Arjun Murthy

@AMurthy100Fresh takes on life sciences Past stops @Yale and @McKinsey Boston 🌎

Similar User

@Gogetter_Life

@KaleidoArtisan

@SpryStrategies

@South32Hermosa

@SHGI_SparxFire

@BVMays1

@OmnitubeNetwork

@binplorer

@MaternLawGroup

@JAXNewYork

@Happyvibesllc

@_brightscout

@LifeCreekHealth

@MarketOneMedia

@Libertiny

The top 10 immunology drugs generated ~$70 billion in revenue in '23. Some call outs: 1. Humira finally facing competition - there are now 9 biosimilars in the US. 2. Sanofi's Dupixent continued to hit records - new approval and positive phase 3 for COPD 3. J&J's Stelara will…

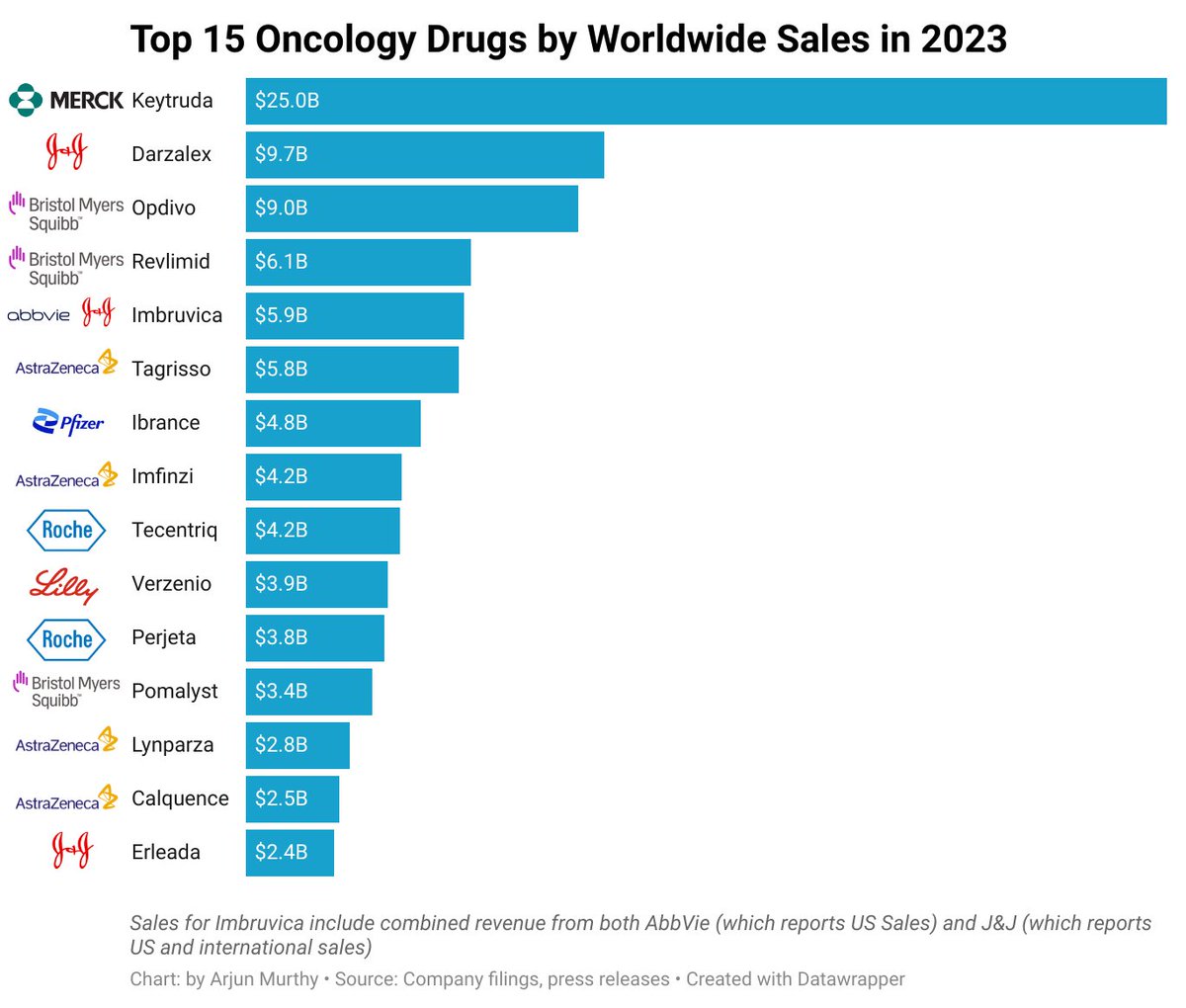

Oncology is the single largest pharma market - here's a look at the 15 biggest oncology drugs by sales in 2023. Notable that several of the top sellers are facing LOEs soon - Keytruda and Opdivo both in '28

Satya Nadella on Bloomberg tonight with the understatement of the century: When asked if Microsoft will push for governance changes at OpenAI: "Surprises are bad" and that "This idea that changes happen without being in the loop is not good"

💊 2023 Market Map of Life Sciences Partnerships The 10 largest pharma companies have struck more than 60 partnership deals so far in 2023 📈 Here's a recap of the 3 biggest takeaways: 💉 1. Oncology and Immunology dominated, accounting for almost a third of all partnerships,…

Blockbuster drugs come at a price In most industries, a breakout product is a blessing. But in life sciences, its a race against time to develop new products to cover when the patent expires And some are more reliant than others...

Q3 Earnings Snapshot: AstraZeneca kept sales growth in the double digits for the 3rd quarter in a row The GLP-1 deal with China's Ecogene got a lot of buzz, but oncology remains the powerhouse driving growth Worth noting the solid level of diversification - top 5 products…

Vertex missed Q3 estimates, with sales growth cut in half compared to the prior quarter... ...but the company advanced a strong pipeline in acute pain, hematology, and kidney disease that will help it diversify beyond its mainstay Cystic Fibrosis drugs

Biogen CEO seeks collaborations to expand pipeline as postpartum depression, Alzheimer’s and ALS drugs launch bcbn.org/boston-cambrid… #news #biotech

What do Ken Griffin (Citadel) and Eric Schmidt (Google) have in common? Both donated $10mn each to the UK Biobank, which has longitudinal health data on 500,000 people

Pfizer dropped its Q3 results yesterday... and saw Paxlovid sales crash 97% 📉 It's the corporate version of 'long covid' ⚕️

Thiel on America: “Companies started since 1990 worth $100B+. 11 are in the US, 6 in China. Zero everywhere else.” 🤯

There are many AI customer support tools out there, but RightPage (YC S23) is the only one built for *complex* tickets that aren't simple actions. Their data pipeline for their LLM means their bot writes detailed indistinguishable-from-human answers. ycombinator.com/companies/righ…

How is continued economic growth possible with finite material resources? This is not, as some think, a rhetorical question. It actually has an answer: because the most valuable kinds of economic growth take the form of rearranging resources more cleverly.

780 days - that's long it took Twitter to reach its first 10 million users - something Threads has achieved in just 7 hours, thanks to leveraging Instagram's pre-built distribution

The ChatGPT and LLM craze has explored thousands of potential use cases so far, but nearly all have not broken through (yet)… Often due to poor Information Retrieval (giving right context to LLM) and evaluation (limited ability to determine what good looks like and improve)

$CCL Carnival Cruise Lines is up ~140% YTD. While impressive, what's less known is that during the Covid crisis, its share count almost doubled from ~700mln to ~1.3bln as they scrambled to raise funds. That's one reason why it's unlikely to reach pre-covid highs of $40+

United States Trends

- 1. Brian Kelly 5.474 posts

- 2. Gators 9.077 posts

- 3. Louisville 4.775 posts

- 4. Feds 32,7 B posts

- 5. Nuss 2.975 posts

- 6. Stanford 7.959 posts

- 7. #UFC309 34,3 B posts

- 8. Billy Napier 1.448 posts

- 9. Mizzou 3.861 posts

- 10. Lagway 3.850 posts

- 11. Brohm N/A

- 12. Nebraska 8.501 posts

- 13. Tyler Warren 1.915 posts

- 14. #MostRequestedLive 3.988 posts

- 15. Heisman 13,1 B posts

- 16. Ron English N/A

- 17. #Huskers 1.281 posts

- 18. Moura 6.716 posts

- 19. Raiola N/A

- 20. Chris Wright 11,5 B posts

Who to follow

-

gogetter.Life

gogetter.Life

@Gogetter_Life -

Kaleidoscope Artisan

Kaleidoscope Artisan

@KaleidoArtisan -

Spry Strategies

Spry Strategies

@SpryStrategies -

South32 Hermosa project

South32 Hermosa project

@South32Hermosa -

Sparx Holdings Group

Sparx Holdings Group

@SHGI_SparxFire -

B.V. Mays

B.V. Mays

@BVMays1 -

OmniTube Network

OmniTube Network

@OmnitubeNetwork -

Binplorer — BNB Chain BEP-20 explorer

Binplorer — BNB Chain BEP-20 explorer

@binplorer -

Matern Law Group, PC

Matern Law Group, PC

@MaternLawGroup -

JAX New York

JAX New York

@JAXNewYork -

Happy Vibes

Happy Vibes

@Happyvibesllc -

Brightscout

Brightscout

@_brightscout -

Life Creek Health

Life Creek Health

@LifeCreekHealth -

Market One Media

Market One Media

@MarketOneMedia -

Tom Libertiny

Tom Libertiny

@Libertiny

Something went wrong.

Something went wrong.