jevgenijs Kazanins

@jevgenijjsI write about publicly traded fintech companies at https://t.co/m51plasvt6.sometimes I write about banks too.And visa.Not financial advice

Today’s @PopularFintech letter is my attempt to understand the opportunity behind Square Banking $SQ. Square is competing with the giants, Chase and American Express. It won’t be easy, but…wasn’t it the whole premise of Fintech, to replace the incumbents? popularfintech.com/p/the-opportun…

Every question on Natwest $NWG earnings call is like 10 minutes long. Not sure that would fly with American banks.

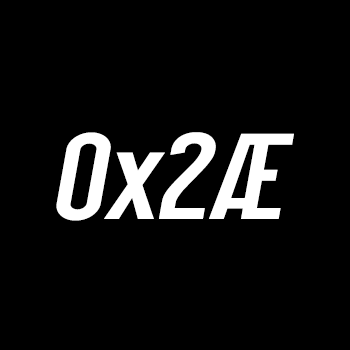

People just love chats, human or AI-powered 👉🏻 American Express $AXP: “We are seeing a decline in the number of total phone calls and an increase in customers who choose to leverage our chat channel to complete their servicing request.”

American Express $AXP: “Our Agile Partner Platform or APP, gives Fintechs and other partners a more seamless way to launch cards on our network. Square $SQ was one of the first cards launched with APP. APP offers access to Amex Offers, presale ticketing and dining benefits.”

American Express $AXP Investor Day 2024: “We’re expanding the use of partners like Stripe, Adyen, SumUp to accelerate coverage and card acceptance [ outside of the U.S. ]”

American Express $AXP: “Our largest 15 countries comprise 57% of the total international card payments revenue pool. Our top 5 countries, Australia, Canada, Japan, Mexico and the U.K., represent 33% of that pool.”

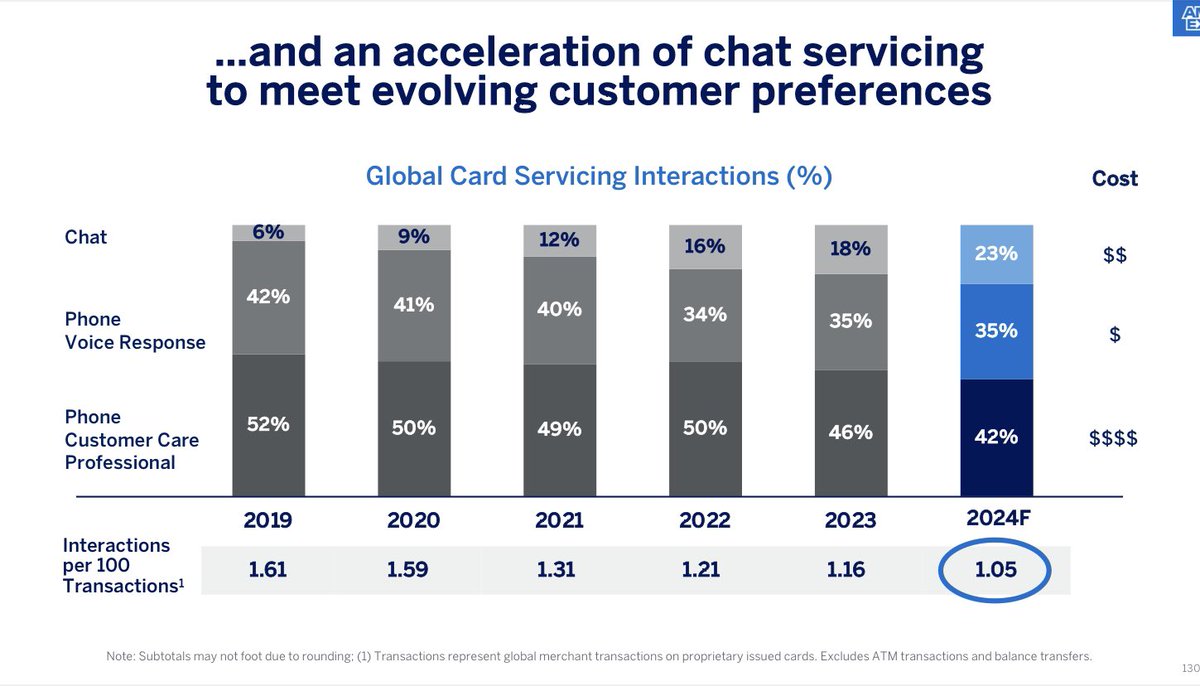

American Express $AXP Investor Day 2024: “At the end of 2023, we had a 31% share of all small business card borrowing…and a 47% share in overall card spend”

American Express $AXP: “We’re also building new ways to partner. Amex Sunc provides standardized APIs, enabling early-stage companies to utilize Amex capabilities, ensuring that our card customer will noy need to choose between Fintechs or Amex card program.”

American Express $AXP Investor Day 2024: “33% of all small business payments in the U.S. are still made via paper check (down from 67% in 2010)”👇🏻

American Express $AXP had a 45.8% share of all small business card spending in 2019. In 2023 that share increased to 47.1% 👇🏻

American Express $AXP Investor Day 2024: U.S. consumer credit card billings are projected to grow 8% annually until 2026 👇🏻

American Express $AXP Investor Day 2024: “When you compare our younger customers to their industry peers, you see that the subset we attract are far more premium across a number of dimensions. They have higher average incomes, higher average spend and higher credit quality.”

American Express $AXP created a slide for its investor day to illustrate that in the time of difficulty, people first pay to American Express (“AXP customers on AXP Products”), and only then to competitors (“AXP customers on non-AXP products”). That’s a flex 👇🏻

American Express $AXP Investor Day 2024: “Our revenue model is the opposite of the top 5 issuers in the U.S. Our premium product strategy delivers significantly higher average annual fees and annual spend versus competitors.”

American Express $AXP Investor Day 2024: “Our customers spend a combined $1.5 trillion per year across 80 million cards in force, which can be used in 202 countries and territories.”

“Capital One Financial Corporation $COF and Walmart $WMT announced that they have ended the agreement that made Capital One the exclusive issuer of Walmart Consumer Credit Cards.”

“Capital One will retain ownership and servicing of the credit card accounts. Additional information will be provided in the coming months to Walmart credit card holders.”

United States Trends

- 1. CASSANDRA 26,9 B posts

- 2. #SmackDown 95,3 B posts

- 3. CM Punk 25,7 B posts

- 4. Paul Heyman 10,8 B posts

- 5. Khalid 29,7 B posts

- 6. #OPLive 3.749 posts

- 7. #TorontoTSTheErasTour 55,6 B posts

- 8. Jared McCain 14,5 B posts

- 9. I DID SOMETHING BAD 15,3 B posts

- 10. Chaz Lanier 1.897 posts

- 11. Creighton 5.234 posts

- 12. IDSB 4.025 posts

- 13. Kendrick 887 B posts

- 14. #BlueBloods 2.843 posts

- 15. Bianca 18 B posts

- 16. Caleb Love N/A

- 17. Bayley 5.187 posts

- 18. MSNBC 292 B posts

- 19. Baylor 5.874 posts

- 20. #OPNation 1.963 posts

Something went wrong.

Something went wrong.