Similar User

@takashi_murabit

@ctd_hmuz

@38blackswan

@0Jgajgbjgg

@100flowers_m

@btem2ntxLeHxKuu

@ensaigaisai

@UKS_BOJ

@tanki_shijo

@vabosan2008

@kankigunso

@JgbYoshi

@bunkytonky

@bozan_bot

@wtf_ami

BREAKING: Central banks bought 60 tonnes of gold in October, the largest monthly net purchase so far in 2024. Meanwhile, China resumed gold purchases in November after a 6-month pause. This year alone, India and Turkey have purchased 77 and 72 tonnes of gold. Central banks…

大統領選は、まずは、この5州の結果だけをみてればよいかと。fivethirtyeightの開票進捗予測をふまえると日本時間では NC州 11/6(水)10:30頃 GA州 11/6(水)12:30頃 MI州 11/6(水)13:30頃 ※集計を早める規則変更しているので期待も込めて WI州 11/7(木)15:00頃 PA州…

OOPS! #China’s central bank didn’t buy any gold for a 2nd month in June. Bullion held by the People’s Bank of China remained at 72.8mln ounces. The central bank opted not to add to reserves in May, ending an 18mth buying spree that helped push Gold prices to their highest ever.…

Ever notice that when the household survey is stronger than the establishment survey, nobody mentions it? Remember that next time the household survey is weak and someone tells you that's a harbinger of doom. It's not. The household survey is a noisier version of the…

New York Fed President John Williams says monetary policy is “the most restrictive in 25 years” Nevertheless, “I expect it will be appropriate to maintain a restrictive stance for quite some time” newyorkfed.org/newsevents/spe…

Total US Debt just crossed $33 TRILLION China and Japan are dumping US treasuries at a record pace This won’t end well A thread 🧵

US Treasuries, already in a brutal rout, are poised to suffer when the world’s last negative interest-rate regime in Japan comes to an end, Bloomberg survey shows trib.al/aA8v7K2

The US government paid $711 billion on net interest payments this year, according to the CBO. This is an increase of $177 billion, or 33%, from fiscal year 2022. Average interest rates on Federal debt have gone from 1.5% in 2022 to nearly 3.0% today. Annualized US interest…

US govt interest payments per day have doubled from $1bn per day before the pandemic to almost $2bn per day in 2023, Apollo's Slok has calculated.

Typical macro cycle turns are slow to start, but they all end in recession. The current modest rise in unemployment is about median for a year in since YC inversion compared to post-war cycles. But it’s usually in this time frame where things start to get interesting:

Dallas Fed President Lorie Logan, who has been at the hawkish end of the FOMC, takes seriously the recent run-up in Treasury yields and term premiums, in particular. Her conviction about the need to hike again sounds like it is diminishing as a result. dallasfed.org/news/speeches/…

BRICS DUMPING 🚨 $17,400,000,000 in US Treasuries Dumped by BRICS Nations China, Brazil and Saudi Arabia in One Month New numbers from the U.S. Treasury Department show China’s ownership of Treasury securities dropped from $835.4 billion at the start of July to $821.8 billion…

Almost every hard landing looks at first like a soft landing What's standing in the way of a soft landing now: -The Fed staying too high for too long -A too-hot economy -A rise in oil prices -A financial market rupture "Planes land. Economies don't." wsj.com/economy/centra…

1/11 Banks are in a pretty bad spot when considering the unrealized losses on securities at FDIC-insured commercial banks rose +$42.9bn to $558.4bn in 2Q23 (+8% QoQ), following two consecutive months of declines. Stated differently, of the $5.089tn in total securities held by...

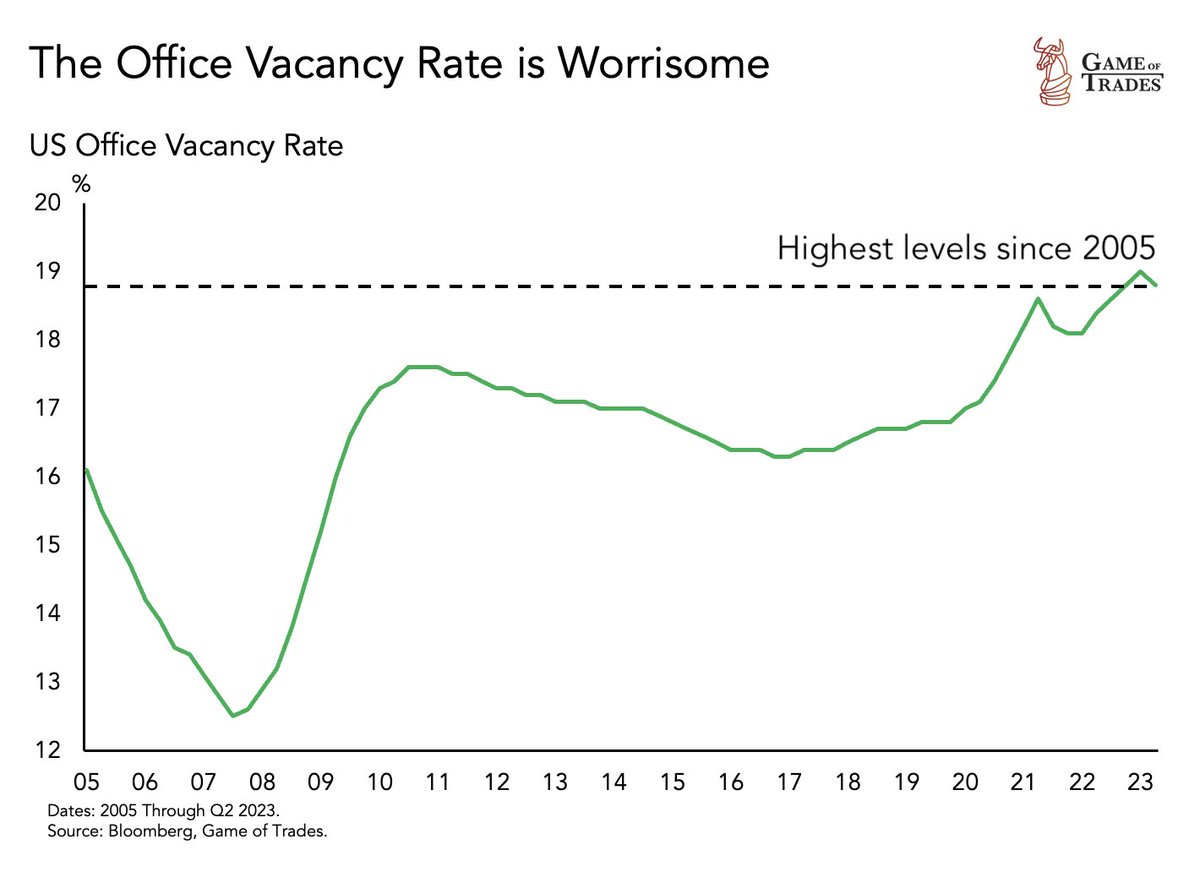

US office vacancy rate just hit record highs A storm is coming for regional banks A thread 🧵

“Unrealized Losses” on Bonds Held by Banks

Mortgage demand has fallen to Dec 1996 levels With mortgage rates skyrocketing And the Fed still keeping rates high The housing market is in a tough spot

Student loan payments are set to resume in October for the first time since 2020. There are now a total of 45 million people in the US with student loans and $1.6 trillion of student loans outstanding. The average monthly student loan payment is ~$200. This means roughly $9…

Warning: Bankruptcy filings have spiked to levels last seen during C19 and the Financial Crisis

The Cleveland Fed updated their inflation nowcast this morning. August CPI is now projected at 0.79%, pushing the YoY to 3.82%. September CPI is now projected at 0.45%, pushing the YoY to 3.91%. Driving this has been the rise in gasoline prices. Yes, the Cleveland Fed has…

United States Trends

- 1. #IDontWantToOverreactBUT N/A

- 2. #mondaymotivation 23 B posts

- 3. #Superman 23,5 B posts

- 4. Good Monday 52,5 B posts

- 5. #SkylineSweeps N/A

- 6. Victory Monday 1.836 posts

- 7. Big Bass Xmas Extreme N/A

- 8. #HALLUCINATION 24,3 B posts

- 9. John Williams N/A

- 10. Immanuel 5.254 posts

- 11. Burna 32,7 B posts

- 12. Boston Tea Party 2.749 posts

- 13. $PENGU 22,5 B posts

- 14. Jerod Mayo 1.946 posts

- 15. Trump 2028 9.879 posts

- 16. MARK LEE 87,9 B posts

- 17. Mona Lisa 42,8 B posts

- 18. Feliz Navidad 23,5 B posts

- 19. benny hill N/A

- 20. Carti 47,6 B posts

Who to follow

Something went wrong.

Something went wrong.