Claus Aasholm

@clausaasholmDigging semiconductor and tech data for evidence based management and strategies.

Similar User

@SDTech_Groupe

@humanwareonline

@vasudeva57

@JordonCowboys

@RobertKeyNote

@Dr_AhmadAlrajhi

@KalypsoROK

@HargravesInst

@ericasunshinele

@derekcheshire

@putrasenjayan

@nsightfactory

@MarkMWhelan

@FahadAlarabi

@feikobrug

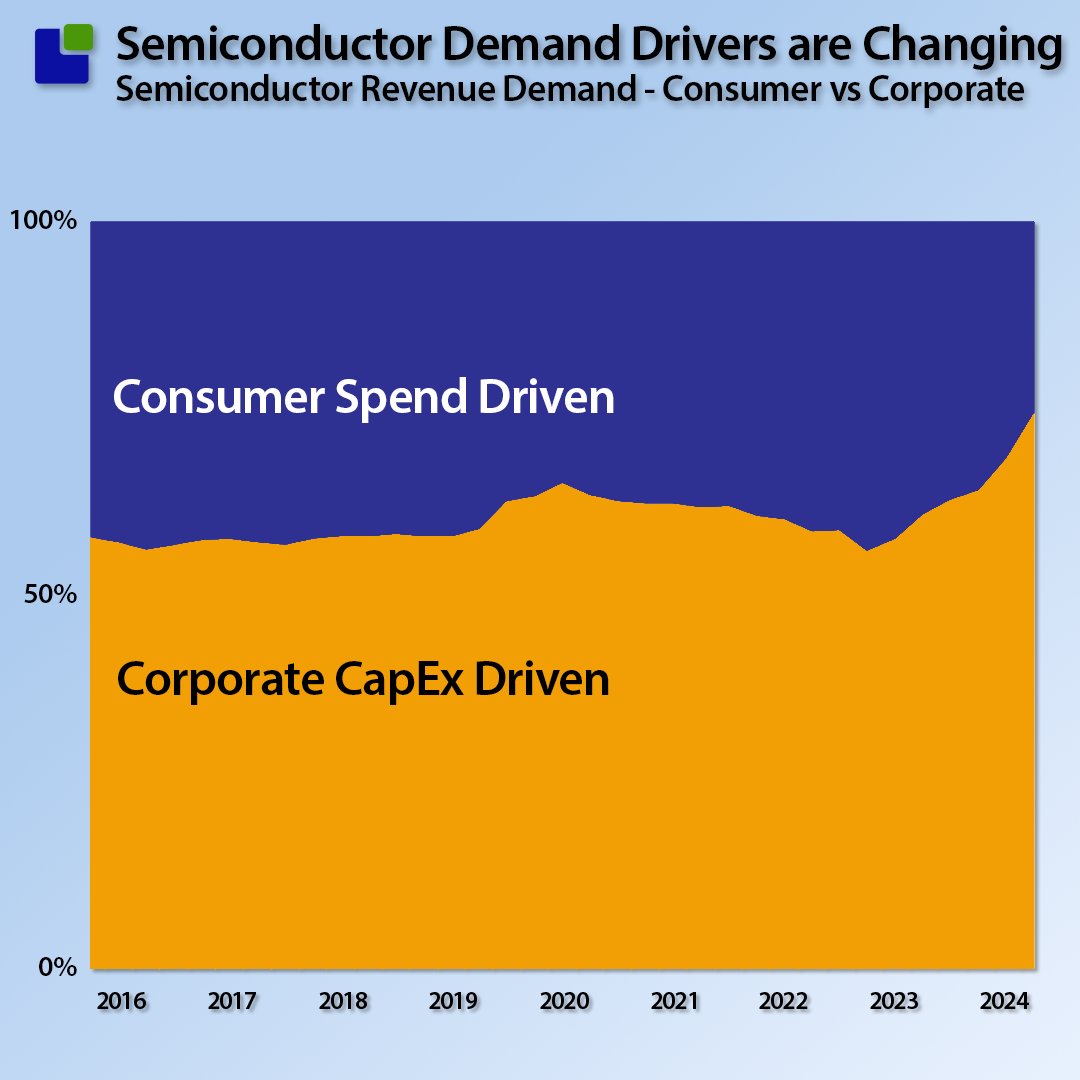

The AI revolution has made the semiconductor industry's demand equation less dependent on consumer sentiment. This can dramatically change the semiconductor's four-year boom-and-bust cycle, during which we collectively make the same mistakes as the last cycle, laying the…

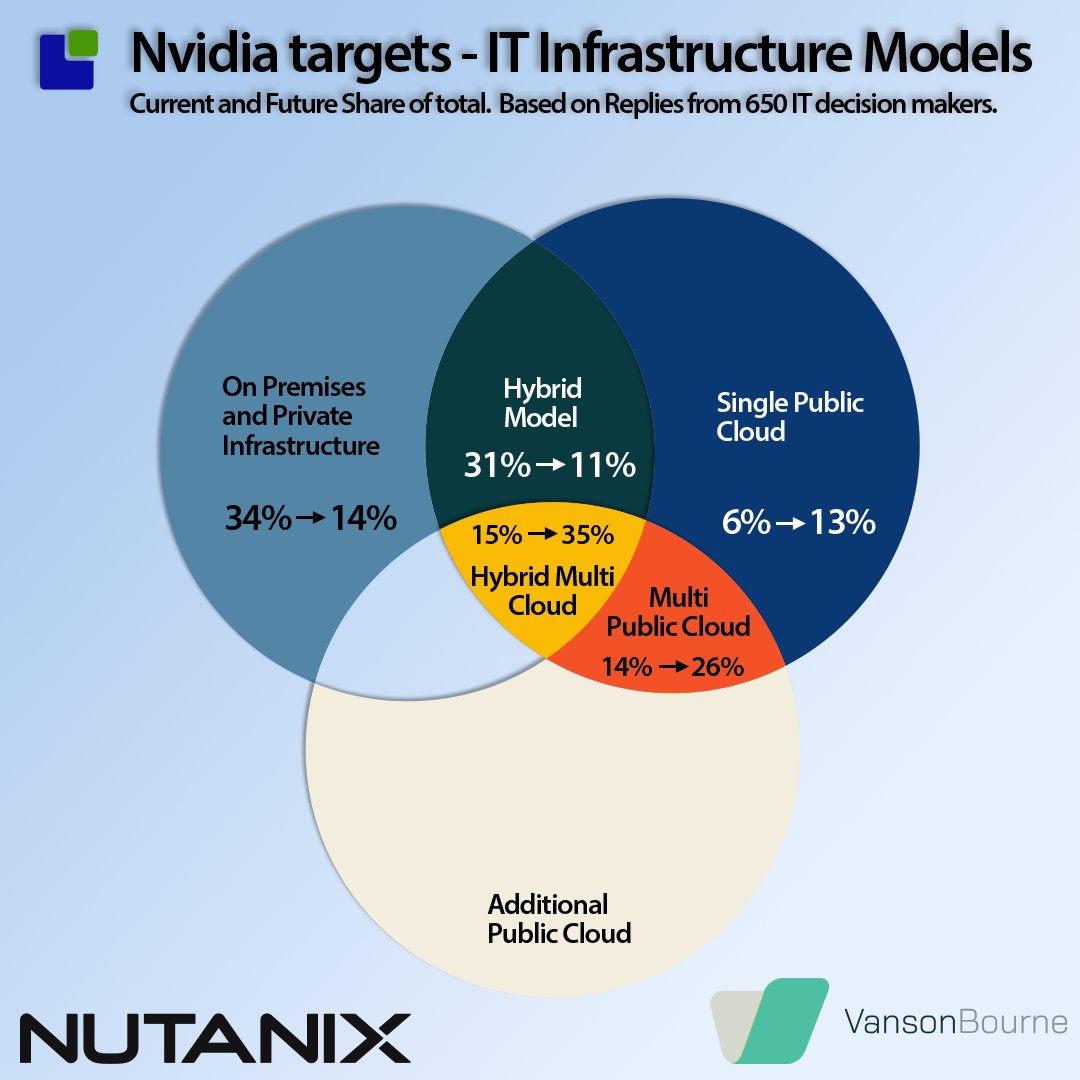

The first stage of Nvidia's impressive growth journey has been fuelled by the AI training needs of Cloud companies and AI Natives like OpenAI. While the AI investment commitments from the cloud companies remain strong, Nvidia is looking to develop more income streams. Given the…

The semiconductor industry simmers and bubbles. The demand is shifting rapidly to data centre CapEx while the supply chain is trying to catch up. From one semiconductor cycle to many. From a complex supply chain to an even more complex supply chain. I will present my analysis at…

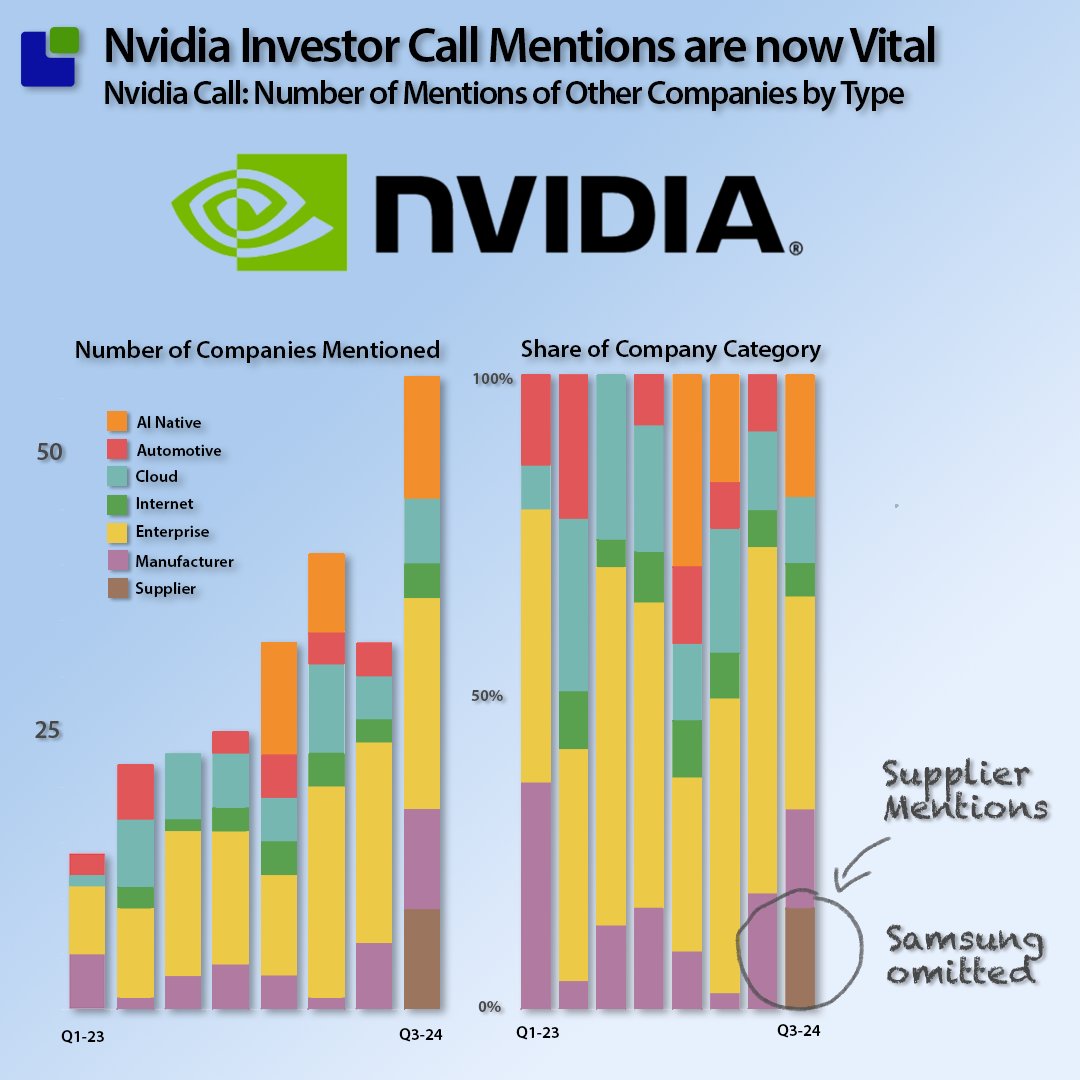

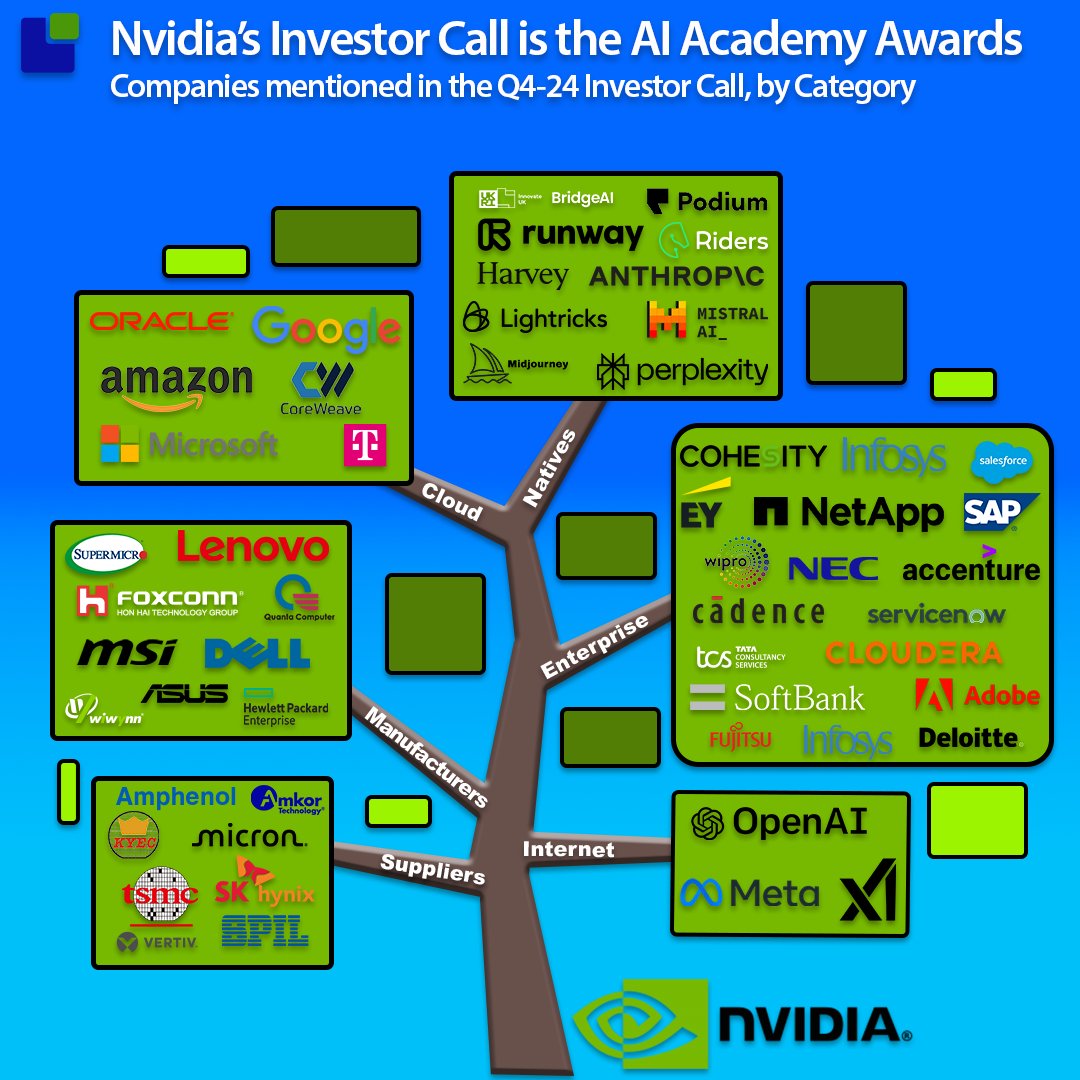

If you think it is irrelevant to be mentioned on an investor call, you should talk to Samsung. They were not mentioned in the Nvidia Investor Call, while their two main competitors, SK Hynix and Micron, were. Jensen was immediately confronted with the omission: "Nvidia is…

There is no company name-dropping in most investor calls in the Semiconductor industry except for competitor names. Information about suppliers and customers can be sensitive, and in general, it is not shared. However, a graphics gaming company changed that right before becoming…

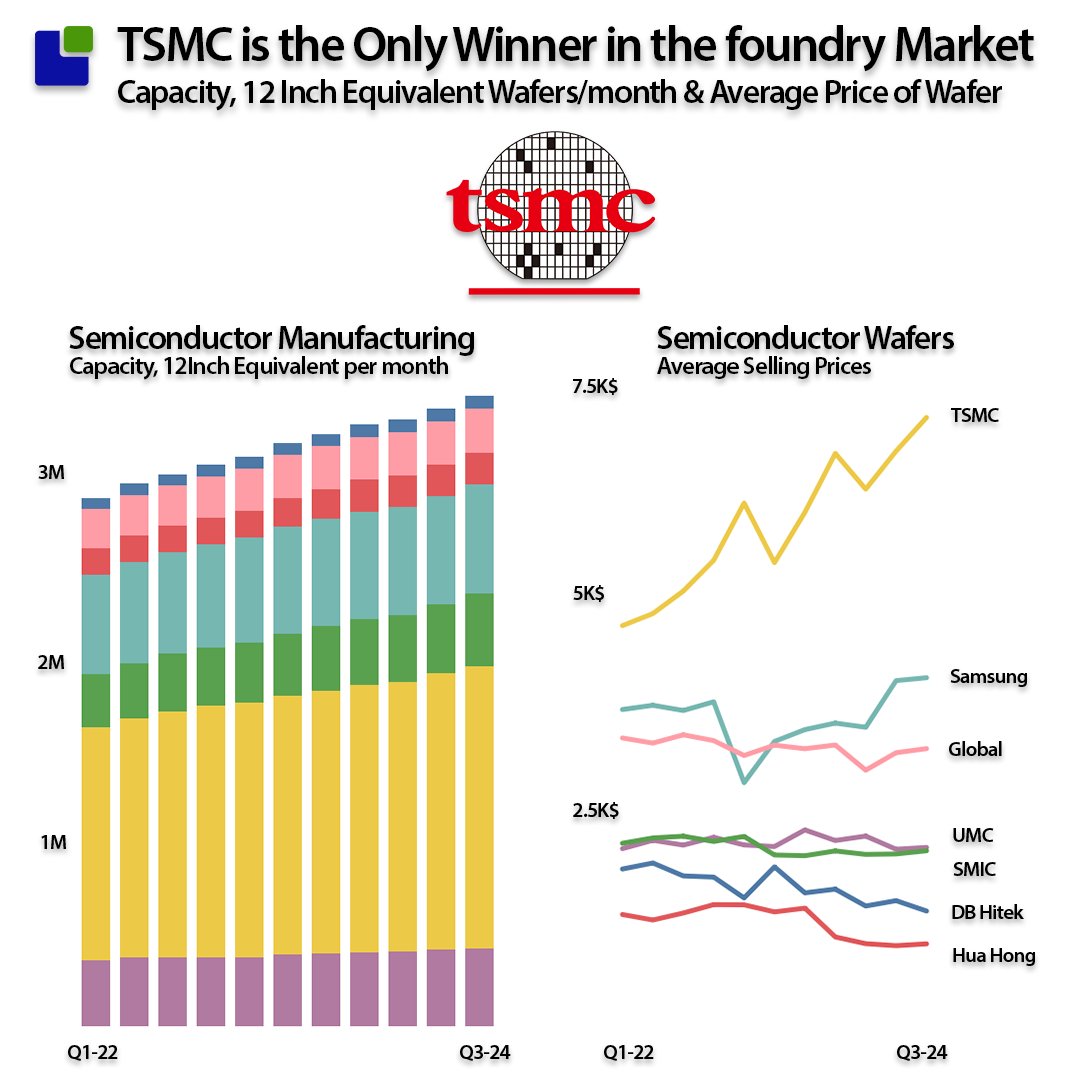

Despite responding to the market downturn by cutting CapEx investments, semiconductor foundries had to fight over fewer orders while more capacity came online. The capacity is growing at 8%, similar to the current average global semiconductor market growth. The problem is the…

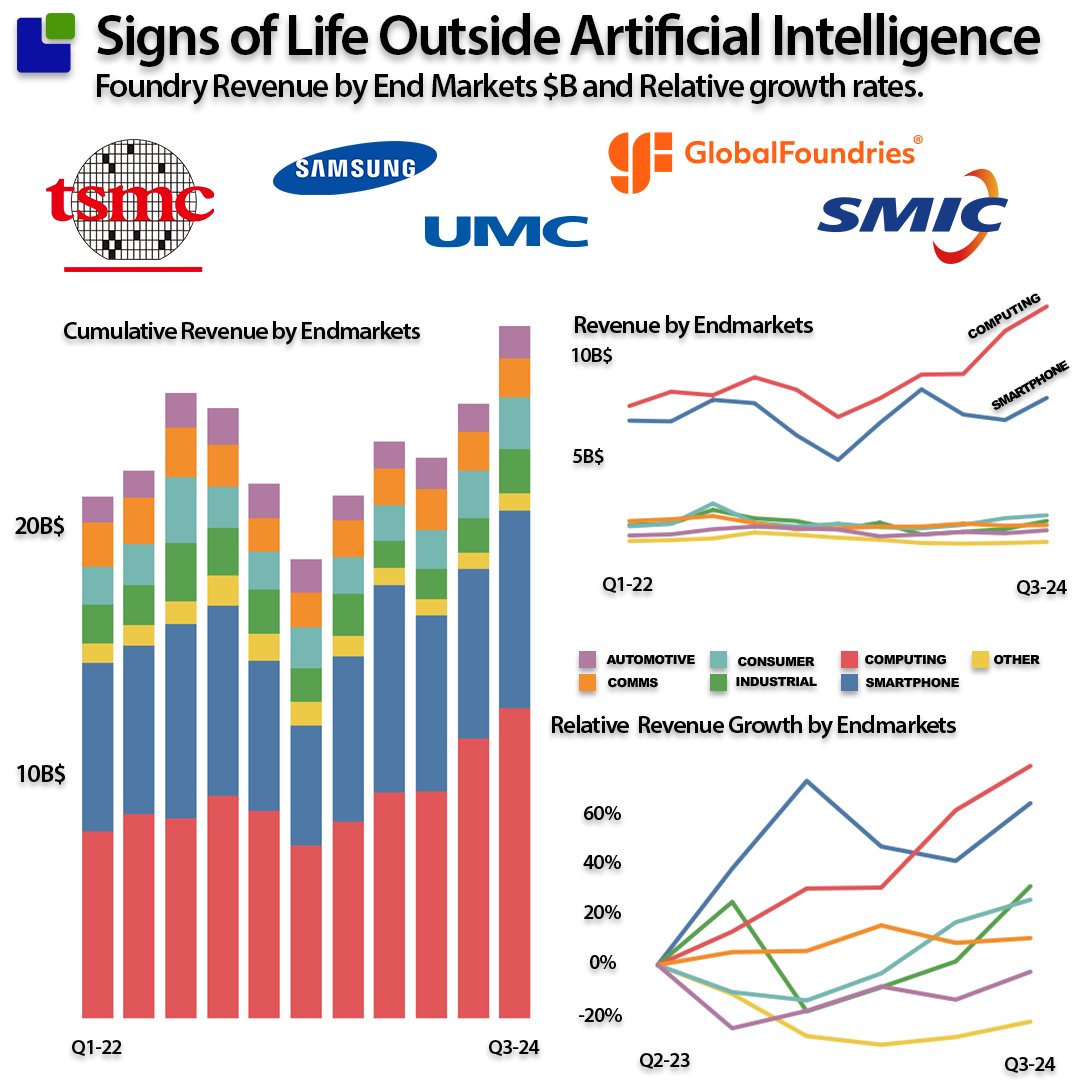

The supply chain is whispering while accelerated computing continues dominating the Semiconductor industry after Nvidia's release. The Hybrid Semiconductor companies dependent on the Industrial, Automotive and Communications markets guided Q4 revenue down collectively. But now…

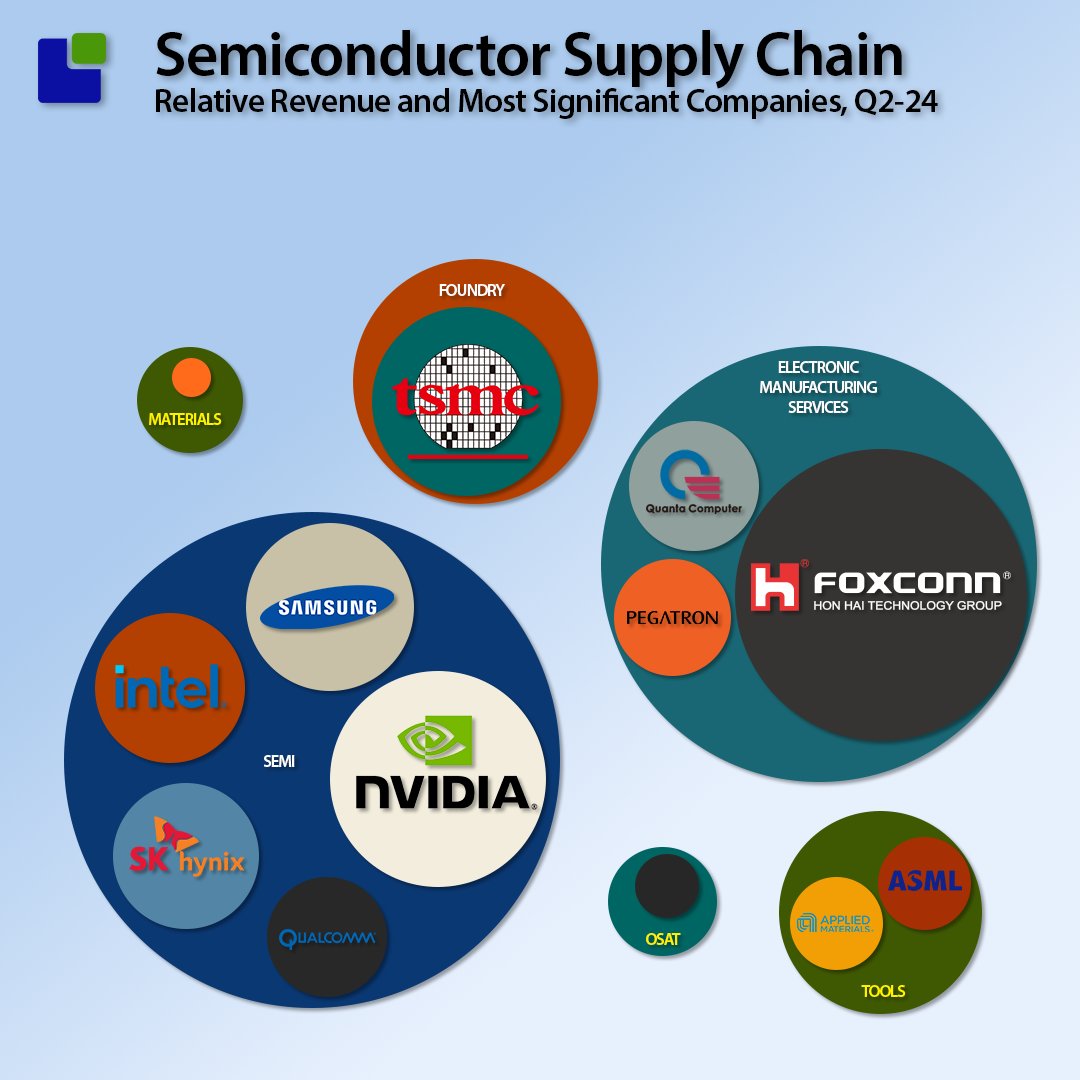

Once again, the stock market survived the apocalypse as Nvidia brought the bacon home. If you compare the gains to Nvidia's Cost of Goods sold, the supply chain has already shown that something good is coming. Once TSMC's and SK Hynix's silicon enter the golden company, it gets…

To get a quick overview of Hybrid Semiconductors' current and future fab capacity, I use the Meteor Chart (which I call the Fireworks chart in better times). It shows the distance travelled in a year regarding the financial value of the capacity (Property, plant, and equipment)…

Like a slow rollercoaster, the Semiconductor industry moves in four-year cycles. The cycle length is more or less constant, but the timing of cycles is different in each industry subsector. While Nvidia will report on its own upcycle tomorrow, the Hybrid Semiconductor Companies…

One of my favourite Buffett quotes is: “Only when the tide goes out do you learn who has been swimming naked.” While none of the Semiconductor companies using hybrid manufacturing has been swimming naked, some are now revealing the colour of their bathing suits. It is not…

"Never waste a good crisis!" Hybrid semiconductor companies serving broader markets, such as automotive and industrial, must maintain faith in their business and manufacturing models. While it is easy to invest in upturns, investments in the downturn often create the foundation…

In the shadows of the AI revolution and Nvidia's meteoric rise, the Semiconductor Workhorses are still stuck in the downcycle that has lasted 8 quarters. What looked like a turning point was shot down by the Q4 guidance that will mark a new low point. These companies use the…

Investigating the CapEx of large cloud companies gives good insight into the near-term future of the Data centre capacity. Still, it is possible to look even deeper into the future. Investigating gross property, plant, and equipment in the balance sheet shows the share of…

Despite worries about diminishing returns on large LLM's the cloud companies will continue to increase CapEx investments in Q4-24 and into 2025. That is if you believe in investor communication from large cloud companies. Another question is whether accelerated computing is…

Since the last "normal" Semiconductor quarter in Q2-23, the top 5 Cloud owners have spent an additional $70B on CapEx or about the same as Nvidia's combined revenue has grown. With the recent news/research/noise of a diminishing return on even Larger LLMs (eLLLMs?), it is…

There is more business data than ever, but most of this data does not generate insights. It is like we got more hay on top of the same amount of needles. I am fascinated by stories told with data, and each blog post requires data collection, analysis and presentation. Most…

While Elon is busy with other stuff, Tesla has begun its total transformation into a tech company. If the car companies thought Tesla was difficult to compete with before, they haven't seen anything yet. Elon's interest in AI has been around for a while. He already has a few…

I just published a post about the status of the AI business from the supply side (GPUs) and the demand side (Cloud CapEx). Meanwhile, a story broke that the LLMs are flatlining, and the AI revolution is over. I got so depressed that I let AI lead a status overview of the Cloud…

While it is becoming clear that cloud and AI technology are vital for the global economy, they are already crucial for the US economy. It begins and ends with the US, where the most significant AI profits will be reported, and wild stock gains will be made. However, in the…

United States Trends

- 1. Bama 36 B posts

- 2. Knicks 13,2 B posts

- 3. Pete 216 B posts

- 4. Miami 110 B posts

- 5. Clemson 18,8 B posts

- 6. #WWENXT 23,6 B posts

- 7. Sabres 4.100 posts

- 8. minghao 34,4 B posts

- 9. #RHOBH 3.276 posts

- 10. #HardKnocks 2.208 posts

- 11. Wemby 7.104 posts

- 12. #drinkIKOA N/A

- 13. NBA Cup 9.937 posts

- 14. #GoAvsGo 2.147 posts

- 15. XDefiant 12,5 B posts

- 16. Amari Williams N/A

- 17. Gundam 149 B posts

- 18. South Carolina 27,4 B posts

- 19. Josh Dix 1.707 posts

- 20. Magic 156 B posts

Who to follow

-

SDTech

SDTech

@SDTech_Groupe -

HumanWare

HumanWare

@humanwareonline -

S. Vasudeva Rao

S. Vasudeva Rao

@vasudeva57 -

Jordon.✭

Jordon.✭

@JordonCowboys -

RJ

RJ

@RobertKeyNote -

أحمد الراجحي🇸🇦(محام☆مستشار☆محكم)

أحمد الراجحي🇸🇦(محام☆مستشار☆محكم)

@Dr_AhmadAlrajhi -

Kalypso: A Rockwell Automation Business

Kalypso: A Rockwell Automation Business

@KalypsoROK -

Hargraves Institute

Hargraves Institute

@HargravesInst -

Erica Sunshine Lee

Erica Sunshine Lee

@ericasunshinele -

Derek Cheshire - Innovationist

Derek Cheshire - Innovationist

@derekcheshire -

sbl

sbl

@putrasenjayan -

Semiconductor Business Intelligence

Semiconductor Business Intelligence

@nsightfactory -

Mark M. Whelan (futurecenter.eth)

Mark M. Whelan (futurecenter.eth)

@MarkMWhelan -

فهد العرابي |🇸🇦 |FAHAD ALARABI

فهد العرابي |🇸🇦 |FAHAD ALARABI

@FahadAlarabi -

Feiko Brugman

Feiko Brugman

@feikobrug

Something went wrong.

Something went wrong.