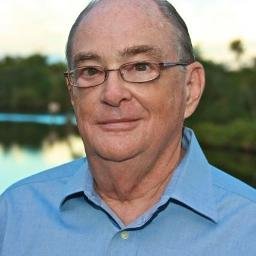

Tony Holland

@tjhollandChairman of Enterprise Angel Fund

Similar User

@workwithrender

@XLerateHealth

@ChuxPicks

@BFLouMichael

@stacygriggs

@StinesAllison

@JohnFischer22

@GregLangdon

@HunterGerlach

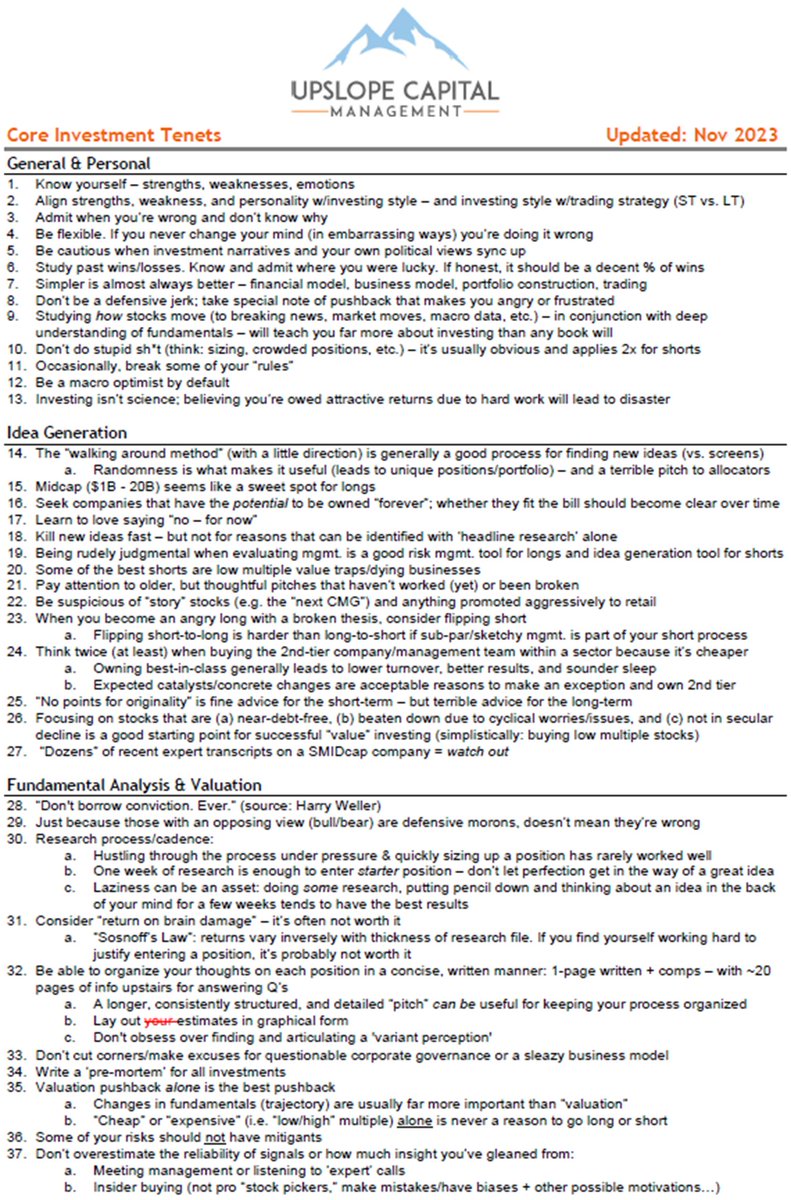

Updated Upslope's "Consolidated Learnings" document -- marked and clean versions attached and linked below: upslopecapital.com/s/Consolidated…

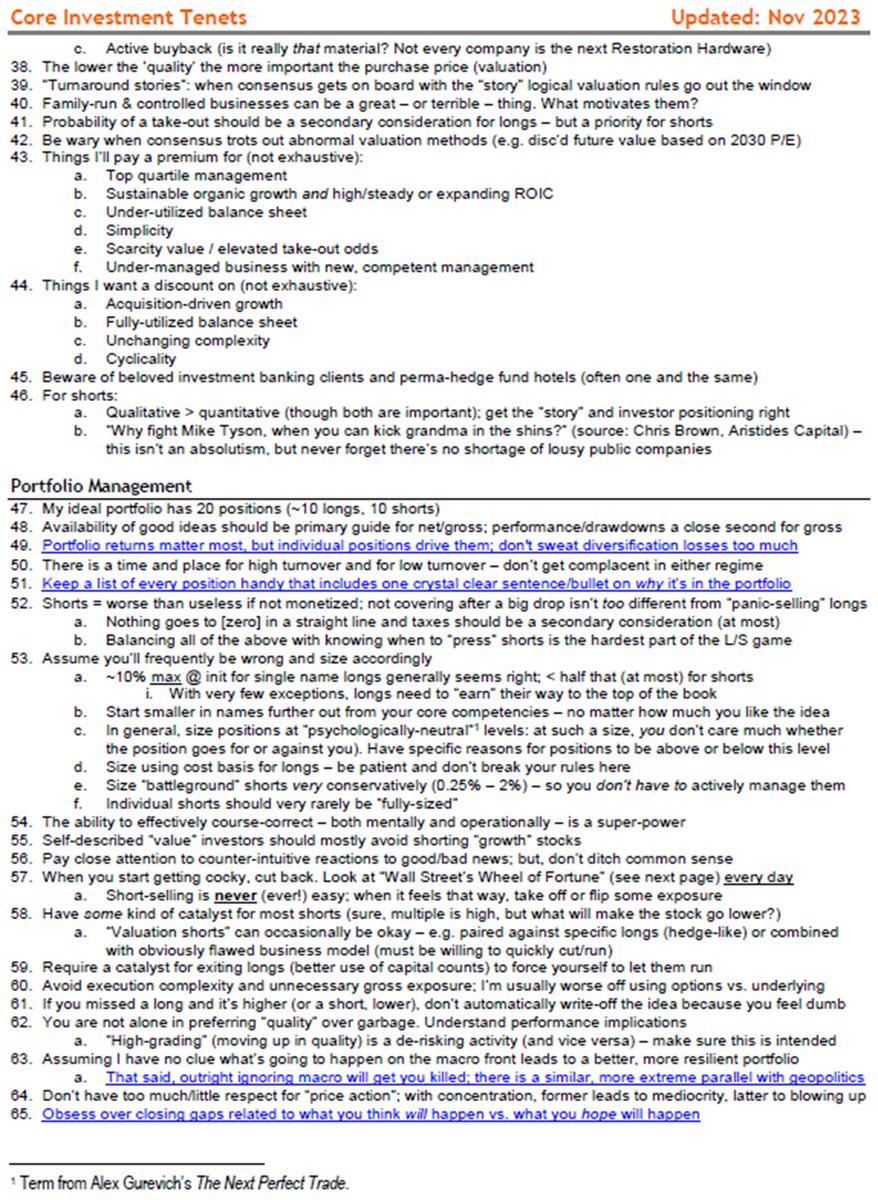

Hedge fund exposure to mega-cap tech is in the 99th percentile. At the start of 2023, exposure was in the 12th percentile. via Goldman Sachs

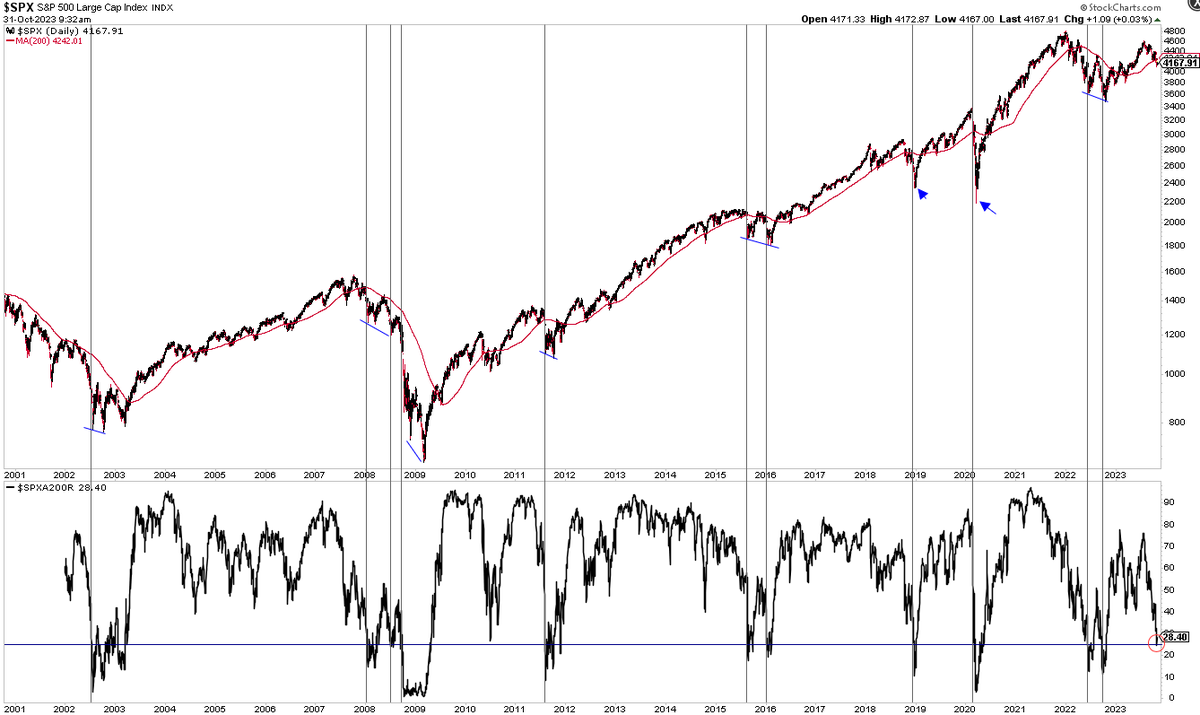

Last week, just 25% of $SPX stocks were >200-d. Since 2002, this has usually been 'near' the low (except 2008-09 and 2020) but never 'at' the low, which has sometimes followed several months later

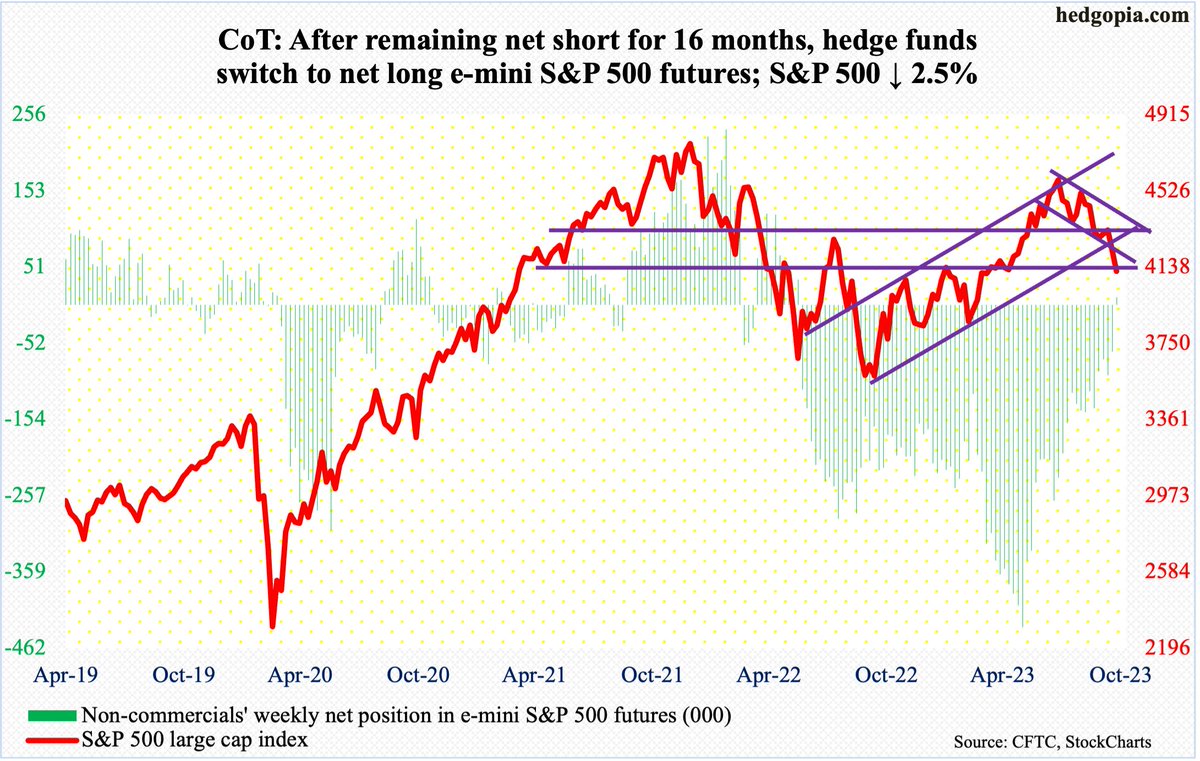

For first time since June last year, non-commercials are net long e-mini $SPX futures. Cash (4117) breaches channel support as well as 200DMA but ends week on lateral support. Daily oversold, with RSI just dipping below 30. Odds of a reflex rally have grown. $SPY

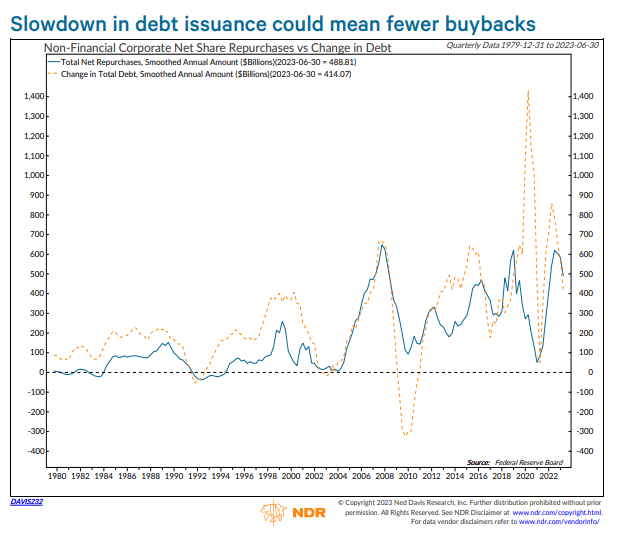

Higher rates have made equities less compelling from income and valuation perspectives. They could also be a drag on backbacks. Changes in total corporate debt have generally tracked share repurchases, with rising rates likely an impediment to corporate demand for equites.

Put/Call ratio 1.30, highest of the year.

Yes, September is the worst month for stocks on avg, as you've probably heard 10,000 times by now. The good news is when up 10% YTD or more and down in August? Sept higher 8 of 10 times and up median 2.6% (since 1950).

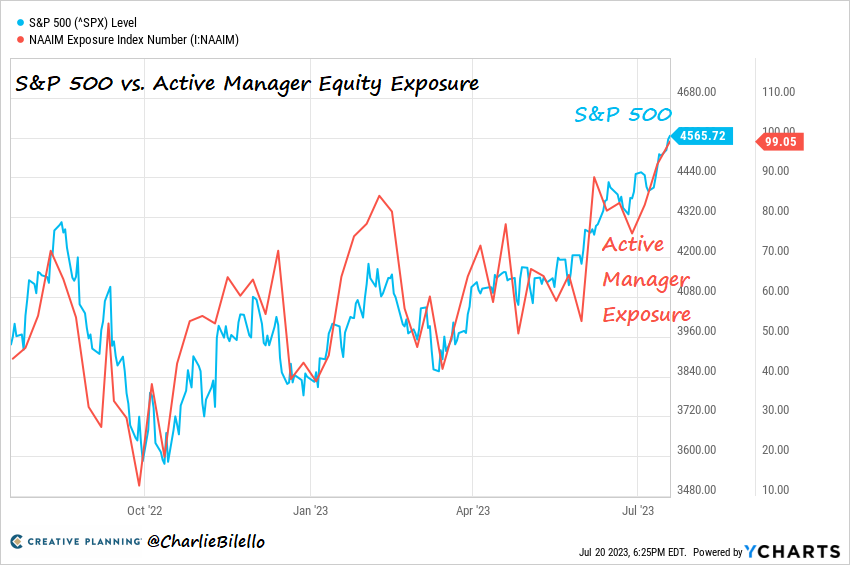

The mild market drop this month has made a loud enough noise to scatter the sparrows a bit. Equity exposure among tactical fund managers in the weekly NAAIM survey hits the lowest level of 2023.

5-d $CPCE highest since early March. Usually (not always) near the low in $SPX, w/ near term R/R tilted higher

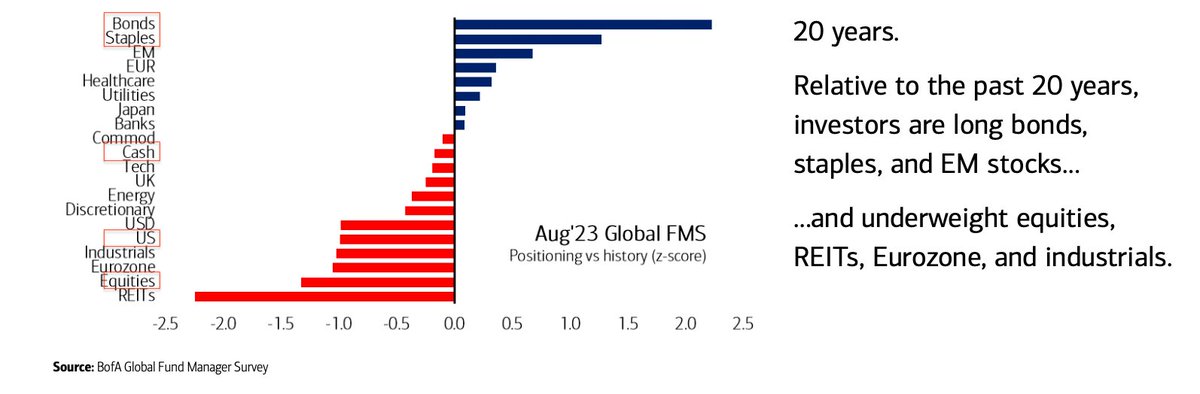

BAML fund mgrs: overweight bonds and defensives, underweight equities, esp. US. Cash neutral

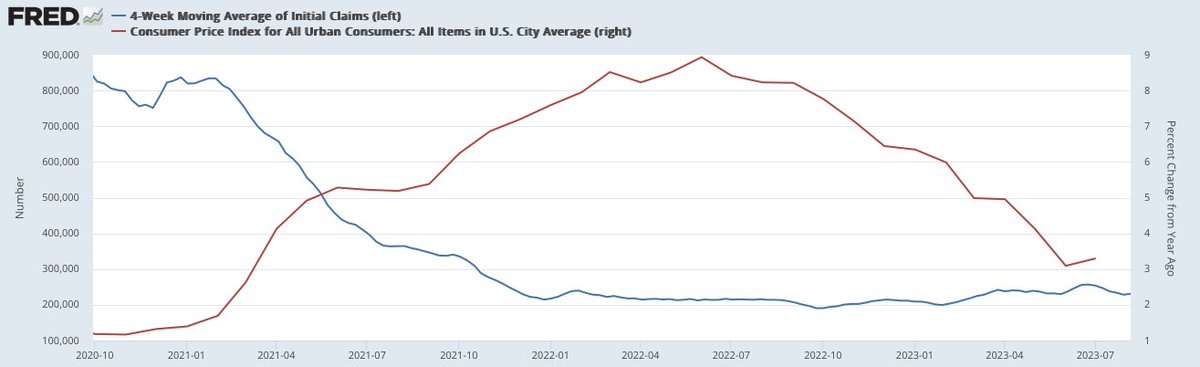

This thread: Inflation falling (red line) while employment remains robust (blue line).

Active managers had less than 20% exposure to equities last October when the S&P 500 was at 3,500. Today their equity exposure has jumped above 99% with the S&P 500 above 4,500. This is the highest exposure since November 2021.

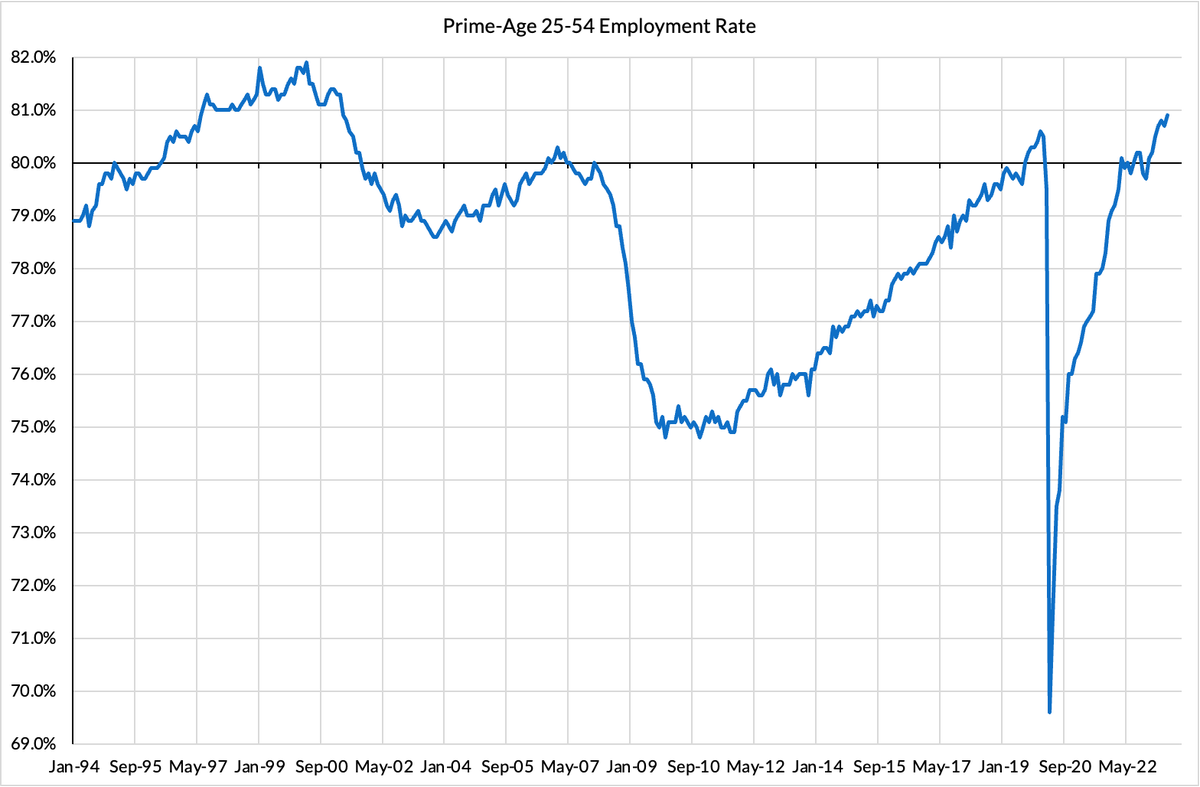

Don't be fooled by the headline commentary; this is another really solid jobs report The Prime-Age 25-54 Employment Rate adjusts for participation and demographic changes. It reached another new high in this expansion! Just 1% from all-time highs now (81.9% in April 2000)

I am really struggling with the new Tweetdeck. Hard to use.

The market usually stinks during the upcoming week and then rallies in July

That's how you start a long weekend.

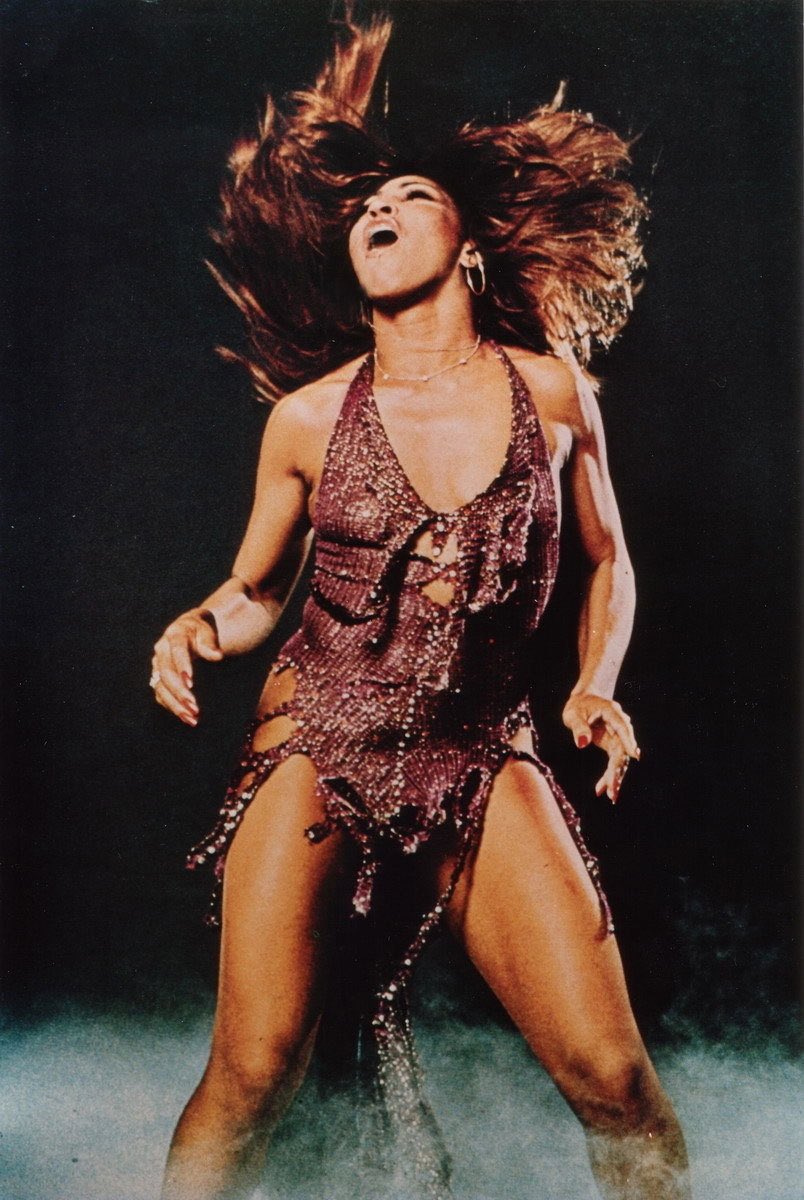

I’m so saddened by the passing of my wonderful friend Tina Turner. She was truly an enormously talented performer and singer. She was inspiring, warm, funny and generous. She helped me so much when I was young and I will never forget her.

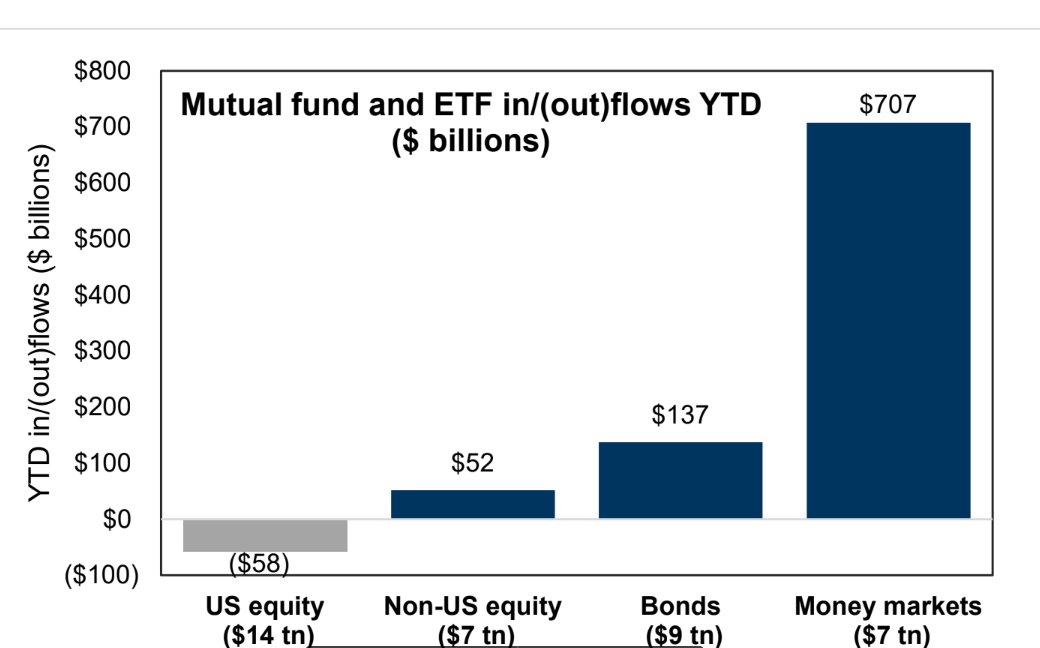

Where all the money has gone this year --Goldman

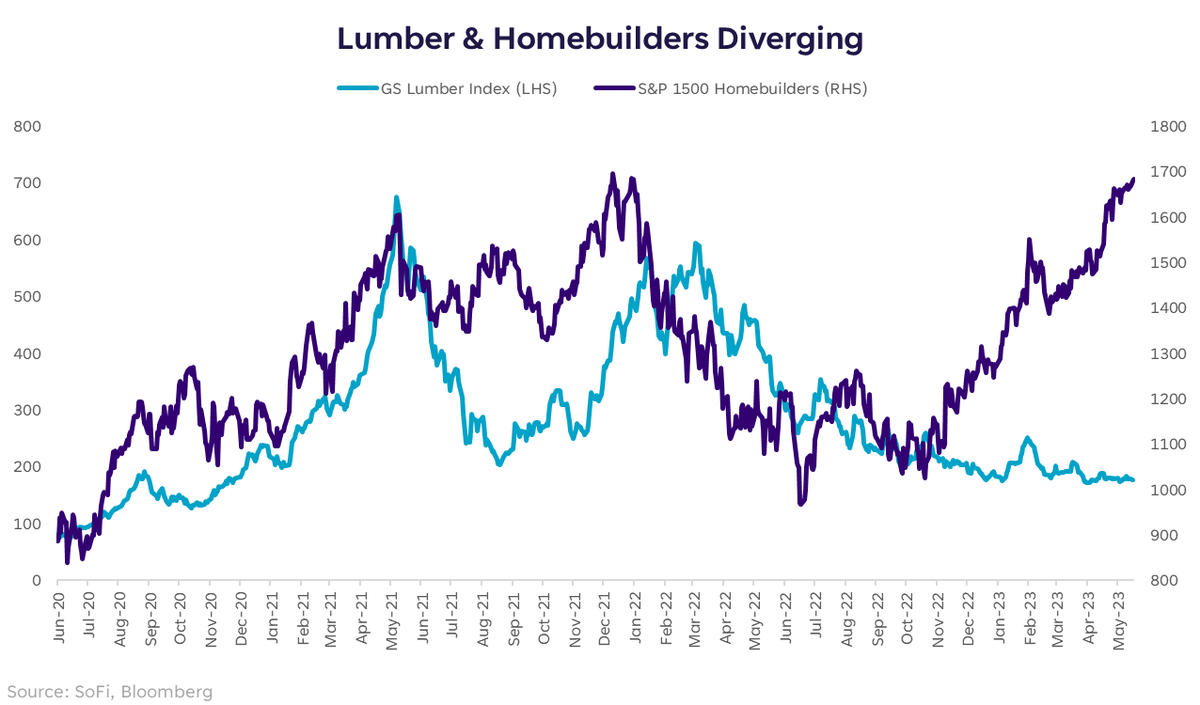

'The lumber market is sending a curiously divergent message vs. homebuilder stocks.' sofi.com/article/invest… ht @SoberLook

I do not think it means what you think it means.

United States Trends

- 1. Cowboys 44,5 B posts

- 2. Cooper Rush 6.627 posts

- 3. #WWERaw 69,9 B posts

- 4. Parsons 9.520 posts

- 5. Nikki Giovanni 17,4 B posts

- 6. #CINvsDAL 12,4 B posts

- 7. Ja'Marr Chase 12,2 B posts

- 8. Ja'Marr Chase 12,2 B posts

- 9. Leon Lett 1.393 posts

- 10. Luigi 770 B posts

- 11. Tee Higgins 6.269 posts

- 12. Jerry Jones 1.755 posts

- 13. Simpsons 17,4 B posts

- 14. Overshown 3.424 posts

- 15. #WhoDey 1.118 posts

- 16. Mike McCarthy 1.158 posts

- 17. Trey Lance 1.077 posts

- 18. CeeDee 7.780 posts

- 19. #MNFxESPN 1.300 posts

- 20. Harmeet 25,7 B posts

Something went wrong.

Something went wrong.