Micheal Green

@profplum00Exclusive discussions on stock/crypto markets, price action analysis, and more for a select group. Private page. Mainpage: @Profplum99

Net inflows into Vanguard total market complex (VTI/VTSMX/share classes) have been ~zero for almost 15 months... unprecedented. Some has been a rotation to narrower fund strategies, e.g. large cap growth, tech, etc.... but still a notable change. Any thoughts @EricBalchunas ?

I read a lot of nonsense about the improving balance sheet of the bottom 50% in terms of net worth. This is "true" in the same sense that I am an excellent basketball player if you ignore the competition. Over the past fifteen years, there has been a remarkable transformation of…

I'm just not seeing the debt service as an issue here. Personal interest payments are in decline. Debt service as % of income in decline. Wages up. And net worth of bottom 50% improving. Allows bottom 50% to start borrowing again... new credit cycle = demand growth

Always amazed at the lengths to which the mind will "de-sieve" itself with "facts"... the average HNW household has 32% of its assets in primary and secondary homes, not 4%. There's a reason they diversify away from real estate.

The biggest tailwind for real estate capital raising is coming from HNW individuals. The avg HNW individual has 4% allocated to real estate compared to institutions which allocate 10%-12% to RE. That gap is closing and all the big guys are going after HNW capital.

I'd like to believe this is not intentional, but this might be the dumbest thing you'll read today. This is how to convert a COINCIDENT indicator of recession (Sahm Rule) into a lagging indicator. The hurdle is not the point!

Oh, Canada... that big country to the north of us... true patriot love... but jobs they do not have

He's write. Private sector job growth ex-Birth/Death remains positive YoY. But still decelerating.

“Why, yes, the kibble coated with gravy made from short ribs and baby back ribs was delicious, now that you ask… maybe a bit of cream next time?”

Worst time to buy... and plenty of new single-family homes available for sale... we've quietly crept up to the 95%ile in history... existing homes still in short supply, but Lumber Liquidators sending a warning

One of the components of our US Housing Market Index, the University of Michigan "Buying conditions for Houses" has fallen to a record 47-year all-time low since the indexes' first data point in 1978: According to market watchers, there is no better barometer on the health of…

GDP-wtd PMI employment and household employment level. Another indicator the goose is cooked.

Passive 2.0

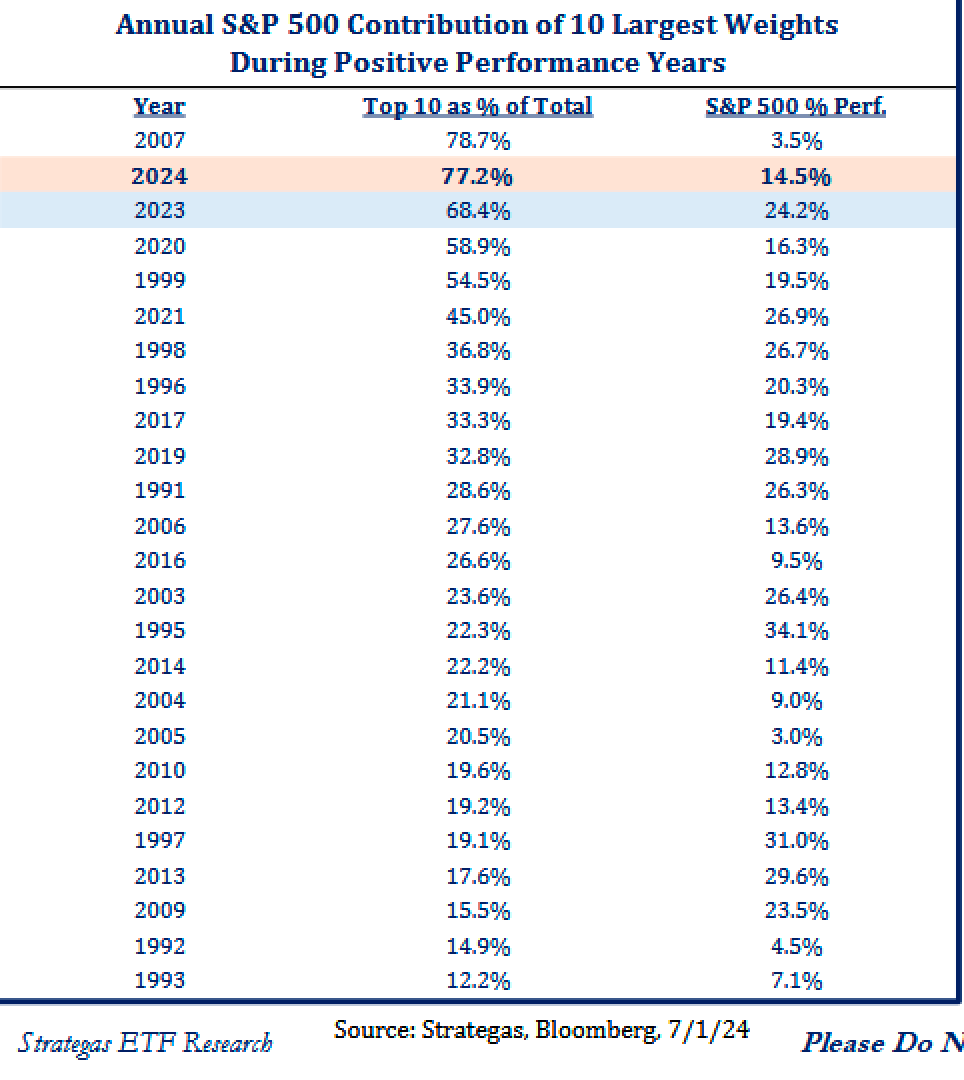

The top 10 biggest stocks in the S&P 500 contributed to 77% of the index's total return in H1. That is the second highest ever reading of that number. Only time its been higher was in (gulp) 2007... via @Todd_Sohn

"At BCAT, the Board’s nominees received more than 20 times as many votes as Saba’s nominees." This is a miracle of humility. Apparently, Boaz and Saba didn't vote for themselves. Or @BlackRock is lying, which seems much more plausible. Or maybe it's Chicago-style voting with…

Liar liar pants on 🔥! Here is the most important tweet I’ve ever written about activism. I hope you’ll resend and forward. Everyone, look at the sentence below taken DIRECTLY from @BlackRock’s Friday 5pm press release. Then look below that at the voting results. Their lying…

ISM New Orders CRUSHES expectations /s

Let’s try this again… green line is S&P futures introduction, red line is index funds cleared to use futures to buy positions (in violation of 40 Act)

It's increasingly clear that a subset of our population has lost their minds... buried in the Michigan inflation expectations (which beat expectations) is that 12% of the respondents now expect 10% or higher inflation over the next 5-10 years. The mean value is now well above the…

We've now exceeded the drop in Core PCE YoY from Volcker... perhaps we should hike because people don't like Taylor Swift ticket prices... perhaps it's "just like" 1972, but if so we'd have to see the labor force grow by 19.5MM over next 8 years (37.1MM population adjusted). Call…

Headline PCE inflation comes in at 0% MM in May (actually ever so slightly declined at the second decimal). Core PCE comes in at 0.08% MM, a soft version of meeting 0.1% expectations. YY core PCE inflation is now 2.6%.

Anyone else have CNN go dead? Both website and TV…

$SMCI delivers a parting gift to the R2000 on its second to last day in the index... "So long and thanks for all the fish!"

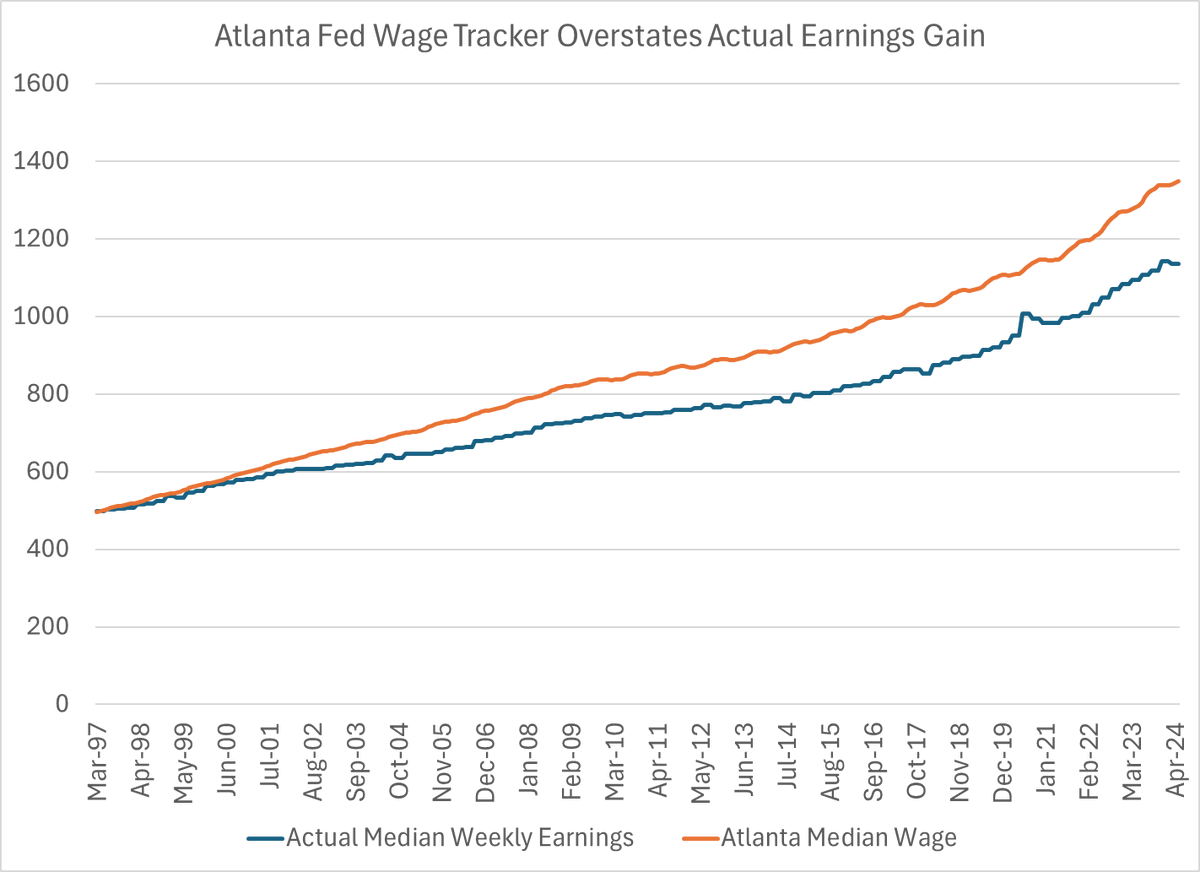

Blame the Atlanta Fed too... just like passive investing beats most active managers by delivering the average return every day, statistics quoting the Atlanta Fed median wage survey misunderstand cumulative reality

In their essays for EIG today, both Krugman and Strain offer reasons why people may be more negative than the data suggests they should be. I would offer an additional theory: blame the BLS and FRED. Seriously? Yes. Stay with me for a moment...

United States Trends

- 1. #LasVegasGP 9.337 posts

- 2. #IPLAuction 59,8 B posts

- 3. Good Sunday 52,8 B posts

- 4. Chuck Woolery 5.848 posts

- 5. Max Verstappen 131 B posts

- 6. Lakers 40,9 B posts

- 7. Bama 37,7 B posts

- 8. Auburn 35,5 B posts

- 9. Lewis 115 B posts

- 10. #ViratKohli 42,1 B posts

- 11. Pant 55,3 B posts

- 12. Love Connection 5.177 posts

- 13. Sainz 46,8 B posts

- 14. Lando 42,5 B posts

- 15. Ferrari 81,7 B posts

- 16. #FROMily 1.798 posts

- 17. #Sundayfeeling N/A

- 18. UCLA 10,7 B posts

- 19. LAFC 3.785 posts

- 20. Oklahoma 50,3 B posts

Something went wrong.

Something went wrong.