Belle

@lotoh1964If you compare achieving success to reaching for the sky, self-study is the ladder of success.

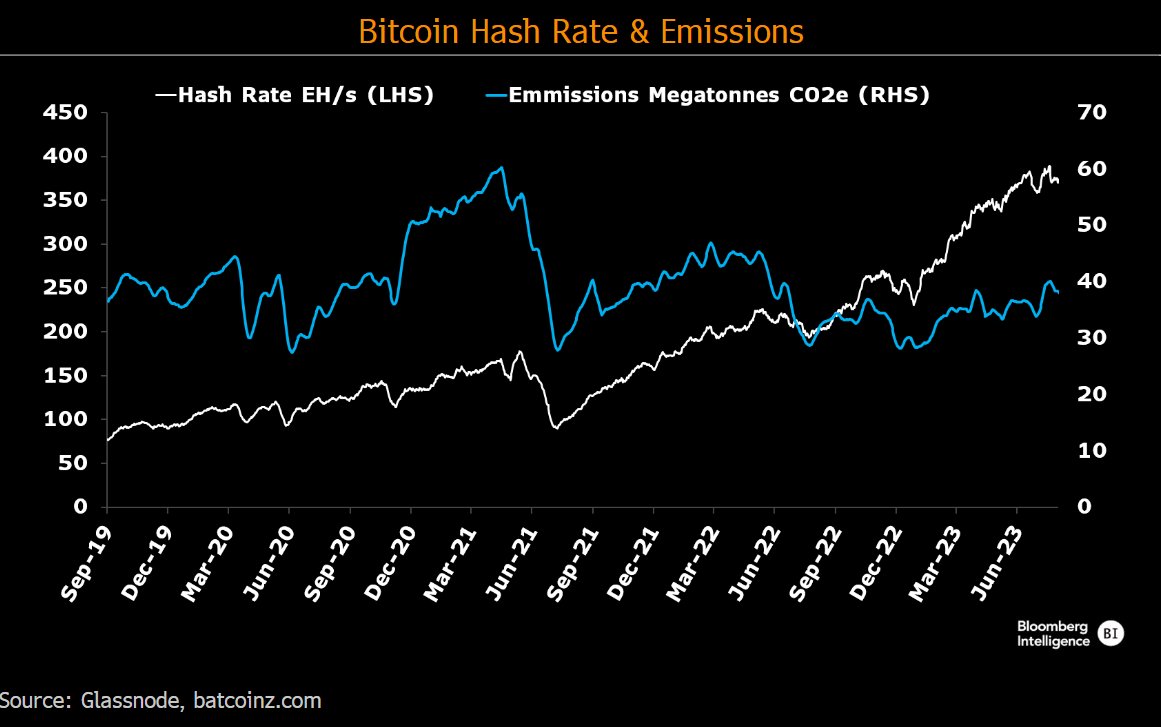

JUST IN Bloomberg Intelligence concur the models & charts developed by @woonomic and myself are more accurate than the Cambridge model, as they factor in offgrid mining and flare gas mitigation x.com/Jamie1Coutts/s…

Emissions Decline as Energy Use⬆️ 👉Despite 4x Hashrate, carbon emissions (blue) are only⬆️6.9% since 2019 🤔Remember, Miners don't "emit" but are consumers of purchased electricity (similar to EVs)

This is a blog sized post, explaining why the rise in size and liquidity of paper BTC markets is an enemy to BTC. And answers why a spot ETF was held back for so long.

Preston, this only matters in margin spot markets. Shorting gold or BTC on spot requires someone to lend the underlying asset. Pull the asset off the exchange and nobody can borrow it to margin short. But what I refer to is futures markets. I can put in USD collateral and sell…

It was a challenging task at TOKEN2049 in Singapore, but in the end I did manage to deliver a ~20 min talk on how on-chain data makes your love life better. youtube.com/watch?v=G2rgXt…

Ever since I opened up DMs, I too hope to be rich like Satoshi.

Willy Woo (@woonomic) joins me to discuss the nature of money, Bitcoin's utilization of new and cheap energy sources, how derivatives and futures markets affect Bitcoin’s price, and the macroeconomics of #Bitcoin.

575 : 1 success rate for BlackRock ETF approvals. Has anyone validated this number? Bullish if true.

BlackRock's record for ETF approvals is 575 wins - 1 loss. You can't argue with that track record, and analysts predict an ETF approval is imminent by early 2024. (9/10)

Investment in landfill methane mining of BTC, generating a healthy yield, will be tranformative. @DSBatten explains with hard data how #Bitcoin is a low hanging fruit to mitigate the world's carbon, and in doing so could increase BTC market cap by 3-6x. youtube.com/watch?v=Hheeou…

Argentina gets a pro-Bitcoin president.

Holy sh*t. Argentina just elected Javier Milei as their next president. History has been made today.

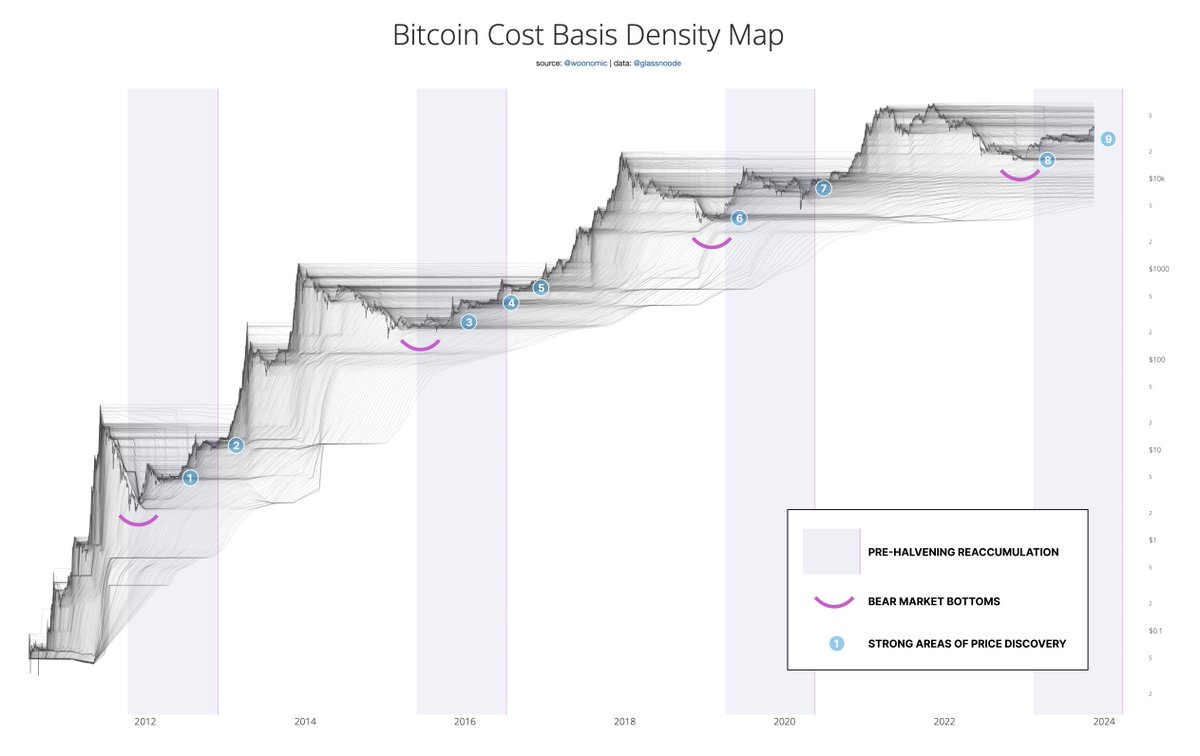

We'll probably never see BTC going below $30k again if this on-chain pattern holds true... (8 for 8 so far) What you see here is #Bitcoin's price discovery across 13 yrs. It's a contour map the BTC supply according to the price HODLers paid for their coins, and how it changed…

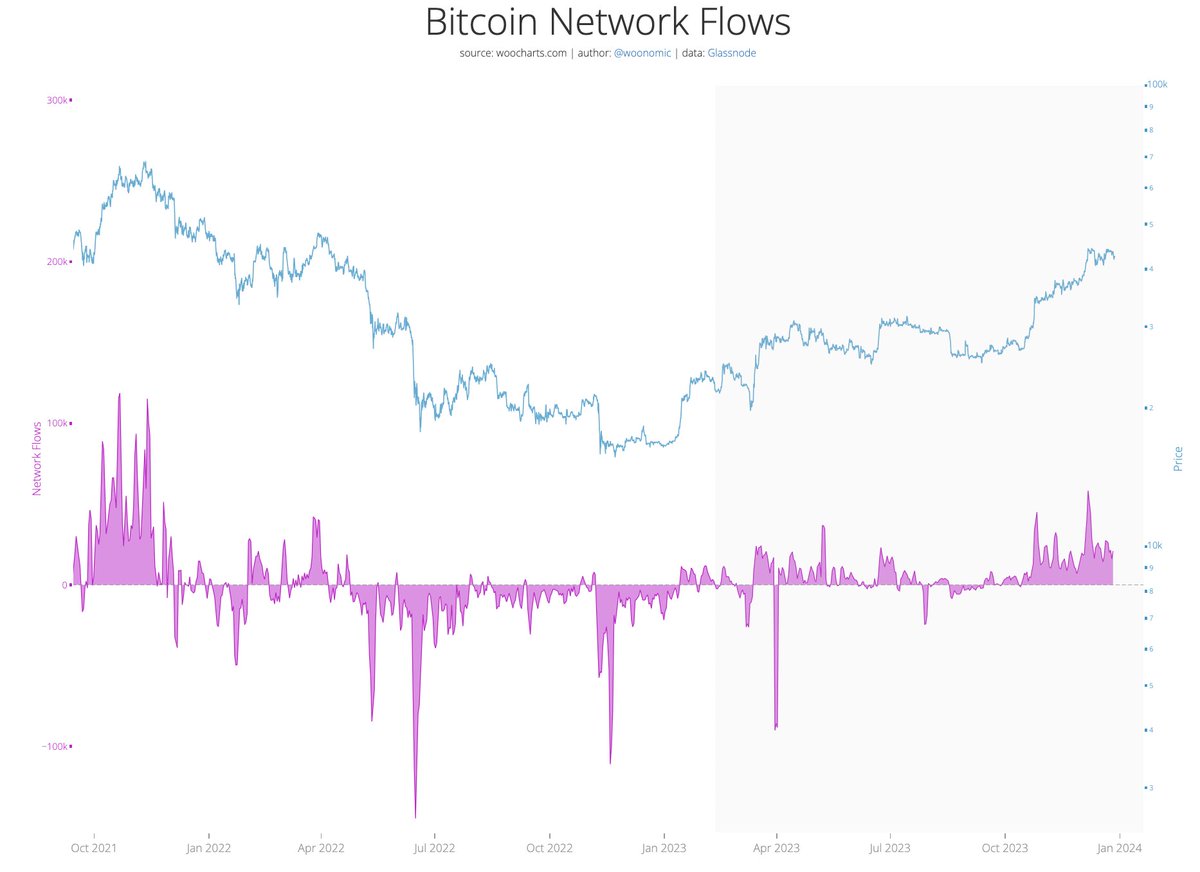

#Bitcoin flows presently making a strong flip to moving off exchanges again. I haven't seen such a swing towards buying since the market bottom.

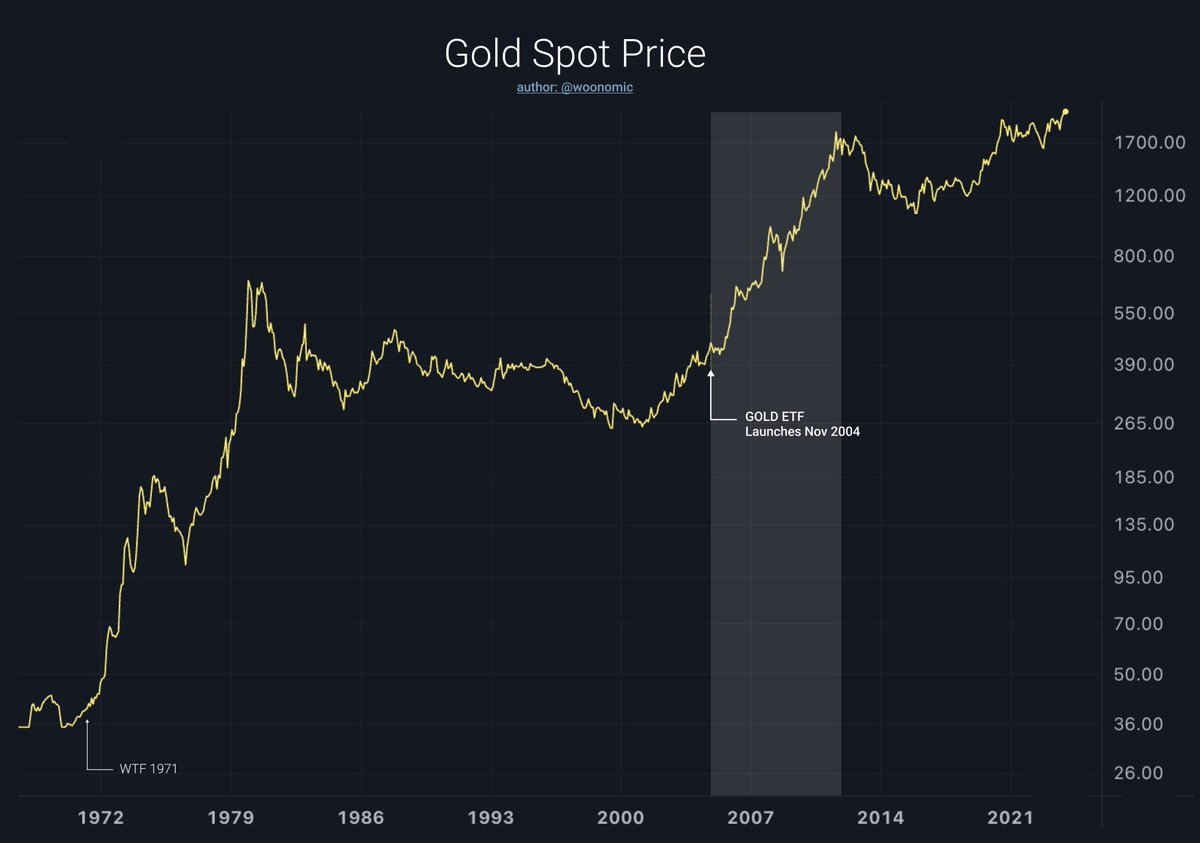

It's very likely we are on the eve of a #Bitcoin spot ETF. The first commodity ETF was SPDR Gold Trust. It provided a simple way for investors to access gold in their portfolio. When it launched gold went on to an 8 year rally with no single down year between 2005 - 2012.

The #Bitcoin CME Gap at 39.7k... By my count 28 out of 30 gaps have been filled on CME daily candles (93%). The other unfilled gap is pictured in the lower left of this chart also.

The BULL case for #Bitcoin - Rates dropping - Global liquidity returning - DXY peaking - Spot ETF imminent - Impressive public company treasury demand for BTC indicated by $MSTR buying appetite - paper BTC on the decline - @PeterSchiff noting Gold at ATH but not BTC -…

BTC market in a nutshell, 2023 update: Long term price is determined by investment and adoption. Short term price is a random walk in the direction that liquidates the most traders on Binance.

BTC market in a nutshell: Long term price is determined by investor activity and adoption curve. The domain of on-chain fundamentals. Short term price is determined by a random walk of pivots in the direction of liquidating the most traders on BitMEX.

Dear @SenWarren, I wish I didn’t have to repost this, but it’s pinned for a reason. My kids and I built a Raspberry Pi as a computer science project. We run it as a #Bitcoin node, for fun and educational purposes. Under your proposals, my kids are therefore classified as a…

@SenWarren these are my daughters, flipping a coin to generate a 256 digit binary number. We converted this to hexadecimals, generated a bitcoin private key, and created a wallet. No KYC was, or will ever be, required.

It's the eve before the BTC spot ETF. The day is coming fast when #Bitcoin becomes a mainstream bucket for wealth allocation. When that day comes, the top 1% most wealthy will hold 0.87 BTC***. That's how little of it there is to go around. **Assumes 5% allocation.

One of my favourite on-chain indicators is the increase or decrease in realised cap, which measures the capital being stored by the #Bitcoin network. We are in a region where money is being poured into the network at an increasing rate.

Long demand in the system is getting frothy. The basis trade*** on BTC perpetuals is earning 75% right now, a level unseen since the 2021 bull market. *** buying spot BTC while shorting perpetual futures in a hedged trade to collect the funding rate paid by bullish speculators

United States Trends

- 1. Colorado 52,3 B posts

- 2. Kansas 26,7 B posts

- 3. Ole Miss 31,8 B posts

- 4. Devin Neal 2.604 posts

- 5. Travis Hunter 9.516 posts

- 6. Indiana 61,8 B posts

- 7. Gators 18,8 B posts

- 8. Jaxson Dart 6.860 posts

- 9. Penn State 7.922 posts

- 10. Ewers 2.018 posts

- 11. Shedeur 7.521 posts

- 12. Shedeur 7.521 posts

- 13. Ohio State 40,7 B posts

- 14. Olivia Miles 1.713 posts

- 15. Sark 2.869 posts

- 16. Wayne 141 B posts

- 17. Heisman 7.683 posts

- 18. Fickell N/A

- 19. Minnesota 16,7 B posts

- 20. Nissan 23,5 B posts

Something went wrong.

Something went wrong.