Similar User

@StefanS41838114

@RashadKerimov3

@StopLossMasterr

@Medd_04

@4kkA707

@angxxxlna

@secondbestracer

@LoLo3PK2

@A_aron215

[𝗣𝗗𝗙] ICT 2024 Mentorship Lecture 1-10 [15+ Hours] Notes / Key Points Co Partner @drrajmmxm Like + RT + Comment "Notes" to receive the link (𝗠𝘂𝘀𝘁 𝗯𝗲 𝗳𝗼𝗹𝗹𝗼𝘄𝗶𝗻𝗴 𝗺𝗲 𝘀𝗼 𝗜 𝗰𝗮𝗻 𝗗𝗠) Community Link :-bento.me/theictconcept

![theictconcept's tweet image. [𝗣𝗗𝗙]

ICT 2024 Mentorship

Lecture 1-10 [15+ Hours]

Notes / Key Points

Co Partner

@drrajmmxm

Like + RT + Comment "Notes" to receive the link

(𝗠𝘂𝘀𝘁 𝗯𝗲 𝗳𝗼𝗹𝗹𝗼𝘄𝗶𝗻𝗴 𝗺𝗲 𝘀𝗼 𝗜 𝗰𝗮𝗻 𝗗𝗠)

Community Link :-bento.me/theictconcept](https://pbs.twimg.com/media/GeMuA97agAE8755.jpg)

In this THREAD I will explain "Market Structure" 1. Bullish MS 2. Gaps 3. Fibonacci 4. Timeframes 🧵(1/13)

Your losses don’t define you, reaction does Every loss is a lesson in disguise,The secret is not to repeat the same mistake twice

Bull market money flow: $BTC> $ETH> ALTS > MICROs > REPEAT This is outdated. The current money flow cycles are more nuanced, Here's a Full Guide:

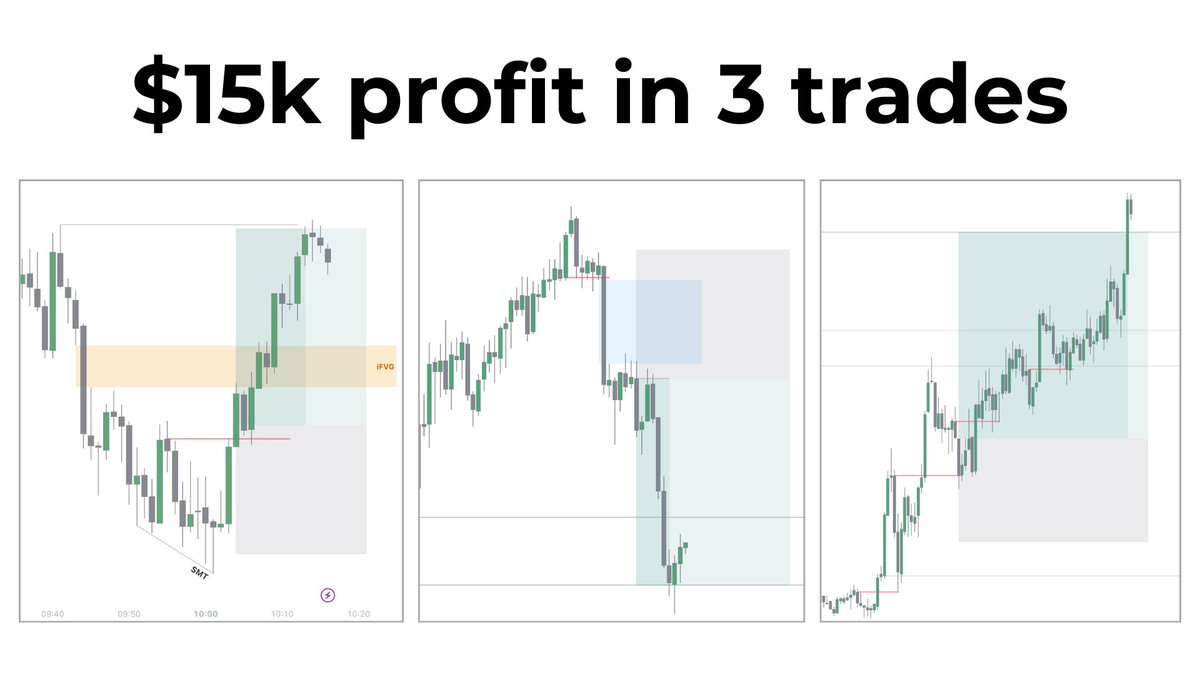

Best CISD setup all day. I didn't take this, but my students managed to catch it. 2 entries given based on CISD.

Trading is simple 1. Find your TARGET on the Daily 2. Hunt the SETUP on 4H 3. Enter the trade on 15 minutes Liquidity = Target HTF > LTF

LS + HTF PDA + LTF CISD + SMT + 1 trade a day + 9:50 macro + sizing up on A+ setups will make all of us rich. Process > Profits. One setup for life.

from my recent livestream, these are the five most important lessons economic calendar top-down analysis managing losses risk management simplifying price all covered in detail below:

I made $15k profit in 3 days. With that, I managed to pass all 5 funded challenges publicly. I only used my CISD Model and called all trades beforehand. And I spend less than 90 mins a day on the charts. Here's a breakdown of the trades I took and why 🧵

Time Based Liquidity and The High Probability Model Like,Retweet and Comment 'Liquidity' for the PDF which has bunch of examples 1/10 🧵

Johnny Somali and his friend get attacked by Koreans

$XAUUSD Trade Idea -Weekly IRL-ERL -H4 Single Candle Double Purge -Tuesday Low Of The Week -Daily IRL TAG W SMT -CLASSIC BUY CANDLE ON WEEKLY 🔑

Weekly Review Week of October 13 Double Purge+PO3+NARRATIVE COMPILATION 🔖 SAVE IT FOR FUTURE USE

ICT Swing Formation. Since 2011 ICT has taught me that even when we are in Bearsih Ordeflow, if I get this swing formation and trade 4th day, I can get no problem an easy entry and target trading within Po3. Very powerful, don't take my word for it go and look for it in charts.

The top 4 ICT trading strategy: -CRT -Power of Three -Quarterly Theory -MMXM Look at each of them, see their similarities, Look at when price reversed etc. ICT has never been divided, just different perspectives to understand the AMD framework (The Foundation of ICT CONCEPTS)

Institutional Order Flow and Liquidity Concept - Identify your Point of Interest - Trade Liquidity to your Next Interested Zones If a POI failed, Trade Order flow into theNext POI I shared all the Setups and Bias on the Telegram Channel x.com/TpwithPolarity…

Orderflow is a concept that observes liquidity interaction This is exactly how to spot it on your Chart and take advantage of it 1. Have a Directional Bias 2. Identify the liquidity Sweep ( swing high and Swing Low Sweep ) 3. Market Efficiency ( Is price trading into the…

United States Trends

- 1. #UFCTampa 52,9 B posts

- 2. Colby 23,7 B posts

- 3. Buckley 16,4 B posts

- 4. Heisman 154 B posts

- 5. Jeanty 69,7 B posts

- 6. Cub Swanson 5.629 posts

- 7. #SNME 171 B posts

- 8. Travis Hunter 122 B posts

- 9. Munguia 5.996 posts

- 10. Kape 7.638 posts

- 11. Hulk Hogan 3.388 posts

- 12. #UFCFightNight 1.297 posts

- 13. Canelo 2.310 posts

- 14. Usman 16,4 B posts

- 15. Yanez 6.873 posts

- 16. Billy Q N/A

- 17. Deion 13,8 B posts

- 18. Sengun 6.182 posts

- 19. Petrino 2.916 posts

- 20. Jacoby 4.416 posts

Something went wrong.

Something went wrong.