Firstly, you should not drink. But if you do, then have some manners to not mix random drinks like a typical dehati. Alcohol poisoning is real! Also, why you mix some ₹4000 per litre drink with ₹30 per litre cold drink? 🤡 Have just cold drink if you don’t have the cojones…

Cash Deposit Guidelines for Savings Accounts (FY 01-04-2024 to 31-03-2025) 🏦 📍 What happens if I deposit more than ₹50,000 in cash? You’ll need to provide a PAN card to the bank for deposits exceeding ₹50,000. Are there penalties for exceeding the ₹10 lakh annual limit?…

Have seen people getting confused between 194Q & 206C (1H) during this audit season. Lets again understand the difference between TDS section 194Q vs TCS section 206C (1H) in a simple way.

Lets understand about TDS section 194C i.e TDS on Payments to contractors in a simple way.

GST Update! RCM on Renting of immovable Property! The CBIC issued a Corrigendum dated October 22, 2024 to Notification No. 09/2024-Central Tax (Rate) dated October 08, 2024, clarified that "any property" should be read as "any immovable property", for renting of commercial…

In this notification term Any Property has been used instead of immovable property. The term “Any Property” has wider scope. Requesting @cbic_india to clarify the same.

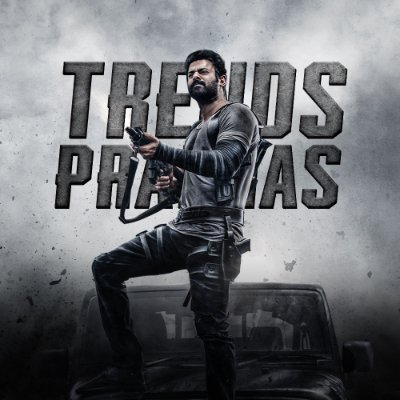

There’s nothing left to say about you …..your legacy is already etched in the history of world cinema ❤️ Happy Birthday #Prabhas Garu! 🤗 Wishing you boundless love and happiness alwayssssss.. There’s no one like you. and there never will be. #HappyBirthdayPrabhas

Kaateramma scene elevated the mass aura of #Prabhas, Repeat value for this scene >>🔥 #SalaarCeaseFire #Salaar #PrashanthNeel

Cinema ❌ Memes ✅ All meme templates in the movie in single video 😂😭 @MythriOfficial Inkenni dachavo emo 😭😭 @RiteshRana Thavvuthunte vastune unnay #MathuVadalara2 #Satya

you have to change the deed... this wouldn't be sufficient to get allowance u/s 40(b)(v). Refer to circular 739 dated 25-03-96. also included in tax audit guidance note. x.com/PGC_CA/status/…

In order to avail the allowance of Remuneration u/s 40(b)(v), partnership deed must specify either of two - 1. Amount of remuneration payable to each working partner OR 2. Manner of quantifying such remuneration. Remuneration will not be allowed where deed is merely refering to…

అందరికి విజయ దశమి శుభాకాంక్షలు ! Wishing everyone a #HappyDusshera #Prabhas

💥💥 New Justice Statue In Supreme Court, A 'Law Is Not Blind' Message

United States Trends

- 1. Bo Nix 8.810 posts

- 2. Falcons 15,6 B posts

- 3. Ravens 82,6 B posts

- 4. Chiefs 66,3 B posts

- 5. Steelers 116 B posts

- 6. Paige 17,1 B posts

- 7. Bears 115 B posts

- 8. Packers 75,2 B posts

- 9. Broncos 23 B posts

- 10. Bills 5.610 posts

- 11. WWIII 58 B posts

- 12. Jets 58 B posts

- 13. Lamar 32,7 B posts

- 14. Jennings 8.756 posts

- 15. Mahomes 20,2 B posts

- 16. Josh Allen 7.911 posts

- 17. Randle 12,1 B posts

- 18. Geno 21,8 B posts

- 19. Worthy 48,7 B posts

- 20. #KCvsBUF 8.245 posts

Something went wrong.

Something went wrong.