Nick Maggiulli

@dolarsanddataHelping people build wealth since 2017. Author of Just Keep Buying: https://t.co/sAiQygROmV

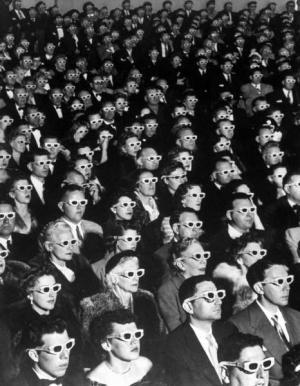

The larger someone's lottery win, the higher the likelihood that THEIR NEIGHBORS declare bankruptcy. Don't lose someone else's game. Focus on winning your own.

Here's the research paper this is from if you're interested: ire.hec.ca/en/wp-content/…

I know the title of this is extremely out of touch, but my main takeaway from all the retirement research I've done is that most people need LESS than they initially think to have a nice retirement.

Can You Retire at 30 with $10 Million in a High Cost of Living Area? My latest: ofdollarsanddata.com/can-you-retire…

Jared is one of my favorite writers on the internet. Go check out his new book, No Worries (on how to live a stress-free financial life) out today!

NO WORRIES drops today! I'm so fired up about this book. It will improve the lives of thousands of people. Take my word for it. You're going to want to get it. amazon.com/No-Worries-liv…

Can You Retire at 30 with $10 Million in a High Cost of Living Area? My latest: ofdollarsanddata.com/can-you-retire…

If you are saving up for a big purchase (e.g., house, wedding, etc.) within the next three years, keep your money in: -Cash/High-Yield Savings Accounts -Money Market Accounts -Treasury Bills Investing it in stocks or long-term bonds isn't worth the risk.

More money is lost looking for good stocks than is made in finding them. Add up the time spent, the money spent (doing research), and the emotional toll and there's no debate. You can choose to do all that work or you could simply...own an index. Choose wisely.

Pessimists sound smart Optimists make money Remember that.

If you had picked a random month to start buying U.S. stocks and kept buying for the rest of the decade, there is a 83% chance that you would have outperformed 5-Year Treasuries. Though stocks don't always go up, betting against them is rarely a good idea.

Some lifestyle creep is fine (and I encourage it), but the data suggests that spending more than 50% of your raises pushes your financial independence further away. When good fortune comes, enjoy it, but don't forget about your future as well.

Reading can be healing, informative, transformative, provide help with sleep and enhance your imagination. And sometimes, it makes you good money when you read the right book at the right time. I was reading Just Keep Buying by Nick Maggiulli around the end of 2022 and the…

There is no "right" way to invest. I've seen people get rich in stocks, real estate, owning their own businesses, and much more. Anyone who tells you otherwise is trying to sell you something.

"I wish people could realize all their dreams and wealth and fame, so that they could see that it is not where you are going to find your sense of completion." -Jim Carrey

I'm happy to announce that I've finally built an S&P 500 historical return calculator (with data going back to 1871 via Shiller). The output includes both nominal and inflation-adjusted returns (with and without dividends). Enjoy! ofdollarsanddata.com/sp500-calculat…

There are now 4 investment calculators on my website. I added a standard investment return calculator, a S&P 500 DCA calculator, and a historical U.S. stock/bond calculator as well. Enjoy! ofdollarsanddata.com/calculators/

Just added an Income by Age and Net Worth by Age calculator to the mix (bringing the total to 6 calculators): ofdollarsanddata.com/calculators/

I'm happy to announce that I've finally finished my Income by Age and Net Worth by Age calculators (using the 2022 Survey of Consumer Finances) Enjoy! Income by Age Calculator [With Percentiles]: ofdollarsanddata.com/income-by-age-…

Net Worth by Age Calculator [With Percentiles]: ofdollarsanddata.com/net-worth-by-a…

Imagine spending YEARS of your life studying markets, macro, etc. when you could've gotten the same (or better) result simply by buying a diversified basket of income-producing assets every single month. Investing is one of the few fields where amateurs can beat experts.

Last week my friend sold some of his Bitcoin to pay off his mortgage. He was worried that he might have given up some upside, but I told him that nothing was guaranteed expect his monthly payments. Sometimes you should trade maybes for certainties.

United States Trends

- 1. Hunter 369 B posts

- 2. Justin Tucker 28,4 B posts

- 3. Ravens 70,9 B posts

- 4. Eagles 102 B posts

- 5. Lamar 66,7 B posts

- 6. Panthers 26,1 B posts

- 7. Bryce Young 15,4 B posts

- 8. Cavs 13,6 B posts

- 9. Bucs 12 B posts

- 10. #UniswapHack 89,4 B posts

- 11. #BaddiesMidwest 3.330 posts

- 12. #YellowstoneTV 1.587 posts

- 13. Saquon 26,3 B posts

- 14. #LetEmKnow 3.611 posts

- 15. Donovan Mitchell 3.471 posts

- 16. Ray Davis 1.035 posts

- 17. #KeepPounding 2.974 posts

- 18. Bills 127 B posts

- 19. Good for Joe 5.525 posts

- 20. Adam Thielen 4.421 posts

Something went wrong.

Something went wrong.