Petru Félix

@petru_vdwfelixDipping my toe into the freelance world of writing. Coverage inc. Finance & Programme Management, drawing from experience at multinationals. Volunteer @parkrun

Similar User

@Khabibmmapro

@ssuae99

@rareofferszone

@IanElgamer3

@hitman_os

@Mashuksiddiqui

Data Science: The Modern-day Pillar of Economics by @petru_vdwfelix buff.ly/3QQTsTE

South Africa's President Ramaphosa says its energy crisis is an 'existential threat' to SA's economy & social fabric. He's promising to bring the daily power cuts 'to an end'. 7 mins on a story that's about more than electricity. Produced by Floyd Cush, Michael Cox, Mary Fuller.

🧵RISING INTEREST RATES ARE A BIGGER DEAL THAN YOU MIGHT THINK🧵 This is important (hence the caps). I’m a bit worried people are being WAY too complacent about rising interest rates. They assume that because they’re so low now vs the 1990s, this’ll be a walk in the park. NO.

The Euro zone narrative is shifting. A few months ago it was: "there won't be recession." Recently it shifted to: "there'll be recession, but it'll be shallow." This weekend we began to make the final shift: "we're heading for deep recession." Euro is going to fall a lot more...

Global recession is coming. We've had a recession forecast for the Euro zone since March and the recent data flow is increasingly pointing to a severe recession that will engulf Germany. The forward-looking expectations component in the German IFO survey is almost as bad as 2008.

The #Fed will be looking at an #economy in which #energy and #food inflation is likely to come down in the next 3 months BUT, now that the drivers of #inflation have been allowed to broaden, core is likely to remain stubbornly high The @WSJ chart below shows the magnitude in play

Germany enters a manufacturing recession.

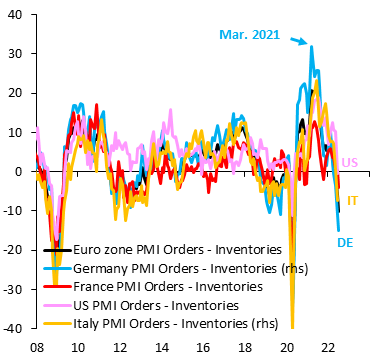

Recession in Europe is coming. We've had a Euro zone recession forecast since March. Recent data from the global manufacturing PMIs are shockingly weak. The forward-looking orders - inventories for Germany (lhs) and UK (rhs) are nearing their 2008 global financial crisis lows...

The siren song of QE twisted many heads in Europe. But if QE holds yields down artificially, private investors sell & get out, as risk-adjusted returns just aren't high enough, leaving ECB on the hook for ever. Euro zone QE is Hotel California: "you check in, but never leave..."

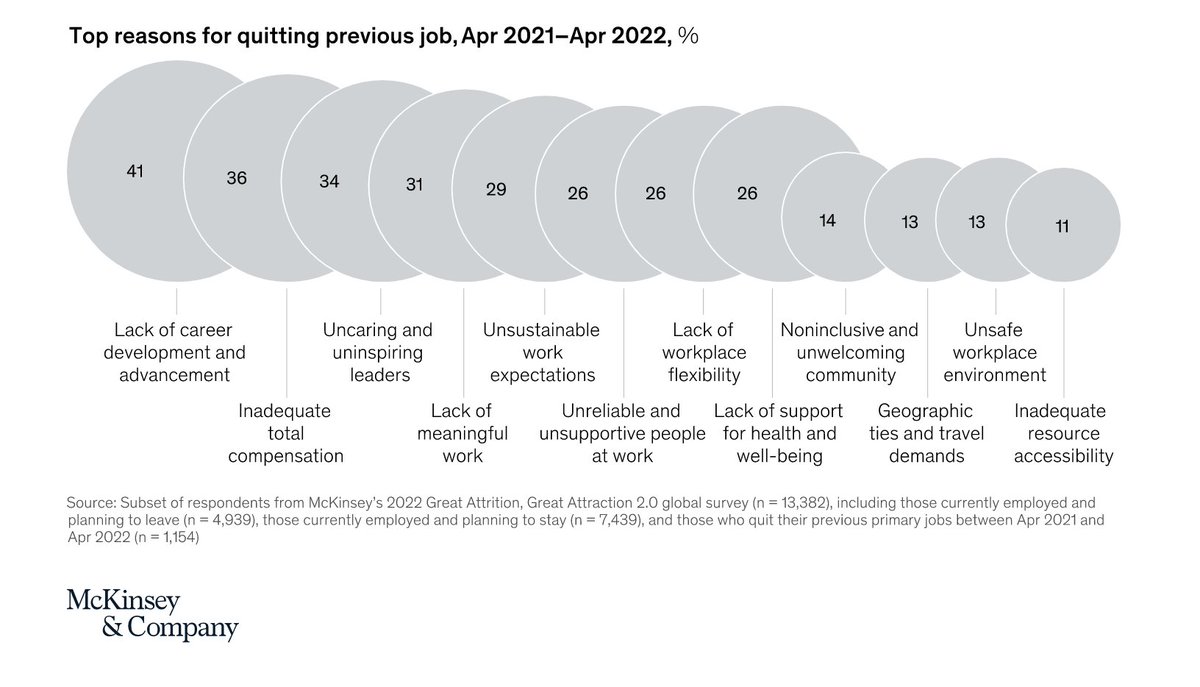

Lack of career advancement and development is now the top reason why people leave their job according to a new McKinsey study.

One day after the 50 bps hike from the ECB, German manufacturing data are cratering. The forward-looking orders - inventories component in the manufacturing PMI (blue) is well on the way down to the lows of the global financial crisis in 2008. Euro zone is going into recession...

Russia is flush with cash, given that its export revenues from oil and gas are through the roof. Russia's central bank is therefore cutting interest rates, while Ukraine is hiking in a desperate attempt to ward off devaluation and currency crisis. We are the enablers of all this.

Life goes by very fast. And the worst thing in life that you can have is a job that you hate and have no energy or creativity in.

THREAD on why "living with" frequent mass Covid infections is a BAD IDEA (& what we can do!): There is a negative feedback cycle for transmission & *each time* we go through it in a wave we damage our people, our NHS and our economy a bit more. let me show you how... 1/17

Gold prices in Japanese yen do not agree with the lower low seen in the dollar price plot. When they disagree, it is usually the price of gold in yen that ends up being right about where both plots are headed.

Bond market volatility is climbing to levels not seen since the Great Financial Crisis. 👀

The Euro zone is going into recession. Given that, Euro is far too strong & will weaken more. Two reasons it's not done so already: (i) ECB is still holding on to hikes; (ii) "parity" is a psychological threshold that markets are afraid of. Both things will fall by the wayside...

Many central bank balance sheets are set to shrink as tightening continues. 👀

Read to collect the dots, write to connect them

When economic activity slows, businesses start taking fewer new orders and inventories of unsold goods start piling up. That's what's happening now in the Euro zone, especially for countries closest to Ukraine, like Germany (DE) and Austria (AT). Euro zone recession is coming...

United States Trends

- 1. Thanksgiving 441 B posts

- 2. $cuto 7.492 posts

- 3. #MigglesArmy 2.933 posts

- 4. Custom 72,5 B posts

- 5. Dodgers 59,7 B posts

- 6. #WednesdayMotivation 4.899 posts

- 7. SKZ HOP UNVEIL UNFAIR 16,1 B posts

- 8. FELIX UNFAIR MV UNVEIL 16 B posts

- 9. Good Wednesday 27,5 B posts

- 10. Wrecking 14,7 B posts

- 11. UNTITLED UNMASTERED N/A

- 12. #sociprovider N/A

- 13. DB Cooper 3.687 posts

- 14. #27Nov 3.825 posts

- 15. Landman 3.466 posts

- 16. Sharon Stone 24,2 B posts

- 17. Hump Day 14,4 B posts

- 18. #WednesdayWisdom N/A

- 19. Snell 38,9 B posts

- 20. Cutoshi N/A

Something went wrong.

Something went wrong.