?

The idea is that after ending double taxation is passed by Congree and signed by President Trump. the U.S. Treasury will inform all foreign banks about our new no double taxation law.

Would the foreign banks STILL be expected to carry paperwork/transfer data for their (unwanted) US clients?

Killing FATCA / citizen-based expat taxation is a slam dunk. It tortures Americans abroad. Trump promised to kill it. But most importantly it costs more to administer than the revenue it takes in!

Wow

As of 2010, there are over 70,000 pages of tax regulations. I think we can safely condense this.

United States Trends

- 1. Thanksgiving 2,42 Mn posts

- 2. Bears 70,4 B posts

- 3. Bears 70,4 B posts

- 4. Caleb Williams 7.863 posts

- 5. $VSG 6.775 posts

- 6. Shaboozey 4.158 posts

- 7. #VECTOR 1.092 posts

- 8. #IDEGEN N/A

- 9. Thankful 490 B posts

- 10. Gibbs 15,2 B posts

- 11. Eberflus 7.865 posts

- 12. #CHIvsDET 6.329 posts

- 13. Turkey 309 B posts

- 14. Ben Johnson 3.280 posts

- 15. #OnePride 9.806 posts

- 16. DJ Moore 2.439 posts

- 17. #NationalDogShow N/A

- 18. Goff 7.017 posts

- 19. Penei Sewell 2.741 posts

- 20. Jorgensen 5.651 posts

Who to follow

-

Accidental Americans

Accidental Americans

@USAccidental -

SEATNow.org - Stop Extraterritorial American Tax

SEATNow.org - Stop Extraterritorial American Tax

@SEATNow_org -

John Richardson - Counsellor for US persons abroad

John Richardson - Counsellor for US persons abroad

@ExpatriationLaw -

AccidentallyAmerican

AccidentallyAmerican

@AccidentallyUSC -

JC Double Taxed 🇦🇺 🇺🇸 END Double Taxation

JC Double Taxed 🇦🇺 🇺🇸 END Double Taxation

@JCDoubleTaxed -

Laura Snyder

Laura Snyder

@TAPInternation -

Rebecca Abroad

Rebecca Abroad

@AbroadRebecca -

Zach

Zach

@ZachExpat -

Jenny❤️🐱🌹🐝🏴🇬🇧⚖️

Jenny❤️🐱🌹🐝🏴🇬🇧⚖️

@CrossBriton -

Mike Breen

Mike Breen

@MikeBre14267200 -

Amy From Sydney

Amy From Sydney

@Amy_From_Sydney -

Americans Abroad

Americans Abroad

@ACAVoice -

American Iron Curtain

American Iron Curtain

@AmerIronCurtain -

Sleeping Giants FR

Sleeping Giants FR

@slpng_giants_fr -

Keith REDMOND 🟦▪️🎹▪️ 🇺🇸🇫🇷🇪🇺▪️

Keith REDMOND 🟦▪️🎹▪️ 🇺🇸🇫🇷🇪🇺▪️

@Keith__REDMOND

Something went wrong.

Something went wrong.