Pavel Hála

@halapavFounder of https://t.co/XLWivbb0oC. Astrophysics, ML, AI, deep learning, algorithmic trading, market making. Tweets are commentary only. Not investment advice!

Similar User

@SpreadChartsCom

@DobreTrejdy

@KopacekInvestor

@opcni_tipy

@dominikkovarik

@LYNX_Broker

@Martin_ekonom

@klubinvestoru

@miroslavpitak

@homarih2007

@a_calvello

@CommodityImpVol

@Wolfmansblog

@cryptocupcake

@NationalWheat

In previous blog posts, I focused on Chinese weaknesses. So in the latest post, I outlined an optimistic scenario for #China 🇨🇳. Can it beat the #US 🇺🇸 in the game of geopolitical chess❓ Let's find out in the article 👇 pavelhala.com/posts/optimist…

While US natural #gas 🇺🇸🔥 price is consolidating, European prices have broken out! 🇪🇺📈 #ONGT #NG_F $UNG $BOIL $KOLD $FCG $AR $RRC $SWN

I've been thinking about this a lot lately. It could have a groundbreaking impact across commodities and would certainly affect my core outlook.

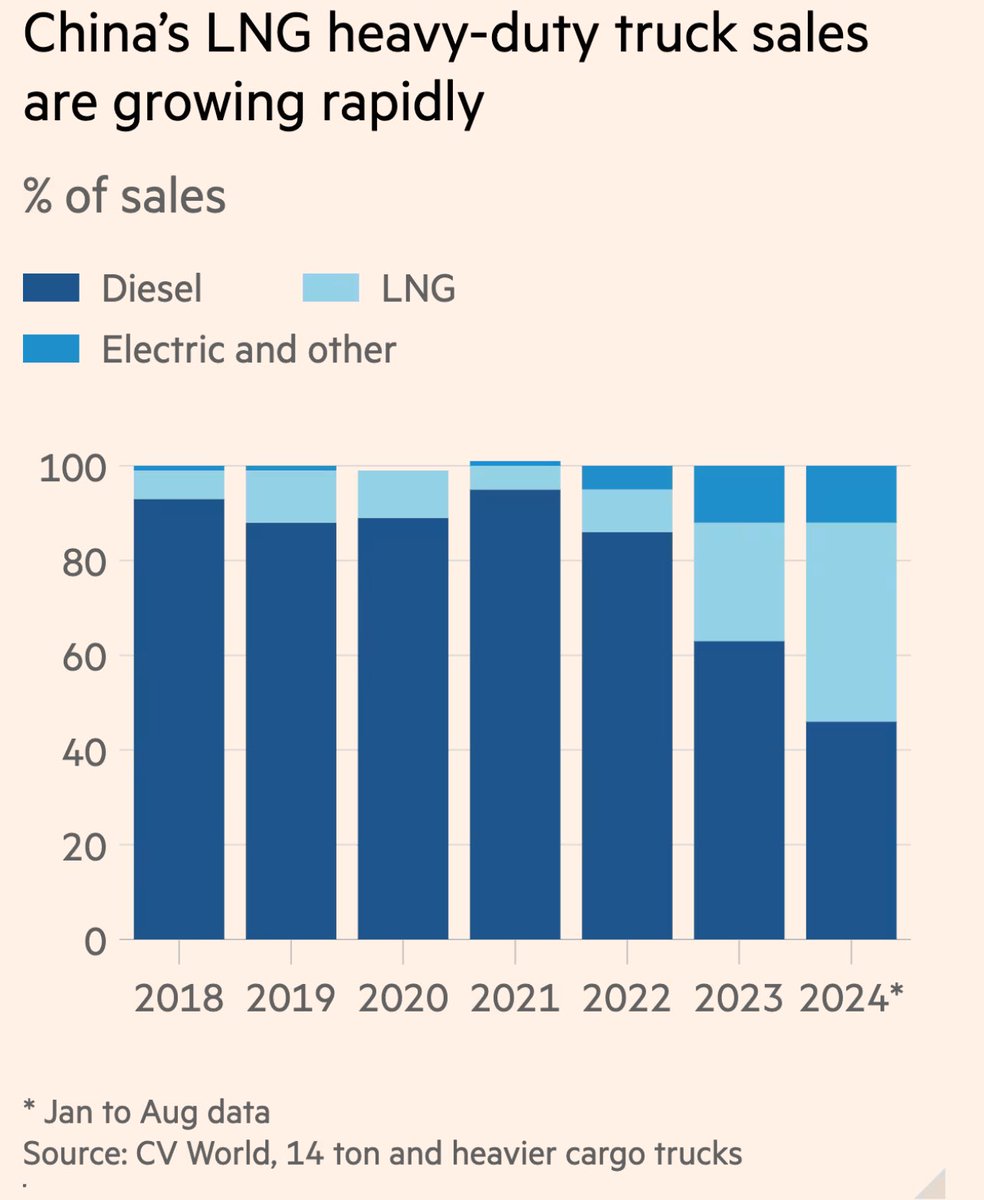

My view? 2023 was peak oil demand in China. Cars switch to coal (BEVs), trucks to LNG. It’s cheaper. “The country is flooded with cheap natgas from Russia,” Daimler Truck’s chief Daum told analysts in Aug. Sluggish truck sales & Daimler’s lack of a natgas engine made it an…

In previous blog posts, I focused on Chinese weaknesses. So in the latest post, I outlined an optimistic scenario for #China 🇨🇳. Can it beat the #US 🇺🇸 in the game of geopolitical chess❓ Let's find out in the article 👇 pavelhala.com/posts/optimist…

Could a war between the #US 🇺🇸 and #China 🇨🇳 break out? 💥 Sure! And who is likely to win that war❓ That's what my latest blog post tries to answer 👇 pavelhala.com/posts/who-woul…

I'm really glad I'm fully systematic. Discretionary traders probably suffer from unbearable FOMO these days.

This conversation made my day. Choosing the lack of scientific research as an attack vector against @ylecun is really dumb. Elon is going soft.

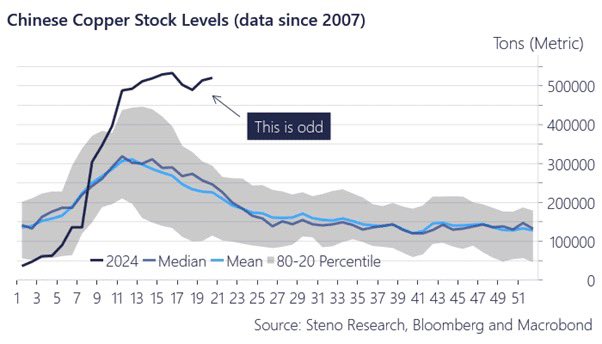

One of the preconditions for war between the #US 🇺🇸 and #China 🇨🇳 that I outlined 3 months ago seems to be playing out. Remember, it's just a precondition, not a trigger. Nevertheless, it's not a good sign. Chart by @AndreasSteno

I've decided to launch a personal blog where I can broaden my scope into topics such as #AI, #physics, #history, and #geopolitics. The first post is about the odds of a hot #war flaring up between the #US and #China. pavelhala.com/posts/us-china…

We are thrilled to announce that we have obtained a license to distribute market data for @SGXGroup #commodities! Learn more about the history of commodity trading in #Singapore and find out what new data from SGX we've incorporated into our app. spreadcharts.com/introducing-co…

The shift in Chinese behavior towards Taiwan I wrote about.

"Before '20, #China rarely entered #Taiwan's ADIZ. Last yr, that number >1,700...PLA forces rarely crossed the median line of the Strait before '22. Today, Chinese aircraft cross the line almost daily, leaving Taipei only minutes to assess 🇨🇳’s intentions" nytimes.com/2024/02/26/opi…

I've decided to launch a personal blog where I can broaden my scope into topics such as #AI, #physics, #history, and #geopolitics. The first post is about the odds of a hot #war flaring up between the #US and #China. pavelhala.com/posts/us-china…

This might provide a helpful context for the current bearishness. Or maybe not as it's just recency bias. From my own experience, everybody saw a recession coming in 2007. Just not THE recession.

2008 wasn't some cataclysm only a few geniuses saw coming. There were relentless bearish headlines for years (starting in 2006). It's not that nobody saw it coming. It's that after years of bearish headlines and the market going up, nobody took the bears seriously.

Here we are, half a year later. Not only am I being paid 5% p.a. to hold the safest asset in the world, but I'm also enjoying it as our local currency crumbles.

I own the safest asset in the world and even get paid 5% p.a. to do so. Meanwhile, I watch in disbelief as everyone tries to speculate on every little move in the markets and gets crushed in the chop.

Pavel believes the Wheat market is bottoming. We have posted today's interview with Pavel @spreadchartscom: bit.ly/3J34qCz @ForexStopHunter @PipCzar @SteliosConto @Vulgi @forexflowlive @kvanderschrick #FOREX #TRADING

I own the safest asset in the world and even get paid 5% p.a. to do so. Meanwhile, I watch in disbelief as everyone tries to speculate on every little move in the markets and gets crushed in the chop.

It's incredible just how strong herd instinct is. People go from "laser eyes" to Twitter checkmarks to AI self-image generators. The desire to belong and socially imitate to fit in is so strong.

Something gold bugs should think about.

Some investors have shunned equities & property for 11 years. Imagine the gains they had to forgo in order to stay invested in Gold. The opportunity cost has been extremely high, especially because the asset does NOT pay any income (dividend, interest, rent, royalty, etc).

United States Trends

- 1. Black Friday 751 B posts

- 2. Heisman 15,5 B posts

- 3. Travis Hunter 21,6 B posts

- 4. Jeanty 11,8 B posts

- 5. Raiders 32 B posts

- 6. #ChiefsKingdom 6.394 posts

- 7. Oklahoma State 8.127 posts

- 8. Wanya Morris N/A

- 9. Gundy 2.499 posts

- 10. Donovan Mitchell 1.425 posts

- 11. Fickell 2.081 posts

- 12. #HelluvaBoss 51,5 B posts

- 13. #VECTOR 2.069 posts

- 14. Chris Jones 1.167 posts

- 15. $VSG 9.314 posts

- 16. #TheOfficalTSTheErasTourBook N/A

- 17. hailee 5.389 posts

- 18. #LVvsKC 4.365 posts

- 19. Jack Jones N/A

- 20. Justin Watson N/A

Who to follow

-

SpreadCharts.com

SpreadCharts.com

@SpreadChartsCom -

Dobré Trejdy :c)

Dobré Trejdy :c)

@DobreTrejdy -

Martin Kopáček - investor

Martin Kopáček - investor

@KopacekInvestor -

David Ševčík

David Ševčík

@opcni_tipy -

Dominik Kovařík

Dominik Kovařík

@dominikkovarik -

LYNX Broker

LYNX Broker

@LYNX_Broker -

Martin Lembák

Martin Lembák

@Martin_ekonom -

Klub investorů

Klub investorů

@klubinvestoru -

Miroslav Piták

Miroslav Piták

@miroslavpitak -

Homarih

Homarih

@homarih2007 -

Angelo Calvello

Angelo Calvello

@a_calvello -

CommodityVol.com

CommodityVol.com

@CommodityImpVol -

Eric Wilkinson

@Wolfmansblog -

Janet Elizabeth

Janet Elizabeth

@cryptocupcake -

National Wheat Foundation

National Wheat Foundation

@NationalWheat

Something went wrong.

Something went wrong.