Similar User

@_red_pill_

@Sinderella_eth

@CHEEZKING_WSK

@man1eth

@LL99557158

@baliislandhorse

@0xWilf

@MumfordThorgal

Forward this video to friends & family to understand just how evil the government has been

Marc Andreessen just shocked the world on JRE. He revealed the government is: • Kicking people off banking networks • Using NGOs to do their dirty work • Secretly trying to control AI I took a day to digest it all... And these are the 11 things I can't stop thinking about:

🚨Win an Antminer S21 + 1 Year of Free Hosting🚨 ~$8,400 of value! How to enter? Like, RT, Follow, and Sign up for the Blockware Marketplace = 1 Entry Buy an ASIC on the Blockware Marketplace = 10 Entries The giveaway runs through the end of January. Good luck!

Whats "next", after BTC ETF [assuming BTC doesnt shit the bed]: 1. ETH ETF narrative, benefits LSD's and L2 tokens 2. Eyeballs back on unlaunched L2s to play same games again [memecoins, defi on zk, scroll, strk] 3. Restaking tokens [Eigenlayer and others] 4. BTC "ecosystem"

As someone who works in crypto, but has a background in both reinsurance and tradfi, I have some views here. To give a little background, I've been involved in the tokenization of assets at scale, I've traded all kinds of fixed income, and I've managed one of the largest ILS…

We’ve gotten RWAs all wrong. The future of RWAs aren’t copy-paste of tradfi assets, inheriting the inefficiencies of the old system. The RWA mega-protocols of 2030 will leapfrog tired off-chain infrastructure and: A) Solve an actual, non-fugazi non-legerdemain problem for…

The 48 Laws of Power is a modern classic. Not a day passed where I hadn't thought about the ammoral relevations backed by historical examples Some highlights 👇👇👇

1/ Just finished reading the draft plan of reorganization filed by FTX (i.e. JR3 and team). Headline points: - US and Intl recover from separate pools - Maybe restart FTX Intl - Crypto claims going to be assessed in USD at Ch 11 date - Mostly waffling Quite disappointing.

88% of the digital currency Prime Trust holds is $AUDIO

So BlackRock, Citadel, Deutsche Bank and NASDAQ have all started to enter the crypto space in the last week. They've bullied out participants so they can scoop up cheap coins. The trajectory for crypto has never been more clear.

After the Celsius claims deal, there’s a big question: “What could FTX2.0 learn from it?” What if you combined ideas from both the Celsius deal and the 2016 Bitfinex IOU token deal? What might it look like? Here’s an FTX2.0 🧵 to spark ideas 👇 pls share+comment. Never know!

The Celsius plan is a great example of what an FTX2.0 deal could look like. Headlines scream "creditors get tokenised equity" but the deal isn't as good as what some fantasize for FTX2.0. But it also isn't terrible. Restructurings require compromise. May do deep dive.

1/ BREAKING: The U.S. Chamber of Commerce has just filed a brief in the @Coinbase v. SEC case, calling out the SEC for acting "unlawfully" in the digital asset space. This is The U.S. Chamber of Commerce--not the Chamber of Digital Commerce. This is a Big Deal. Here's why...

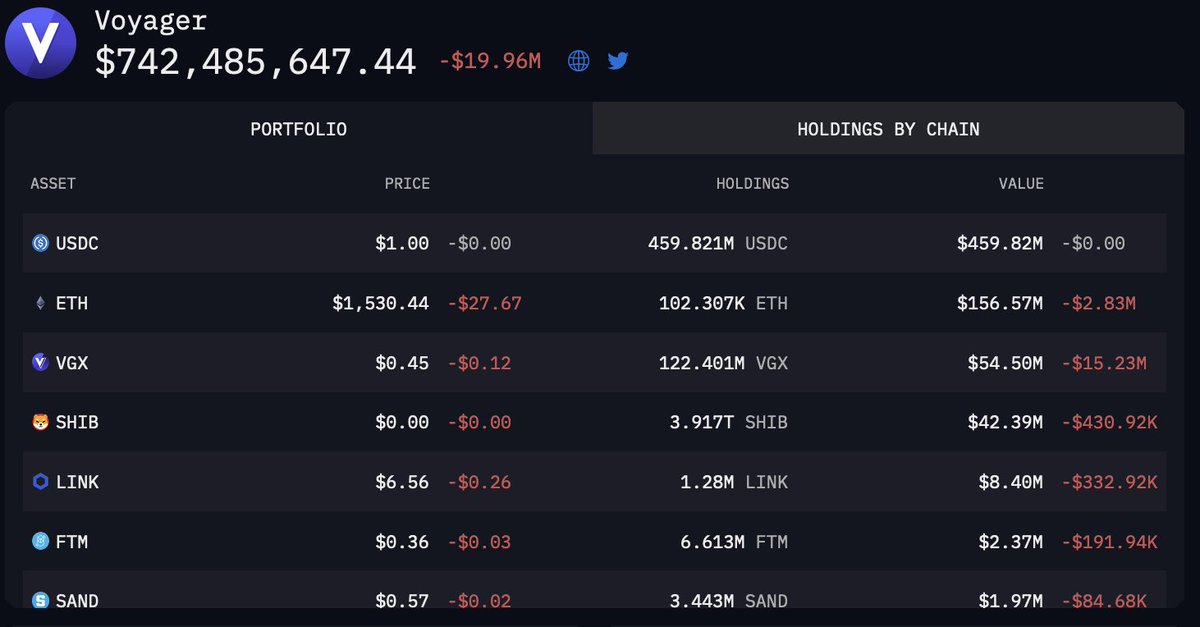

Pour one out for Voyager creditors FTX gonna save us🙏 FTX implodes 💀 Binance gonna save us 🥳 US blocks sale 😳 Court allows sale to go through 😩🙏 Binance pulls out 🪦

[DB] Crypto Lender Voyager Says Received a Letter From BINANCE.US Terminating the Asset Purchase Agreement

AI Drake drops another one. Winters Cold by Lvcci ai.

For two years, Democrats gave @GaryGensler a pass for his disastrous agenda. It's time for accountability. From his destructive climate disclosure rule to his regulation by enforcement of digital assets, Chair Gensler’s agenda has weakened capital markets & stifled innovation.

Chairman @PatrickMcHenry wasted no time taking @GaryGensler to task at today's hearing. "We have a constitutional duty to conduct oversight of the agencies under our jurisdiction and we will continue to do so aggressively." Read more: financialservices.house.gov/news/documents… 📺 Watch👇

Andrew Kang’s net worth is $200mill+ You can track his portfolio live. Invest like Andrew in 7 steps: 🧵👇

Some of this year's biggest pumps have been driven by aggressive Korean bidding. $APT and $ARB are recent examples. I've found a method that you can use to spot Korean pumps EARLY. 🧵: Here's your full guide.👇

[DB] US Govt Sold 9,800 BTC on March 14, Intends to Sell a Further 41,500 BTC Connected to Silk Road in Four Batches Over the Course of the Year: Court Filing

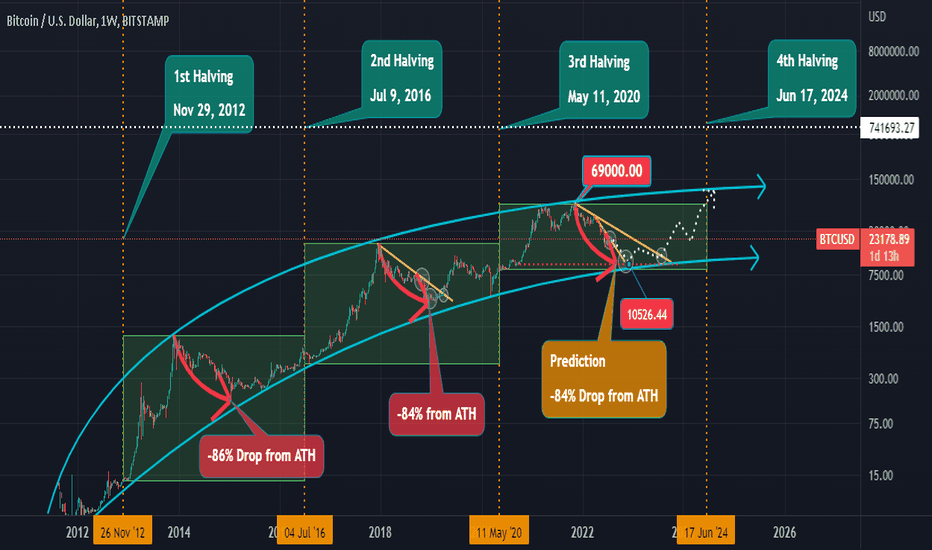

$BTC Halving: Do you want DCA or stay poor Halving cycle returns: 1st cycle: 50,000% 2nd cycle: 12,000% 3rd cycle: 2,000% 4th cycle (expected): April-May 2024 As with all new assets (Bonds, Commodities, Derivatives, etc) as adoption continues it leads to lower volatility. 1/n

Hope everyone is enjoying themselves on this fine day.

Voyager is in the process of liquidating their on-chain assets. They are currently sending 7-8 figures of crypto to Wintermute and Coinbase addresses daily. They have over 100K ETH remaining to sell off - that's over $150M! Arkham will be dropping a deep-dive at 12:00 EST.

United States Trends

- 1. Cowboys 51,3 B posts

- 2. #FranklinFire 1.284 posts

- 3. Nikki Giovanni 34,9 B posts

- 4. Luigi 890 B posts

- 5. Cooper Rush 7.147 posts

- 6. Micah Parsons 5.016 posts

- 7. Leon Lett 1.638 posts

- 8. Chase 88,9 B posts

- 9. Chase 88,9 B posts

- 10. #WWERaw 83,1 B posts

- 11. Malibu 3.355 posts

- 12. Cillian Murphy 2.885 posts

- 13. 28 Years Later 4.947 posts

- 14. Tee Higgins 8.160 posts

- 15. #CINvsDAL 13,2 B posts

- 16. Jerry Jones 2.305 posts

- 17. She's 12 11,3 B posts

- 18. Nobel 41,7 B posts

- 19. Overshown 4.316 posts

- 20. Mike McCarthy 1.478 posts

Something went wrong.

Something went wrong.